NBA Team Golden State Warriors Minority Shareholders to Sell 10% Shareholding at $7 Billion Valuation

30th September 2023 | Hong Kong

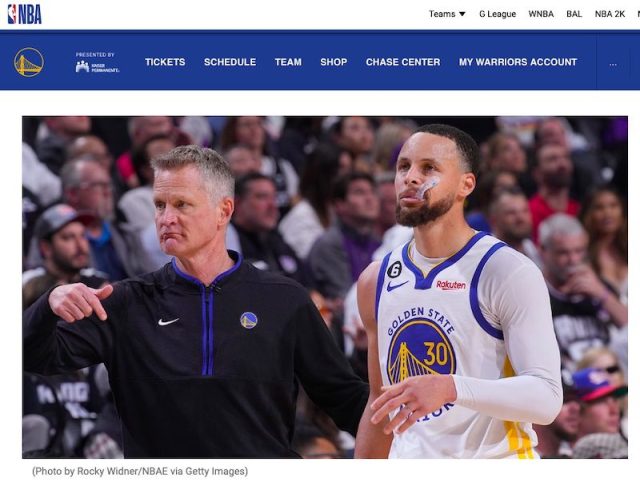

NBA team Golden State Warriors minority shareholders have been reported to be selling 10% shareholding ($700 million) at $7 billion valuation. In 2010, Joe Lacob and investors had bought Golden State Warriors for $450 million. From 2015 to 2022, Golden State Warriors had won 4 NBA championships, with the team led by Steph Curry, Klay Thompson, Draymond Green and coach Steve Kerr. In August 2023, NBA basketball superstar & billionaire Michael Jordan (Age 60, Born 1963) personal fortune is is estimated at around $3.5 billion after selling his selling his majority stake in NBA team Charlotte Hornets for $3 billion to investors including Gabe Plotkin & Rick Schnall, having acquired the NBA team in 2010 for $275 million and will retain a minority stake after the transaction. More info below:

“ NBA Team Golden State Warriors Minority Shareholders to Sell 10% Shareholding at $7 Billion Valuation “

NBA Basketball Superstar & Billionaire Michael Jordan Personal Fortune at $3.5 Billion after Selling Majority Stake in NBA Team Charlotte Hornets for $3 Billion to Investors Including Gabe Plotkin & Rick Schnall, Acquired Team in 2010 for $275 Million & Will Retain Minority Stake

25th August 2023 – NBA basketball superstar & billionaire Michael Jordan (Age 60, Born 1963) personal fortune is now at $3.5 billion after selling his selling his majority stake in NBA team Charlotte Hornets for $3 billion to investors including Gabe Plotkin & Rick Schnall, having acquired the NBA team in 2010 for $275 million and will retain a minority stake after the transaction. In June 2023, Gabe Plotkin (Founder of investment management firm Tallwoods Capital) had acquired a minority stake in Charlotte Hornets for 2019, served as an alternate governor on the NBA Board of Governors, and Rick Schnall (Co-President of private equity firm Clayton, Dubilier & Rice) has a minority stake in NBA team Atlanta Hawks (in the process of selling), and is an alternate governor on the NBA Board of Governors since 2015. Charlotte Hornets: “The Buyer Group will also include Chris Shumway, Dan Sundheim, Ian Loring, Dyal HomeCourt Partners, North Carolina natives recording artist J. Cole and country music singer-songwriter Eric Church, and several local Charlotte investors, including Amy Levine Dawson and Damian Mills. As part of the transaction, Jordan will retain a minority ownership share of the team. The transaction is subject to the approval of the NBA Board of Governors. Along with the Hornets, HSE ownership includes the Greensboro Swarm (NBA G League) and Hornets Venom GT (NBA 2K League), as well as managing and operating Spectrum Center, each of which is included as part of the sale.”

NBA Basketball Superstar & Billionaire Michael Jordan Sells Majority Stake in NBA Team Charlotte Hornets for $3 Billion to Investors Including Gabe Plotkin & Rick Schnall, Acquired Team in 2010 for $275 Million & Will Retain Minority Stake

17th June 2023 – NBA basketball superstar & billionaire Michael Jordan (Age 60, Born 1963) is selling his selling his majority stake in NBA team Charlotte Hornets for $3 billion to investors including Gabe Plotkin & Rick Schnall, having acquired the NBA team in 2010 for $275 million and will retain a minority stake after the transaction. Gabe Plotkin (Founder of investment management firm Tallwoods Capital) had acquired a minority stake in Charlotte Hornets for 2019, served as an alternate governor on the NBA Board of Governors, and Rick Schnall (Co-President of private equity firm Clayton, Dubilier & Rice) has a minority stake in NBA team Atlanta Hawks (in the process of selling), and is an alternate governor on the NBA Board of Governors since 2015. Charlotte Hornets: “The Buyer Group will also include Chris Shumway, Dan Sundheim, Ian Loring, Dyal HomeCourt Partners, North Carolina natives recording artist J. Cole and country music singer-songwriter Eric Church, and several local Charlotte investors, including Amy Levine Dawson and Damian Mills. As part of the transaction, Jordan will retain a minority ownership share of the team. The transaction is subject to the approval of the NBA Board of Governors. Along with the Hornets, HSE ownership includes the Greensboro Swarm (NBA G League) and Hornets Venom GT (NBA 2K League), as well as managing and operating Spectrum Center, each of which is included as part of the sale.”

NBA Basketball Superstar & Billionaire Michael Jordan Sells Majority Stake in NBA Team Charlotte Hornets for $3 Billion to Investors Including Gabe Plotkin & Rick Schnall

16th June 2023 – Hornets Sports & Entertainment (HSE) announced today that Chairman Michael Jordan has reached an agreement to sell his majority stake in the Charlotte Hornets to a group (“the Buyer Group”) led by Gabe Plotkin and Rick Schnall.

Plotkin, who acquired a minority stake in the Hornets in 2019, has been an alternate governor on the NBA Board of Governors since 2019 and is the founder and chief investment officer of Tallwoods Capital LLC. Schnall is co-president of Clayton, Dubilier & Rice LLC, where he has worked for 27 years, and has been a significant minority owner of the Atlanta Hawks and an alternate governor on the NBA Board of Governors since 2015. Schnall is in the process of selling his investment in the Hawks, which is expected to be completed in the next several weeks.

The Buyer Group will also include Chris Shumway, Dan Sundheim, Ian Loring, Dyal HomeCourt Partners, North Carolina natives recording artist J. Cole and country music singer-songwriter Eric Church, and several local Charlotte investors, including Amy Levine Dawson and Damian Mills.

As part of the transaction, Jordan will retain a minority ownership share of the team. The transaction is subject to the approval of the NBA Board of Governors. Along with the Hornets, HSE ownership includes the Greensboro Swarm (NBA G League) and Hornets Venom GT (NBA 2K League), as well as managing and operating Spectrum Center, each of which is included as part of the sale.

Chairman & Majority Owner of Charlotte Bobcats, Michael Jordan

An NBA legend, Michael Jordan was inducted into the Naismith Memorial Basketball Hall of Fame in September 2009. As a player, Jordan virtually rewrote the record book. He played 13 seasons for the Chicago Bulls, leading the league in scoring a record 10 times. His 30.1 points per game average is the highest in NBA history and, with 32,292 points, he ranks fifth on the all-time scoring list. Jordan led the Chicago Bulls to six NBA Championship titles and was named NBA Finals MVP during each of those series. A five-time regular season MVP, in 1991 and 1992, he became the only player to win back-to-back regular season and Finals MVP awards.

In March 2010, Jordan became the majority owner of the Charlotte Bobcats, after four years as part of the team’s ownership group and its Managing Member of Basketball Operations. Jordan is the first former player to become the majority owner of an NBA franchise. Under his direction, the team changed its name to the Charlotte Hornets prior to the 2014-15 season, bringing the historic moniker back to its fans and the city.

Jordan burst onto the national stage as a freshman at the University of North Carolina, leading his team to the NCAA Championship with a dramatic game-winning shot. Following a stellar college career during which he was a two-time College Player of the Year and first team All-America, Jordan was chosen with the third pick of the 1984 NBA Draft. Jordan is a two-time Olympic Gold Medal winner, most famously as a member of the 1992’s “Dream Team.”

After a brief stint as an owner and executive with the Washington Wizards in 2000-01, Jordan returned to the court as a player for the team for the 2001-02 and 2002-03 seasons before retiring.

Off the court, Michael Jordan has also proven to be a successful businessman. Since its creation, his Jordan Brand (a division of NIKE) has been an innovator of athletic shoes and apparel. The Jordan Brand has grown to become a market leader under Jordan’s creative design input. As one of the world’s most popular and recognizable figures, Jordan’s endorsement portfolio includes 2K, Gatorade and Upper Deck, among others. His other business ventures include several thriving restaurants. Jordan also serves as a special advisor to the Board of Directors of DraftKings and Sportradar.

Along with his friend, three-time Daytona 500 winner, Denny Hamlin, Jordan launched a NASCAR team, 23XI Racing, in the fall of 2020. 23XI Racing made its NASCAR Cup Series debut at the Daytona 500 in February 2021.

Jordan strongly believes in giving back to the community. He has long supported many charitable causes that provide opportunities for at-risk youth, help kids with disabilities and illnesses and teach and mentor children. In 2017, Jordan donated $7 million to fund two Novant Health Michael Jordan Family Medical Clinics in Charlotte. The clinics have provided critical health care services to more than 5,000 patients and have been an important access point for COVID-19 vaccination, testing, treatment and education. Jordan made an additional gift of $10 million in early 2020 for two medical clinics in his hometown, Wilmington, North Carolina that are scheduled to open in 2022. Jordan has served as Make-A-Wish’s Chief Wish Ambassador since 2008 and has been a wish granter for the organization for more than 30 years. In addition, he is a supporter of the NAACP Legal Defense and Education Fund, the University of North Carolina and the James R. Jordan Boys and Girls Club in Chicago, as well as other organizations. Jordan is also a founding donor of the Smithsonian’s National Museum of African American History and Culture in Washington, DC. In 2020, he, along with Jordan Brand, announced their 10-year, $100 million Black Community Commitment initiative, dedicated to addressing systemic racism and improving outcomes for Black Americans.

In 2016, Jordan was awarded the Presidential Medal Freedom, the nation’s highest civilian honor, by President Barack Obama.

Jordan and his wife, Yvette, have two daughters, Victoria and Ysabel. He also has three children, Jeffrey, Marcus and Jasmine, from a previous marriage.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit