Interview with Kevin Foo, Head of HNW Insurance at Noah Singapore

The 2021 Private Wealth Series

How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion?

The 2021 Private Wealth Series is a special coverage on private wealth in Asia. Hear from leading private wealth experts, institutes, banks, private banks, fund managers, investment managers, insurers, tax, legal, risks, regional and international experts and many more.

Learn about private wealth in Asia, how to manage $3 million to $300 million of assets, where to find private wealth services, how key financial centres such as Hong Kong and Singapore play a role in managing assets, should assets be managed regionally or globally. Find out where the wealth is growing fastest, how the biggest wealth transfer is taking shape, how managing traditional wealth and new wealth is different and many more. If you are a financial professional, professional investor or institutional investor, how do you advise clients and how do you manage $20 million to $3 billion of assets?

Interview with Kevin Foo, Head of HNW Insurance at Noah Singapore

The 2021 Private Wealth Series: Kevin Foo, Head of HNW Insurance at Noah Singapore

We speak to Kevin Foo, Head of HNW Insurance at Noah Singapore, who shares his valuable insights on China, China high net worths (HNWs), managing wealth & assets offshore in Hong Kong & Singapore and Noah’s growth in The 2021 Private Wealth Series.

Noah Holdings Limited (NYSE: NOAH) is a leading and pioneer wealth management service provider in China offering comprehensive one-stop advisory services on global investment and asset allocation primarily for high net worth investors. In the first half of 2021, Noah distributed RMB52.1 billion (US$8.1 billion) of investment products. Through Gopher Asset Management, Noah had assets under management of RMB155.9 billion (US$24.1 billion) as of June 30, 2021.

Noah’s wealth management business primarily distributes private equity, private secondary, mutual fund and other products denominated in RMB and other currencies. Noah delivers customized financial solutions to clients through a network of 1,268 relationship managers in 81 cities in mainland China, and serves the international investment needs of its clients through offices in Hong Kong, Taiwan, United States and Singapore. The Company’s wealth management business had 397,235 registered clients as of June 30, 2021. As a leading multi-asset manager in China, Gopher Asset Management manages private equity, real estate, public securities, multi-strategy and other investments denominated in RMB and other currencies. The Company also provides other businesses. Visit: Noah Holdings

Highlights from Interview

- On Chinese HNWs: “Loading up heavily on PE / VC funds, which lacks liquidity”

- “Real estate investment has always taken the centre stage in a Chinese portfolio”

- Chinese HNWs: “Handing over position, but not the authority”

- 1st Generation Focus: “Wealth creation, Making more money”

- 1st Generation Wealth: “Large majority are business owners who are accustomed to stomach risk”

- On Wealth Transfer: “Some are starting to understand the need for wealth preservation rather than focusing on wealth creation”

- China HNWs: “Hong Kong will likely be their 1st port of call”

- Singapore for China HNWs: “Top-notch wealth hub and independent jurisdiction with a bilingual population”

- “Singapore education system allows the HNW younger 2nd and even 3rd generation to study or work in Singapore”

- “Growing trend of HNW seeking out IAM (Independent Asset Managers) or Independent wealth management, like Noah Singapore”

- China Millionaires: Double to over 10 million by 2025

- On Entering into Chinese HNW space: “Go for it! This is a space that is growing and will continue to grow.”

- On Investments: “Time in the market and not timing the market”

- Likely first travel destination: “Mainland China for sure!”

” Real estate investment has always taken the centre stage in a Chinese portfolio “

Introduction:

Who are you and what do you do?

Kevin: I am Kevin Foo, heading the HNW insurance vertical for Noah Singapore, as part of our international team. Our Singapore office holds a CMS license (Capital Market Services) in Singapore, which allows us to offer both investment and insurance, as part of our Private Wealth Management service that we are offering to HNW individuals. (HNW ~ High net worth)

On China HNWs

Noah Holdings focus on HNWIs and is a leading wealth management and asset management company in China. China is growing so fast, and as a result producing lots of billionaires, UHNWs & HNWs.

1. What are the hot topics with clients, especially for Chinese clients today? What are some of the interesting stories about clients in China, perhaps in managing their wealth?

Kevin: With little impact of COVID on the Chinese economy, research has also shown that the average household income in China is expected to grow at 8.5% for the next 5 years, and almost doubling the number of millionaires in excess of 10 million by 2025.

- China millionaires to double to over 10 million by 2025

- Noah’s offshore wealth management expertise in Singapore

- Chinese HNWs: “Handing over position, but not the authority”

- Trust structure solution: Control over outcome, transit wealth to next generation

- Chinese HNWs: Loading up heavily on PE / VC funds, which lacks liquidity

In the latest Singapore’s central bank Monetary Authority of Singapore (MAS) Report 2020, Singapore Asset Under Management (AUM) grew from S$4 trillion (2019) to S$4.7 trillion (2020), with about 76% of AUM from offshore (2019). All these data shows that there will be massive demand for wealth management in Singapore. And with Noah Singapore setup, we want to offer offshore wealth management expertise for this growing segment of Chinese wealth. View: 2020 MAS AUM Report

Most importantly, by managing their wealth in an independent jurisdiction, the Chinese HNWs are finding that it is part of their asset diversification strategy as well as their ability to settle in globally if needed. Singapore naturally becomes their preferred option. Singapore has handled this pandemic well and is also place that is welcoming to offshore investors with no language barrier.

From wealth planning perspective, one of the key concerns for many Chinese HNWs are now at the crossroads of handing over their assets to the next generation. While they know they have the need to hand over, there is still a need for control. As the saying goes” 交权,不交棒” (Jiāo quán, bù jiāo bang), which means “Handing over position, but not the authority.” One of the most preferred solutions, is the use of Trust structure. They can have control over outcome through use of Trust deed and appointing protector, while transiting their wealth to the next generation.

In terms of investment management, Chinese HNWs are loading up heavily on PE / VC funds in their portfolio, which is understandable, as there is a lot of listing activities in recent years. (PE / VC ~ Private Equity / Venture Capital)

From a total wealth management perspective, there is a need to de-risk the portfolio to ensure their portfolio returns can be stable and not suffer sharp drop in value from any unexpected market movement. Another challenge of such portfolio is in legacy planning, such portfolio is too focused in getting a promising returns in the future, and (PE / VC funds) lacks liquidity.

” Chinese HNWs: Loading up Heavily on Pe / vc funds, which lacks liquidity “

On Noah, Wealth Planning, Wealth Structuring

2. For HNWIs, what wealth management or investments solutions are clients looking at? Is there a difference between what mainland Chinese are looking at and overseas Chinese?

Kevin: Being an offshore wealth management booking centre (Singapore), there is a need to start consolidating many of their assets on a platform that they can manage easily and offer as “safe harbour” where this portfolio can grow and be protected.

However, most of the time, their focus will be on wealth creation by the 1st generation. Clients will be looking out for the upcoming IPO company to buy or any new PE fund to invest in. I guess, “Making more money” remains the main focus regardless which part of the globe we, as Chinese, is from.

- 1st Generation Focus: Wealth creation, Making more money

- 1st Generation Wealth: Large majority are business owners who are accustomed to stomach risk

- Consolidate assets on a platform to manage easily and as “safe harbour”

- Wealth Transfer: Some are starting to understand the need for wealth preservation rather than focusing on wealth creation

- Singapore is well positioned to be both global gateway and gateway towards Southeast Asia neighbours

As creator of their 1st generation wealth, large majority are business owners who are accustomed to stomach risk. You can observe this from their investment portfolio that that owned. As they start planning to hand over their wealth, some are starting to understand the need for wealth preservation rather than focusing on wealth creation, so that the wealth accumulated can be handed over in a carefully planned process.

Of course, there will be some, who are purely seeking out investment opportunities and Noah Singapore is positioned uniquely to offer a Southeast Asia flavour investment theme to be added into their investment mix, while providing them with a global investment platform.

Many of them are familiar with Trust structures and are planning to set up Trust or Family office in Singapore as part of their legacy planning. With Singapore being a global financial hub with comprehensive financial eco-system of asset managers, clients are exposed to wider variety of investment themes, beyond of what they are familiar with in China, Hong Kong or US.

Singapore is well positioned to be both, as a global gateway and also a gateway towards our Southeast Asia neighbours, offering Southeast Asia themed investment opportunities. To meet such demand and also to be a one stop solution provider, my HQ has set up our very own Trust company, ARK Trust (Singapore), where our clients can opt to use as part a total solution offering.

” 1st Generation Focus: Wealth creation, Making more money “

Wealth Planning and Wealth Structuring are hot topics today, especially for next generation wealth transfer and the growing millionaires / HNWIs.

3. What is Noah doing for clients today for Wealth Planning & Wealth Structuring?

Kevin: When planning for wealth transfer through the use of Trust structures, stability and being an independent country becomes important considerations as the legacy must last through many generations. Singapore naturally become one of the preferred hub, as part of their asset diversification consideration.

- Trust Structures: Stability and being an independent country becomes important as the legacy must last through many generations

- VCC coupled with attractive and clear tax rules such as 13R/13X, makes Singapore extremely attractive

Another reason is that many traditional offshore jurisdictions are being challenged for the need to prove economic substances when setting up offshore companies to hold their assets. With the rise of big data and increase in tax transparency, the need to have a proper structure in a reputable jurisdiction become key for many HNW.

Recently, we had interest from clients that are enquiring about Variable Capital Company (VCC) structure which was introduced last year in Singapore to help boost Singapore as a preferred offshore wealth management hub. VCC coupled with attractive and clear tax rules such as 13R/13X, makes Singapore extremely attractive as offshore wealth management hub for our Chinese clients, especially for those who have the intent to set up family office here.

With less language barrier and higher education level, you may have also observed the trend of the next generations being more mobile. They are setting up their career all over the globe. The younger generations are also having the option to settle anywhere in the world. With such high mobility, a periodic review of their structure is necessary to ensure that it fulfils its intent. A more portable solution such as Private Life Placement Insurance can also be considered to meet such demand.

” Stability and being an independent country becomes important as the legacy must last through many generations “

Noah in Singapore

Recently you acquired Capital Markets Services license in Singapore. Singapore is a key financial centre in Asia alongside Hong Kong with many billionaires and UHNWs & HNWs setting up base or moving to Singapore, including managing & investing in properties, acquiring residency status, planning for children’s education or managing their assets.

4. How is Singapore positioned compared to Hong Kong? What is your business plan in Singapore?

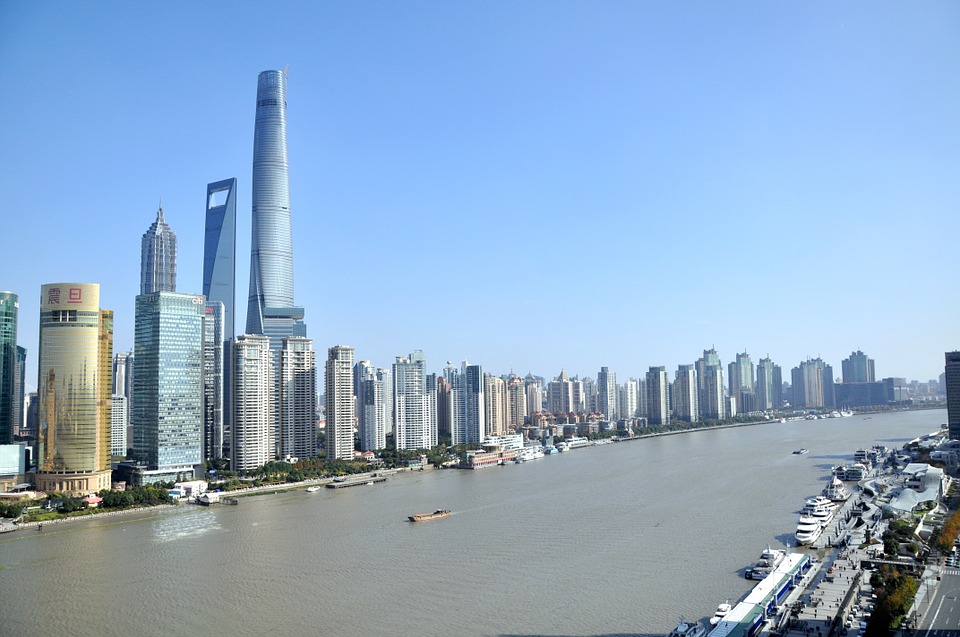

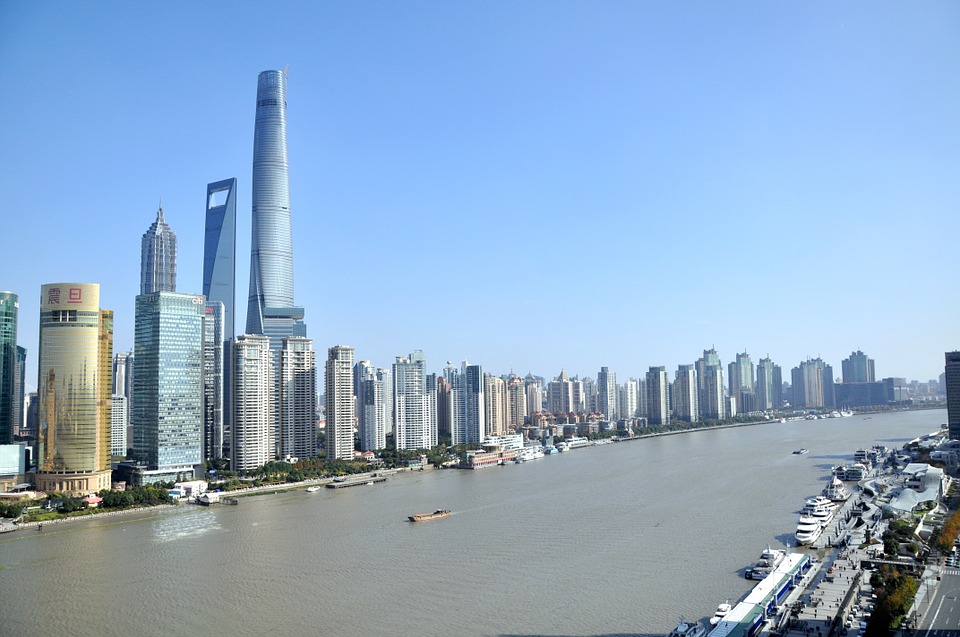

Kevin: Hong Kong, in my opinion will be well positioned for growth, as there is a push by the Chinese government to develop The Greater Bay Area (GBA). To share some data, the GDP generated by GBA has already surpassed $1.4 trillion, contributing 12% of the Chinese economy and it is expected to grow exponentially, with more investment being pumped in by the Chinese Central Government. If you are familiar with the massive population of both Tokyo Metropolitan and New York, the GBA has a total population with these 2 cities combined with an estimated population close to 67 million.

- Hong Kong, GBA: GDP $1.4 trillion & 67 million population, contributing 12% to China economy

- China HNWs: Hong Kong will likely be their 1st port of call

- Singapore for China HNWs: Top-notch wealth hub and independent jurisdiction with a bilingual population

- Singapore education system: Allows HNW younger 2nd and even 3rd generation to study or work in Singapore.

- Singapore booking office offers an open architecture platform

Currently, Hong Kong will be a jurisdiction that many Chinese are familiar with and likely be their 1st port of call, as they quench their thirst for offshore wealth management and investment services.

Strategically, Singapore has a very unique proposition for Chinese HNW; a top-notch wealth hub and importantly Singapore is an independent jurisdiction with a bilingual population. We will form part of the bigger Noah network for our Noah clientele to choose from. There is also not enough focus on other benefits of Singapore. For example, Singapore education system allows the HNW younger 2nd and even 3rd generation to study or work in Singapore. On top of being a preferred wealth hub, Singapore is also a top tier city, which is excellent as a place to live and work.

At Noah Singapore, we are leveraging the strength of our product platform. Each product platform is anchored to a global team of specialists. In Singapore, we have professionals with diverse experience. Our product platform comprises of members with alternative investment class selection expertise, fund selection expertise from private banking practice to HNW Insurance solutions.

From wealth planning perspective, we have our sister company, ARK Trust (Singapore) which my HNW insurance team partner with. HNW insurance team also have our own client servicing manager to help with Singapore’s life insurance underwriting process.

Most importantly Singapore booking office offers an open architecture platform. We want to offer our clients the best-in-class from our international products, not just in Singapore. As clients structure their wealth into Singapore, the key is to offer them what our entire Noah International network is able to offer, while providing them with an expert view of what Singapore can offer.

” Singapore – Top-notch wealth hub and independent jurisdiction with a bilingual population “

5. How can Singapore clients benefit with Noah’s China expertise?

Kevin: For Singapore clients, we have the ability to offer an exclusive investment opportunity into China. As you may already know, Noah Holdings, has an asset management arm, Gopher Asset Management. One of its strengths is the ability to have that in-depth research and offer Chinese investments from a Chinese perspective.

From these offerings, you will find that Noah (Singapore) is extremely unique in this aspect, where we are able to satisfy both local HNW market and Chinese HNW offshore wealth management needs.

” Gopher Asset Management – Offer Investments from a Chinese Perspective “

6. For Chinese HNW Clients (overseas), comparing to a Private Bank, what is the strength of Noah Singapore?

Kevin: I personally believe that private banks will always have their appeal. However, if you observe, there is also a growing trend of HNW seeking out IAM (Independent Asset Managers) or Independent wealth management, like Noah Singapore.

We are aligned with what our clients wants to achieve financially and to create a personalised experience in their offshore wealth planning journey.

There is appeal within the Noah brand franchise. Noah is an established brand name in China and in Singapore and we can offer dual advantages. Singapore being a reputable wealth hub as an independent country with a group of professionals (Noah) with strong expertise and a strong understanding of the Chinese culture compared to Singapore local private banks. We also aspire in making their wealth planning process simple and seamless as they start to move their offshore wealth into Singapore, with a brand that they are familiar with and they can trust.

” Noah is an established brand name in china “

7. Who are the product providers and partners that you are currently working with?

Kevin: For investment, we are partnering with select IAMs (Independent Asset Managers) to structure unique investment opportunities for our clients. With us still being new in Singapore, we are also very much open in partnering with more IAMs who have strong performance track record, as we want to provide that Southeast Asia theme for our clients.

For insurance, we will go through an internal scoring matrix based on 3 key areas 1) credit rating 2) familiarity in solutions for offshore HNW & 3) product competitiveness. While we do not believe in a platform that offers every provider in the market and we are always keeping our eyes on the market and reviewing our providers.

” Partnering with more IAMs who have strong performance track record “

Trends in China

China is a massive economy with a huge population. There are so many new ideas, ventures, initiatives everyday that has created an incredible economic growth engine and journey, with vibrant and fast-growing number of companies and jobs, tremendous income opportunities, wealth growth creating billionaires, UHNWs & HNWs, and bringing hundreds of millions of people out of poverty, improving living conditions & life, opportunities for more and more people.

8. It will take a long time for you to share – briefly, can you share some key trends and investment opportunities in China?

Kevin: Real estate investment has always taken the centre stage in a Chinese portfolio. However, in the recent years, there is a saying: “PE funds are the real estate investment of the yester-years.” And many Chinese HNW’s portfolio are overweighted in PE funds, as an asset class. (PE ~ Private Equity)

PE funds are considered as an illiquid asset class. As part of wealth planning, one of the considerations is to help client to provide liquidity planning. Once their portfolio is packed full of illiquid assets, from the perspective of legacy planning, it is never a good idea.

With IPO trend strong in China, naturally there is a need for proper structuring for the UHNW who are planning to IPO their company. Noah Singapore is again poised to offer such service to them.

In Noah Singapore, rather than just focusing on wealth creation through investment, we want to ensure that their wealth is being preserved. Alternative holding structure, such as Private Placement Life Insurance (PPLI) is one such structure that allows client to achieve that. PPLI still a new concept to many and has many advantages as a PIC (Private Investment Company) while offering the benefit of tax deferral. HNW clients can also have the option to structure it with a Trust for more complex wealth planning need, and it is highly customisable.

There are many insurers that offers PPLI, however, not all PPLI are the same. It is important to work with a qualified wealth planner and tax advisor to select the right PPLI provider and structure it properly.

” Real estate investment has always taken the centre stage in a Chinese portfolio “

Final Words

1. Any advice for Singapore wealth planning managers who are planning to enter into Chinese HNW Space?

Kevin: Go for it! This is a space that is growing and will continue to grow. For those who have concern on your Chinese language skill, you are not alone. I am one of them and have struggled and continue to do so, as English is the main communication language in Singapore.

Don’t be shy and just practise. For all my webinars and clients meeting, I will prepare my scripts in English before translating into mandarin. Did I make any embarrassing mistake? Of course, I did! But those stories are for another time.

” Chinese HNW Space: Go for it! This is a space that is growing and will continue to grow “

2. You are so busy, do you have time to manage your wealth and investments?

Kevin: I strongly believe in “Time in the market and not timing the market.” Setting aside 15% of my income regularly into a diversified portfolio, which consist of mainly mutual funds. With another 10% of my income into Life insurance. “Life” already come with the word “if” in the centre. Life is full of “What ifs”. Life insurance is a great tool for wealth creation for legacy planning.

My greatest fear is that I have outstanding debts that I am not aware of and passing those debts as liability to them.

3. What is your first likely destination once travel opens up again?

Kevin: Mainland China for sure!

There are many clients that have invited me over and due to the recent pandemic, all our interaction is still via video call.

Thank you Kevin for sharing your valuable insights on China, China high net worths (HNWs), managing wealth & assets offshore in Hong Kong & Singapore, and Noah’s growth in The 2021 Private Wealth Series.

Kevin Foo, Head of HNW Insurance at Noah Singapore

Kevin Foo is the Head of High Net Worth Insurance at Noah Singapore. Noah Singapore holds a CMS license (Capital Market Services) allowing Noah Singapore to offer both Investment and Insurance, as part Noah’s Private Wealth Management Service to HNW individuals. (HNW ~ High net worth)

Kevin is an accomplished individual in the insurance industry and was the former Head of Bancassurance at Tokio Marine (Asia), which is Japan’s largest insurance group and one of the largest insurance group in the world. Prior to Tokio Marine, he was at Aviva (Business Development) and HSBC (Vice President, Financial Planning).

Kevin holds the Chartered Financial Consultant (ChFC®), Associate Wealth Planner (AWP™) and Chartered Life Underwriter (CLU®). He had graduated from the University of Bradford with a Bachelor in Accounting & Finance.

About Noah Holdings

Noah Holdings Limited (NYSE: NOAH) is a leading and pioneer wealth management service provider in China offering comprehensive one-stop advisory services on global investment and asset allocation primarily for high net worth investors. In the first half of 2021, Noah distributed RMB52.1 billion (US$8.1 billion) of investment products. Through Gopher Asset Management, Noah had assets under management of RMB155.9 billion (US$24.1 billion) as of June 30, 2021.

Noah’s wealth management business primarily distributes private equity, private secondary, mutual fund and other products denominated in RMB and other currencies. Noah delivers customized financial solutions to clients through a network of 1,268 relationship managers in 81 cities in mainland China, and serves the international investment needs of its clients through offices in Hong Kong, Taiwan, United States and Singapore. The Company’s wealth management business had 397,235 registered clients as of June 30, 2021. As a leading multi-asset manager in China, Gopher Asset Management manages private equity, real estate, public securities, multi-strategy and other investments denominated in RMB and other currencies. The Company also provides other businesses. Visit: Noah Holdings

Gopher Asset Management Co, Ltd (Gopher Asset), was established in March 2010 as a subsidiary of Noah Holdings Limited (NOAH: NYSE), the largest independent wealth management company in China. Take the Fund of Funds(FOF) as the primary and leading product line, Gopher Asset’s business scope ranges from Private Equity Investment, Real Estate Fund Investment, Equity Investment, Fixed Income Investment, Portfolio Investment, and other diversified fields. As of the first quarter of 2021, Gopher’s total AUM has surpassed RMB 154.1 billion.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit