Reddit IPO on NYSE with Share Price Increasing +48% on Day 1 Trading from $34 to $50.44 with Market Value of $8 Billion on 21st March 2024, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian

22nd March 2024 | Hong Kong

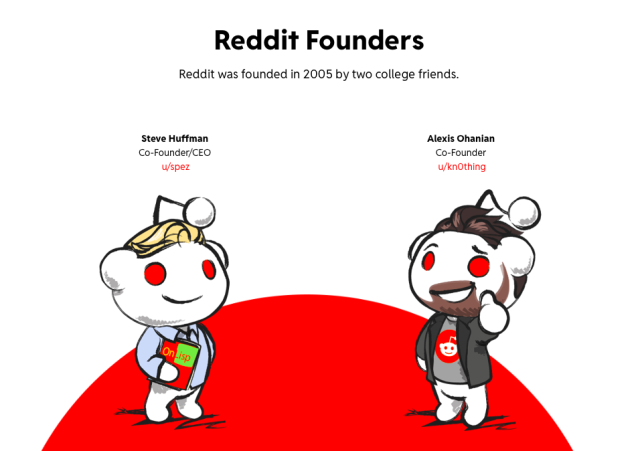

Reddit, a social media network of communities, has IPO on New York Stock Exchange (NYSE) with share price increasing +48% on day 1 trading (21/3/24) from $34 to $50.44 with market value of $8 billion. Earlier in March 2024, Reddit was reported to be planning for an IPO on New York Stock Exchange (NYSE) in March 2024 at around $6.5 billion market value and targeting to raise up to $748 million in IPO proceeds. In late February 2024, Reddit was reported to be planning for an IPO on New York Stock Exchange (NYSE) under symbol RDDT, with reports of a planned IPO in March 2024 with market valuation at around $10 billion. In 2021, Reddit had filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. In 2023, Reddit is forecasted to generate $800 million in advertising revenue.

“ Reddit IPO on NYSE with Share Price Increasing +48% on Day 1 Trading from $34 to $50.44 with Market Value of $8 Billion on 21st March 2024, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian “

Reddit Plans IPO on NYSE in March 2024 at $6.5 Billion Market Value & to Raise $748 Million in IPO Proceeds, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian

16th March 2024 – Reddit, a social media network of communities, is planning for an IPO on New York Stock Exchange (NYSE) in March 2024 at around $6.5 billion market value and targeting to raise up to $748 million in IPO proceeds. In late February 2024, Reddit was reported to be planning for an IPO on New York Stock Exchange (NYSE) under symbol RDDT, with reports of a planned IPO in March 2024 with market valuation at around $10 billion. In 2021, Reddit had filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. In 2023, Reddit is forecasted to generate $800 million in advertising revenue.

Reddit Plans IPO on NYSE in March 2024 at $6.5 Billion Market Value, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian

2nd March 2024 – Reddit, a social media network of communities, is planning for an IPO on New York Stock Exchange (NYSE) in March 2024 at around $6.5 billion market value. In late February 2024, Reddit was reported to be planning for an IPO on New York Stock Exchange (NYSE) under symbol RDDT, with reports of a planned IPO in March 2024 with market valuation at around $10 billion. In 2021, Reddit had filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. In 2023, Reddit is forecasted to generate $800 million in advertising revenue.

Reddit to IPO on New York Stock Exchange under Symbol RDDT, Reported Planned IPO in March 2024 with Market Valuation Around $10 Billion, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian

24th February 2024 – Reddit, a social media network of communities, is planning for an IPO on New York Stock Exchange (NYSE) under symbol RDDT, with reports of planned IPO in March 2024 with market valuation of around $10 billion. In 2021, Reddit had filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. In 2023, Reddit is forecasted to generate $800 million in advertising revenue.

Reddit Targets IPO in March 2024 with Market Valuation Around $10 Billion, Filed for IPO with United States SEC in 2021, Founded in 2005 by University of Virginia College Friends Steve Huffman & Alexis Ohanian

1st February 2024 – Reddit, a social media network of communities, is targeting an IPO in March 2024 with reported market valuation of around $10 billion. In 2021, Reddit had filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. In 2023, Reddit is forecasted to generate $800 million in advertising revenue.

Reddit Files for IPO with United States SEC, Market Valuation of $10 Billion

17th December 2021 – Reddit, a social media network of communities, has filed for IPO with the United States Securities and Exchange Commission (SEC), with market expecting a valuation of more than $10 billion. Founded in 2005 by University of Virginia college friends Steve Huffman and Alexis Ohanian, Reddit grew to 52 million daily users and $100 million in advertising revenue in Q2 2021. In August 2021, Reddit raised $700 million in Series F funding, led by Fidelity Management, Research Company and including other existing investors, at a post-money valuation of over $10 billion. (IPO ~ Initial Public Offering)

Reddit Files for IPO

Reddit: Reddit, Inc. today announced that it has confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the ”SEC”) relating to the proposed initial public offering of its common stock. The number of shares to be offered and the price range for the proposed offering have not yet been determined. The initial public offering is expected to occur after the SEC completes its review process, subject to market and other conditions.

We are in a quiet period, and for regulatory reasons, we cannot say anything further. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended (“Securities Act”). This announcement is being issued in accordance with Rule 135 under the Securities Act.

Reddit Secures $700 Million in August 2021

Reddit: As we shared earlier this year when Reddit raised its Series E round of funding, we are making strategic investments to grow Reddit and our business, including expanding internationally, innovating new ways to foster community, and bolstering our advertising offerings and capabilities. These efforts require us to grow our teams and make smart bets on how to make Reddit better, faster, easier to use, and more empowering for communities. We are also evolving as a business, maturing, and building the operational structures that will help propel us into the future with transparency, values, and integrity.

We have been making a great deal of progress on all fronts — from hiring our first chief financial officer and building out a comprehensive finance function, to expanding internationally in the UK, Canada, Australia, and more countries to come. This year Reddit marked its first $100 million advertising revenue quarter (Q2 2021), representing a 192 percent increase compared to the same period last year. And, we are investing in our products and diversifying the Reddit experience to include new ways for communities to connect through video and audio.

We are optimistic and encouraged that not only are we resourced and capitalized to continue on our growth path, but also that our investors support our vision and want to deepen their stakes in our future. We will raise up to $700 million in Series F funding, led by Fidelity Management and Research Company LLC. and including other existing investors, at a post-money valuation of over $10 billion. We are committed to our mission of providing community and belonging to everyone and look forward to continuing on our journey with the support of our users, employees, clients, and investors.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit