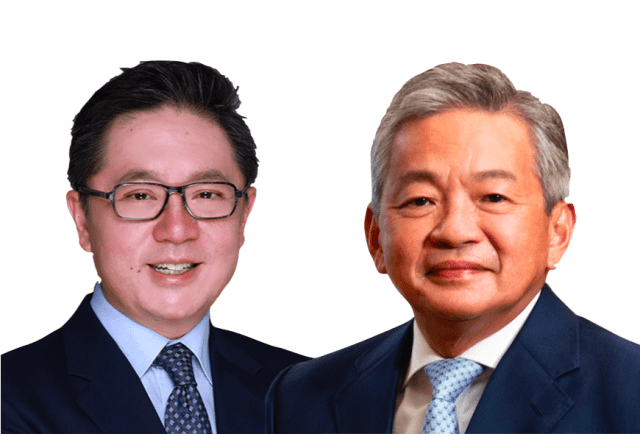

Swiss Private Bank Julius Baer Appoints Private Banking Veteran Chin Lit Yee as Head of Southeast Asia, Kelvin Tay Succeeds as Group Head Southeast Asia & Yee Kim Tan as Singapore Branch Manager

13th April 2023 | Hong Kong

Swiss private bank Julius Baer has appointed Chin Lit Yee as the new Julius Baer Head of Southeast Asia, with Head of Wealth Planning & Family Office Service Kelvin Tay succeeding Chin Lit Yee as Group Head Southeast Asia and Yee Kim Tan appointed as Singapore Branch Manager (all effective 13th April 2023). Julius Baer new Head of Southeast Asia Chin Lit Yee is a private banking veteran with more than 30 years of wealth management experience including at Credit Suisse, Deutsche Bank & JP Morgan, and will report to Jimmy Lee (Julius Baer Member of the Executive Board & Head Asia-Pacific). Julius Baer Greater China (Singapore) Location Head and Group Head Yee Kim Tan will take on additional responsibility as Singapore Branch Manager, and will oversee Julius Baer Singapore Branch’s daily operations, risk controls, and governance. Benjamin Sim will continue in his role as Deputy Branch Manager and COO Singapore. Julius Baer: “As Julius Baer intensifies its focus on Asia, the Bank’s second home market, it is dedicated to delivering exceptional client service and unique, tailor-made solutions to clients in South East Asia, and is committed to strengthening its bench and promoting internal talent. With Singapore and Hong Kong hosting two of the Group’s seven booking centres and employing 24% of the total workforce, these locations have become the second- and third-largest Group hubs. The appointments of Yee, Tan, and Tay to their new roles underscore Julius Baer’s unwavering dedication to cultivating in-house talent and ensuring sustained growth and success in the region.”

“ Swiss Private Bank Julius Baer Appoints Private Banking Veteran Chin Lit Yee as Head of Southeast Asia, Kelvin Tay Succeeds as Group Head Southeast Asia & Yee Kim Tan as Singapore Branch Manager “

Julius Baer Member of the Executive Board & Head Asia-Pacific, Jimmy Lee: “The appointment of Chin Lit to Head South East Asia showcases his exceptional leadership and deep understanding of the region. He is an accomplished leader, renowned for his strategic vision and ability to build high-performing teams. South East Asia is a critical region for Julius Baer, and Chin Lit’s appointment reinforces our commitment to delivering unparalleled service and innovative solutions to our clients while also nurturing our in-house talent. Yee Kim has played a crucial role in the success of our Hong Kong and Singapore branches, and we are delighted to appoint him to Branch Manager. His leadership skills, expertise, and business knowledge make him the ideal candidate to lead the Singapore office and drive growth in the region.”

Julius Baer New Head of Southeast Asia, Chin Lit Yee: “I look forward to steering Julius Baer South East Asia towards greater heights, further building on our success in the region. As we continue to expand our business in Asia, I am confident in our ability to maintain a client-centric approach, delivering excellent service and solutions that help our clients achieve their financial goals. I am honoured to lead the team and look forward to collaborating with my colleagues to continue delivering strong results.”

Swiss Private Bank Julius Baer Appoints Private Banking Veteran Chin Lit Yee as Head of Southeast Asia, Kelvin Tay Succeeds as Group Head Southeast Asia & Yee Kim Tan as Singapore Branch Manager

Swiss private bank Julius Baer appoints Chin Lit Yee as the new Julius Baer Head of Southeast Asia. Head of Wealth Planning & Family Office Service Kelvin Tay succeeds Chin Lit Yee as Group Head Southeast Asia. Yee Kim Tan appointed as Singapore Branch Manager. All appointments effective 13th April 2023.

About Julius Baer

Julius Baer is the leading Swiss wealth management group and a premium brand in this global sector, with a focus on servicing and advising sophisticated private clients. In all we do, we are inspired by our purpose: creating value beyond wealth. At the end of 2022, assets under management amounted to CHF 424 billion. Bank Julius Baer & Co. Ltd., the renowned Swiss private bank with origins dating back to 1890, is the principal operating company of Julius Baer Group Ltd., whose shares are listed on the SIX Swiss Exchange (ticker symbol: BAER) and are included in the Swiss Leader Index (SLI), comprising the 30 largest and most liquid Swiss stocks. Julius Baer is present in over 25 countries and around 60 locations. Headquartered in Zurich, we have offices in key locations including Bangkok, Dubai, Dublin, Frankfurt, Geneva, Hong Kong, London, Luxembourg, Madrid, Mexico City, Milan, Monaco, Mumbai, Santiago de Chile, São Paulo, Shanghai, Singapore, Tel Aviv and Tokyo. Our client-centric approach, our objective advice based on the Julius Baer open product platform, our solid financial base and our entrepreneurial management culture make us the international reference in wealth management.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit