Billionaire & Founder of Self-Driving Luminar Technologies Austin Russell Age 28 Buys 82% of Forbes Valued at $800 Million from Hong Kong Integrated Whale Media Investments, Forbes Family Exits But Chairman Steve Forbes Remains Involved in Company

17th May 2023 | Hong Kong

Billionaire & founder of self-driving technology company Luminar Technologies Austin Russell (Age 28) has acquired 82% of Forbes valued at $800 million from Hong Kong Integrated Whale Media Investments, with Forbes family exiting but Chairman Steve Forbes remains involved in the company. Steve Forbes is the grandson of Forbes founder Bertie Charles Forbes, founding Forbes in 1917. In 2022, Forbes had cancelled plan to go public in a $630 million SPAC listing with Magnum Opus Acquisition Corp. In 2014, Hong Kong based investor Integrated Whale Media had bought a majority stake in Forbes for around $475 million. More info below.

“ Billionaire & Founder of Self-Driving Luminar Technologies Austin Russell Age 28 Buys 82% of Forbes Valued at $800 Million from Hong Kong Integrated Whale Media Investments, Forbes Family Exits But Chairman Steve Forbes Remains Involved in Company “

Billionaire & Founder of Self-Driving Luminar Technologies Austin Russell Age 28 Buys 82% of Forbes Valued at $800 Million from Hong Kong Integrated Whale Media Investments

12th May 2023 – Today, American innovator and automotive tech industry pioneer Austin Russell, the Founder and CEO of Luminar, and Hong-Kong based Integrated Whale Media Investments (IWM) announced they have entered into a definitive agreement for the acquisition of majority ownership in Forbes Global Media Holdings in a transaction valuing the company at nearly $800 million. Mr. Russell will hold an 82% interest in the entity that controls the global media platform upon closing of the transaction, bringing ownership back to the United States and with a renewed focus of helping shape the next generation of capitalism where financial success and building value for the world both intersect. All capital for the acquisition has been fully committed and independent of his stake in Luminar.

“For over 100 years, Forbes has served as the authority representing success and business news at a global scale, and I’m honored to be selected by the owners as the new steward of the brand,” said Mr. Russell. “Today, success should no longer represent wealth accumulation at any cost, but instead be defined by how value is created and the positive ripple effects it can have. My hope is that Forbes can continue to even better serve its readership by helping objectively inform, recognize, and challenge leaders to tackle society’s biggest challenges under this mission, with high quality content as well as platforms for its business-focused community.”

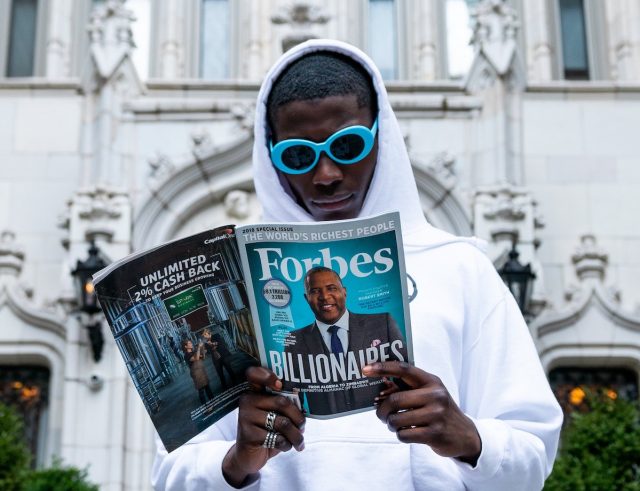

Mr. Russell has previously been recognized by Forbes on its cover, Forbes 30 under 30 list, and as the youngest self-made billionaire. Last year he was recognized on the Philanthropy 50 list of the top charitable donors in America.

Mr. Russell will act as a visionary for the brand, and will not be involved in its day-to-day operations. To help guide the company into its next chapter, Forbes will empower a new board consisting of American media, tech, and AI experts at the top of their fields. IWM will also keep one board seat in conjunction with their retained minority stake. Forbes’ platform is profitable and growing with multiple verticals beyond publishing that range from real estate to financial services. The brand will look to attract some of the best and brightest minds to help transform the company into a technology-first business to further accelerate its growth trajectory.

“When IWM acquired Forbes in 2014, our vision was to keep the legendary brand as a strong force in the media world, fully accelerate Forbes to digital, and leverage the strength of the brand to create new revenue streams. We were able to achieve our goals,” said Jeffrey Yam, Managing Director of Integrated Capital. “Now, we are excited to pass the torch to someone who we believe can catapult Forbes’ legacy to even greater heights with his authentic vision to create a new era of capitalism, backed by one of the most recognizable business brands in the world. We believe there is significant opportunity for value growth with the new vision and, as a result, we will be retaining a minority stake. We look forward to the next chapter of the Forbes growth story.”

“We welcome Austin Russell. He is a dynamic entrepreneur and thought leader who has built an industry-leading business from the ground up. His energy and vision will enable Forbes to continue and enhance the excellent work for which we are known,” said Steve Forbes, Chairman and Editor-in-Chief of Forbes Media.

As part of the transaction, the remaining stake of Forbes owned by the Forbes family will be acquired by the new owner. However, Steve Forbes will remain involved in the company.

Mr. Russell founded his Florida and California-based company Luminar over 10 years ago, and has led the company to become the global leader in automotive lidar and software technology. Luminar is guided by a bold 100-year vision: to save as many as 100 million lives and 100 trillion hours on the road over the next 100 years through reducing vehicle accidents and enabling autonomous capabilities. Russell has no plans to sell or leverage any portion of his stake in Luminar.

Completion of the transaction is expected to take place later this year and is subject to customary closing conditions.

About Forbes

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 140 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 48 licensed local editions in 82 countries. Forbes Media’s brand extensions include real estate, education and financial services license agreements.

About Austin Russell

Austin Russell is an American inventor, business leader, and self-driving industry pioneer as the Founder and CEO of Luminar Technologies (NASDAQ: LAZR), the global leader in automotive LiDAR hardware and software technology. Under Mr. Russell’s leadership, Luminar has developed the first lidar and software technology capable of powering production autonomous vehicles, has amassed over 50 commercial partners including the majority of the world’s largest automakers, and has a greater enterprise value than all other public competitors in the space combined. Mr. Russell founded Luminar in 2012 at age 17 after previously working on various photonics and optoelectronics projects as an early teen, architecting a new kind of lidar to enable safe assisted and autonomous capabilities on cars, trucks, and robo-taxis, with over 100 awarded patents. Now at 28, he is currently the world’s youngest self-made billionaire. Mr. Russell was also a recipient of the Thiel Fellowship, MIT Tech Review Innovators Under 35, and Forbes 30 under 30 alumni. He is an active philanthropist, notably donating $70 million to the Central Florida Foundation with a primary focus on his local community, and was recognized last year on the Philanthropy 50 as the 36th largest charitable donor in America.

Forbes Cancels SPAC Listing Plan Due to Deteriorating SPAC Market Condition

3rd June 2022 – Forbes, the global media brand covering influential leaders and the rich, has cancelled its SPAC listing plan on NYSE due to deteriorating SPAC market conduction, terminating the Business Combination Agreement with Magnum Opus Acquisition Limited (NYSE: OPA), a special purpose acquisition company. Forbes announced record revenue and earnings last year, and has already exceeded the business forecast for 2022 it outlined in its initial investor deck.

Forbes

“The Forbes brand is a sought-after and trusted brand with more than 100 years of equity that is synonymous with success and validation,” said Mike Federle, CEO, Forbes. “Our digital transformation has delivered double-digit revenue and EBITDA growth over the past year, which not only significantly outperformed the financial targets provided at the start of the SPAC transaction last year but continues to deliver high quality cashflows and compelling year-over-year and sequential growth since then. This is a testament to the incredible team we have assembled at Forbes that is delivering across our Media, and Brand Extensions business, as well as our newer consumer conversion strategy that has shown triple digit revenue growth over the past two years.”

The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE events, custom marketing programs and 45 licensed local editions covering 76 countries. Forbes™ brand extensions include real estate, education and financial services license agreements. Through its digital platforms, Forbes is among the top 50 most visited websites on the internet.

About Forbes

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 45 licensed local editions covering 76 countries. Forbes Media™ brand extensions include real estate, education and financial services license agreements. For more information, visit the Forbes News Hub or Forbes Connect.

About Magnum Opus

Magnum Opus Acquisition Limited is a special purpose acquisition company sponsored by L2 Capital, a private investment firm. Magnum Opus is a partnership of enterprise builders and public and private market investment specialists with extensive experience operating and investing throughout the business life cycle from founding, scaling operations through public listing. Magnum Opus aims to partner with public ready enterprises at the forefront of convergence of consumption and technology. Magnum Opus™ mission is to support companies to realize their vision as they embark on their journey into the public markets and face new opportunities, challenges and stakeholders.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit