10 Reasons Why Many Dislike Doing Financial Sales to Consumers

Sales is not an easy job. Financial sales is even tougher. Since it involves numbers, one has to be fundamentally sound in mathematics. But what makes financial sales to consumers tougher is one have to deal with a uncertain future, individual emotions and many more … …

Read the 10 reasons why many dislike doing financial sales to consumers:

No.1 They have to sell products they don’t believe in

Yes, they don’t believe in the financial products. Below are examples of what most people think:

- Insurance is what many already have, and don’t need anymore

- Stocks are too risky and not for everyone

- Bonds are risky especially when interest rate goes up

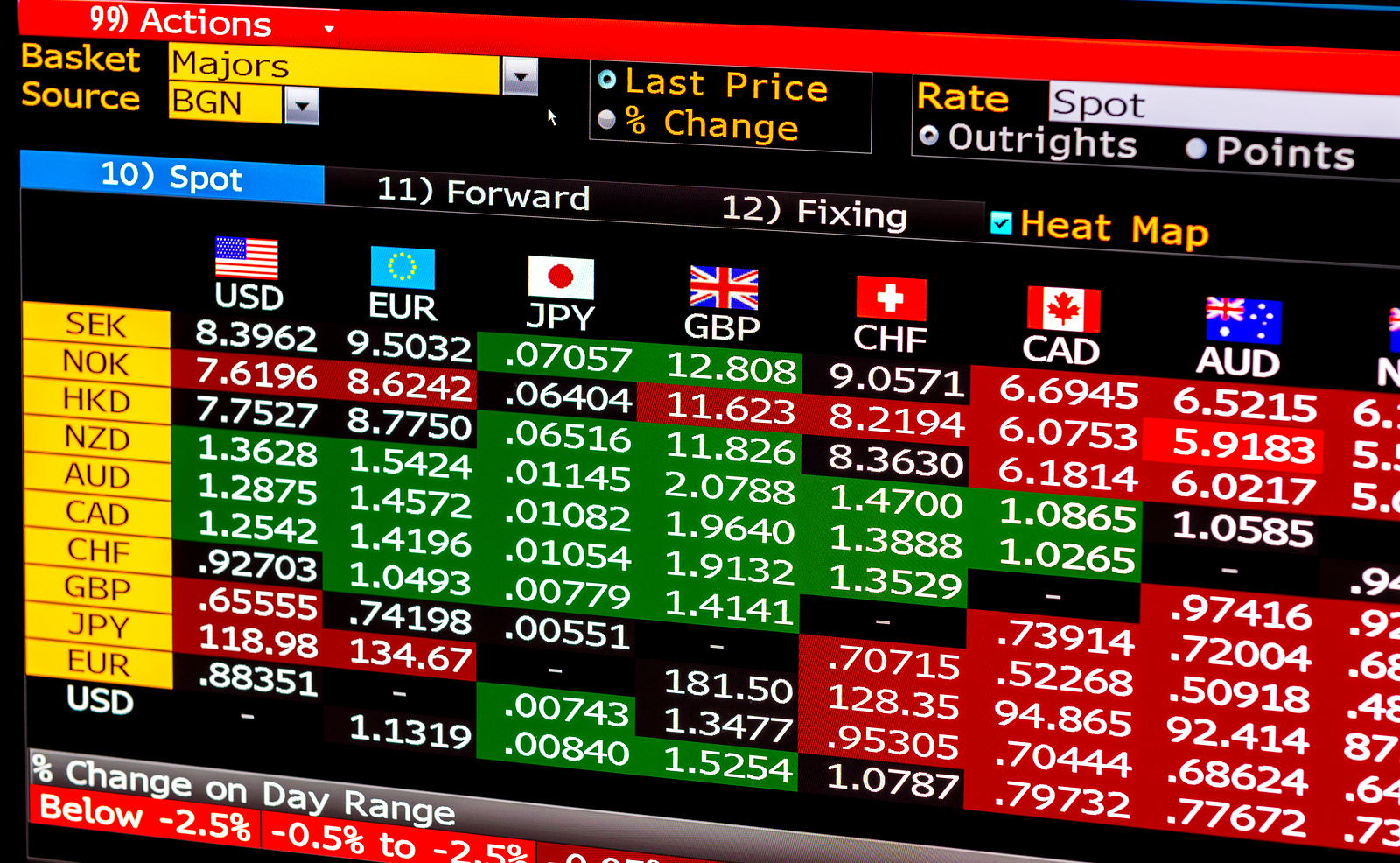

- Foreign Exchange is risky

- Unit Trust can’t be trusted

- Structured Products are ambiguous

- Leverage is dangerous

They are mostly skeptical, which is great since their financial knowledge is likely elementary, initially. These could be quickly overcome as they gain a better understanding. Though most prefer not to take the step. Instead, they continue not to believe in the products.

No. 2 They have to sell risky products

If financial sales is only associated with returns, then every wealth manager or investment professional would be a superstar and could make a winning investments anytime.

All financial products comes with risks. Deposits with banks carry risks. A currency has systemic & political risks, such as being unrecognised in some countries.

So it is very much on balancing the expected returns and risks. But they feel they have to sell risky products to customers.

No. 3 They have to pressure customer

Sales is always associated with pressuring customers. But we don’t see airlines hard-selling first class tickets nor Ferrari selling sports car to anyone. It is apparent that most people can’t afford it. This is call market segmentation.

When it comes to financial products, imagine if stocks were never listed since most people don’t need stocks then, there wouldn’t had been a vibrant financial and capital markets today.

Or perhaps if stocks and bonds have a consistent returns of 20% annually, suddenly everyone would want to invest into the product.

Related Articles

Dutch East India Company is the first stock in the world. It was listed on Amsterdam Stock Exchange in 1602.

No. 4 They have to meet high sales targets

The ones that meet the sales target find it a joy doing sales and achieving the high targets. The one that think the sales target is impossible to reach, will spend their time thinking about how it is nearly impossible to meet the sales target.

Meanwhile, thousands of transactions are done daily while millions and billions of investments are made. They just missed the action today.

Related Articles:

No. 5 They have to deal with customers, and in difficult times.

Imagine being scolded in a banking branch, in office or at starbucks. Most sales people had gone through days like this. And since not many enjoy this, and having to endure such incidents, most people prefer not to be in customer service, let alone doing financial sales.

Financial sales have an extra burden. The financial market can crash anytime, that can result in customers losing money suddenly. This means if you only have 1 customer, you probably get 1 angry customer. But if you have 300 customers … …

Which is they avoid dealing directly with clients.

No. 6 They have to deal with their Emotions

Sometimes, customers have their off-days or are in a terrible mood. This can happen anytime to anyone. And in financial sales, the sales person will get the brunt of it unknowingly.

It is not easy, given that bankers or financial consultants are considered credible, knowledgable and trusted, they have to suddenly deal with emotions that cracks their stature and pride, and become either a whipping boy or counsellor. Not a role many would want to do.

No. 7 They have to compete with fellow sales peers

When it comes to sales, inevitably, a ranking table evolves and sometimes published. Knowing that you have to compete with fellow colleagues and people whom you don’t like, and colleagues who outshine you at the top either filled you with doubts, jealousy and envies.

They start to associate them (the ones that did better) with inferior ethics and improper selling process. And they think they wouldn’t want to be doing well in sales by lowering their standards of ethics and sales techniques.

No. 8 They have to deal with Complaints

Uncompetitive pricing, inferior products, poor customer service, no free gifts, not appreciating loyal customers. They know they have to deal with all these complaints.

Another reason why they dislike doing financial sales.

No. 9 You have to deal with internal departments & colleagues

We meant inefficient & incompetent colleagues who are slow to help them in ensuring things are properly done for clients.

Everyone knows that it takes a team to deliver good products and services to customers. And since financial industry is a knowledge intensive industry, it is inevitable that one will be working with young graduates or people who have poor knowledge and are less productive at getting things done.

And when things go wrong, somebody have to face the customer.

No. 10 They have deal with an unpredictable financial market

The tenth and the most important reason why most people shun financial sales is because one have to deal with an unpredictable financial market. This can put your intelligence, judgement & credibility at risks – since customers are likely to go back to the person who recommended the products to them.

Which is the reason why most people prefer to move into institutional financial sales, since most investment proposals are team-based. Plus, when things goes wrong, the company could lose money but both parties keep their job, still.

The top salesperson in the organization probably missed more sales than 90% of the sales people on the team, but they also made more calls than the others made

Zig Ziglar

Related Articles

- 14 Questions Personal Bankers Get Daily

- What Wealth Managers in Singapore Struggle with?

- 8 Reasons Why Building a Portfolio is Tough in Asia

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit