India Financial Intelligence Unit Fined India Fintech Paytm Banking Unit $662,000 for Money Laundering Breaches, Allowing Funds from Online Gambling to be Transferred to Bank Accounts in Paytm Payments Bank

2nd March 2024 | Hong Kong

India Financial Intelligence Unit (FIU) has fined India fintech Paytm banking unit $662,000 for money laundering breaches, allowing funds from online gambling to be transferred to bank accounts in Paytm Payments Bank. Earlier in February 2024, India fintech Paytm had been banned by India central bank (Reserve Bank of India, RBI) from payment operations including new credit, deposit, top-up & fund transfer from 29th February 2024. Paytm share price decreased -20% after the announcement with current market value at $4.65 billion. In 2022 March, India fintech Paytm had disallowed to accept new customers by India Central Bank Reserve Bank of India (RBI), with share price dropping 23% in a week and 50% from November 2021 IPO from $10 billion market capitalization to $5.08 billion (18/3/22) in 5 months. Reserve Bank of India cited: “material supervisory concerns” and “restrictions will continue pending a comprehensive audit of its information-technology systems”. Paytm:”The company is taking steps to comply, including the appointment of an external auditor … … Existing customers aren’t affected.” Paytm is an India financial technology company which runs India popular payment app and similar to China Ant Group.

“ India Financial Intelligence Unit Fined India Fintech Paytm Banking Unit $662,000 for Money Laundering Breaches, Allowing Funds from Online Gambling to be Transferred to Bank Accounts in Paytm Payments Bank “

India Fintech Paytm Banned by India Central Bank from Payment Operations Including New Credit, Deposit, Top-Up & Fund Transfer from 29th February 2024, Share Price Decreased -20% after Announcement with Market Value at $4.65 Billion

1st February 2024 – India fintech Paytm has been banned by India central bank (Reserve Bank of India, RBI) from payment operations including new credit, deposit, top-up & fund transfer from 29th February 2024. Paytm share price decreased -20% after the announcement with current market value at $4.65 billion. In 2022 March, India fintech Paytm had disallowed to accept new customers by India Central Bank Reserve Bank of India (RBI), with share price dropping 23% in a week and 50% from November 2021 IPO from $10 billion market capitalization to $5.08 billion (18/3/22) in 5 months. Reserve Bank of India cited: “material supervisory concerns” and “restrictions will continue pending a comprehensive audit of its information-technology systems”. Paytm:”The company is taking steps to comply, including the appointment of an external auditor … … Existing customers aren’t affected.” Paytm is an India financial technology company which runs India popular payment app and similar to China Ant Group.

India Fintech Paytm Falls 23% in a Week After Ban to Accept New Clients, Falls 50% from IPO $10 Billion to $5 Billion Market Value in 5 Months

19th March 2022 – India fintech Paytm has been disallowed to accept new customers by India Central Bank Reserve Bank of India (RBI), with share price dropping 23% in a week and 50% from November 2021 IPO from $10 billion market capitalization to $5.08 billion (18/3/22) in 5 months. Reserve Bank of India cited: “material supervisory concerns” and “restrictions will continue pending a comprehensive audit of its information-technology systems”. Paytm:”The company is taking steps to comply, including the appointment of an external auditor … … Existing customers aren’t affected.” Paytm is an India financial technology company which runs India popular payment app and similar to China Ant Group.

India Paytm IPO with $10 Billion Market Value, Founder Becomes Billionaire with $2.4 Billion

(November 2021) Paytm, the India financial technology company which runs India popular payment app and similar to China Ant Group, has IPO on Bombay Stock Exchange with a market capitalisation of $20 billion on Thursday (18/11/21). Listed as One97 Communications, the shares fell more 27% and had hit the the lower circuit breaker of 20%. Vijay Shekhar Sharma, who founded Paytm in 2010, became a billionaire with estimated fortune of $2.4 billion. The IPO raised $2.5 billion and existing investors include Softbank Vision Fund, Berkshire Hathaway, Ant Group and Alibaba Group. (IPO ~ Initial Public Offering)

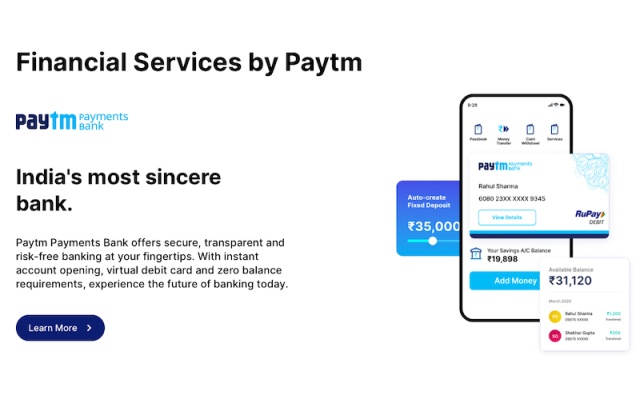

Paytm, Founded in 2010

Founded in 2010 by Vijay Shekhar Sharma, Paytm quickly grew to become a popular payment app in India. Today, more than 20 million merchants & businesses are powered by Paytm to accept payments digitally. More than 300 million Indians use Paytm to Pay at their stores, and Paytm App is used to pay bills, do recharges, send money to friends & family, book movies & travel tickets.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit