Japan F&B, Beer & Health Science $15 Billion Giant Kirin Buys Australia Health Group Blackmores for $1.2 Billion in Cash, Founded in 1930s by Maurice Blackmore

27th April 2023 | Hong Kong

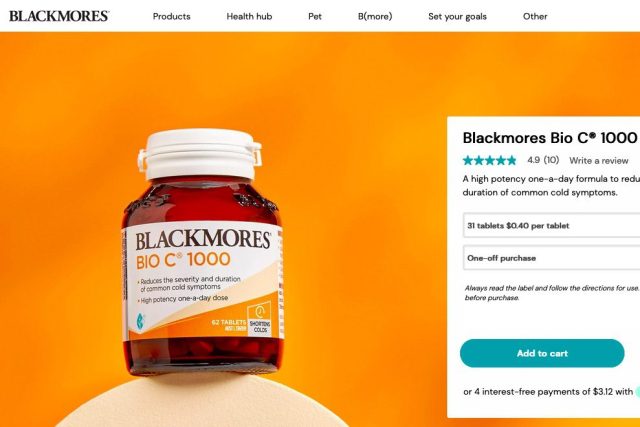

Japan F&B, beer and health science $15 billion giant Kirin has announced to buy Australia health group Blackmores for $1.2 billion in cash (A$1.88 billion, Share price A$95, 23.7% premium to last close 27/4/23). Blackmores was founded in 1930s as a health food company by Maurice Blackmore. Kirin President and Chief Executive Officer, Yoshinori Isozaki: “Blackmores presents an exciting opportunity to transform the scale and reach of our Health Science domain. Kirin Group is working to create social value and economic value by solving social issues through our business activities, and we have been transforming our business from a brewing business to the business model creating value across Food & Beverages and Pharmaceuticals domains, based on the concept of “CSV” (Creating Shared Value).” Kirin is a leading Food & Beverage, Pharmaceuticals and Health Science company, headquartered in Tokyo and listed on the Tokyo Stock Exchange with a market capitalisation of $15.1 billion (A$22.9 billion).

” Japan F&B, Beer & Health Science $15 Billion Giant Kirin Buys Australia Health Group Blackmores for $1.2 Billion in Cash, Founded in 1930s by Maurice Blackmore “

Japan F&B, Beer & Health Science $15 Billion Giant Kirin Buys Australia Health Group Blackmores for $1.2 Billion in Cash, Founded in 1930s by Maurice Blackmore

Takeshi Minakata, Director of the Board, Senior Executive Officer, President of Health Science Business Division in charge of Strategy of the Health Science Domain: “We believe Blackmores will accelerate the transformation of our Health Science Domain as both Kirin and Blackmores share a vision to improve people’s lives through our products as well as a commitment to quality, innovation and investment. We are excited about the growth potential for the Blackmores business and look forward to supporting its growth and development, and furthering its commitment to quality ingredients and product development.

Blackmores Chair, Wendy Stops:“The Kirin Scheme represents an attractive, all-cash transaction. The Blackmores Board believes the agreed Scheme Consideration represents appropriate long-term value for the Company and an attractive outcome for Blackmores shareholders. The Blackmores Board has accordingly unanimously recommended that Blackmores shareholders vote in favour of the Scheme, subject to customary conditions such as independent expert conclusions and no superior proposal.”

Blackmores Chief Executive Officer & Managing Director, Alastair Symington: “Today is an important day in the history of Blackmores. The Kirin proposal recognises the strong leadership position that Blackmores, through its brands and people, has established in the natural health sector across the Asia Pacific region over our long history. Importantly it also confirms the significant opportunity that lies ahead for our employees and other key stakeholders of Blackmores as both companies come together to combine their focus on growing Kirin’s health science business across the world. The combination of Kirin and Blackmores is testament to the clarity and ambition of our collective strategic direction and is recognition of the significant effort, and capital invested at Blackmores over the past 3 years in repositioning the business for sustainable profitable growth.”

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit