Blackstone Reaches 2% Withdrawal Limit Again for 4th Straight Month with $3.9 Billion Requests for $71 Billion Real Estate Income Trust Fund, 8.4% Returns in 2022 & 12.3% Annualized Returns Since 2017

4th March 2023 | Hong Kong

Top private equity firm Blackstone with $975 billion AUM has reached its 2% monthly withdrawal limit again for the 4th straight month with $3.9 billion withdrawal requests for its $71 billion Real Estate Income Trust Fund. The Blackstone Real Estate Income Trust Fund has generated 8.4% returns in 2022 and 12.5% annualized returns since 2017. Earlier in November 2022, Blackstone limited withdrawal from its $125 billion real estate fund following an increase in withdrawal request in November 2022. Blackstone Real Estate Income Trust Fund had approved $1.3 billion of redemption, representing 43% of requests in November 2022. The Blackstone Real Estate Income Trust Fund (BREIT) allows 2% of funds to be redeemed each month, and a maximum of 5% in a quarter. The $125 billion fund excluding debts, has a net asset value of $69 billion. In 2021 the 5th year of the fund, Blackstone Real Estate Income Trust Fund reported 28.7% returns, 12.4% returns for Class S Shares (Class S shares with sales load of 24.4%), and total asset value of $94 billion. The 3 years annualised return is 14.5% with no sales load. 82% of the fund is concentrated in Residential & Industrial and 73% is concentrated in the South and West regions of the United States. (AUM ~ Assets under Management). See below for Blackstone statement to investor on 1st March 2023.

” Blackstone Reaches 2% Withdrawal Limit Again for 4th Straight Month with $3.9 Billion Requests for $71 Billion Real Estate Income Trust Fund, 8.4% Returns in 2022 & 12.3% Annualized Returns Since 2017 “

About Blackstone Real Estate Income Trust

Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across key property types and to a lesser extent in real estate debt investments. BREIT is externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $319 billion in investor capital under management. Further information is available at www.breit.com.

Blackstone Statement to Investor on 1st March 2023

Blackstone Statement to Investor on 1st March 2023

Dear Investor,

Thank you for your investment in Blackstone Real Estate Income Trust, Inc. (“BREIT”) and entrusting Blackstone as a steward of your capital.

We built BREIT to outperform with a “70/80/90” portfolio: ~70% Sunbelt markets which are growing faster than the rest of the country; ~80% rental housing and industrial sector concentrations where fundamentals and cash flows are historically strong; and ~90% fixed rate debt that we locked in at low rates for the next 6.5 years, minimizing interest rate risk. We are proud that BREIT has generated strong performance across market cycles:*

- 12.3% annualized net return since inception (January 1, 2017), outperforming publicly traded REITs by more than 2×5,6

- 14.4% annualized net return over the past three years5

- 8.4% net return in 2022, supported by 13% estimated cash flow growth from our real estate assets, while most asset

classes suffered significant losses - 4.5% annualized distribution rate, equal to a current 7.1% tax-equivalent yield given 94% of 2022 distributions were characterized as “return of capital”.

Since BREIT’s formation over six years ago, its Share Repurchase Plan (the “Repurchase Plan”) has allowed for repurchases up to 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter, subject to BREIT’s majority independent Board of Directors’ broad repurchase discretion.9 This structure was designed to both prevent a liquidity mismatch and maximize long-term shareholder value.

BREIT received repurchase requests of $3.9B in February, which is $1.4B or 26% lower than January. In accordance with the Repurchase Plan, BREIT fulfilled approximately $1.4B of repurchase requests, which is equal to 2% of NAV and represents ~35% of the shares submitted for repurchase. Repurchases were fulfilled at the January 31, 2023 NAV per share for your applicable share class.

Under the Repurchase Plan, unfulfilled repurchase requests are not carried over automatically to the next month. Additionally, unless you elect to remain in the Distribution Reinvestment Plan (“DRIP”) all shares submitted for repurchase will be removed from the DRIP at this time. Please contact your financial representative if you would like to remain in the DRIP. If you would like to resubmit any unsatisfied portion of your current repurchase request for repurchase in the future, you will need to submit a new repurchase request for these shares prior to 4:00 p.m. (ET) on the second-to-last business day of the applicable month. Further details on BREIT’s Repurchase Plan and BREIT’s NAV per share are available at www.breit.com, or in its public filings, available on the Securities and Exchange Commission’s website at www.sec.gov.

Today more than ever, manager selection is critical, and BREIT benefits from Blackstone’s 30+ year track record successfully navigating market cycles and real-time market insights as the largest owner of commercial real estate globally. We remain confident that BREIT’s portfolio will continue to be well-positioned to deliver strong performance and a consistent tax-advantaged distribution yield.

Sincerely,

Blackstone Real Estate Income Trust

Blackstone Real Estate Income Trust Fund Receives $4 Billion Investment from University of California for 6 Years with Minimum 11.25% Annualized Returns, Blackstone Offers $1 Billion as Collateral to Cover Shortfall to Meet 11.25% Returns

5th January 2023 – Blackstone Real Estate Income Trust Fund (BREIT) $69 billion fund that had faced liquidity issue in late 2022, has received a $4 billion investment from the University of California with a locked-in period for 6 years with minimum 11.25% annualized returns, and with Blackstone offering $1 billion as collateral (Blackstone investments) to cover any shortfall to meet the 11.25% returns target. If Blackstone Real Estate Income Trust Fund (BREIT) achieves above the 11.25% hurdle rate, Blackstone will receive a 5% incentive fee.

Blackstone Limits Withdrawal from $125 Billion Real Estate Fund Following Increase in Withdrawal Request, Blackstone Real Estate Income Trust Fund Approved $1.3 Billion – 43% of Requests in November 2022

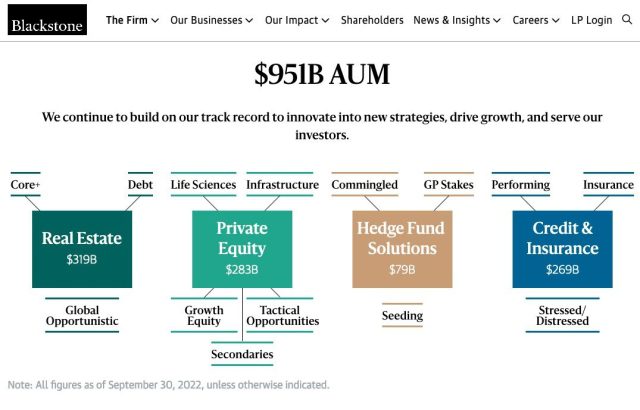

2nd December 2022 – Top private equity firm Blackstone with $951 billion AUM has limited withdrawal from its $125 billion real estate fund following an increase in withdrawal request in November 2022. Blackstone Real Estate Income Trust Fund approved $1.3 billion of redemption, representing 43% of requests in November 2022. The Blackstone Real Estate Income Trust Fund (BREIT) allows 2% of funds to be redeemed each month, and a maximum of 5% in a quarter. The $125 billion fund excluding debts, has a net asset value of $69 billion. In 2021 the 5th year of the fund, Blackstone Real Estate Income Trust Fund reported 28.7% returns, 12.4% returns for Class S Shares (Class S shares with sales load of 24.4%), and total asset value of $94 billion. The 3 years annualised return is 14.5% with no sales load. 82% of the fund is concentrated in Residential & Industrial and 73% is concentrated in the South and West regions of the United States. (AUM ~ Assets under Management)

About Blackstone Real Estate Income Trust – Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across key property types and to a lesser extent in real estate debt investments. BREIT is externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $319 billion in investor capital under management. Further information is available at www.breit.com.

About Blackstone – Blackstone is the world’s largest alternative asset manager. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our $975 billion in assets under management include investment vehicles focused on private equity, real estate, public debt and equity, infrastructure, life sciences, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis.

Blackstone Real Estate Income Trust Fund Announcement

Blackstone on 1st Dec 2022 – Since formation nearly six years ago, BREIT’s Share Repurchase Plan (the “Repurchase Plan”) has allowed for repurchases up to 2% of net asset value (“NAV”) in any month and 5% of NAV in a calendar quarter, subject to BREIT’s majority independent Board of Directors’ broad repurchase discretion.1 This structure was designed both to prevent a liquidity mismatch and maximize long- term shareholder value.

BREIT received repurchase requests equal to 2.7% of NAV in October, or approximately $1.8 billion, and received approval from its majority independent Board of Directors to fulfill 100% of repurchase requests.2 BREIT has now received repurchase requests exceeding both the 2% of NAV monthly limit and 5% of NAV quarterly limit, triggering proration for the remaining 2.3% of NAV for the quarter. Accordingly, BREIT repurchased approximately $1.3 billion in November, equal to its 2% of NAV monthly limit and approximately 43% of each investor’s repurchase request. In December, up to 0.3% of NAV will be eligible for repurchase to total 5% of NAV for the quarter. If BREIT receives elevated repurchase requests in the first quarter of 2023, BREIT intends to fulfill repurchases at the 2% of NAV monthly limit, subject to the 5% of NAV quarterly limit.

Under the Repurchase Plan, unfulfilled repurchase requests will not be carried over automatically. Investors will need to resubmit any unsatisfied portion of their current repurchase request for repurchase in the future.

Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across key property types and to a lesser extent in real estate debt investments. BREIT is externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $319 billion in investor capital under management. Further information is available at www.breit.com.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We seek to create positive economic impact and long-term value for our investors, the companies we invest in, and the communities in which we work. We do this by using extraordinary people and flexible capital to help companies solve problems. Our $975 billion in assets under management include investment vehicles focused on private equity, real estate, public debt and equity, infrastructure, life sciences, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit