Kuaishou IPO Rises 160% on Day 1, Raised $5.32 Billion

7th February 2021 | Hong Kong

Chinese short video streaming & social media platform Kuaishou Technology share price rose 160% on the first day of trading (5/2/21) on the Hong Kong Stock Exchange, valuing the company at more than $150 billion. Kuaishou Technology IPO price is HKD 115, opened much higher at HKD 338 and rising to a high of HKD 345, before closing at HKD 300 on the 1st day of trading.

“Kuaishou IPO Rises 160% on Day 1”

Kuaishou Technology had priced the company at the top range IPO price at HKD 115, raising $5.32 billion (HKD 41.28 billion) in IPO proceeds. (IPO ~ Initial Public Offering)

Kuaishou – From GIF Creator to Short Video Service

Kuaishou Technology was founded in 2011 by former Google employee Su Hua and HP software engineer Cheng Yixiao. The company known as GIF Kuaishou, allow users to created animated images, also known as GIFs (Graphics Interchange Format). In 2013, they launched a social media platform and short video service and they grew rapidly to become one of the largest online social media & video streaming platform. For the first 9 months of 2020, their app reported daily users of 262.4 million and revenue of $6.2 billion.

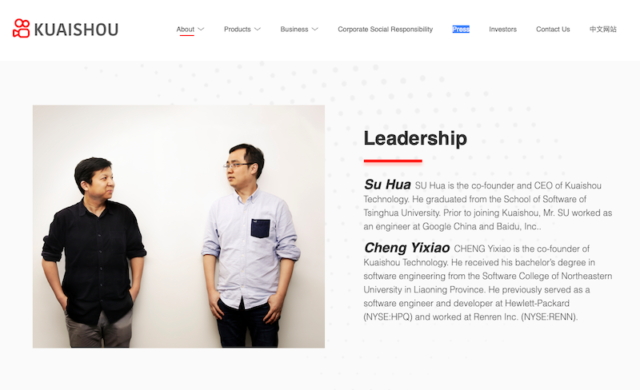

One of the Richest in Asia: Su Hua and Cheng Yixiao

With the IPO of Kuaishou Technology, Su Hua and Cheng Yixiao became billionaires and one of the richest people in Asia with their personal fortune rising to more than $18 billion and $13 billion respectively.

Su Hua is the co-founder and CEO of Kuaishou Technology. He graduated from the School of Software of Tsinghua University. Prior to joining Kuaishou, Mr. SU worked as an engineer at Google China and Baidu, Inc..

Cheng Yixiao is the co-founder of Kuaishou Technology. He received his bachelor’s degree in software engineering from the Software College of Northeastern University in Liaoning Province. He previously served as a software engineer and developer at Hewlett-Packard (NYSE:HPQ) and worked at Renren Inc. (NYSE:RENN).

Cornerstone Investors, Underwriters

Kuaishou Technology is backed by Tencent and in the IPO, cornerstone investors include Capital group, BlackRock, Fidelity, Morgan Stanley, GIC, Temasek, Abu Dhabi Investment Authority, Canadian Pension Plan Investment Board and Boyu Capital.

Morgan Stanley, Bank of America and China Renaissance Holdings are the underwriters of the IPO.

Visit: Kuaishou | Investor Information

Related:

- Airbnb IPO Rises 112% on Day 1, Raised $3.5 billion

- DoorDash IPO Rises 85% on Day 1, Raised $3.3 billion

- JD Health IPO Rises 55% on Day 1, Raised $3.4 billion

- Ant Group $300 Billion Record IPO Suspended in both Shanghai and Hong Kong Exchange

- New York Stock Exchange Remains Market Leader for IPO in 2020, Raising $81.8 Billion

- NASDAQ Executed 300 IPOs in 2020, Raising $77.86 Billion

- Shanghai Stock Exchange is Now the World’s 3rd Largest Stock Exchange

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit