Japan Central Bank to Buy $1.67 Billion of 5 to 25 Years Government Bonds to Stop Rising Yield & Falling Bond Prices, USDJPY Falls to Lowest in 32 Years at 150.27

21st October 2022 | Hong Kong

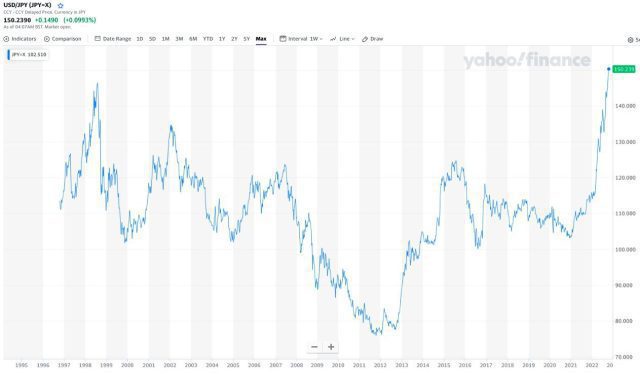

Japan central bank (Bank of Japan) has announced to buy $1.67 billion of 5 to 25 years Japan government bonds (JGBs) to stop rising yield & falling bond prices, with USDJPY falling to lowest in 32 years (21/10/22: USDJPY 150.27). Bank of Japan maintains the 10-year government bond yield at around 0%, but the yield has increased to around 0.26% (21/10/22). Increase in bond yield typically cause existing bond prices to fall. Bank of Japan Announcement: “To buy 100 billion yen of JGBs with maturities of 10-20 years,100 billion yen of bonds with maturities of 5-10 years, 50 billion yen of bonds with maturities longer than 25 years.”

“ Japan Central Bank to Buy $1.67 Billion of 5 to 25 Years Government Bonds to Stop Rising Yield & Falling Bond Prices, USDJPY Falls to Lowest in 32 Years at 150.27 “

USDJPY from 1996 to 2022 (26 Years) Chart

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit