$71 Billion Luxury Group Kering & Qatar Royal Family Investment Group Mayhoola Buy 30% of Valentino for $1.8 Billion with Option to Acquire 100% of Valentino by 2028

28th July 2023 | Hong Kong

Luxury group Kering with $71 billion market capitalization and Qatar royal family Investment Group Mayhoola have jointly acquire 30% of fashion brand Valentino for $1.8 billion (EUR 1.7 billion) with an option to acquire 100% of Valentino by 2028. Kering & Mayhoola: “Kering and Mayhoola enter into a binding agreement for the acquisition by Kering of a 30% shareholding in Valentino, for a cash consideration of €1.7 billion. The agreement comprises an option for Kering to acquire 100% of the share capital of Valentino no later than 2028. The transaction is part of a broader strategic partnership between Kering and Mayhoola, which could lead to Mayhoola becoming a shareholder in Kering.” On Acquisition: “Founded in Rome in 1960 by Valentino Garavani, Valentino is one of the most internationally recognized Italian luxury houses. A Maison de Couture with a strong heritage, a high-end luxury positioning rooted in Haute Couture and a portfolio of iconic creations, Valentino has developed an attractive ready-to-wear, leather goods and accessories offering that appeals to a very loyal customer base and celebrities around the world. Today, Valentino has 211 directly operated stores in more than 25 countries and has recorded revenues of €1.4 billion and recurring EBITDA of €350 million in 2022. The strategic partnership will further support the brand elevation strategy implemented by Valentino CEO Jacopo Venturini under the ownership of Mayhoola, which turned it into one of the most admired luxury houses in the world. Kering will become a significant shareholder with Board representation. Mayhoola will remain the majority shareholder with 70% of the share capital and will continue to execute on the successful brand elevation strategy. As part of the broader partnership, Kering and Mayhoola will explore potential joint opportunities in line with their respective development strategies. The transaction is expected to close by end of 2023, subject to clearance by the relevant competition authorities.”

” $71 Billion Luxury Group Kering & Qatar Royal Family Investment Group Mayhoola Buy 30% of Valentino for $1.8 Billion with Option to Acquire 100% of Valentino by 2028 “

$71 Billion Luxury Group Kering & Qatar Royal Family Investment Group Mayhoola Buy 30% of Valentino for $1.8 Billion with Option to Acquire 100% of Valentino by 2028

About Kering

A global Luxury group, Kering manages the development of a series of renowned Houses in Fashion, Leather Goods and Jewelry: Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Qeelin, Ginori 1735 as well as Kering Eyewear and Kering Beauté. By placing creativity at the heart of its strategy, Kering enables its Houses to set new limits in terms of their creative expression while crafting tomorrow’s Luxury in a sustainable and responsible way. We capture these beliefs in our signature: “Empowering Imagination”. In 2022, Kering had over 47,000 employees and revenue of €20.4 billion.

About Mayhoola

Mayhoola Lux S.à.r.l. (“Mayhoola”) is an investment entity directly controlled by Qatari Mayhoola for Investments LLC. Mayhoola’s strategy focuses on global investments in the luxury industry with a long-term investment approach. Current portfolio includes an impressive stable of luxury top-of-mind fashion houses: the Italian Maison de Couture Valentino, French luxury house Balmain and Italian Pal Zileri. Mayhoola also owns the leading Turkish luxury department stores Beymen.

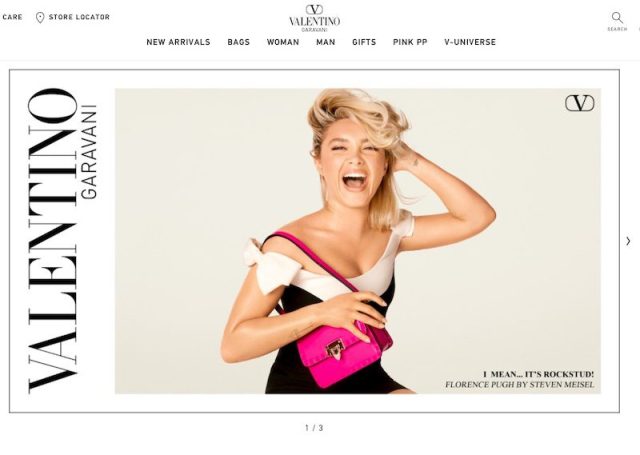

About Valentino

Maison Valentino is synonymous with inclusiveness, uniqueness and creativity; a leading Italian institution in the fashion and luxury sector. The company, with its signature DNA, is a landmark of Made in Italy on the international scene, the most established Italian Maison de Couture with presence in Couture, Prêt-à-porter, Bags, Shoes and Accessories collections, and in activities with licensed partners in Valentino Eyewear and Valentino Beauty. Jacopo Venturini, CEO from June 2020, and Pierpaolo Piccioli, sole Creative Director from 2016 are re-signifying the iconic codes leveraging Valentino’s unrivalled brand heritage in the contemporary world. Maison Valentino is present in 162 locations through a strategic distribution network enhanced to date, which involves boutiques located in key shopping locations around the world and around 1,000 points of sale. Founded in 1960 by Valentino Garavani and Giancarlo Giammetti, Valentino S.p.A. is controlled by Mayhoola for Investments LLC since 2012.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit