$1 Trillion Private Equity Firm Blackstone Targets 6 to 7 Headcount in Singapore by 2025 with Managing Director Aravind Krishnan to Relocate from India to Singapore, Celebrated 10th Year Anniversary in Singapore in 2023 Attended by Singapore Deputy Prime Minister Lawrence Wong, Blackstone President & COO Jon Gray, Chairman APAC Chris Heady & Chairman Singapore Gautam Banerjee

17th January 2024 | Hong Kong

Leading private equity firm Blackstone with $1 trillion AUM (Assets under Management) is targeting 6 to 7 headcount in Singapore by 2025 with Managing Director Aravind Krishnan to relocate from India (Mumbai) to Singapore. In 2023 November, Blackstone celebrated the 10th year anniversary in Singapore (9/11/23), with the event attended by Singapore Deputy Prime Minister Lawrence Wong, Blackstone President & COO Jon Gray, Chairman APAC Chris Heady & Chairman of Singapore Gautam Banerjee. Steve Schwarzman, Chairman, CEO & Co-Founder, Blackstone: “Ten years ago, we set up our Blackstone Singapore office with the support of our fantastic leaders in the region, many of whom are still here today. We have since grown more than threefold across functions, serving a diversity of investors. We are so excited about the future of the country and for Blackstone in the market.” Jon Gray, President & Chief Operating Officer, Blackstone: “We are incredibly proud of what we’ve built in Singapore over the last 10 years. Our local team – anchored by our founding values of excellence, innovation, and integrity – has brought the best of Blackstone to the market. We’ve established long- standing partnerships with major public service investors, and made investments that contribute to the local economy and communities in meaningful ways. We are committed to growing our presence in Singapore – a vital gateway to Southeast Asia.” Gautam Banerjee, Chairman of Singapore, Blackstone: “We would not be where we are today without the support of the Singapore government and our partners in the market. This is just the beginning of our journey. Singapore has so much to offer – it is Asia’s center of talent and innovation and one of the best places to do business in the world. We’d love to do more in Singapore and continue to bring our global expertise for a wider range of investors.” More info below:

“ $1 Trillion Private Equity Firm Blackstone Targets 6 to 7 Headcount in Singapore by 2025 with Managing Director Aravind Krishnan to Relocate from India to Singapore, Celebrated 10th Year Anniversary in Singapore in 2023 Attended by Singapore Deputy Prime Minister Lawrence Wong, Blackstone President & COO Jon Gray, Chairman APAC Chris Heady & Chairman Singapore Gautam Banerjee “

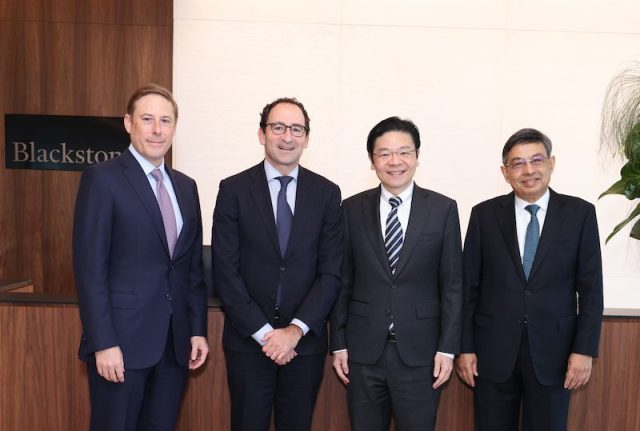

Blackstone Celebrates 10th Year Anniversary in Singapore Attended by Singapore Deputy Prime Minister Lawrence Wong, Blackstone President & COO Jon Gray, Chairman APAC Chris Heady & Chairman Singapore Gautam Banerjee

11th November 2023 – Blackstone has celebrated the 10th year anniversary in Singapore (9/11/23), with the event attended by Singapore Deputy Prime Minister Lawrence Wong, Blackstone President & COO Jon Gray, Chairman APAC Chris Heady & Chairman of Singapore Gautam Banerjee. Steve Schwarzman, Chairman, CEO & Co-Founder, Blackstone: “Ten years ago, we set up our Blackstone Singapore office with the support of our fantastic leaders in the region, many of whom are still here today. We have since grown more than threefold across functions, serving a diversity of investors. We are so excited about the future of the country and for Blackstone in the market.” Jon Gray, President & Chief Operating Officer, Blackstone: “We are incredibly proud of what we’ve built in Singapore over the last 10 years. Our local team – anchored by our founding values of excellence, innovation, and integrity – has brought the best of Blackstone to the market. We’ve established long- standing partnerships with major public service investors, and made investments that contribute to the local economy and communities in meaningful ways. We are committed to growing our presence in Singapore – a vital gateway to Southeast Asia.” Gautam Banerjee, Chairman of Singapore, Blackstone: “We would not be where we are today without the support of the Singapore government and our partners in the market. This is just the beginning of our journey. Singapore has so much to offer – it is Asia’s center of talent and innovation and one of the best places to do business in the world. We’d love to do more in Singapore and continue to bring our global expertise for a wider range of investors.” More info below:

Blackstone Celebrates 10th Year Anniversary in Singapore Attended by Singapore Deputy Prime Minister Lawrence Wong

9th Nov 2023 – Blackstone today celebrated the 10th-year anniversary of its Singapore business with an event at its new office attended by the Deputy Prime Minister and Minister for Finance, and Chairman of the Monetary Authority of Singapore, Lawrence Wong; Blackstone’s President and Chief Operating Officer, Jon Gray; Blackstone’s Chief Financial Officer, Michael Chae; Blackstone’s Global Head of Private Wealth Solutions, Joan Solotar; Blackstone’s Global Head of Insurance Solutions, Gilles Dellaert; Global Head of Blackstone Alternative Asset Management, Joe Dowling; Blackstone’s Chairman of Asia Pacific and Head of Real Estate Asia, Chris Heady; and Blackstone’s Head of Asia Private Equity, Amit Dixit.

Over the past decade, Blackstone has built diverse capabilities in Singapore to serve a broad range of investors. It has made marquee investments including Eclipse and Soilbuild Business REIT, high-quality office buildings that house multinational corporations across the financial and technology sectors; and Interplex, a global leader in connector technology for fast-growing sectors. Blackstone’s contributions to the local community have been recognized by the Singapore government including Community Chest, the philanthropic arm of Singapore’s National Council of Social Service.

About Blackstone

Blackstone is the world’s largest alternative asset manager. We seek to create positive economic impact and long-term value for our investors. We do this by relying on extraordinary people and flexible capital to help strengthen the companies we invest in. Our over $1 trillion in assets under management include investment vehicles focused on private equity, real estate, public debt and equity, infrastructure, life sciences, growth equity, opportunistic, non-investment grade credit, real assets and secondary funds, all on a global basis. Further information is available at www.blackstone.com. Follow @blackstone on LinkedIn, X (Twitter), and Instagram.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit