The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Investment / Alternatives Summit - March / Oct / Nov

Investment Day - March / July / Sept / Oct / Nov

Private Wealth Summit - April / Oct / Nov

Family Office Summit - April / Oct / Nov

View Events | Register

This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $30 billion.

Rothschild & Co Closes United States Miami Office after 1 Year of Opening on 2023, Partner Eric Hirschfield Who Leads Chicago & Miami Office to Retire, Was Goldmans Sachs Investment Banking Global Head Of Paper & Packaging Sector & And Joined Rothschild & Co in 2016

22nd August 2024 | Hong Kong

Rothschild & Co is closing the United States Miami office after 1 year of opening in 2023, with Partner Eric Hirschfield who leads Chicago & Miami office announcing to retire. Eric Hirschfield was Goldmans Sachs Investment Banking Global Head of Paper & Packaging Sector, and joined Rothschild & Co in 2016. Rothschild & Co has professional in 59 locations in 47 countries. In 2024 March, Rothschild banking dynasty descendant Lord Jacob Rothschild (Nathaniel Charles Jacob Rothschild) died at age 87 (26/2/24). Lord Jacob Rothschild is a billionaire with a personal fortune at around $1 billion.

“ Rothschild & Co Closes United States Miami Office after 1 Year of Opening on 2023, Partner Eric Hirschfield Who Leads Chicago & Miami Office to Retire, Was Goldmans Sachs Investment Banking Global Head Of Paper & Packaging Sector & And Joined Rothschild & Co in 2016 “

Caproasia Access | Events | Summits | Register Events | The Financial Centre

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Basic Member: $5 Monthly | $60 Yearly

Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680)

Hong Kong | Singapore

March / July / Sept / Oct / Nov

Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Join 20+ CIOs & Senior investment team, with > 60% single family offices with $300 million AUM. Taking place in Hong Kong and in Singapore. Every March, July, Sept, Oct & Nov.

Visit | Register here

10th April & 16th Oct Hong Kong Ritz Carlton | 24th April & 6th Nov Singapore Amara Sanctuary Resort

Join 80 single family offices & family office professionals in Hong Kong & Singapore

Links: 2025 Family Office Summit | Register here

March / Oct / Nov in Hong Kong & Singapore

Join leading asset managers, hedge funds, boutique funds, private equity, venture capital & real estate firms in Hong Kong, Singapore & Asia-Pacific at the Investment / Alternatives Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

April / Oct / Nov in Hong Kong & Singapore

Join CEOs, CIOs, Head of Private Banking, Head of Family Offices & Product Heads at The Private Wealth Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

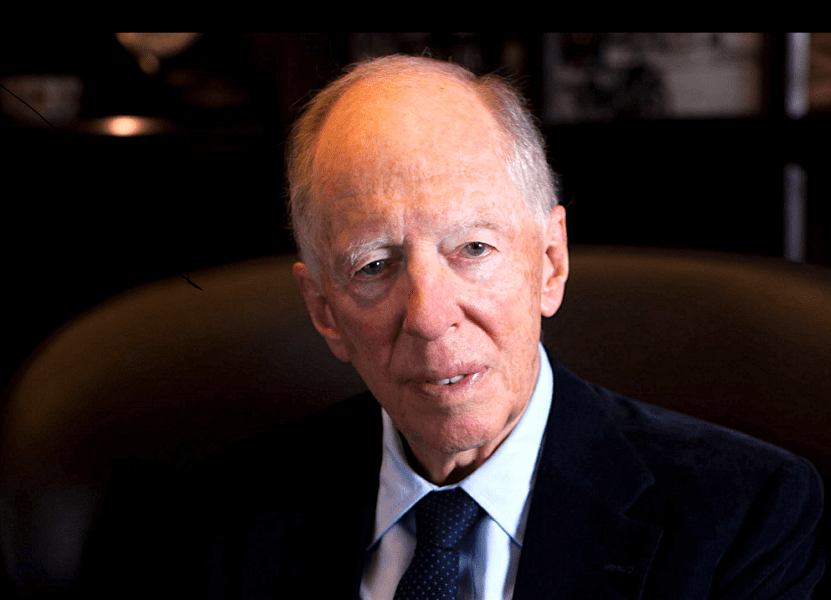

Rothschild Banking Dynasty Descendant Lord Jacob Rothschild Dies at Age 87, Billionaire with Personal Fortune at Around $1 Billion

2nd March 2024 – Rothschild banking dynasty descendant Lord Jacob Rothschild (Nathaniel Charles Jacob Rothschild) has died at age 87 (26/2/24). Lord Jacob Rothschild is a billionaire with a personal fortune at around $1 billion. Lord Jacob Rothschild started his career at family bank NM Rothschild & Sons and left in 1980. Lord Jacob Rothschild founded numerous companies including St James’s Place (J Rothschild Assurance Group), and leading investment trusts company RIT Capital Partners (1988 to 2019). Lord Jacob Rothschild wife (Serena) had died in 2019, and is survived by 4 children (3 daughters, 1 son) and grandchildren. Rothschild Foundation: “The Rothschild Foundation is sad to announce the death of its Chairman, Lord Rothschild, businessman, entrepreneur, philanthropist and cultural leader, who made a profound difference to many areas of British life. He led, amongst other institutions, the National Gallery, the National Lottery Heritage Fund and the family’s flagship, Waddesdon Manor. He supported many causes, some close to his home in Buckinghamshire, others as far afield as Israel, Albania, Greece and the United States. He was committed to helping communities, the environment, education and above all, the arts. His exemplary service to his country was recognised on several occasions, with a GBE, a CVO and as a member of the Order of Merit. Jacob Rothschild was an extraordinary person, and his loss will be felt by many. The family is committed to continuing his legacy and the foundation which he loved and endowed. He was married for more than fifty years to Serena (nee Dunn 1936-2019) with whom he had four children, Hannah, Beth, Emily and Nat and many grandchildren. His daughter Hannah takes over with immediate effect as Patron and Chair of the Rothschild Foundation.” In 2022, Rothschild banking dynasty descendant Sir Evelyn Robert Adrian de Rothschild died at the age of 91 (7th Nov 2022), a prominent banker including holding roles of ex-Chairman of Rothschild banking branches and also the ex-Chairman of leading business publication – The Economist (1972 to 1989).

Rothschild Banking Dynasty Descendant Sir Evelyn de Rothschild Dies at Age 91, Ex-Chairman of Rothschild Branches & The Economist

10th November 2022 – Rothschild banking dynasty descendant Sir Evelyn Robert Adrian de Rothschild has died at the age of 91 (7th Nov 2022), a prominent banker including holding roles of ex-Chairman of Rothschild banking branches and also the ex-Chairman of leading business publication – The Economist (1972 to 1989). In 2003, he setup his family office E L Rothschild to manage his family investments, and Sir Evelyn Robert Adrian de Rothschild is estimated to have a personal fortune of $5 billion to $10 billion. The founder of the Rothschild dynasty is Mayer Amschel Rothschild, who was born in 1744. Mayer Amschel Rothschild (1744-1812) laid the foundations on which his 5 sons and their descendants would build a Europe wide banking empire. The Rothschild family take their name from the house they occupied in the Judengasse in Frankfurt -‘zum Roten Schild’ (house of the Red Shield). The origins of the family coat of arms can be traced back to 1817, and the family motto, ‘Concordia, Integritas, Industria’ (Harmony, Integrity, Industry) to 1822. More info about Rothschild family & business below | Visit: The Rothschild Archive

New York Times on passsing of Sir Evelyn Robert Adrian de Rothschild: “With his love of racehorses, sports cars, parties and excursions abroad, Mr. Rothschild might have become an international playboy. He failed economics and dropped out of Cambridge University, seemed happier on polo grounds than in banking circles in the City, and had little taste for high finance or investment strategies. But the Rothschild name and history weighed upon him. Sir Evelyn’s father was the chairman, and his great-great-grandfather the founder, of N.M. Rothschild & Sons, the British branch of the family banking empire that began in 18th-century Frankfurt, Germany, and that, with its networks of couriers and spies, financial wizardry and political alliances, spread across Europe, making fortunes and influencing the destinies of nations for 200 years … … So after apprenticeships in New York and Toronto, Mr. Rothschild in 1957 joined N.M. Rothschild as a partner-in-training. Over two decades, colleagues said, he mastered the intricacies of a boutique bank trying to survive in a globalized world of financial institutions, some with 200,000 employees and trillion-dollar assets. His bank had only 600 employees and assets of $7 billion, but it had the storied Rothschild name.

And Mr. Rothschild, who rose to chairman in 1976, used it to advantage. Like his forebears, he promoted strong ties with Britain’s government, news media and financial and business communities. He became chairman of The Economist and director of Lord Beaverbrook’s newspaper group, chairman of the British Merchant Banking & Securities House Association and a financial adviser to Queen Elizabeth II, who knighted him in 1989.”

Rothschild Business Activities

Rothschild Business Activities

- Banking: Merchant banking, Private banking

- Finance: Asset management, Bills of exchange, Equity, Gobal financial advice, Mergers & acquisitions, Insurance (The Alliance Assurance Company), Venture capital (The Exploration Company), Pensions, Investments

- Government finance: Bonds, loans & sovereign lending, Privatisation

- Commodities: Cotton, Indigo, Sugar, Tea & coffee, Tobacco

- Communications & technology

- Civil engineeering: Bridges, Tunnels

- Hotels, tourism & leisure

- Manufacturing: Cars, Iron & steel (Witkowitz (Vítkovice) Mines, Steel and Ironworks Corporation), Textiles

- Media & publishing

- Natural resources (mining & trade): Coal, Copper, Nickel, Oil, Platinum, Diamonds, Rubies, Quicksilver, Salt, Silver

- Gold: Gold mining and bullion, The Royal Mint Refinery, The Gold Fixing

- Power & utilities: Electricity, Hydroelectricity (BRINCO), Gas, Water

- Transport: Aircraft, Canals, waterways & harbours (The Suez Canal shares purchase), Road transport, Shipping

- Railways: Kaiser-Ferdinand’s Nordbahn, The Chemin de fer du Nord, Brazilian railways, Indian railways, The London Underground, The New York Subway, Mass transit railways

- Wine: Château Lafite, Château Mouton

Rise of the Rothschilds – Video

Origins of Rothschild

The Rothschild Archive – Mayer Amschel Rothschild was born in 1744 in the Judengasse, in Frankfurt. His father, Amschel Moses had a business in goods-trading and currency exchange. He was a personal supplier of collectable coins to the Prince of Hesse.

With the help of relatives, Mayer Amschel secured an apprenticeship under Jacob Wolf Oppenheimer, at the banking firm of Simon Wolf Oppenheimer in Hannover, in 1757, where he acquired useful knowledge in foreign trade and currency exchange, before returning to his brothers’ business in Frankfurt in 1763. He became a dealer in rare coins and won the patronage of the immensely wealthy Crown Prince Wilhelm I of Hesse (1743-1821), who had also earlier patronised his father. His coin business grew to include a number of princely patrons, and then expanded through the provision of financial services. In 1769, Mayer Amschel gained the title of ‘Court Agent’, managing the finances of Wilhelm I who became Wilhelm IX, Landgrave of Hesse-Kassel on the death of his father in 1785. Business expanded rapidly following the French Revolution when Rothschild handled payments from Britain for the hire of Hessian mercenaries.

In 1806, Napoleon invaded Hesse in response to Wilhelm IX’s support for Prussia. On the advance of Napoleon’s army, Wilhelm IX was forced to go into exile in the Duchy of Holstein. The dilemma of how to conceal his coffers from the occupying forces was solved by Carl Friedrich Buderus (1759-1819), his financial adviser, who recommended that all his stock be confided to the House of Rothschild because they were best placed to protect his funds, and he thus entrusted part of his vast fortune to Mayer Amschel Rothschild for safekeeping. Mayer turned to his son, Nathan, in London. Nathan invested £550,000 of Wilhelm IX’s funds in British government securities and bullion. These investments proved extremely lucrative and, by the time Wilhelm IX returned from exile, had accrued considerable interest. The Rothschilds’ reputation for trustworthiness and astute financial management was firmly established.

From 1807, under Buderus’ influence, Wilhelm IX’s extensive financial transactions were largely exclusively handled by the House Rothschild, and until the expulsion of the French army from the Electorate of Hesse in 1813, Buderus, on behalf of Wilhelm IX, used the services of the Rothschilds to discreetly carry out financial transactions throughout Europe. In these early years of the 19th century, Mayer Amschel Rothschild consolidated his position as principal international banker to Wilhelm IX and began to issue his own international loans, borrowing capital from the Landgrave. He also profited from importing goods in circumvention of Napoleon’s continental blockade. As a result of these dealings, Mayer Amschel amassed a not inconsiderable fortune and, in 1810, renamed his firm M A Rothschild und Söhne, establishing a partnership with his four sons still in Frankfurt, (his son Nathan Mayer Rothschild (1777-1836) had arrived in England in 1798, establishing a business in Manchester, before moving to London to found N M Rothschild in the City in 1809).

The 5 Sons of Mayer Amschel Rothschild

The Rothschild Archive – Nathan Mayer Rothschild’s increasingly successful business provided a model for his brothers back in Frankfurt. In 1812, James Mayer Rothschild (1792-1868) established a banking house in Paris. Salomon Mayer Rothschild (1774-1855) settled in Vienna in 1820. Carl Mayer Rothschild (1788-1855) set up business in Naples in 1821, leaving Amschel Mayer (1773-1855), to head the Frankfurt bank. From these roots, the Rothschild banking business spread out across much of Europe becoming the most successful international bankers of the age. The core banking business is today in the hands of the seventh generation of Rothschilds.

Evelyn Robert Adrian de Rothschild (1931-2022)

The Rothschild Archive – Sir Evelyn Robert Adrian de Rothschild was born on 29 August 1931. He is the only son of Anthony Gustav de Rothschild (1887-1961) and Yvonne Lydia Louise née Cahen d’Anvers. He was named after his uncle Evelyn Achille de Rothschild who was killed in action during the First World War. Like many of his cousins, Sir Evelyn spent some of his childhood in America during the Second World War. Upon his return he was educated at Harrow School, London and at Trinity College, Cambridge University.

- After his national service, aged 26, he joined N M Rothschild & Sons to be trained in the family’s business, following in the steps of his father. In 1976 Sir Evelyn took over as Chairman of N M Rothschild & Sons Limited and in 1982 became Chairman of Rothschilds Continuation Holdings AG, the co-ordinating company for the merchant banking group. He served until 2003 when he oversaw the merger of the family’s French and UK houses, whereby his French cousin, Baron David de Rothschild took the Chairmanship.

- He married Jeannette Ellen Dorothy Bishop (1940-1981), on 30 September 1966. They divorced in 1971. He married, secondly, Victoria Lou Schott (1949-2021), on 1 July 1973 and together they had three children; Jessica, Anthony and David. They were divorced in 2000. He married Lynn Forester in November 2000.

- Active in many businesses Sir Evelyn was chairman of the Economist (1972-1989), Director of Charter Consolidated (1973), Chairman of British Merchant Banking & Securities House Association(1985–1989), Deputy Chairman of the Milton Keynes Development Corporation (1971–1984), Director of De Beers Consolidated Mines (1977–1994), and Director of IBM United Kingdom Holdings Limited (1972–1995).

- An owner of thoroughbred racehorses, he was a former chairman of United Racecourses (1977-1994). He was awarded the honorary degree of Bachelor of Science (B.Sc.) and Bachelor of Economics (B.Econ.) by Hull University College, in 1994 and the honorary degree of Doctor of Science (D.Sc.) by London University, in 1999. He was Governor of Harrow School in 1976. In 1967 Sir Evelyn created the ERANDA Foundation (now the Eranda Rothschild Foundation) to support social welfare, promote the arts and to encourage research into medicine and education.

- Sir Evelyn de Rothschild was a Governor of the London School of Economics and Political Science as well as an active patron of the arts and supporter of a number of charities. He served as Chairman of the Delegacy of St Mary’s Hospital Medical School from 1977 to 1988. He was Member of the Council of the Royal Academy of Dramatic Art, a trustee of the Shakespeare Globe Trust, and in 1998 was appointed Chairman of The Princess Royal Trust for Carers. Sir Evelyn was the founding Chairman in 1990 of The European Association for Banking and Financial History, a position he held until retiring in 2004.

- He was invested as a Knight in 1989. Sir Evelyn’s family home is Ascott House, a country estate in Buckinghamshire, given to The National Trust in 1950. Sir Evelyn de Rothschild died aged 91 on 7 November 2022.

The Rothschild Archive was established in 1978 by Victor, 3rd Lord Rothschild. In 1999 the ownership of the Archive was transferred to The Rothschild Archive Trust, an independent body of family members and advisers committed to securing the future of the collection and to developing its use by the academic community. The purpose of the Archive is to collect, preserve and promote the archives of the Rothschild businesses and family. The Trustees of The Rothschild Archive Trust administer the Archive as an independent charitable trust in purpose-built premises made available within the offices of the London business. Additionally, records of the French Rothschild banking business, held on deposit at the Archives Nationales du Monde du Travail, may be consulted in Roubaix, France. Visit: The Rothschild Archive

For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm.

Join Events & Find Services

Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services.

Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at angel@caproasia.com or mail@caproasia.com

Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets?

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

2020 List of Private Banks in Hong Kong

2020 List of Private Banks in Singapore

2020 Top 10 Largest Family Office

2020 Top 10 Largest Multi-Family Offices

2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion

2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM

For Investors | Professionals | Executives

Latest data, reports, insights, news, events & programs

Everyday at 2 pm

Direct to your inbox

Save 2 to 8 hours per week. Organised for success

Register Below

Get Ahead in 60 Seconds. Join 10,000 +

Save 2 to 8 hours weekly. Organised for Success.

Sign Up / Register

Please click on desktop.

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Contact Us

For Enquiries, Membershipmail@caproasia.com, angel@caproasia.com

For Listing, Subscription

mail@caproasia.com, claire@caproasia.com

For Press Release, send to:

press@caproasia.com

For Events & Webinars

events@caproasia.com

For Media Kit, Advertising, Sponsorships, Partnerships

angel@caproasia.com

For Research, Data, Surveys, Reports

research@caproasia.com

For General Enquiries

mail@caproasia.com

a financial information technology co.

since 2014