Blackstone Limits Withdrawal from $125 Billion Real Estate Fund Following Increase in Withdrawal Request, Blackstone Real Estate Income Trust Fund Approved $1.3 Billion – 43% of Requests in November 2022

2nd December 2022 | Hong Kong

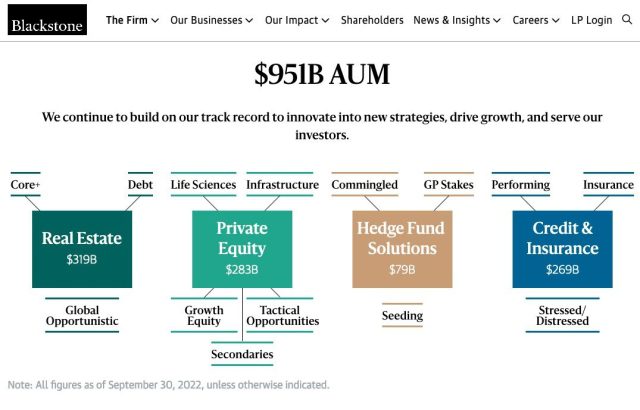

Top private equity firm Blackstone with $951 billion AUM has limited withdrawal from its $125 billion real estate fund following an increase in withdrawal request in November 2022. Blackstone Real Estate Income Trust Fund approved $1.3 billion of redemption, representing 43% of requests in November 2022. The Blackstone Real Estate Income Trust Fund (BREIT) allows 2% of funds to be redeemed each month, and a maximum of 5% in a quarter. The $125 billion fund excluding debts, has a net asset value of $69 billion. In 2021 the 5th year of the fund, Blackstone Real Estate Income Trust Fund reported 28.7% returns, 12.4% returns for Class S Shares (Class S shares with sales load of 24.4%), and total asset value of $94 billion. The 3 years annualised return is 14.5% with no sales load. 82% of the fund is concentrated in Residential & Industrial and 73% is concentrated in the South and West regions of the United States. (AUM ~ Assets under Management)

“ Blackstone Limits Withdrawal from $125 Billion Real Estate Fund Following Increase in Withdrawal Request, Blackstone Real Estate Income Trust Fund Approved $1.3 Billion – 43% of Requests in November 2022 “

About Blackstone Real Estate Income Trust

Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across key property types and to a lesser extent in real estate debt investments. BREIT is externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $319 billion in investor capital under management. Further information is available at www.breit.com.

Blackstone Real Estate Income Trust Fund Announcement

Blackstone on 1st Dec 2022 – Since formation nearly six years ago, BREIT’s Share Repurchase Plan (the “Repurchase Plan”) has allowed for repurchases up to 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter, subject to BREIT’s majority independent Board of Directors’ broad repurchase discretion.1 This structure was designed both to prevent a liquidity mismatch and maximize long- term shareholder value.

BREIT received repurchase requests equal to 2.7% of NAV in October, or approximately $1.8 billion, and received approval from its majority independent Board of Directors to fulfill 100% of repurchase requests.2 BREIT has now received repurchase requests exceeding both the 2% of NAV monthly limit and 5% of NAV quarterly limit, triggering proration for the remaining 2.3% of NAV for the quarter. Accordingly, BREIT repurchased approximately $1.3 billion in November, equal to its 2% of NAV monthly limit and approximately 43% of each investor’s repurchase request. In December, up to 0.3% of NAV will be eligible for repurchase to total 5% of NAV for the quarter. If BREIT receives elevated repurchase requests in the first quarter of 2023, BREIT intends to fulfill repurchases at the 2% of NAV monthly limit, subject to the 5% of NAV quarterly limit.

Under the Repurchase Plan, unfulfilled repurchase requests will not be carried over automatically. Investors will need to resubmit any unsatisfied portion of their current repurchase request for repurchase in the future.

Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across key property types and to a lesser extent in real estate debt investments. BREIT is externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $319 billion in investor capital under management. Further information is available at www.breit.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager with $951 billion in assets under management. With $283 billion of assets under management, Blackstone’s private equity business has been a global leader since 1985.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit