$12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation, New Owners Own NFL Cleveland Browns & Major League Soccer Club Columbus Crew

4th March 2023 | Hong Kong

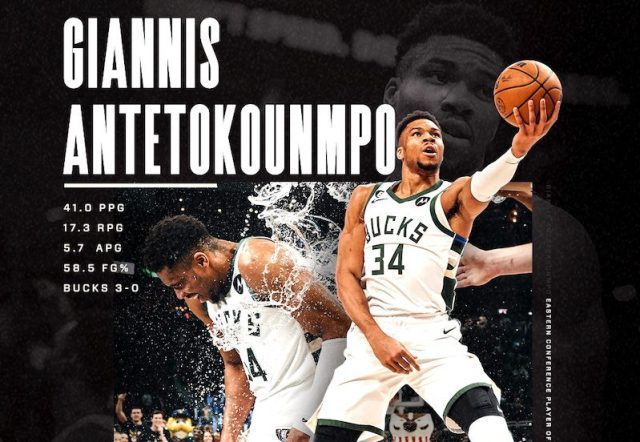

Untied States private equity group Avenue Capital ($12.5 billion AUM) founder Marc Lasry is selling NBA basketball team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 billion valuation, with the new owners also owning 2 major sports team in United States (NFL Cleveland Browns & Major League Soccer (MLS) club Columbus Crew). NBA basketball team Milwaukee Bucks is currently one of the leading basketball team in NBA, and recently won the NBA championships in 2021. In 2022 December, billionaires Mat Ishbia & his brother Justin Ishbia has bought a majority stake in NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value. AUM ~ Assets under management. More info below.

“ $12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation, New Owners Own NFL Cleveland Browns & Major League Soccer Club Columbus Crew “

Avenue Capital Group is a global investment firm that was founded in 1995 by its Senior Principals, Marc Lasry and Sonia Gardner. The firm is primarily focused on specialty lending, distressed debt and other special situations investments in the United States, Europe and Asia. The Senior Principals and the Senior Portfolio Managers have spent virtually their entire careers in this investment strategy. Headquartered in New York, with three offices across Europe, four offices throughout Asia, an office in Silicon Valley and an office in Abu Dhabi, the firm manages assets estimated to be approximately $12.5 billion as of January 31, 2023. Avenue draws on the skills and experience of over 180 employees worldwide and maintains a well-developed infrastructure with dedicated Accounting, Operations, Legal, Risk Management, Compliance, Business Development and Information Technology Departments.

Marc Lasry Chairman, CEO & Co-Founder – Mr. Lasry co-founded Avenue Capital Group in 1995, and distressed investing has been the focus of his professional career for over 39 years. Prior to forming Amroc Investments, LLC (“Amroc”) as an independent entity, Mr. Lasry managed capital for Amroc Investments, L.P., an investment fund affiliated with the Robert M. Bass Group. Prior to that, Mr. Lasry was Co–Director of the Bankruptcy and Corporate Reorganization Department at Cowen & Company. Prior to Cowen, he was the Director of the Private Debt Department at Smith Vasiliou Management Company, the firm where he first became involved in the distressed debt markets. He spent the prior year practicing law at Angel & Frankel where he focused on bankruptcies. Mr. Lasry also clerked for the Honorable Edward Ryan, former Chief Bankruptcy Judge for the Southern District of New York. Mr. Lasry is currently a member of the Council on Foreign Relations and he has served and will continue to serve on various other boards of advisors/directors of both for-profit and not-for-profit private and public companies. Mr. Lasry graduated with a B.A. in History from Clark University (1981) and a J.D. from New York Law School (1984).

$12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation

Billionaires Mat Ishbia & Brother Justin Ishbia Buy Majority Stake in NBA Teams Phoenix Suns & WNBA Phoenix Mercury at $4 Billion Market Value, Owns United States Largest Mortgage Lender United Wholesale Mortgage Which IPO via SPAC in 2021 at $16 Billion Valuation

22nd December 2022 – Billionaires Mat Ishbia & his brother Justin Ishbia has bought a majority stake in NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value. Billionaires Mat Ishbia & his brother Justin Ishbia family (founded by father Jeff Ishbia in 1986) owns United States largest wholesale mortgage lender United Wholesale Mortgage, which IPO via SPAC listing in 2021 at $16 billion valuation. United Wholesale Mortgage was launched as a side job by Jeff Ishbia while working as an attorney. See transaction announcement below.

Founded in 1968, the Phoenix Suns are one of the NBA’s premier franchises. Under Sarver’s stewardship, the team made seven playoff appearances, four trips to the western conference finals and one NBA finals appearance. The Phoenix Mercury, founded in 1997, were one of eight founding members of the WNBA and the only remaining team to still be in business and operated by its original NBA team owner. The Mercury under Sarver’s ownership made 14 playoff appearances, including a current record 10 consecutive, appeared in four WNBA finals, and won three WNBA championships.

Announcement – NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value

Group Led by Mat Ishbia Agrees to Acquire Majority Stake in Phoenix Suns and Mercury Basketball Teams

Robert Sarver, managing partner of Suns Legacy Holdings (owner of the Phoenix Suns and Mercury), and Mat Ishbia, Chairman and CEO of United Wholesale Mortgage, today announced that Mat and his brother Justin have reached an agreement to purchase a majority stake in the franchises, pending approval from the NBA. Mat will serve as Governor and Justin will serve as alternate Governor.

The agreement values the Suns and Mercury at $4 billion. The deal involves the sale of more than 50% ownership of the team including all of Robert Sarver’s interest, and a portion of the interest of minority partners, who were also granted additional sale rights.

“Mat is the right leader to build on franchise legacies of winning and community support and shepherd the Suns and Mercury into the next era,” said Sarver, who acquired control of both teams in 2004 and oversaw the two winningest records of major professional sports franchises in Arizona. “As a former collegiate basketball player and national champion, Mat has exactly the right spirit, commitment and resources to pursue championships. Equally important, though, is his philanthropic outlook and commitment to using sports as a way to elevate and connect people. I know he shares my unwavering support for women’s basketball and I look forward to watching him become a unifying force across the Valley of the Sun.”

While the deal is pending league approval, Ishbia said: “I am extremely excited to be the next Governor of the Phoenix Suns and Mercury. Both teams have an incredibly dynamic fan base and I have loved experiencing the energy of the Valley over the last few months. Basketball is at the core of my life, from my high school days as a player to the honor of playing for Coach Izzo and winning a national title at Michigan State University. I’ve spent the last two decades building my mortgage business, United Wholesale Mortgage, into the number one mortgage lender in America and I’m confident that we can bring that same level of success to these great organizations on and off the floor. This is a dream come true for my entire family including my parents, my three children, and my brother Justin, who will be making a significant investment with me and bring his incredible business acumen and shared passion for basketball. I appreciate Robert Sarver’s time and support throughout the process. We are so honored to be, with approval by the NBA, the next stewards of the Phoenix Suns and Phoenix Mercury.”

Phoenix Suns

Founded in 1968, the Phoenix Suns are one of the NBA’s premier franchises. Under Sarver’s stewardship, the team made seven playoff appearances, four trips to the western conference finals and one NBA finals appearance. The Phoenix Mercury, founded in 1997, were one of eight founding members of the WNBA and the only remaining team to still be in business and operated by its original NBA team owner. The Mercury under Sarver’s ownership made 14 playoff appearances, including a current record 10 consecutive, appeared in four WNBA finals, and won three WNBA championships.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit