17th Asian Financial Forum 2024 Hong Kong Attended by More than 3,600+ Financial & Business & Leaders, Over 700 Investors 1-on-1 Meetings in AFF Deal-Making, Top 3 Challenges are Geopolitical Fragmentation 66.7%, Slowdown in Recovery 17.7% & Inflation 6%, Top 3 Most Promising Industries in China are Digital economy 31.4%, Electric Vehicles 26.1% & Renewable Energy 18.8%

29th January 2024 | Hong Kong

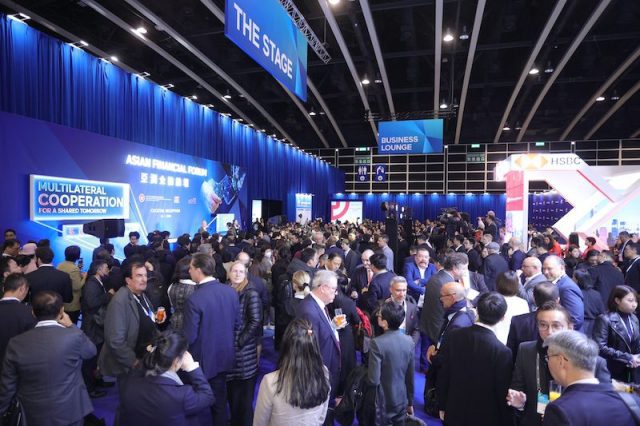

The 17th Asian Financial Forum 2024 (AFF 2024) Hong Kong took place on the 24th & 25th January 2024, attended by more than 3,600+ financial & business & leaders with over 700 investors 1-on-1 meetings in AFF deal-making. The 2024 AFF programs include keynote luncheons, exhibitions, deal-making, CIO insights and opportunities in Mainland China, ASEAN & Middle-East. At the AFF 2024, attendees identified the top 3 challenges are geopolitical fragmentation 66.7%, slowdown in recovery 17.7% and inflation 6%, and the top 3 most promising industries in China are digital economy 31.4%, electric vehicles 26.1% and renewable energy 18.8%. AFF 2024: “The 17th Asian Financial Forum (AFF), jointly organised by the Hong Kong Special Administrative Region (HKSAR) Government and Hong Kong Trade Development Council (HKTDC), successfully concluded today, attracting over 3,600 financial and business elites from more than 50 countries and regions, including over 70 overseas and Mainland China delegations. The Forum showcased Hong Kong’s thriving economy as participants explored opportunities, accelerated sustainable development and multilateral cooperation and launched Hong Kong’s conferences for the year. The event was marked by a vibrant atmosphere. Various segments – including the opening session, plenary discussions, policy dialogue, keynote luncheons and cocktail reception – were well attended. Leaders from around the world actively engaged in discussions. Through the years, the Forum has played a crucial role in deepening business and trade collaboration. AFF Deal-making, a global investment project-matching event jointly organised by the HKTDC and Hong Kong Venture Capital and Private Equity Association (HKVCA), was well received, facilitating over 700 one-on-one meetings, connecting funds and investment projects from around the world. The founder of one of the start-ups from Thailand said he had met 20 visitors with potential deals, ranging from a family office to a legal adviser. He also commented that the geographical diversity of the visitors at Deal-making was extensive, ranging from India to Europe and Japan. The deal-making session had presented valuable opportunities to find potential business partners. This year’s AFF also facilitated the signing of various Memorandums of Understanding (MoUs) and Agreement. These included the Comprehensive Avoidance of Double Taxation Agreement between Hong Kong and Croatia and Memorandum of Understanding between the Financial Services Development Council and Financial Sector Development Program of Saudi Arabia. The Forum also featured exhibition zones including the Fintech Showcase, Fintech HK Startup Salon, the InnoVenture Salon and Global Investment Zone, presenting innovative solutions from international financial institutions and introducing prospective unicorns from Hong Kong and around the world. The exhibition segment brought together over 140 exhibitors, including international financial institutions, technology companies, start-ups, investment promotion agencies, and sponsors, including knowledge partner PwC, along with HSBC, Bank of China, Standard Chartered Bank, UBS, China International Capital Corporation (CICC), Huatai International and Cyberport.” More info below:

“ 17th Asian Financial Forum 2024 Hong Kong Attended by More than 3,600+ Financial & Business & Leaders, Over 700 Investors 1-on-1 Meetings in AFF Deal-Making, Top 3 Challenges are Geopolitical Fragmentation 66.7%, Slowdown in Recovery 17.7% & Inflation 6%, Top 3 Most Promising Industries in China are Digital economy 31.4%, Electric Vehicles 26.1% & Renewable Energy 18.8% “

17th Asian Financial Forum 2024 Hong Kong Attended by More than 3,600+ Financial & Business & Leaders

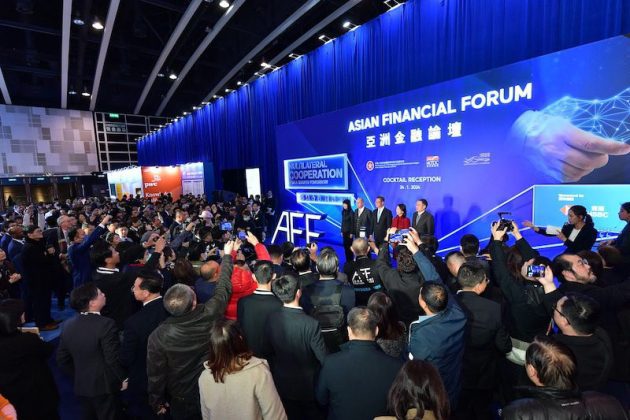

25th January 2024 – The 17th Asian Financial Forum (AFF), jointly organised by the Hong Kong Special Administrative Region (HKSAR) Government and Hong Kong Trade Development Council (HKTDC), successfully concluded today, attracting over 3,600 financial and business elites from more than 50 countries and regions, including over 70 overseas and Mainland China delegations. The Forum showcased Hong Kong’s thriving economy as participants explored opportunities, accelerated sustainable development and multilateral cooperation and launched Hong Kong’s conferences for the year. The event was marked by a vibrant atmosphere. Various segments – including the opening session, plenary discussions, policy dialogue, keynote luncheons and cocktail reception – were well attended. Leaders from around the world actively engaged in discussions.

In just two days, the Forum arranged over 700 one-on-one meetings, successfully connecting investors with project owners and exploring opportunities for industry and investment cooperation. After the Forum’s conclusion, participants will have the opportunity to continue discussions and meetings online from tomorrow until 30 January (Tuesday). Over the two-day physical event, the AFF brought together more than 140 policymakers, international financial and multilateral organisation representatives, financial institutions and corporate leaders from around the world as speakers.

On the first day of the Forum, Prof Jeffrey D Sachs, President of the UN Sustainable Development Solutions Network, addressed the keynote luncheon, affirming the importance of Hong Kong as an international financial centre. He said that global cooperation could help solve problems that were even beyond our reach. He believed Hong Kong could play a full role in sustainable development financing, an increasingly important area.

One of the highlights of this year’s AFF was the Plenary Session I – Charting the Path to a Shared Future, hosted by Christopher Hui, Secretary for Financial Services and the Treasury of the HKSAR, bringing together financial officials from around the world to discuss economic challenges countries face. Julapun Amornvivat, Deputy Minister of Finance, Thailand, said: “The Asian Financial Forum is the place where both the public and private sectors can have honest discussions to find solutions to tackle major problems today and transform the economy for the future.” H.E. Dr Mohamed Maait, Minister of Finance, Egypt, mentioned that the world was grappling with rising geopolitical tensions and a lack of clarity about the future, weighing on the achievement of sustainable economic growth. To address global challenges, the world needed to deploy all efforts to coordinate economic policies on a multilateral scale.

On the second day, the Breakfast Panel focused on Unleashing the Dragon’s Currency: Navigating Renminbi Internationalisation on the Global Stage, allowing participants to delve into the renminbi’s growing use worldwide and trends in international demand. Prof Douglas W Diamond, Nobel Laureate in Economic Sciences in 2022 and Merton H Miller Distinguished Service Professor of Finance at the University of Chicago’s Booth School of Business, addressed the Keynote Luncheon on the second day, which was moderated by Raymund Chao, Asia Pacific and China Chairman, PwC.

Global Spectrum, Dialogues for Tomorrow and Fireside Chat brought together pioneers from various industries to discuss a host of topical subjects, explored the latest Web 3.0 and virtual asset development, the future of fintech innovation, CIO Insights, green finance and opportunities in new markets. Speakers included Bob Prince, Co-Chief Investment Officer of Bridgewater Associates, Dr Ma Jun, Chairman and President, Hong Kong Green Finance Association (HKGFA), Guinandra (Andra) Jatikusumo, Group Director and Chief of Investments & Business Development of CT Corp, Darmawan Junaidi, President Director, Bank Mandiri, Yat Siu, Co-Founder and Executive Chairman, Animoca Brands, and more.

Understanding prospects for mainland industries, environmental economics

- To gauge participants’ views on the global economic outlook this year, the Forum conducted on-site voting during panel discussions. For instance, at the Panel Discussion on Global Economic Outlook, participants were asked about the greatest threats or uncertainties to economic growth in the Asia-Pacific. Most attendees identified geopolitical fragmentation (66.7%) as the biggest challenge, followed by a slowdown in the recovery momentum in key economies (17.7%), persistent inflation (6%), a tightened monetary environment (4.2%), continued supply chain reshaping (3.6%) and other factors (1.8%).

- In the newly introduced Panel Discussion on Stewarding China’s New Chapter, participants were asked about the most promising industries in Mainland China. The digital economy took top spot with 31.4%. Electric vehicles (26.1%) and renewable energy (18.8%) followed in second and third place, respectively. Advanced manufacturing (15.8%), other industries (4.2%) and electronic devices (3.2%) ranked subsequently.

Over 700 matching sessions held on-site, online platform continues to yield results – Through the years, the Forum has played a crucial role in deepening business and trade collaboration. AFF Deal-making, a global investment project-matching event jointly organised by the HKTDC and Hong Kong Venture Capital and Private Equity Association (HKVCA), was well received, facilitating over 700 one-on-one meetings, connecting funds and investment projects from around the world. The founder of one of the start-ups from Thailand said he had met 20 visitors with potential deals, ranging from a family office to a legal adviser. He also commented that the geographical diversity of the visitors at Deal-making was extensive, ranging from India to Europe and Japan. The deal-making session had presented valuable opportunities to find potential business partners.

This year’s AFF also facilitated the signing of various Memorandums of Understanding (MoUs) and Agreement. These included the Comprehensive Avoidance of Double Taxation Agreement between Hong Kong and Croatia and Memorandum of Understanding between the Financial Services Development Council and Financial Sector Development Program of Saudi Arabia.

The Forum also featured exhibition zones including the Fintech Showcase, Fintech HK Startup Salon, the InnoVenture Salon and Global Investment Zone, presenting innovative solutions from international financial institutions and introducing prospective unicorns from Hong Kong and around the world. The exhibition segment brought together over 140 exhibitors, including international financial institutions, technology companies, start-ups, investment promotion agencies, and sponsors, including knowledge partner PwC, along with HSBC, Bank of China, Standard Chartered Bank, UBS, China International Capital Corporation (CICC), Huatai International and Cyberport.

The 2024 International Financial Week (IFW) commenced on 24 January to create synergies, bringing together over 20 partner events. These events cover a many topics of global interest to the financial and business community. They include private equity investment, alternative investments, sustainable investments, family offices and women’s empowerment, among others. These events highlight the role of Hong Kong as an international financial centre.

To seize opportunities and promote the conference and event economy, the AFF collaborated with various organisations to arrange activities for participants beyond the Forum. These activities included free admission to the Hong Kong Palace Museum, Hong Kong’s iconic Aqua Luna red-sail junk boat, TramOramic tour and open-top Big Bus arranged by the Hong Kong Tourism Board. These experiences allowed forum guests to feel at home and appreciate the vibrancy and diversity of Hong Kong.

Furthermore, to provide overseas participants with a better understanding of the Guangdong-Hong Kong-Macao Greater Bay Area and the vast business opportunities within, organisers will lead a delegation to Shenzhen tomorrow (26 January), including corporate visits and exchange activities.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit