South Korean & Founder of Biotech, Cosmetic & Anti-Wrinkle Caregen CEO Chung Yong-ji Becomes Self-Made Billionaire, Share Price Rises to $1.56 Billion Market Value with 64% Shareholding

11th February 2023 | Hong Kong

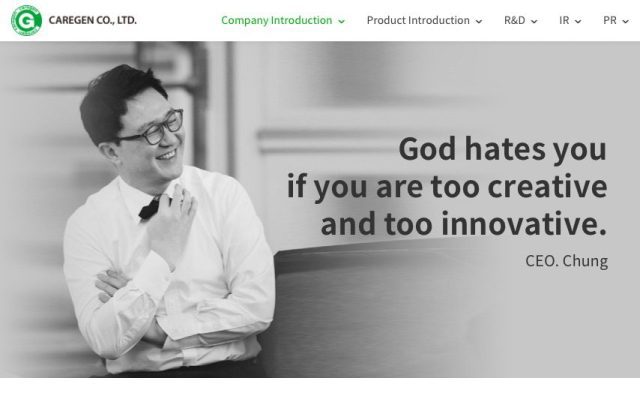

South Korean & founder of biotech, cosmetic & anti-wrinkle Caregen Co. CEO Chung Yong-ji has become a self-made billionaire, with Caregen share price rising to $1.56 billion market value (Chung Yong-ji: 64% Shareholding of Caregen Co. valued at $1 billion 10/2/23). Caregen Co. CEO Chung Yong-ji: “Caregen is a dynamic and progressive biotechnology company infrastructured with peptide-based R & D,and is a global leader with world-class peptide library and a large number of patents in the field of peptide research and development. Since its foundation in 2001, the company has developed and launched various products such as cosmeceuticals, medical devices, functional foods and pharmaceuticals based on our more than 360 globally patented peptides and skin delivery technology. Currently, we are expanding our market by exporting to over 130 countries. Caregen will lead the market with continuous research and development and technological innovation to provide peptide-based high-quality and differentiated products to our partners around the world through a global network.” Chung Yong-ji founded Caregen in 2001 and in 2015, listed Caregen on South Korea stock exchange (Kosdaq) raising $160 million in the IPO (Initial Public Offering). Chung Yong-ji has a PhD (Animal Science) from Cornell University, Masters in Biology from Texas State University, and Bachelor in Genetic Engineering from Sungkyunkwan University.

“ South Korean & Founder of Biotech, Cosmetic & Anti-Wrinkle Caregen CEO Chung Yong-ji Becomes Self-Made Billionaire, Share Price Rises to $1.56 Billion Market Value with 64% Shareholding “

South Korean & Founder of Biotech, Cosmetic & Anti-Wrinkle Caregen Co. CEO Chung Yong-ji Becomes Self-Made Billionaire, Share Price Rises to $1.56 Billion Market Value with 64% Shareholding

Chung Yong-ji has become a self-made billionaire, with share price rising to a $1.56 billion market value (Chung Yong-ji: 64% Shareholding of Caregen Co. valued at $1 billion 10/2/23). Chung Yong-ji has a PhD (Animal Science) from Cornell University, Masters in Biology from Texas State University, and Bachelor in Genetic Engineering from Sungkyunkwan University.

About Caregen

Caregen, a global leader in peptide research and development ,is a global biotechnology company that has commercialized the unlimited expandability of its patented peptides as many innovative products since its establishment in 2001. Over 600 different functional peptides developed by Caregen for the past 19 years have opened new paradigm in the field of biotechnology by expanding its applications to cosmeceutical, Class III medical devices, food supplement, and pharmaceuticals. We are striving to dramatically improve human life and health providing total health care solution through the development, production, and supply of various peptides. Our innovative peptide-based products provide solutions to many people around the world who are pursuing health and beauty with our unique skin delivery technology that maximize the efficacy and effectiveness of products

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit