What happens when you hit Error Page, Page not found or 404 on Financial Times?

You usually skip the page. But if you are a serious Economist or an Investment Expert who’s looking for something curiously intellectual, read on as you discover what leading economists think of the missing page?

What is in the 404 page:

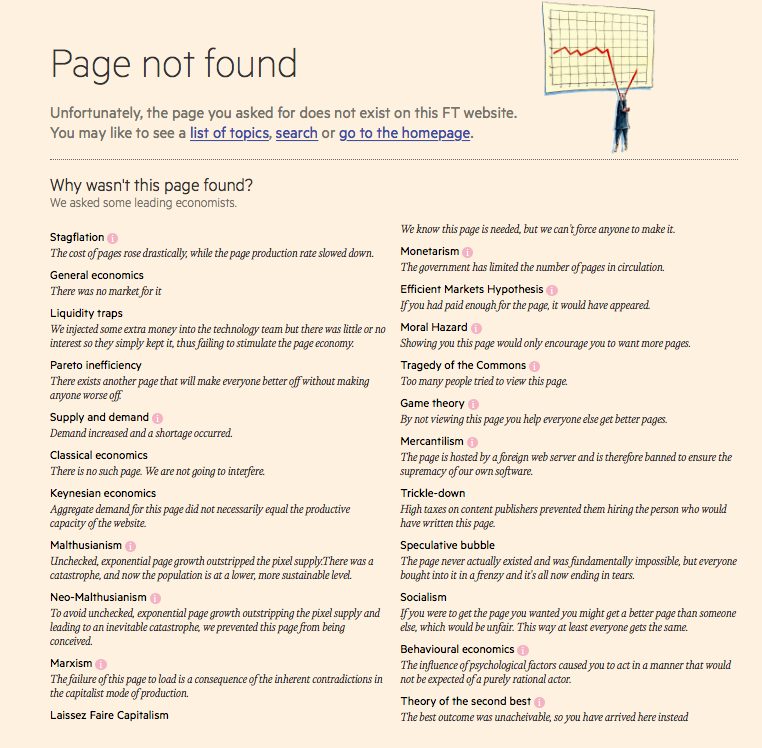

- Why wasn’t this page found?

- 22 of the best replies from Economists

This is how it looks like:

Where we discover the page:

- Visit the 404 Page here: Financial Times 404 Page

- Visit the 404 Page thought-process here: FT Labs

The Financial Times 404 Page:

Why wasn’t this page found?

We asked some leading economists.

(We numbered it for easy reading)

No. 1 Stagflation

The cost of pages rose drastically, while the page production rate slowed down.

No. 2 General economics

There was no market for it

No. 3 Liquidity traps

We injected some extra money into the technology team but there was little or no interest so they simply kept it, thus failing to stimulate the page economy.

No. 4 Pareto inefficiency

There exists another page that will make everyone better off without making anyone worse off.

No. 5 Supply and demand

Demand increased and a shortage occurred.

No. 6 Classical economics

There is no such page. We are not going to interfere.

No. 7 Keynesian economics

Aggregate demand for this page did not necessarily equal the productive capacity of the website.

No. 8 Malthusianism

Unchecked, exponential page growth outstripped the pixel supply.There was a catastrophe, and now the population is at a lower, more sustainable level.

No. 9 Neo-Malthusianism

To avoid unchecked, exponential page growth outstripping the pixel supply and leading to an inevitable catastrophe, we prevented this page from being conceived.

No. 10 Marxism

The failure of this page to load is a consequence of the inherent contradictions in the capitalist mode of production.

No. 11 Laissez Faire Capitalism

We know this page is needed, but we can’t force anyone to make it.

No. 12 Monetarism

The government has limited the number of pages in circulation.

No. 13 Efficient Markets Hypothesis

If you had paid enough for the page, it would have appeared.

No. 14 Moral Hazard

Showing you this page would only encourage you to want more pages.

No. 15 Tragedy of the Commons

Too many people tried to view this page.

No. 16 Game theory

By not viewing this page you help everyone else get better pages.

No. 17 Mercantilism

The page is hosted by a foreign web server and is therefore banned to ensure the supremacy of our own software.

No. 18 Trickle-down

High taxes on content publishers prevented them hiring the person who would have written this page.

No. 19 Speculative bubble

The page never actually existed and was fundamentally impossible, but everyone bought into it in a frenzy and it’s all now ending in tears.

No. 20 Socialism

If you were to get the page you wanted you might get a better page than someone else, which would be unfair. This way at least everyone gets the same.

No. 21 Behavioural economics

The influence of psychological factors caused you to act in a manner that would not be expected of a purely rational actor.

No. 22 Theory of the second best

The best outcome was unacheivable, so you have arrived here instead

22 replies from leading Economists what they think of the missing page on Financial Times.

All content on this page are credited to Financial Times. The Financial Times (FT) is one of the world’s leading business news and information organisations, recognised internationally for its authority, integrity and accuracy.

” This page was part of an FT Labs experiment into improving your experience when you encounter an error on a Financial Times website. “

- Visit the 404 Page here: Financial Times 404 Page

- Visit the 404 Page thought-process here: FT Labs

Related Articles:

- 14 Ways an Economist Says I Love You

- What happens when you hit Error Page, Page not found or 404 on Financial Times?

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit