Billionaires Bill Gates & Melinda Divorce, $150 Billion Assets

7th May 2021 | Hong Kong

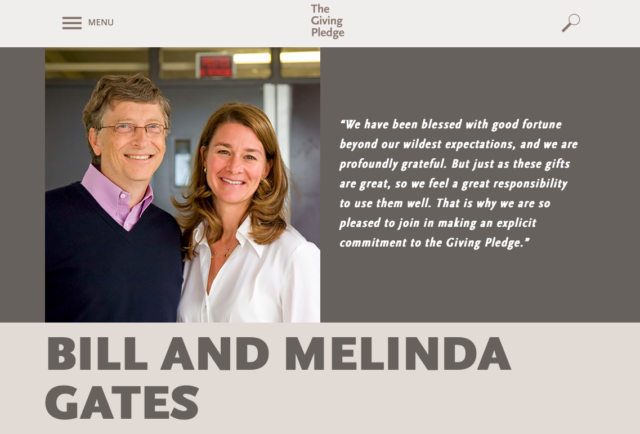

Billionaires Bill Gates, one of the world’s richest man and co-founder of Microsoft, and his wife Melinda have filed for divorce in Seattle, United States after 27 years of marriage (1994) citing broken marriage – “we no longer believe we can grow together as a couple”.

“Bill Gates & Melinda Divorce, $150 Billion Assets”

Bill and Melinda Gates, with total assets of around $150 billion, are one of the most recognised couple globally for their philanthropic activities, especially through the Bill & Melinda Gates Foundation. The Bill & Melinda Foundation have a $49 billion trust endowment, dispersing grants of $5 billion yearly with $5.1 billion to 136 countries in 2019.

Related:

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- Billionaire & Google co-Founder Sergey Brin Setup Family Office in Singapore

- Billionaire and Founder of Hedge Fund Renaissance Technologies James Simons Retires

- Top Hedge Fund Manager and Billionaire Ray Dalio Setup Family Office in Singapore

- Billionaire James Dyson Switches Residency Back to UK from Singapore

Bill Gates Twitter:

$150 Billion Assets, Commit to Philanthropic Activities

The total value of assets, including trustee and business control could be more than $150 billion, including their family office Cascade Investment ($74 billion) and Bill & Melinda Gates Foundation ($49 billion). Bill Gates is estimated to have a personal fortune of more than $120 billion (2021).

After their divorce, both Bill and Melinda Gates have committed to continue their philanthropic activities together through the Bill & Melinda Gates Foundation. They have also signed a separation contract for their properties, business interests and assets.

Bill (Age 65) and Melinda Gates (Age 56) had met at Microsoft and married in 1994. They have 3 children, Jennifer (25), Phoebe (21) and Rory Gates (18).

Bill Gates, co-founder of Microsoft

Bill Gates is the co-founder of Microsoft (1975), which is the largest personal computer software company in the world. He has a personal fortune of more than $120 billion.

In 2010, Bill Gates, Melinda (Bill’s wife) and Warren Buffet founded the “Giving Pledge”, where billionaires pledge to give majority of their wealth to philanthropy or charitable causes during their lifetimes or in their wills.

Cascade Investment

Founded in 1995, Cascade Investment is the family office of Bill and Melinda Gates. Cascade Investment manages more than $51 billion of family assets (2020). In May 2021, Cascade Investment disclosed holdings valued the total portfolio at $74 billion.

Related:

- 2020 Top 10 Largest Family Office in the World

- 2020 Top 10 Largest Multi-Family Offices in the World

- Top Family Office Reports in 2020

Bill & Melinda Gates Foundation

Founded in 2000, the Bill & Melinda Gates Foundation reported $49.8 billion of trust endowment at the end of 2019. Since inception to 2019, the foundation had given a total grant of $54.8 billion. In recent years, the foundation disburses around $5 billion of direct grant support yearly. (2018: $5 billion, $2019: 5.1 billion).

In 2019, the foundation funded a total of 136 countries. In United States, the foundation support those with fewer resources, providing access to opportunities to succeed in school and life. Internationally, the foundation focus on improving health, and helping people to lift themselves out of hunger and extreme poverty.

Bill Gates and Melinda Gates are the Co-chair and Trustee of Bill & Melinda Gates Foundation, while Warren Buffett, Chairman of Berkshire Hathaway, is a trustee of Bill & Melinda Gates Foundation.

Every year, the foundation received a donation from Warren Buffet. The donation started in 2006 with $1.6 billion, increasing every year and in 2019, the donation amounted to $2.7 billion. In total, the foundation received $27.3 billion from Warren Buffet over 14 years.

Warren Buffet Donation to Foundation:

| Year | Amount |

| 2006 | $1.6 billion |

| 2007 | $1.8 billion |

| 2008 | $1.8 billion |

| 2009 | $1.3 billion |

| 2010 | $1.6 billion |

| 2011 | $1.5 billion |

| 2012 | $1.5 billion |

| 2013 | $2.0 billion |

| 2014 | $2.1 billion |

| 2015 | $2.2 billion |

| 2016 | $2.2 billion |

| 2017 | $2.4 billion |

| 2018 | $2.6 billion |

| 2019 | $2.7 billion |

| Total | $27.3 billion |

The Giving Pledge

The Giving Pledge is a global philanthropic movement launched in 2010 by Microsoft chairman Bill Gates and his wife Melinda Gates along with Berkshire Hathaway chairman Warren Buffett with a total of 40 billionaires. The Giving Pledge is a moral commitment by the world’s wealthiest to give the majority of their wealth to charitable causes.

Currently, there are 220 pledgers from 25 countries.

Notable names are:

- Facebook founder Mark Zuckerberg and Priscilla Chan ($103 billion)

- Tesla founder Elon Musk ($162 billion)

- Oracle founder Larry Ellison ($90 billon)

- Virgin Group founder Richard Branson and Joan Branson. ($5 billion)

- Linkedin founder Reid Hoffman and Michelle Yee ($2 billion)

- David Rockefeller, deceased 2017 (3.8 billion)

Notable names from finance are:

- Bridgewater Associates founder Ray Dalio & Barbara Dalio ($20 billion)

- Blackstone founder Stephen Schwarzman ($23 billion)

- Carlyle Group founder David Rubeinstein ($4 billion)

- Bloomberg founder Michael Bloomberg ($59 billion)

- Icahn Enterprises founder Carl Icahn ($15 billion)

- Tudor Investment founder Paul Tudor Jones and Sonia ($7 billion)

(est. current networth, Feb 2021)

Signers of the Giving Pledge

Signers of the Giving Pledge commit to give the majority of their wealth to philanthropy, either during their lifetimes or in their wills.

To Join the Giving Pledge

To join the Giving Pledge, billionaires will need to have at least $1 billion in personal net worth and and are ready to make a public pledge to donate the majority of their personal wealth to philanthropy. Visit: The Giving Pledge

Related:

- South Korean Billionaire & Chairman of Kakao Kim Beom-Su to Give More than Half His $10 Billion Fortune Away

- Billionaire & Google co-Founder Sergey Brin Setup Family Office in Singapore

- Billionaire and Founder of Hedge Fund Renaissance Technologies James Simons Retires

- Top Hedge Fund Manager and Billionaire Ray Dalio Setup Family Office in Singapore

- Billionaire James Dyson Switches Residency Back to UK from Singapore

Related:

- 2020 Top 10 Largest Family Office in the World

- 2020 Top 10 Largest Multi-Family Offices in the World

- Top Family Office Reports in 2020

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit