3 Important Knowledge to Have as a Wealth Manager

What is Wealth Management? What exactly does a Wealth Manager do? Do you have a perfect answer or do you struggle to answer these questions?

It might be difficult to give a straight-forward answer. It perhaps depends on your client.

What do they need? What are they looking for? Do they have $10,000 for you to advise or do they have $10 million for you to manage? Should the wealth products, solutions and advise differ because of the difference in net worth ?

How about a client with $10 million or a client with $500 million? Would you advise them differently?

Regardless of who you advise, there are 3 important knowledge for a Wealth Manager to have. What are the 3 important knowledge to have?

#1 Banking

No matter how or little or how much a client have, much of their liquid assets would be in the banks. Almost any monetary transactions will be passing through a bank. This means there are bound to be banking questions, and come along with occasional mistakes and hiccups that you might be able to help them with.

” LIKELY BE JUDGED FROM YOUR BASIC FINANCE KNOWLEDGE “

Having strong banking knowledge also makes you look much more credible when engaging clients.

Banking services is the only common knowledge between you and your clients. In other words, most clients will not be able to understand what you explain on investments and wealth management. You will likely (initially) be judged from your basic finance knowledge. And since most clients are familiar with banking services, they might judge you on how well you know about banking.

For example, they might think:” If you can’t be trusted on banking services, how could they trust you on managing their wealth & investments. And if you can’t even understand basic banking services, how can you understand the complex global financial markets and global economy? “

Key Banking Knowledge:

- Deposits, Cash, Current Account

- Loans & Credit Facilities

- Interest Rates

- FX Rates

- Money Transfer (Domestic / International)

- Banking Regulations

- Brands of Financial Institutions

#2 Asset Management

What is Asset Management? Why is learning Asset Management important in advising clients?

ARE YOU GOING AFTER CLIENTS’ WEALTH OR CLIENTS’ ASSETS?

Are you going after clients’ wealth or clients’ assets?

Probable Answer: You can manage their assets, while you can provide wealth advice to your clients.

What you are trying to ultimately manage:

- Liquid Assets (Cash, Stocks, Bonds)

- Illiquid Assets (Real Estate, Others)

- Future Assets (Insurance, Future Income)

Key Asset Management Knowledge:

- All Asset Classes

- Asset Management Structures / Vehicles

- Asset Structuring / Ownership Transfer

- Taxes, Laws & Regulations (Domestic / International)

- Cashflow, Asset Optimisation

#3 Investment Management

Investment Management is one of the most difficult to understand for many Wealth Managers.

Unlike Banking and Asset Management where the purposes might be for cost savings, efficiency and risk management, Investment Management carries the responsibilities of fulfilling the investment expectations (the expected returns).

” STRONG KNOWLEDGE DOESN’T NECESSARY EQUATE TO POSITIVE RESULTS “

This is one area, where having strong knowledge doesn’t necessary equate to positive results.

How do wealth managers build up their Investment Management knowledge and expertise? Do you rely on investment experts? What if they are wrong? What if they are right, and you had doubts or did not follow their recommendations?

Key Investment Management Knowledge:

- Knowledge (Financial Market, Economy)

- Types of Investments

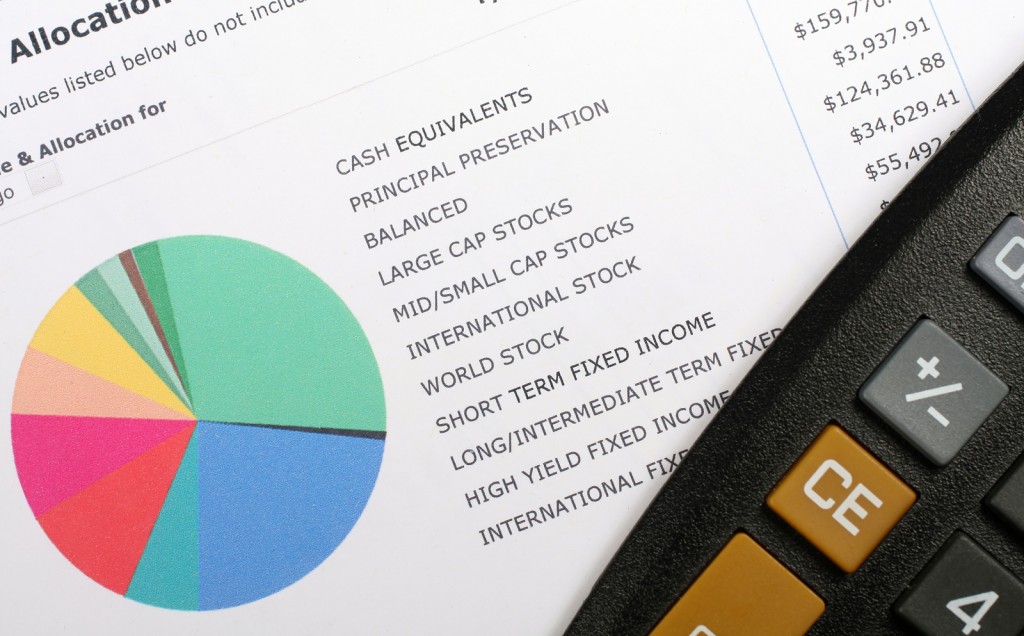

- Portfolio Allocation

- Portfolio Management

- Risk Management

- Execution

- Opportunity Cost / Re-Investment / Tax

- Contracts / Term-sheets

Are you a Wealth Manager? Or are you interested to become one? How do you rate your knowledge in the 3 area? How many years do you think it takes to learn the 3 area? Which is the easiest? Which is the most difficult to learn?

- Banking

- Asset Management

- Investment Management

What is next after learning the 3 key knowledge? Is this all you need to be an effective Wealth Manager?

- Why Clients Struggle with Receiving Wealth Advice

- How Clients Make Decisions on their Wealth and Investments

- How do Private Bankers Acquire New Clients?

- 6 Ways to Generate High Revenue

- 7 Popular Revenue Models

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit