Hong Kong to Increase Deposit Protection Scheme from $63,000 to $102,000 or HKD 500,000 to HKD 800,000, Deposit Protection Scheme (Amendment) Bill 2024 to be Gazetted on 12th July 2024, Phase 1 Implementation on 1st October 2024 & Phase 2 Full Implementation on 1st January 2025, Protects 92% Depositors from Current Level of 89% of Depositors, Next Review Will be 3 Years Later in 2027

5th July 2024 | Hong Kong

Hong Kong has increased the Deposit Protection Scheme (DPS) from $63,000 to $102,000 (HKD 500,000 to HKD 800,000), with the Deposit Protection Scheme (Amendment) Bill 2024 to be gazetted on 12th July 2024 (Phase 1 Implementation (1/10/24) & Phase 2 full implementation on 1/1/24). The new Hong Kong Deposit Protection Scheme (DPS) will protect 92% of depositors from the current level of 89% of depositors. The next review will be 3 years later in 2027. Hong Kong SAR (3/7/24): “The Government welcomed the passage of the Deposit Protection Scheme (Amendment) Bill 2024 by the Legislative Council (LegCo) today (July 3) to implement various measures to enhance the Deposit Protection Scheme (DPS), including: 1) raising the protection limit from the current $500,000 to $800,000; 2) refining the levy system to enable the DPS Fund underpinning the Scheme to reach the target fund size within a reasonable timeframe under the increased protection limit; 3) providing enhanced coverage to affected depositors upon a bank merger or acquisition; 4) requiring the display of the DPS membership sign on the electronic banking platforms of DPS members; and 5) streamlining the negative disclosure requirement on non-protected deposit transactions for private banking customers. The Amendment Ordinance will be gazetted on July 12 and will be implemented in two phases. The first phase, which comes into effect on October 1, 2024, will cover measures requiring a shorter period of preparatory work, such as the enhancement of protection limit to $800,000. The second phase, which covers other measures, will be implemented on January 1, 2025.”

“ Hong Kong to Increase Deposit Protection Scheme from $63,000 to $102,000 or HKD 500,000 to HKD 800,000, Deposit Protection Scheme (Amendment) Bill 2024 to be Gazetted on 12th July 2024, Phase 1 Implementation on 1st October 2024 & Phase 2 Full Implementation on 1st January 2025, Protects 92% Depositors from Current Level of 89% of Depositors, Next Review Will be 3 Years Later in 2027 “

The Secretary for Financial Services and the Treasury, Christopher Hui: “The Deposit Protection Scheme (Amendment) Ordinance 2024 (the Amendment Ordinance) can help further strengthen the function of the DPS in the financial safety net, enhance depositors’ confidence and raise the resilience of the banking sector and the overall stability of the financial system, thereby reinforcing Hong Kong’s position as an international financial centre.”

The Chairman of the Hong Kong Deposit Protection Board, Ms Connie Lau: “We would like to express our sincere gratitude to the LegCo for the passage of the Amendment Ordinance, which marks a key milestone in the development of the DPS. The enhancements will not only ensure the DPS is in line with international standards, but will also provide better protection for depositors and further contribute to the stability of the banking system in Hong Kong. We look forward to working closely with the banking industry to implement the enhancement measures as scheduled, and will launch a series of promotional campaigns to raise the public awareness of the enhanced DPS.”

Hong Kong to Increase Deposit Protection Scheme from $63,000 to $102,000 or HKD 500,000 to HKD 800,000, Protecting 92% Depositors from Current Level of 89% of Depositors, Target to Implement by 2024 & Next Review Will be 3 Years Later in 2027

8th February 2024 – The Hong Kong Deposit Protection Board has concluded a public consultation to increase the Hong Kong Deposit Protection Scheme (DPS) from $63,000 to $102,000 (HKD 500,000 to HKD 800,000), which will protect 92% of depositors from the current level of 89% of depositors. The target timeline to implement is by 2024, with the next review to be 3 years later in 2027. Hong Kong Deposit Protection Board: ”Based on the written submissions received and the findings of the public opinion survey, the respondents generally welcomed and supported the proposed enhancements to the DPS, including raising the protection limit from the current HK$500,000 to HK$800,000, while there were mixed views within the banking industry on the appropriate level of protection limit. Having carefully considered all the comments received and relevant factors, the Board considers that raising the protection limit to HK$800,000 is sufficient at this stage to suitably enhance protection to depositors, as this level represents a 60% increase in the protection limit, which will more than compensate for the cumulative inflation over time, hence translating into around 20% increase in the real value of deposit protection. Moreover, the majority of depositors (more than 92%) will enjoy full deposit coverage, in line with international standards. On the whole, except for some refinements to certain implementation details which were made in response to banks’ comments, the Board will proceed to prepare legislative amendments based on the proposals in the consultation paper.” More info below:

Connie Lau Yin-hing, SBS, JP, Chairman of the Board: “We are grateful to all the respondents for their time and effort in reviewing the policy recommendations on enhancing the DPS and providing us with their valuable comments. The proposed enhancements are crucial to ensuring that the DPS keeps up with international best practice and remains effective in contributing to banking stability as intended. Given that the global landscape on deposit insurance is expected to remain uncertain in the coming years, the Board will strive to put the new protection limit into effect within this year and commence the next review three years after its implementation (i.e. 2027), with the aim of completing the review exercise in the following year. During the next review, we will consider whether there is a need to further enhance deposit protection having regard to the latest international and local developments as well as relevant guiding principles and indicators.”

Donald Chen, CEO of the Board: “We have carefully considered all the comments received, and have strived to strike a balance amongst all the views when coming up with the consultation conclusions. We will work closely with the Government to introduce the amendment bill into the Legislative Council in the next few months. Our target is to implement the policy proposals in two phases. The first phase, covering the enhanced protection limit and other measures requiring a shorter period of preparatory work, is aimed to take effect in the fourth quarter of this year, while the second phase covering the rest of the enhancements is targeted to come into force in early 2025.”

Hong Kong to Increase Deposit Protection Scheme from $63,000 to $102,000 or HKD 500,000 to HKD 800,000, Protecting 92% Depositors from Current Level of 89% of Depositors, Target to Implement by 2024 & Next Review Will be 3 Years Later in 2027

6th February 2024 – The Hong Kong Deposit Protection Board (the Board) published today (6 February) the consultation conclusions on the public consultation relating to enhancements to the Deposit Protection Scheme (DPS) in Hong Kong. The consultation conclusions contain the major comments received and the Board’s response to those comments.

The Board launched a three-month public consultation on 13 July 2023. In the consultation paper, the Board set out a number of policy recommendations, including (i) raising the protection limit; (ii) refining the levy system; (iii) enhancing the deposit protection arrangements in the event of a bank merger; (iv) expanding the requirement on the display of the DPS membership sign to digital channels; and (v) streamlining the negative disclosure requirements on non-protected deposits for private banking customers.

- By the end of the consultation period on 12 October 2023, the Board had received a total of 33 written submissions from the general public, a consumer protection organisation, the banking industry, and relevant professional bodies. In order to solicit more views from the general public, the Board had also commissioned the Hong Kong Institute of Asia-Pacific Studies of the Chinese University of Hong Kong to conduct a public opinion survey on the key proposed enhancements, interviewing around 1,000 Hong Kong residents aged 18 years old or above and having bank accounts in Hong Kong.

- Based on the written submissions received and the findings of the public opinion survey, the respondents generally welcomed and supported the proposed enhancements to the DPS, including raising the protection limit from the current HK$500,000 to HK$800,000, while there were mixed views within the banking industry on the appropriate level of protection limit.

- Having carefully considered all the comments received and relevant factors, the Board considers that raising the protection limit to HK$800,000 is sufficient at this stage to suitably enhance protection to depositors, as this level represents a 60% increase in the protection limit, which will more than compensate for the cumulative inflation over time, hence translating into around 20% increase in the real value of deposit protection. Moreover, the majority of depositors (more than 92%) will enjoy full deposit coverage, in line with international standards. On the whole, except for some refinements to certain implementation details which were made in response to banks’ comments, the Board will proceed to prepare legislative amendments based on the proposals in the consultation paper.

The report on consultation conclusions is available on the Board’s website (www.dps.org.hk).

Insights by Donald Chen, Chief Executive Officer of Hong Kong Deposit Protection Board

A new milestone for Deposit Protection Scheme in 2024

- The Hong Kong Deposit Protection Board (the Board) conducted a public consultation on proposed enhancements to the Deposit Protection Scheme (DPS) between July and October last year. Having carefully considered all the comments received, we are pleased to publish the consultation conclusions today setting out in detail the final policy proposals for the DPS enhancements, which marks a new milestone in the development of the Scheme.

- Since its inception in 2006, the DPS has been playing an important role as the “Guardian of Deposits” in Hong Kong. It gives small depositors peace of mind, making them less likely to be affected by rumours and lose confidence in individual banks or even in the banking system as a whole. This in turn can help reduce the likelihood of rumour-driven bank runs and hence ripple effects on the entire banking system. Deposit protection is indeed a core element of the overall financial safety net.

Comments received during the public consultation

- A key feature of the DPS is the protection limit. It was raised from its original level of HK$100,000 per depositor per bank to the current HK$500,000 in 2011, which has been in place for more than 10 years now. In order to keep up with the latest international and local developments, the Board has proposed a number of enhancements to the DPS, one of which is to raise the protection limit by 60% to HK$800,000.

- During the public consultation, the Board received a total of 33 written submissions from members of the general public, a consumer protection organisation, the banking industry and professional bodies, which contain many valuable comments. To solicit more views from the public, the Board also commissioned the Hong Kong Institute of Asia-Pacific Studies of the Chinese University of Hong Kong to conduct a public opinion survey, successfully interviewing around 1,000 residents aged 18 years old or above with bank accounts in Hong Kong.

- After consolidating all the comments received, we are pleased to note that around 80% of the general public who took part in the survey, the consumer protection organisation and relevant professional bodies agreed with the proposal to raise the protection limit to HK$800,000. They also supported the other proposed enhancements.

- At the same time, we are aware of mixed views within the banking industry, with some banks supporting the proposed HK$800,000 protection limit, while some others suggested further raising the protection limit to HK$1 million.

Final policy proposal

- It is understandable that some quarters of the community and industry may prefer a higher protection limit. However, we are mindful that the primary objective of the DPS is to protect small depositors, thereby helping to maintain banking stability. This is our overarching principle when considering the appropriate level of protection limit. After taking into account all the comments received and carefully considering the relevant factors, the Board is of the view that raising the protection limit to HK$800,000 is sufficient at this stage to suitably enhance protection to depositors and hence promote banking stability.

- We can assess whether a new protection limit can suitably and adequately enhance depositor protection from two perspectives. First, from an individual perspective, any increase in the protection limit should keep pace with inflation so as to maintain the real value of protection for each depositor. A 60% increase in the protection limit to HK$800,000 will be more than sufficient to offset the cumulative impact of inflation since early 2011 (when the protection limit of HK$500,000 came into effect), and will enhance the real value of protection by as much as 20%.

- Another perspective is from the banking system as a whole. Of the 24.4 million depositors in Hong Kong at present, more than 22.5 million will be fully protected under the protection limit of HK$800,0001. In other words, more than 92% of depositors will enjoy full deposit coverage. This figure exceeds the benchmark of 90% recommended by the International Association of Deposit Insurers (IADI). As an international financial centre, Hong Kong has a large number of high net worth individuals and large corporates. Quite a few of the remaining depositors who are not fully covered by the protection limit in fact come from these groups. Therefore, even if the protection limit were to be raised to a higher level, the number of fully protected depositors would not increase significantly.

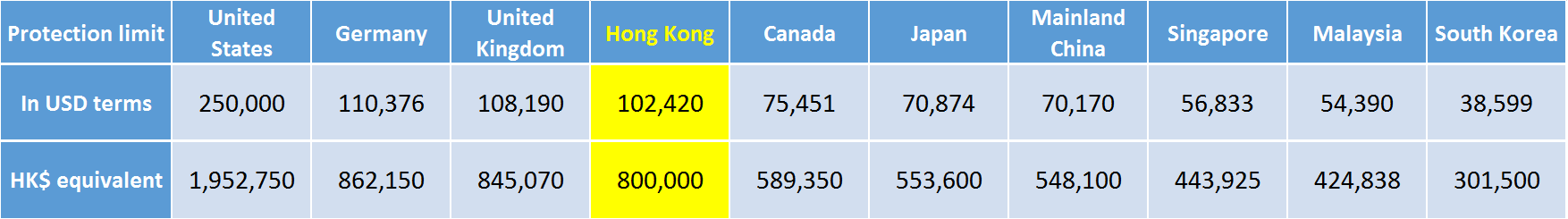

- Indeed, a protection limit of HK$800,000 in Hong Kong will be significantly higher than many other Asian economies, and also comparable with the European economies (see table below).

Note: Based on exchange rates as at end-December 2023. The US and Canada provide deposit protection on a “per account category” basis, while all other jurisdictions provide deposit protection on a “per depositor per bank” basis.

- While depositors are generally familiar with the scope of protection under the DPS, some may not be fully aware of the fact that deposit protection is backed by the DPS Fund, which is in turn dependent on annual contributions from the banking industry. The higher the level of the protection limit, the more the DPS Fund needs to grow correspondingly to ensure that it has sufficient funds for any potential payout situation in the future. The banking industry has to pay more contributions as a result. If the additional contributions place a significant financial burden on banks, they may have a greater incentive to pass on such costs to their customers.

- Raising the protection limit to HK$800,000 will require only a moderate growth of 30% in the size of the DPS Fund, from the current HK$6.3 billion to about HK$8.2 billion. As the additional costs associated with the higher protection limit are manageable, coupled with competition amongst banks, we believe that the likelihood of banks passing on such costs to their customers can be minimised. This is particularly important for small and medium-sized enterprises and small depositors as they gradually emerge from the shadow of the pandemic.

- Is there any room to further increase the protection limit in the future? The Board is open-minded about this and fully appreciates that policies should be adaptable to changing circumstances. In particular, as the bank failures that occurred last year in the US and Europe have prompted the IADI to review whether there is a need to update some of its Core Principles, and some jurisdictions are also contemplating reforms to their deposit insurance systems, we expect the global deposit insurance landscape to remain uncertain in the coming years. We will keep a close eye on the latest developments and will also expedite the timeline for the next round of review of the DPS. Our aim is to commence the next review exercise three years after the implementation of the HK$800,000 protection limit, and complete the review in the following year.

Next steps

- Now that the consultation exercise has concluded, we will proceed to the next stage of DPS enhancements – the legislative exercise. At the earlier meeting of the Panel on Financial Affairs of the Legislative Council (LegCo), Panel members in general supported the policy recommendations on DPS enhancements. The Board, together with the Government, is currently working on an amendment bill for submission to the LegCo in the next few months. Our target is to put the new protection limit of HK$800,000 into effect in the fourth quarter of this year, and to implement the other enhancements in phases by early 20252.

- As the effectiveness of the DPS also hinges upon public understanding of and confidence in the Scheme, we plan to launch a series of promotional campaigns in due course to help the general public gain a deeper understanding of the enhanced DPS.

- We hope that this latest round of DPS enhancements will further strengthen Hong Kong’s financial safety net. The bank failures in the US and Europe last year demonstrate that apart from deposit protection, other building blocks of the financial safety net are also crucial in preventing bank failures and mitigating their impact on the overall financial system. They include a robust banking supervisory regime, sound risk management by banks, and an effective resolution regime. The Board will continue to work closely with the Hong Kong Monetary Authority and other stakeholders in the financial safety net to contribute to Hong Kong’s financial stability.

Donald Chen

Chief Executive Officer

Hong Kong Deposit Protection Board

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit