Ex-New York Hedge Fund Manager at SAC Capital & Cheyne Capital Steven Marks Personal Fortune Increased to $180 Million 7 Days after Mexican Quick Service Restaurant Guzman y Gomez IPO on Australia Stock Exchange, Founded in Sydney in 2006

26th June 2024 | Hong Kong

Ex-New York hedge fund manager at SAC Capital & Cheyne Capital Steven Marks personal fortune has increased to $180 million, 7 days after his Mexican quick service restaurant Guzman y Gomez IPO on Australia Stock Exchange (ASX) at $1.4 billion valuation (AUD 2.2 billion), with share price increasing +33% to AUD 29.4 after 1 week of trading from IPO price of AUD 22 (20/6/24). Guzman y Gomez sold AUD 335.1 million value of new shares in the IPO. Guzman y Gomez was founded in Sydney in 2006 by ex-New York hedge fund Manager Steven Marks and wholesale & retail fashion professional Robert Hazan, with the restaurant named after Steven Marks’ 2 childhood friends Guzman & Gomez. Guzman y Gomez – Guzman y Gomez (GYG) is one of Australia’s fastest growing Quick Service Restaurant (“QSR”) businesses, delivering clean, fresh, made-to-order, Mexican-inspired food. Since opening its first restaurant in Sydney in 2006, GYG has expanded its network to over 200 restaurants globally. Guzman y Gomez was founded in Sydney in 2006 by New Yorkers and childhood best friends Steven Marks and Robert Hazan. Steven, a former hedge fund manager, and Robert, who had a background in fashion wholesale and retail, both missed the authentic fresh flavours of Mexican cuisine that they had grown up with in America. After realising that there was a genuine gap in the Australian market for fresh, clean Mexican food, they decided to create their own restaurant named Guzman y Gomez to honour their childhood friends. Steven and Robert had a vision to build a restaurant business that had the speed and convenience of fast food but to re-invent the fast food category by serving high-quality food.

“ Ex-New York Hedge Fund Manager at SAC Capital & Cheyne Capital Steven Marks Personal Fortune Increased to $180 Million 7 Days after Mexican Quick Service Restaurant Guzman y Gomez IPO on Australia Stock Exchange, Founded in Sydney in 2006 “

Mexican Quick Service Restaurant Guzman y Gomez IPO on Australia Stock Exchange at $1.4 Billion Valuation, Share Price Increased +33% to AUD 29.4 after 1 Week of Trading from IPO Price of AUD 22 (20/6/24), Sold AUD 335.1 Million Value of New Shares in the IPO, Founded in Sydney in 2006 by ex-New York Hedge Fund Manager Steven Marks and Wholesale & Retail Fashion Professional Robert Hazan, Restaurant Named after Steven Marks 2 Childhood Friends Guzman & Gomez

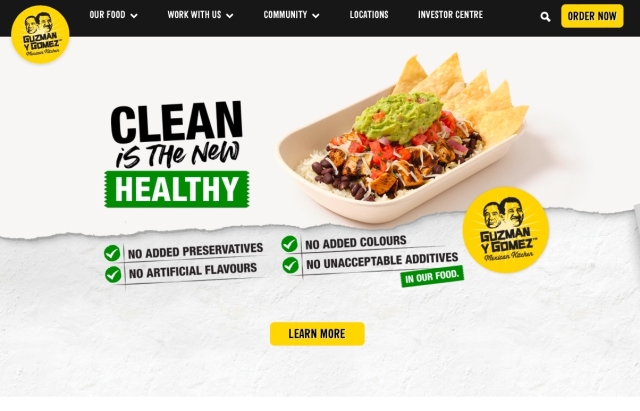

26th June 2024 – Mexican quick service restaurant Guzman y Gomez has IPO on Australia Stock Exchange (ASX) at $1.4 billion valuation (AUD 2.2 billion), with share price increasing +33% to AUD 29.4 after 1 week of trading from IPO price of AUD 22 (20/6/24). Guzman y Gomez sold AUD 335.1 million value of new shares in the IPO. Guzman y Gomez was founded in Sydney in 2006 by ex-New York hedge fund Manager Steven Marks and wholesale & retail fashion professional Robert Hazan, with the restaurant named after Steven Marks’ 2 childhood friends Guzman & Gomez. Guzman y Gomez – Guzman y Gomez (GYG) is one of Australia’s fastest growing Quick Service Restaurant (“QSR”) businesses, delivering clean, fresh, made-to-order, Mexican-inspired food. Since opening its first restaurant in Sydney in 2006, GYG has expanded its network to over 200 restaurants globally. Guzman y Gomez was founded in Sydney in 2006 by New Yorkers and childhood best friends Steven Marks and Robert Hazan. Steven, a former hedge fund manager, and Robert, who had a background in fashion wholesale and retail, both missed the authentic fresh flavours of Mexican cuisine that they had grown up with in America. After realising that there was a genuine gap in the Australian market for fresh, clean Mexican food, they decided to create their own restaurant named Guzman y Gomez to honour their childhood friends. Steven and Robert had a vision to build a restaurant business that had the speed and convenience of fast food but to re-invent the fast food category by serving high-quality food.

Guzman y Gomez – Guzman y Gomez (GYG) is one of Australia’s fastest growing Quick Service Restaurant (“QSR”) businesses, delivering clean, fresh, made-to-order, Mexican-inspired food. Since opening its first restaurant in Sydney in 2006, GYG has expanded its network to over 200 restaurants globally. Guzman y Gomez was founded in Sydney in 2006 by New Yorkers and childhood best friends Steven Marks and Robert Hazan. Steven, a former hedge fund manager, and Robert, who had a background in fashion wholesale and retail, both missed the authentic fresh flavours of Mexican cuisine that they had grown up with in America. After realising that there was a genuine gap in the Australian market for fresh, clean Mexican food, they decided to create their own restaurant named Guzman y Gomez to honour their childhood friends. Steven and Robert had a vision to build a restaurant business that had the speed and convenience of fast food but to re-invent the fast food category by serving high-quality food.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit