$241 Billion L’Oreal Buys Australia Luxury Beauty Brand Aesop for $2.5 Billion from Natura & Co, Which Owns Natura, The Body Shop & Avon

8th April 2023 | Hong Kong

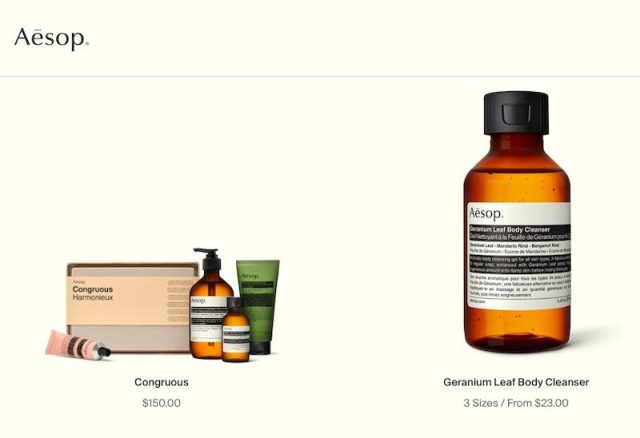

L’Oreal, one of the world largest beauty & cosmetic group with $241 billion market value (6/4/23) has announced to buy Australia luxury beauty brand Aesop for $2.5 billion from Natura & Co, a Brazil headquartered cosmetic group which owns brands including Natura, The Body Shop & Avon. Aēsop was founded in 1987 by former hairdresser Dennis Paphitis (Australian-born, Greek immigrants), blending essential oils into hair products. In 2012, Dennis Paphitis sold Aēsop to Natura & Co (65% for $71 million), and remaining as advisor. L’Oreal: “The proposed transaction values Aēsop at an enterprise value of USD 2.525 billion. Created in 1987, Aēsop is world widely renowned for its skin, hair and body products. With its signature amber packaging, plant-based ingredients, sustainable vegan formulations, and its bespoke customer service, Aēsop has evolved into a global super brand available across luxury retail, beauty, and hospitality locations around the world. Aēsop currently operates around 400 points of sale across the Americas, Europe, Australia, New Zealand, and Asia, with a nascent footprint in China where the first store opened in 2022. The brand posted sales of USD 537 million in 2022.” More info below.

“ $241 Billion L’Oreal Buys Australia Luxury Beauty Brand Aesop for $2.5 Billion from Natura & Co, Which Owns Natura, The Body Shop & Avon “

$241 Billion L’Oreal Buys Australia Luxury Beauty Brand Aesop for $2.5 Billion from Natura & Co

3rd April 2023 – L’Oréal announced today that it has signed an agreement with Natura &Co to acquire Aēsop, the Australian luxury beauty brand. The proposed transaction values Aēsop at an enterprise value of USD 2.525 billion. Created in 1987, Aēsop is world widely renowned for its skin, hair and body products. With its signature amber packaging, plant-based ingredients, sustainable vegan formulations, and its bespoke customer service, Aēsop has evolved into a global super brand available across luxury retail, beauty, and hospitality locations around the world. Aēsop currently operates around 400 points of sale across the Americas, Europe, Australia, New Zealand, and Asia, with a nascent footprint in China where the first store opened in 2022. The brand posted sales of USD 537 million in 2022.

Nicolas Hieronimus, Chief Executive Officer, L’Oréal Groupe, said, “I am very excited to welcome Aēsop and its teams to the L’Oréal Groupe family. Aēsop is the epitome of avant-garde beauty, whose products are not only made with great care and exceptional attention to detail; they are a superb combination of urbanity, hedonism and undeniable luxury. Aēsop taps into all of today’s ascending currents and L’Oréal will contribute to unleash its massive growth potential, notably in China and Travel retail.”

Commenting on the acquisition, Cyril Chapuy, President of L’Oréal Luxe, added, “My Team and I are thrilled to have Aēsop join the L’Oréal Luxe portfolio of iconic global brands. Aēsop holds a very unique positioning on the global luxury beauty market thanks to its design led brand essence, its highly efficacious and sensorial products as well as its customer-obsessed retail philosophy. We look forward to welcoming Aēsop’s CEO Michael O’Keeffe and his experienced and passionate teams to continue to grow together the brand’s remarkable potential, by carrying on cultivating its uniqueness and its values. We have great confidence that Aēsop will join the L’Oréal Luxe Billionaire brands club and therefore contribute significantly to the growth of the Division in the years to come.”

Fábio Barbosa, Chief Executive Officer of Natura &Co,said: “The divestment of Aēsop marks a new development cycle for Natura &Co. With a strengthened financial structure and a deleveraged balance sheet, Natura &Co, exercizing strict financial discipline, will be able to sharpen its focus on its strategic priorities, notably our investment plan in Latin America. We will also be able to concentrate on continuing to improve The Body Shop’s business and refocusing Avon International’s footprint. We are proud of the remarkable success of the Aēsop brand, and we are extremely grateful to all Aēsop’s associates, who contributed immensely not only to Aēsop’s success, but also to making Natura &Co what it is today. We are confident that Aēsop’s growth story will continue under the ownership of L’Oréal and wish Aēsop continued success in this new chapter.”

The closing is subject to certain regulatory approvals and other customary conditions.

About L’Oréal

For over 110 years, L’Oréal the world’s leading beauty player, has devoted itself to one thing only: fulfilling the beauty aspirations of consumers around the world. Our purpose – to create the beauty that moves the world – defines our approach to beauty as inclusive, ethical, generous, and committed to social and environmental sustainability. With our broad portfolio of 36 international brands and ambitious sustainability commitments in our L’Oréal For The Future program, we offer each and every person around the world the best in terms of quality, efficacy, safety, sincerity, and responsibility, while celebrating beauty in its infinite plurality. With 87,400 committed employees, a balanced geographical footprint, and sales across all distribution networks (e-commerce, mass market, department stores, pharmacies, hair salons, travel retail and branded boutiques) in 2022 the Group generated sales amounting to 38.26 billion euros. L’Oréal relies on 20 research centers across 11 countries around the world, a dedicated Research and Innovation team of 4,000 scientists and over 5,500 tech and digital professionals, to invent the future of beauty and become the champion of Beauty Tech.

About Aēsop

Aēsop is an aspirational, luxury brand, that provides efficacious and sensorial products across multiple beauty and wellness categories, including hair, body, skin, home, and fragrance. Since its creation in 1987, Aēsop has delivered significant organic growth while maintaining its strong brand ethos and staying true to its core social and environmental values. Its global footprint of over 395 uniquely designed locations, elegant customer experience and purpose-driven approach have proven particularly attractive to a loyal and expanding community of customers, and the company is now well positioned to become a pioneer in the luxury beauty space. Aēsop is proudly a Certified B Corporation®

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit