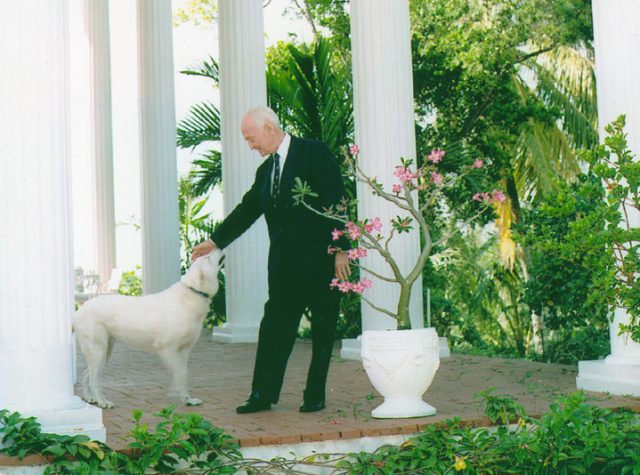

Legendary Investor Sir John Templeton

Who is Sir John Templeton?

Sir John Marks Templeton was the founder of the iconic Templeton Growth Fund in 1954. An investor with his fund at inception, would have gained over 13% annualised return,over a period of 38 years.

Sir John Marks Templeton was the founder of the iconic Templeton Growth Fund in 1954. An investor with his fund at inception, would have gained over 13% annualised return,over a period of 38 years.

In 1992, Templeton Fund was sold to the Franklin Group in 1992 for $440 Million. (At 6% annualised returns, the $440 Million would become $1.95 Billion in 2015). Today, the renamed Franklin Templeton is one of the largest Fund Management firm in the world.

The late Sir John Templeton is also known to be a pioneer in both financial investment and philanthropy.

What did he accomplish?

At age 42, he entered into the Mutual Fund industry and established the Templeton Growth Fund in 1954.

At age 42, he entered into the Mutual Fund industry and established the Templeton Growth Fund in 1954.

For every investor that had $10,000 invested into Templeton Growth Fund Class A at inception, $10,000 would have grown to $2 Million by 1992. The annualised return would be a remarkable 13.96%.

In 1999, Money magazine called him “arguably the greatest global stock picker of the century.”

” Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria “

How did he get started?

The late Sir John Templeton began his Wall Street career in 1938. Using the strategy of “buy low, sell high”, he picked nations, industries, and companies that hit rock bottom. He called them the “points of maximum pessimism.”

The late Sir John Templeton began his Wall Street career in 1938. Using the strategy of “buy low, sell high”, he picked nations, industries, and companies that hit rock bottom. He called them the “points of maximum pessimism.”

As war broke out in Europe in 1939, he borrowed money to buy 100 shares each in 104 companies with market price at one dollar per share or less. Out of the 104 companies, 34 of them were in bankruptcies.

It turned out that of the 34 companies, only 4 of the companies’ shares became worthless. He made enormous profits on the others.

” An investor who has all the answers doesn’t even understand the questions “

What else did he do?

He was convinced that man’s knowledge of the universe is limited. He encouraged humanity to be more open-minded.

In 1972, he established the world’s largest individual annual award – The Templeton Prize. Today (2016), the monetary award is £1,000,000, exceeding the monetary prize of the Nobel Prizes.

In 1987, he contributed much of his assets to the John Templeton Foundation. Soon, he was created Knight Bachelor by Queen Elizabeth II for his many philanthropic accomplishments.

Keynotes

- Birthdate: 29th November 1912

- Origin: Winchester, Tennessee, United States

- Yale University (Graduated in 1934)

- Balliol College at Oxford – Rhodes Scholar (Graduated in 1936)

- Sir John’s death in 2008, at age 95

Source: John Templeton Foundation

Read More:

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit