Utmost Group Advising £57.6 Billion Announced Closure in 2023 of AAM Advisory in Singapore with S$800 Million AUM & 4,000 Clients

20th October 2022 | Singapore

Utmost Group, a leading provider of insurance & savings solutions advising £57.6 billion & 550,000 clients globally, has announced the closure in 2023 of wealth management & advisory firm AAM Advisory in Singapore with S$800 Million Assets under Advisory (AUA) and more than 4,000 clients. AAM Advisory (Singapore) was acquired by Utmost Group in 2021, as part of global acquisition of Quilter International in 2021. Utmost Group: “Utmost has now completed a strategic review of the AAM business and determined that, because our focus is on partner-led distribution rather than building our own, closure and de-authorisation is the preferred strategic outcome.” Paul Thompson, Utmost Group CEO: “The closure of AAM will allow Utmost International to focus on growing our core wealth solutions business and enable us to focus on the continued development of our proposition. Our strategy is built on partner-led distribution and, in 2021, we distributed our products through over 800 distribution partners globally. Singapore is a key strategic market for insurance-based wealth solutions. The Group remains committed to growing its presence here, as well as in the wider Asia region, where we continue to develop attractive propositions for affluent and HNW clients. We are grateful to the AAM staff for their hard work over the years and to our clients for their business, and we will work closely with those who are impacted by this decision to ensure a smooth transition.”

” Utmost Group Advising £57.6 Billion Announced Closure in 2023 of AAM Advisory in Singapore with S$800 Million AUM & 4,000 Clients “

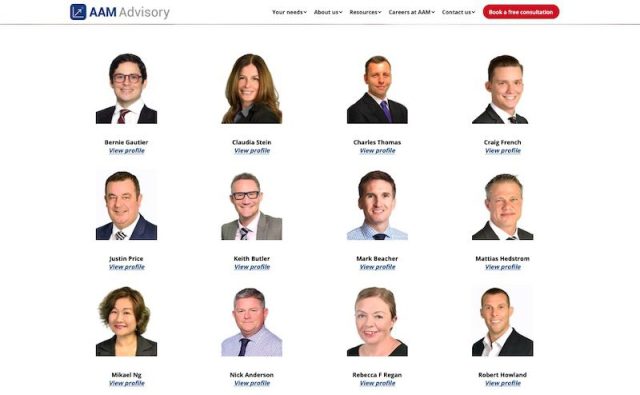

AAM Advisory (Singapore)

AAM Advisory manages over S$800m of assets under advice, principally in third party products, on behalf of over 4,000 clients. It is expected that the closure will be finalised in 2023.

AAM Advisory CEO is Lidya Natalia. Lidya joined AAM Advisory as Head of Finance in June 2015 and has been responsible for the overall financial functions including accounting, audit, budgeting and reporting. She has experience in leading a team of highly experienced accounting professionals to oversee AAM’s financial operations and instil robust internal control to advocate proper accounting practice. In recent years, Lidya has been an active member of the Management Committee working closely with the board members to provide strategic direction for the company and this has cumulated in her appointment in September 2022 as CEO. Lidya has over 15 years’ experience working in the IFA and insurance industries, including two years at KPMG.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit