Facebook Co-Founder Eduardo Saverin B Capital Closes Healthcare Fund 1 with $500 Million Closed 3rd Fund $2.1 Billion in January 2023

2nd March 2023 | Hong Kong

Facebook co-founder Eduardo Saverin private equity firm B Capital has closed its first Healthcare Fund 1 with $500 million, haven just closed its 3rd Fund of $2.1 billion in January 2023. B Capital Healthcare Fund 1 will invest in opportunities across the healthcare sector, from digital health to biotech, and is led by Robert Mittendorff, MD, General Partner & Head of Healthcare at B Capital. B Capital: “The current B Capital global healthcare portfolio includes over 20 companies in the US, Asia and Europe, spanning early venture to late growth venture, across healthtech, digital health, biotech and medtech. Notably, the team co-led the latest round of investment in Hotspot Therapeutics, an AI-enabled drug discovery company, and led the latest round in Triumvira, a novel cell therapy platform in clinical development. The team also led the latest financing in CapitalRX, a transformative tech platform for pharmacy benefits management. In medtech, the team led the last round in Carlsmed, an AI-enabled personalized spinal implant company.” B Capital Group is a private equity firm co-founded by converted-Singapore Citizen Eduardo Saverin, who is also one of Singapore’s richest man with around $9 billion personal fortune, and Raj Ganguly (Senior Advisor, Boston Consulting Group) in 2015. B Capital was founded in 2015 and invests in transformative technology startups during their early expansion stage (Series B, C rounds), at which time a company is prepared for rapid growth and acceleration. The firm partners with technology companies ranging from seed to late-stage growth, primarily in the enterprise, fintech and healthcare tech sectors. The firm invests between $10 million to $50 million in each portfolio company, including reserves for future growth funding. In June 2020, B Capital Group closed its 2nd fund of $820 million, with the group totalling AUM of more than $1.4 billion. In January 2023, B Capital Group closed its 3rd fund of $2.1 billion, with the group totalling AUM of around $6.3 billion. In 2022 May, B Capital cancelled its plans to raise $300 million via a SPAC listing in United States, a filing initiated in February 2021 for B Capital Technology Opportunities Corp to the United States Securities & Exchange Commission. (SPAC ~ Special Purpose Acquisition Company)

Dr. Robert Mittendorff: “We are witnessing unprecedented innovation across the healthcare landscape. Technological advancements in biology, AI and automation are transforming the industry, with business models seeing the convergence of traditional players in novel ways. This moment presents a unique opportunity for B Capital to leverage our dedicated healthcare capital and active investment strategy to find and support companies advancing the healthcare sector.”

Howard Morgan, Chair & General Partner of B Capital: “B Capital has decades of collective operating experience in the healthcare industry and a deep technical focus that allows us to identify and support the best companies in the space. Our unique value-add approach to global venture and growth investment, including our strategic partnership with Boston Consulting Group (BCG), places founders and management teams front-and-center, surrounding them with resources they need to transform large markets through innovation and customer-focused solutions.”

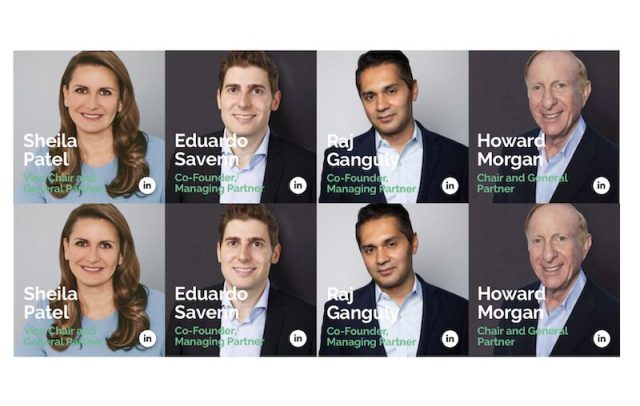

Facebook Co-Founder Eduardo Saverin B Capital Closes 3rd Fund at $2.1 Billion, Founded in 2015 and Led by Howard Morgan, Sheila Patel, Eduardo Saverin & Raj Ganguly

21st January 2023 – Facebook co-founder Eduardo Saverin private equity firm B Capital has closed its 3rd fund at $2.1 billion,. a multi-stage global investment firm led by Howard Morgan, Sheila Patel, Eduardo Saverin & Raj Ganguly. B Capital Group is a private equity firm co-founded by converted-Singapore Citizen Eduardo Saverin, who is also one of Singapore’s richest man with around $9 billion personal fortune, and Raj Ganguly (Senior Advisor, Boston Consulting Group) in 2015. B Capital was founded in 2015 and invests in transformative technology startups during their early expansion stage (Series B, C rounds), at which time a company is prepared for rapid growth and acceleration. The firm partners with technology companies ranging from seed to late-stage growth, primarily in the enterprise, fintech and healthcare tech sectors. The firm invests between $10 million to $50 million in each portfolio company, including reserves for future growth funding. In June 2020, B Capital Group closed its 2nd fund of $820 million, with the group totalling AUM of more than $1.4 billion. In January 2023, B Capital Group closed its 3rd fund of $2.1 billion, with the group totalling AUM of around $6.3 billion. In 2022 May, B Capital cancelled its plans to raise $300 million via a SPAC listing in United States, a filing initiated in February 2021 for B Capital Technology Opportunities Corp to the United States Securities & Exchange Commission. (SPAC ~ Special Purpose Acquisition Company)

Eduardo Saverin, B Capital Co-Founder & Managing Partner: “Since its inception, B Capital has been committed to investing in cutting-edge technology companies. Growth Fund III’s portfolio includes companies that are transforming their respective industries and generating meaningful impact. Our strategic partnership with Boston Consulting Group (BCG) and strong on-the-ground presence in key geographies enable us to provide our portfolio companies with targeted insights and expert advice. This multi-faceted, forward-thinking strategy lays a foundation for consistent portfolio company growth and firm success.”

Raj Ganguly, B Capital Co-Founder & Managing Partner: “Our emphasis on value-add investing, supported by our platform advisors and strategic partnership with BCG, enables us to accelerate business development and growth across our portfolio. This approach drives a high-performance investment model, which we will continue to apply to the Growth Fund III series.”

B Capital

B Capital is a multi-stage global investment firm that partners with extraordinary entrepreneurs to shape the future through technology. With $6.3 billion in assets under management across multiple funds, the firm focuses on seed to late-stage venture growth investments, primarily in the enterprise, financial technology and healthcare sectors. Founded in 2015, B Capital leverages an integrated team across nine locations in the US and Asia, as well as a strategic partnership with BCG, to provide the value-added support entrepreneurs need to scale fast and efficiently, expand into new markets and build exceptional companies.

B Capital was founded in 2015 and invests in transformative technology startups during their early expansion stage (Series B, C rounds), at which time a company is prepared for rapid growth and acceleration. The firm invests between $10 million to $50 million in each portfolio company, including reserves for future growth funding. In June 2020, B Capital Group closed its 2nd fund of $820 million, with the group totalling AUM of more than $1.4 billion. In January 2023, B Capital Group closed its 3rd fund of $2.1 billion, with the group totalling AUM of around $6.3 billion.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit