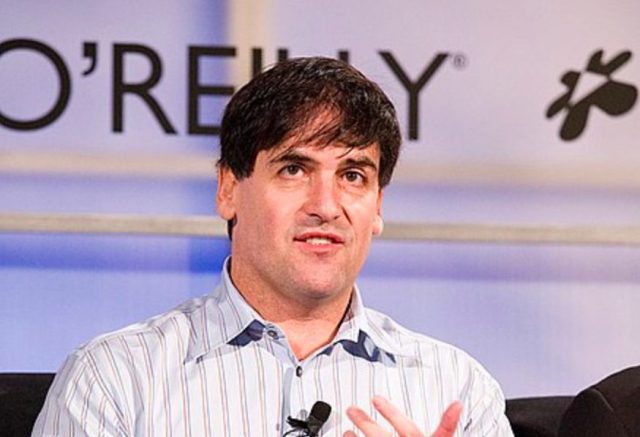

Billionaire Mark Cuban Named in Class Action Lawsuit for Promoting Crypto Currency Platform Voyager Digital, Announced 5-Year Sponsorship of Dallas Mavericks in 2021 & Filed for Bankruptcy in July 2022

18th August 2022 | Hong Kong

Billionaire & NBA team Dallas Mavericks owner Mark Cuban had been named in a class action lawsuit for promoting cryptocurrency platform Voyager Digital, which had announced a 5-year sponsorship of Dallas Mavericks in 2021 and filed for bankruptcy on 6th July 2022. Mark Cuban was a client of Voyager Digital, trading on the platform itself. His comments include: “As close to risk-free as you’re gonna get in the crypto.” In the class action lawsuit, the investors alleged the Voyager Digital was a “Ponzi scheme”.

“ Billionaire Mark Cuban Named in Class Action Lawsuit for Promoting Crypto Currency Platform Voyager Digital, Announced 5-Year Sponsorship of Dallas Mavericks in 2021 & Filed for Bankruptcy in July 2022 “

Earlier in July 2022: Crypto exchange Voyager Digital had filed for chapter 11 bankruptcy protection, with $1.3 billion assets, $350 million cash & $650 million claim against crypto fund Three Arrows Capital. Voyage Digital: “As part of the reorganization process, the Company will file customary “First Day” motions to allow it to maintain operations in the ordinary course. Voyager intends to pay its employees in the usual manner and continue their primary benefits and certain customer programs without disruption. The Company expects to receive court approval for all these routine requests. Trading, deposits, withdrawals and loyalty rewards on the Voyager platform remain temporarily suspended.” Also in July 2022, former Credit Suisse traders $3 billion crypto fund Three Arrows Capital had been ordered into liquidation by a BVI Court (British Virgin Islands), after failing to meet creditors demand for payment including $665 million from Voyager Digital. Three Arrows Capital is founded by 2 former Credit Suisse traders & crypto billionaire Zhu Su (Age 35) and Kyle Davies (Age 35) in 2012 in a kitchen table in their apartment. The fund had over $3 billion worth of cryptocurrencies under management.

Voyager Digital Bankruptcy Filing – 6th July 2022

Voyager Digital Ltd. (“Voyager” or the “Company”) (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2), today announced that it has commenced a voluntary Chapter 11 process to maximize value for all stakeholders. As part of this process, the Company and its main operating subsidiaries filed voluntary petitions for reorganization under Chapter 11 in the U.S. Bankruptcy Court of the Southern District of New York (the “Court”). The Company intends to seek recognition of the Chapter 11 case of Voyager in the Ontario Superior Court of Justice (Commercial List) pursuant to the Companies’ Creditors Arrangement Act.

“This comprehensive reorganization is the best way to protect assets on the platform and maximize value for all stakeholders, including customers,” said Stephen Ehrlich, Chief Executive Officer of Voyager. “Voyager’s platform was built to empower investors by providing access to crypto asset trading with simplicity, speed, liquidity, and transparency. While I strongly believe in this future, the prolonged volatility and contagion in the crypto markets over the past few months, and the default of Three Arrows Capital (“3AC”) on a loan from the Company’s subsidiary, Voyager Digital, LLC, require us to take deliberate and decisive action now. The chapter 11 process provides an efficient and equitable mechanism to maximize recovery.”

The proposed Plan of Reorganization (“Plan”) would, upon implementation, resume account access and return value to customers. Under this Plan, which is subject to change given ongoing discussions with other parties, and requires Court approval, customers with crypto in their account(s) will receive in exchange a combination of the crypto in their account(s), proceeds from the 3AC recovery, common shares in the newly reorganized Company, and Voyager tokens. The plan contemplates an opportunity for customers to elect the proportion of common equity and crypto they will receive, subject to certain maximum thresholds.

Customers with USD deposits in their account(s) will receive access to those funds after a reconciliation and fraud prevention process is completed with Metropolitan Commercial Bank.

The Company continues to evaluate all strategic alternatives to maximize value for stakeholders. The Company has over $110 million of cash and owned crypto assets on hand, which will provide liquidity to support day-to-day operations during the Chapter 11 process, in addition to more than $350 million of cash held in the For Benefit of Customers (FBO) account at Metropolitan Commercial Bank. Voyager also has approximately $1.3 billion of crypto assets on its platform, plus claims against Three Arrows Capital (“3AC”) of more than $650 million.

Voyager previously announced that its subsidiary, Voyager Digital LLC, issued a notice of default to 3AC for failure to make the required payments on its previously disclosed loan of 15,250 BTC and $350 million USDC. Voyager is actively pursuing all available remedies for recovery from 3AC, including through the court-supervised processes in the British Virgin Islands and New York.

The Company also announced the appointment of a four new independent directors: Matthew Ray at Voyager Digital Ltd.; Scott Vogel at Voyager Digital Holdings, Inc.; and Jill Frizzley and Timothy Pohl at Voyager Digital LLC. Information regarding their backgrounds and relevant experience is included at the end of this release.

As part of the reorganization process, the Company will file customary “First Day” motions to allow it to maintain operations in the ordinary course. Voyager intends to pay its employees in the usual manner and continue their primary benefits and certain customer programs without disruption. The Company expects to receive court approval for all these routine requests. Trading, deposits, withdrawals and loyalty rewards on the Voyager platform remain temporarily suspended.

About Voyager Digital Ltd.

Voyager Digital Ltd.’s (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2) US subsidiary, Voyager Digital, LLC, is a cryptocurrency platform in the United States founded in 2018 to bring choice, transparency, and cost-efficiency to the marketplace. Voyager offers a secure way to trade over 100 different crypto assets using its easy-to-use mobile application. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit