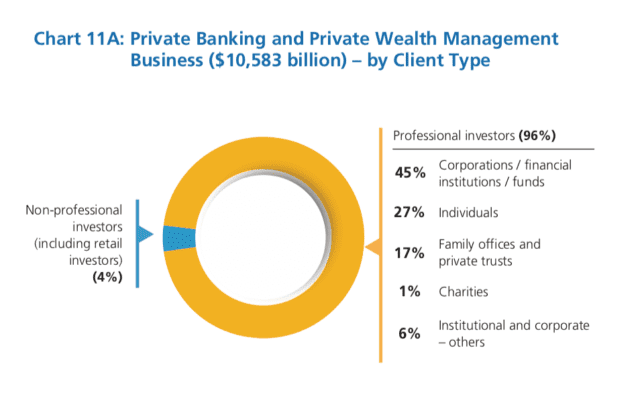

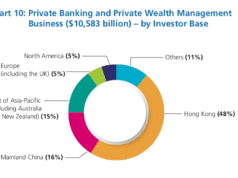

Hong Kong Private Banking and Private Wealth Management – by Client Type

Hong Kong Private Banking and Private Wealth Management – by Client Type:

- Corporations / financial institutions / funds: 45%

- Individuals: 27%

- Family offices & private trust: 17%

- Institutional & corporate / others: 6%

- Charities: 1%

The Hong Kong Securities & Futures Commission (SFC) has released the Hong Kong Asset & Wealth Management Report 2021 titled “Asset & Wealth Management Activities Survey 2021”, providing on overview on Asset Management, Wealth Management, Private Banking, Trust, and Hong Kong as an Offshore Renminbi Centre in 2021. View Full Report: HK SFC

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit