Singapore Convicted Oil Tycoon Lim Oon Kuin Sells 3rd Singapore Good Class Bungalow at Tanglin Hill for $30 Million to 2 Children of Mapletree Investments Group CEO Hiew Yoon Kwong (Hiew Wen Ji & Hiew Wen Li), Sold 2 Good Class Bungalows in 2021 & 2023 for Total of $39.4 Million, Court Sentence Scheduled on 3rd October 2024, Guilty of Cheating & Instigating Forgery with Sentencing Date Set on 3rd October 2024, Presented 2 Forged Oil Contracts of China Aviation Oil & Unipec Singapore to Apply for $111.7 Million Financing from HSBC for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks

30th August 2024 | Hong Kong

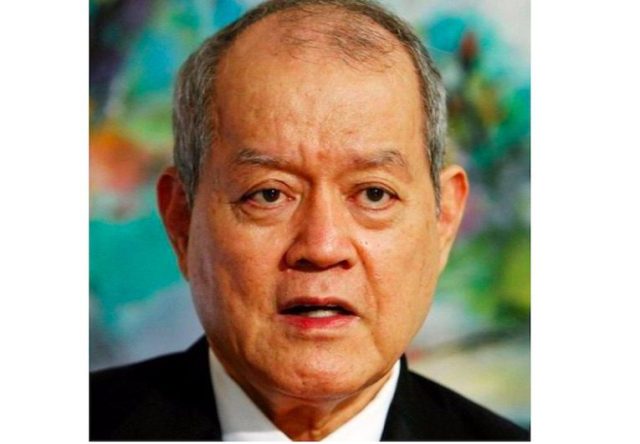

Singapore convicted oil tycoon Lim Oon Kuin has sold his 3rd Singapore Good Class Bungalow (GCB) at Tanglin Hill for $30 million (S$39.2 million) to 2 children of Mapletree Investments Group CEO Hiew Yoon Kwong (Hiew Wen Ji & Hiew Wen Li). In 2024 June, Singapore convicted oil tycoon Lim Oon Kuin is selling his 3rd Singapore Good Class Bungalow (GCB) at Tanglin Hill for $31.7 million (S$43 million) by tender (Knight Frank, closing 19/7/24), having sold 2 Good Class Bungalows (GCB) near luxury residential district 6th Avenue (Bukit Timah) in 2021 & 2023 for a total of $39.4 million (S$53.39 million: Second Avenue for S$27 million & 3rd Avenue for S$26.39 million). Lim Oon Kuin Singapore court sentence is scheduled on 3rd October 2024. In May 2024, a Singapore court has convicted oil tycoon Lim Oon Kuin guilty of cheating & instigating forgery with sentencing date set on 3rd October 2024, presenting 2 forged oil contracts of China Aviation Oil & Unipec Singapore to apply for $111.7 million financing from HSBC. In 2023, Singapore oil tycoon Lim Oon Kuin court trial began on 10th August 2023 for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks including $111.7 million from HSBC for invoice financing. Lim Oon Kuin children Evan Lim (Son) and Lim Huey Ching (Daughter) are also included in the trial and are jointly responsible for all debts. The liquidators are seeking to recover the $3.5 billion to pay off the company’s debt including $90 million dividends to be returned, and the company had been “insolvent” since 2012. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record, involving $111.7 million from HSBC. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion. Singapore Police Force (10/5/24): “On 10 May 2024, Lim Oon Kuin (“Lim”), founder of Hin Leong Trading (Pte) Ltd (“Hin Leong”), was convicted on two charges of cheating under Section 420 of the Penal Code (“Penal Code”) and one charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code after a trial of over 60 days. Background – Lim was first charged in court on 14 August 2020, and was subsequently handed further charges in court on 25 September 2020, 30 April 2021 and 24 June 2021 for his role in perpetuating fraud on various financial institutions. A total of 130 charges were eventually brought against him for cheating and forgery-related offences, and Lim claimed trial to these charges. The trial proceeded on three charges 1) Two charges of cheating under Section 420 of the Penal Code, and, 2) One charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code. These three charges concern two fraudulent discounting applications made by Hin Leong to the Hongkong and Shanghai Banking Corporation Limited (“HSBC”), pursuant to which HSBC disbursed a total of USD 111,683,939 to Hin Leong. The rest of the charges were stood down pending resolution of the trial. The court found that Lim had, through Hin Leong employees, cheated HSBC by representing to the bank that Hin Leong had entered into two contracts for the sale of oil, with China Aviation Oil (Singapore) Corporation Ltd and Unipec Singapore Pte Ltd respectively, and then applying for discounting of those purported transactions. In fact, the two transactions were complete fabrications, concocted on Lim’s directions, and the discounting applications were supported by forged or fabricated documentation. Lim will be sentenced on 3 October 2024. He faces imprisonment of up to 10 years and shall also be liable to a fine for each charge under Section 420 of the Penal Code and Section 468 read with Section 109 of the Penal Code.”

“ Singapore Convicted Oil Tycoon Lim Oon Kuin Sells 3rd Singapore Good Class Bungalow at Tanglin Hill for $30 Million to 2 Children of Mapletree Investments Group CEO Hiew Yoon Kwong (Hiew Wen Ji & Hiew Wen Li), Sold 2 Good Class Bungalows in 2021 & 2023 for Total of $39.4 Million, Court Sentence Scheduled on 3rd October 2024, Guilty of Cheating & Instigating Forgery with Sentencing Date Set on 3rd October 2024, Presented 2 Forged Oil Contracts of China Aviation Oil & Unipec Singapore to Apply for $111.7 Million Financing from HSBC for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks “

Singapore Convicted Oil Tycoon Lim Oon Kuin to Sell 3rd Singapore Good Class Bungalow at Tanglin Hill for $31.7 Million by Tender Closing on 19th July 2024, Sold 2 Good Class Bungalows in 2021 & 2023 for Total of $39.4 Million, Court Sentence Scheduled on 3rd October 2024, Guilty of Cheating & Instigating Forgery with Sentencing Date Set on 3rd October 2024, Presented 2 Forged Oil Contracts of China Aviation Oil & Unipec Singapore to Apply for $111.7 Million Financing from HSBC for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks

24th June 2024 – Singapore convicted oil tycoon Lim Oon Kuin is selling his 3rd Singapore Good Class Bungalow (GCB) at Tanglin Hill for $31.7 million (S$43 million) by tender (Knight Frank, closing 19/7/24), having sold 2 Good Class Bungalows (GCB) near luxury residential district 6th Avenue (Bukit Timah) in 2021 & 2023 for a total of $39.4 million (S$53.39 million: Second Avenue for S$27 million & 3rd Avenue for S$26.39 million). Lim Oon Kuin Singapore court sentence is scheduled on 3rd October 2024. In May 2024, a Singapore court has convicted oil tycoon Lim Oon Kuin guilty of cheating & instigating forgery with sentencing date set on 3rd October 2024, presenting 2 forged oil contracts of China Aviation Oil & Unipec Singapore to apply for $111.7 million financing from HSBC. In 2023, Singapore oil tycoon Lim Oon Kuin court trial began on 10th August 2023 for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks including $111.7 million from HSBC for invoice financing. Lim Oon Kuin children Evan Lim (Son) and Lim Huey Ching (Daughter) are also included in the trial and are jointly responsible for all debts. The liquidators are seeking to recover the $3.5 billion to pay off the company’s debt including $90 million dividends to be returned, and the company had been “insolvent” since 2012. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record, involving $111.7 million from HSBC. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion. Singapore Police Force (10/5/24): “On 10 May 2024, Lim Oon Kuin (“Lim”), founder of Hin Leong Trading (Pte) Ltd (“Hin Leong”), was convicted on two charges of cheating under Section 420 of the Penal Code (“Penal Code”) and one charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code after a trial of over 60 days. Background – Lim was first charged in court on 14 August 2020, and was subsequently handed further charges in court on 25 September 2020, 30 April 2021 and 24 June 2021 for his role in perpetuating fraud on various financial institutions. A total of 130 charges were eventually brought against him for cheating and forgery-related offences, and Lim claimed trial to these charges. The trial proceeded on three charges 1) Two charges of cheating under Section 420 of the Penal Code, and, 2) One charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code. These three charges concern two fraudulent discounting applications made by Hin Leong to the Hongkong and Shanghai Banking Corporation Limited (“HSBC”), pursuant to which HSBC disbursed a total of USD 111,683,939 to Hin Leong. The rest of the charges were stood down pending resolution of the trial. The court found that Lim had, through Hin Leong employees, cheated HSBC by representing to the bank that Hin Leong had entered into two contracts for the sale of oil, with China Aviation Oil (Singapore) Corporation Ltd and Unipec Singapore Pte Ltd respectively, and then applying for discounting of those purported transactions. In fact, the two transactions were complete fabrications, concocted on Lim’s directions, and the discounting applications were supported by forged or fabricated documentation. Lim will be sentenced on 3 October 2024. He faces imprisonment of up to 10 years and shall also be liable to a fine for each charge under Section 420 of the Penal Code and Section 468 read with Section 109 of the Penal Code.”

Singapore Court Convicts Oil Tycoon Lim Oon Kuin Guilty of Cheating & Instigating Forgery with Sentencing Date Set on 3rd October 2024, Presented 2 Forged Oil Contracts of China Aviation Oil & Unipec Singapore to Apply for $111.7 Million Financing from HSBC, Trial Began on 10th August 2023 for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks, Children Evan Lim & Lim Huey Ching Included in Trial & Also Jointly Responsible for All Debts

16th May 2024 – A Singapore court has convicted oil tycoon Lim Oon Kuin guilty of cheating & instigating forgery with sentencing date set on 3rd October 2024, presenting 2 forged oil contracts of China Aviation Oil & Unipec Singapore to apply for $111.7 million financing from HSBC. In 2023, Singapore oil tycoon Lim Oon Kuin court trial began on 10th August 2023 for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks including $111.7 million from HSBC for invoice financing. Lim Oon Kuin children Evan Lim (Son) and Lim Huey Ching (Daughter) are also included in the trial and are jointly responsible for all debts. The liquidators are seeking to recover the $3.5 billion to pay off the company’s debt including $90 million dividends to be returned, and the company had been “insolvent” since 2012. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record, involving $111.7 million from HSBC. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion. Singapore Police Force (10/5/24): “On 10 May 2024, Lim Oon Kuin (“Lim”), founder of Hin Leong Trading (Pte) Ltd (“Hin Leong”), was convicted on two charges of cheating under Section 420 of the Penal Code (“Penal Code”) and one charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code after a trial of over 60 days. Background – Lim was first charged in court on 14 August 2020, and was subsequently handed further charges in court on 25 September 2020, 30 April 2021 and 24 June 2021 for his role in perpetuating fraud on various financial institutions. A total of 130 charges were eventually brought against him for cheating and forgery-related offences, and Lim claimed trial to these charges. The trial proceeded on three charges 1) Two charges of cheating under Section 420 of the Penal Code, and, 2) One charge of instigating forgery for the purpose of cheating under Section 468 read with Section 109 of the Penal Code. These three charges concern two fraudulent discounting applications made by Hin Leong to the Hongkong and Shanghai Banking Corporation Limited (“HSBC”), pursuant to which HSBC disbursed a total of USD 111,683,939 to Hin Leong. The rest of the charges were stood down pending resolution of the trial. The court found that Lim had, through Hin Leong employees, cheated HSBC by representing to the bank that Hin Leong had entered into two contracts for the sale of oil, with China Aviation Oil (Singapore) Corporation Ltd and Unipec Singapore Pte Ltd respectively, and then applying for discounting of those purported transactions. In fact, the two transactions were complete fabrications, concocted on Lim’s directions, and the discounting applications were supported by forged or fabricated documentation. Lim will be sentenced on 3 October 2024. He faces imprisonment of up to 10 years and shall also be liable to a fine for each charge under Section 420 of the Penal Code and Section 468 read with Section 109 of the Penal Code.”

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins on 10th August 2023 for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks Including $111.7 Million from HSBC for Invoice Financing, Children Evan Lim & Lim Huey Ching Included in Trial & Also Jointly Responsible for All Debts

11th August 2023 – Singapore oil tycoon Lim Oon Kuin court trial has began on 10th August 2023 for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks including $111.7 million from HSBC for invoice financing. Lim Oon Kuin children Evan Lim (Son) and Lim Huey Ching (Daughter) are also included in the trial and are jointly responsible for all debts. The liquidators are seeking to recover the $3.5 billion to pay off the company’s debt including $90 million dividends to be returned, and the company had been “insolvent” since 2012. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record, involving $111.7 million from HSBC. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion. Lim Oon Kuin criminal trial will be in October 2023.

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks, Including $111.7 Million from HSBC for Invoice Financing

15th April 2023 – Singapore oil tycoon Lim Oon Kuin court trial has began for fraud over collapsed Hin Leong Trading with $3.5 billion owed to banks, including $111.7 million from HSBC for invoice financing. Lim Oon Kuin is charged for cheating HSBC and instigating an employee to forge false contract record. In 2020 April, Hin Leong Trading informed HSBC that it is facing liquidity issues and his 2 children Lim Huey Ching and Lim Chee Meng joined in a teleconference call with HSBC. HSBC was informed of a miscommunication for invoice financing of contracts with CAO and Unipec, but the contracts had not finalised with CAO and Unipec. In the same month in 2020 April, Commercial Affairs Department of the Singapore Police Force opened an investigation and HSBC contacted CAO and Unipec (20/4/20) but were told the transactions did not occur. The next day (21/4/20), HSBC lodged a police report for false invoice financing documents submitted. Lim Oon Kuin is currently on bail for S$4 million. Lim Oon Kuin founded Hin Leong in 1963 at age 20, and in 2020, had a net worth of around $2 billion.

Singapore Oil Tycoon Lim Oon Kuin Court Trial Begins for Fraud over Collapsed Hin Leong Trading with $3.5 Billion Owed to Banks, Including $111.7 Million from HSBC for Invoice Financing

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit