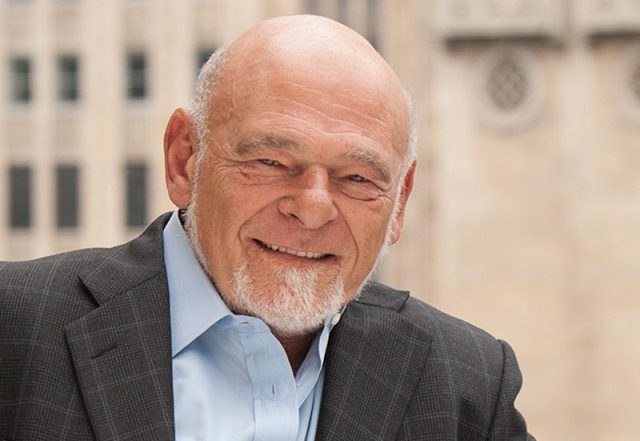

Founder of Modern REITs & Billionaire Sam Zell with $5.2 Billion Fortune Dies at Age 81, Popularized REITs in 1990s and Sold Equity Office Properties Trust REITs to Private Equity Blackstone for $39 Billion in 1997

20th May 2023 | Hong Kong

The founder of modern REITs (Real Estate Investment Trusts) & billionaire Sam Zell with $5.2 billion fortune has died at age 81 (18th May 2023, complications from recent illness). Sam Zell popularized REITs in the 1990s and sold Equity Office Properties Trust REITs to private equity Blackstone for $39 billion in 1997. Sam Zell is the Chairman of Equity Group Investments, Equity LifeStyle Properties, Equity Residential, and Equity Commonwealth. See below for more info.

“ Founder of Modern REITs & Billionaire Sam Zell with $5.2 Billion Fortune Dies at Age 81, Popularized REITs in 1990s and Sold Equity Office Properties Trust REITs to Private Equity Blackstone for $39 Billion in 1997 “

Equity Group Investments Statement 18th May 2023: Sam Zell 1941 – 2023

It is with great sadness that we announce that Sam Zell, chairman of Equity Group Investments, Equity LifeStyle Properties, Equity Residential, and Equity Commonwealth, died today at home due to complications from a recent illness. The family of Equity companies mourns his loss.

Sam Zell was a self-made, visionary entrepreneur. He launched and grew hundreds of companies during his 60-plus-year career and created countless jobs. Although his investments spanned industries across the globe, he was most widely recognized for his critical role in creating the modern real estate investment trust (REIT), which today is a more than $4 trillion industry.

Beloved by family, friends, employees, and colleagues, Sam was an honest, straightforward, inspiring, creative, kind, and brilliant man. He valued and embodied humor, loyalty, and integrity. Above all, he achieved his own vision for his legacy: he was unfailingly a man of his word, or shem tov, the Hebrew term for a good name or reputability.

Sam is survived by his wife, Helen; his sister Julie Baskes and her husband, Roger Baskes; his sister Leah Zell; his three children, Kellie Zell and son-in-law Scott Peppet, Matthew Zell, and JoAnn Zell; and his nine grandchildren. The son of Polish refugees Bernard and Rochelle Zielonka, Sam was born in Chicago four months after his parents’ arrival in the U.S. following their escape from Poland during the German invasion. Being the child of immigrants provided Sam with a deep appreciation for this country, a heightened awareness of risk, and an exceptional work ethic.

Sam began his career by managing student housing apartments as an undergraduate at the University of Michigan. His first employee was Bob Lurie, a fraternity brother. In 1968, Sam founded Equity Group Investments (EGI), a private investment firm headquartered in Chicago. A year later, Bob joined him as a partner at EGI. Together, they built an empire, branching out from real estate to invest across industries in the 1970s and 1980s. Bob died of cancer in 1990, just before Sam launched what became some of the largest and most successful REITs in history: Equity Residential (EQR), one of the largest apartment REITs; Equity LifeStyle Properties (ELS), a manufactured home community and resort REIT; and Equity Office Properties Trust (EOP), which was the largest office building owner in the country and the first REIT in the S&P 500 when it was sold in 1997 for $39 billion in the largest leveraged buyout in history at that time.

Sam was an extensive world traveler. In 1999, he founded Equity International to focus on building real estate–related businesses in emerging international markets. He was among the first U.S. investors to heavily target Brazil and other emerging markets, recognizing the upward movement of the growing middle class there. He was active in bringing a number of Equity International’s companies to the public markets.

In 2014, Sam made another major real estate investment and took control of CommonWealth REIT, an internally managed and self-advised real estate investment trust with commercial office properties in the U.S. He renamed the company Equity Commonwealth (EQC) and was chairman of the board. Sam infused his entrepreneurial culture and contrarian perspective into EQC, which is led by executives with deep real estate experience. Sam’s Equity family of companies and his unwavering focus on corporate governance is recognized by Wall Street. In total, Sam sponsored 12 IPOs across a range of industries.

Sam’s legendary reputation in real estate often overshadowed his investment activity in the corporate sector, although the majority of his holdings were across industries such as transportation and logistics, energy, waste and infrastructure, manufacturing, health care, and agribusiness. He served as chairman of Anixter International Inc., a global provider of wire and cable products, for 34 years and stewarded the sale of the company in 2020 for $4.5 billion. Sam also chaired Covanta Holding Corporation, an international energy-from-waste company; Jacor Communications, Inc., a media holding company that led to the radio industry’s consolidation in the 1990s; and many other companies.

Sam was also a pioneer in sponsoring and promoting entrepreneurship education. He saw entrepreneurs as the engine of the economy and believed they were critical for future growth. Among the programs he sponsored through the Zell Family Foundation were the Zell Lurie Institute at the University of Michigan, his alma mater; the Zell Fellows Program for entrepreneurship at Northwestern University’s Kellogg School of Management; the Samuel Zell and Robert Lurie Real Estate Center at the University of Pennsylvania’s Wharton School; and the Zell Entrepreneurship Program at Reichman University (formerly IDC Herzliya), a private higher education institution in Israel.

A voracious reader, Sam was recognized by Forbes in 2017 as one of the 100 Greatest Living Business Minds. Also that year, he chronicled his fundamental principles for life and business in a book whose title, Am I Being Too Subtle?, captured his humor and his penchant for conveying messages through storytelling.

Sam was recognized for the positive and like-minded culture he formed at his investment firm, Equity Group Investments. “Chief,” as he was affectionately called, created a high-energy meritocracy known for its contrarian strategies, calculated risk-taking, innovative deal structures, and playful environment. Sam lived his own 11th commandment: not to take oneself too seriously.

“Sam lived life testing his limits and helping those around him do the same. He was a self-made entrepreneur, an industry creator and leader, a brilliant dealmaker, a generous philanthropist, and the head of a family he fiercely loved and protected. He had an unapologetic passion for life, a brilliant mind, a contagious wit, and a deep sense of civic responsibility and personal loyalty. All those who loved and learned from him will miss him terribly,” said Scott Peppet, president of Chai Trust Company and Sam’s son-in-law.

A video accompanying this announcement is available at www.samzelllegacy.com. For more information on Sam’s life and accomplishments, visit www.egizell.com and www.samzell.com.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit