$386 Billion Johnson & Johnson to Pay $8.2 Billion to Resolve Talc Baby Powder Product Cancer Claims via Subsidiary Red River Talc LLC Chapter 11 Bankruptcy, 83% of Claimants Accept Settlement Offer of $75,000 to $175,000 Per Victim

27th September 2024 | Hong Kong

Johnson & Johnson (27/9/24: $386 billion market value) will pay $8.2 billion to resolve Talc baby powder product cancer claims via subsidiary Red River Talc LLC Chapter 11 Bankruptcy, with 83% of claimants accepting settlement offer of $75,000 to $175,000 per victim. In 2023 April, Johnson & Johnson has agreed to pay $8.9 billion in settlement over 25 years to resolve Talc baby powder product cancer claims & to re-file for Chapter 11 Bankruptcy, having been rejected by a United States court in 2023 February for bankruptcy filing in 2021 to avoid $3.5 billion liabilities for 38,000 legal claims. Johnson & Johnson: “LTL also has secured commitments from over 60,000 current claimants to support a global resolution on these terms. Importantly, neither LTL’s original filing nor this re-filing is an admission of wrongdoing, nor an indication that the Company has changed its longstanding position that its talcum powder products are safe.” In 2023 February, a United States appeal court has rejected Johnson & Johnson Chapter 11 Bankruptcy filing in 2021 for its Talc company (LTL Management) to avoid $3.5 billion in liabilities for 38,000 of legal claims related to its Talc baby powder product cancer claims, ruling the company for improperly filing for bankruptcy despite no financial distress. Before the bankruptcy filing, Johnson & Johnson had $3.5 billion in settlements, including one $2 billion judgement for 22 women. In 2022, Johnson & Johnson announced that it will stop selling talc-based baby powder globally in 2023. Johnson & Johnson had faced 38,000 lawsuits from consumers & survivors (Claims: Talc products caused cancer due to contamination with asbestos, a known human carcinogen).

“ $386 Billion Johnson & Johnson to Pay $8.2 Billion to Resolve Talc Baby Powder Product Cancer Claims via Subsidiary Red River Talc LLC Chapter 11 Bankruptcy, 83% of Claimants Accept Settlement Offer of $75,000 to $175,000 Per Victim “

$429 Billion Johnson & Johnson to Pay $8.9 Billion over 25 Years to Resolve Talc Baby Powder Product Cancer Claims & to Re-file Chapter 11 Bankruptcy, Rejected by Court in 2023 February for Bankruptcy Filing in 2021 to Avoid $3.5 Billion Liabilities for 38,000 Legal Claims

8th April 2023 – Johnson & Johnson (6/4/23: $429 Billion market value) has agreed to pay $8.9 billion in settlement over 25 years to resolve Talc baby powder product cancer claims & to re-file for Chapter 11 Bankruptcy, having been rejected by a United States court in 2023 February for bankruptcy filing in 2021 to avoid $3.5 billion liabilities for 38,000 legal claims. Johnson & Johnson: “LTL also has secured commitments from over 60,000 current claimants to support a global resolution on these terms. Importantly, neither LTL’s original filing nor this re-filing is an admission of wrongdoing, nor an indication that the Company has changed its longstanding position that its talcum powder products are safe.” In 2023 February, a United States appeal court has rejected Johnson & Johnson Chapter 11 Bankruptcy filing in 2021 for its Talc company (LTL Management) to avoid $3.5 billion in liabilities for 38,000 of legal claims related to its Talc baby powder product cancer claims, ruling the company for improperly filing for bankruptcy despite no financial distress. Before the bankruptcy filing, Johnson & Johnson had $3.5 billion in settlements, including one $2 billion judgement for 22 women. In 2022, Johnson & Johnson announced that it will stop selling talc-based baby powder globally in 2023. Johnson & Johnson had faced 38,000 lawsuits from consumers & survivors (Claims: Talc products caused cancer due to contamination with asbestos, a known human carcinogen).

$429 Billion Johnson & Johnson to Pay $8.9 Billion over 25 Years to Resolve Talc Baby Powder Product Cancer Claims & to Re-file Chapter 11 Bankruptcy

Johnson & Johnson Subsidiary LTL Management LLC (“LTL”) Re-Files for Voluntary Chapter 11 to Equitably Resolve All Current and Future Talc Claims.

- LTL’s Reorganization Plan Has Significant Support From Claimants.

- The Plan Includes LTL’s Present Value Commitment of $8.9 Billion Payable Over 25 Years For Complete Resolution

Johnson & Johnson (NYSE:JNJ) (the Company) today announced that its subsidiary LTL Management LLC (LTL) has re-filed for voluntary Chapter 11 bankruptcy protection to obtain approval of a reorganization plan that will equitably and efficiently resolve all claims arising from cosmetic talc litigation against the Company and its affiliates in North America. To that end, the Company has agreed to contribute up to a present value of $8.9 billion, payable over 25 years, to resolve all the current and future talc claims, which is an increase of $6.9 billion over the $2 billion previously committed in connection with LTL’s initial bankruptcy filing in October 2021. LTL also has secured commitments from over 60,000 current claimants to support a global resolution on these terms. Importantly, neither LTL’s original filing nor this re-filing is an admission of wrongdoing, nor an indication that the Company has changed its longstanding position that its talcum powder products are safe. Johnson & Johnson and its other affiliates did not file for bankruptcy protection and will continue to operate their businesses as usual.

“The Company continues to believe that these claims are specious and lack scientific merit,” said Erik Haas, Worldwide Vice President of Litigation, Johnson & Johnson. “However, as the Bankruptcy Court recognized, resolving these cases in the tort system would take decades and impose significant costs on LTL and the system, with most claimants never receiving any compensation. Resolving this matter through the proposed reorganization plan is both more equitable and more efficient, allows claimants to be compensated in a timely manner, and enables the Company to remain focused on our commitment to profoundly and positively impact health for humanity.”

John Kim, Chief Legal Officer of LTL, said, “Notwithstanding the lack of scientific validity to these claims, plaintiff trial lawyers continue to relentlessly advertise for talc claims, supported by millions of dollars of litigation financing, all in the hopes of a massive return on investment. LTL’s goal has always been to resolve these claims quickly, efficiently and fairly for the claimants, both pending and future, and not incentivize abuse of the legal system. We filed the original action in good faith, and, heeding the Third Circuit’s guidance, have filed this new case to effectuate that intent.”

The Company has won the vast majority of cosmetic talc-related jury trials that have been litigated to date and reiterates that none of the talc-related claims against the Company have merit. The claims are premised on the allegation that cosmetic talc causes ovarian cancer and mesothelioma, a position that has been rejected by independent experts, as well as governmental and regulatory bodies, for decades. More than 40 years of studies by medical experts around the world continue to support the safety of cosmetic talc. Nonetheless, resolving this matter as quickly and efficiently as possible is in the best interests of the Company and all stakeholders.

Last year, the United States Bankruptcy Court for the District of New Jersey ruled that LTL commenced its initial bankruptcy case in good faith, expressing the “strong conviction that the bankruptcy court is the optimal venue for redressing the harms of both present and future talc claimants in this case—ensuring a meaningful, timely, and equitable recovery.” On appellate review, the United States Court of Appeals for the Third Circuit agreed that bankruptcy is “an appropriate forum for a debtor to address mass tort liability.” However, the Third Circuit also concluded that the support the Company provided to LTL in advance of the filing required the dismissal of the original bankruptcy case. The refiled case addresses the Third Circuit’s concerns and relies on well-established legal precedent to obtain the equitable resolution available only in bankruptcy. LTL’s Chapter 11 case was filed in the U.S. Bankruptcy Court for the District of New Jersey.

United States Appeal Court Rejects $430 Billion Johnson & Johnson Chapter 11 Bankruptcy Filing in 2021 for Talc Company to Avoid $3.5 Billion Liabilities for 38,000 Legal Claims Related to Talc Baby Powder Product Cancer Claims, Improperly Filed for Bankruptcy with No Financial Distress

4th February 2023 – The United States appeal court has rejected $430 billion Johnson & Johnson Chapter 11 Bankruptcy filing in 2021 for its Talc company (LTL Management) to avoid $3.5 billion in liabilities for 38,000 of legal claims related to its Talc baby powder product cancer claims, ruling the company for improperly filing for bankruptcy despite no financial distress. Before the bankruptcy filing, Johnson & Johnson had $3.5 billion in settlements, including one $2 billion judgement for 22 women. In 2022, Johnson & Johnson announced that it will stop selling talc-based baby powder globally in 2023. Johnson & Johnson had faced 38,000 lawsuits from consumers & survivors (Claims: Talc products caused cancer due to contamination with asbestos, a known human carcinogen).

Johnson & Johnson – 5 Important Facts About the Safety of Talc

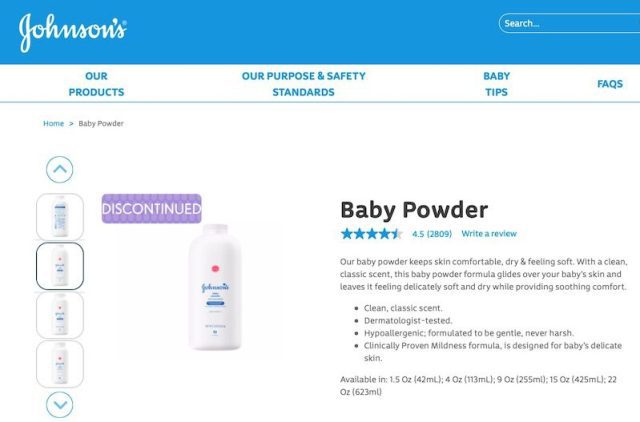

- JOHNSON’S® Baby Powder, made from cosmetic talc, has been a staple of baby care rituals and adult skin care and makeup routines worldwide for over a century.

- The most common cosmetic applications for talc are face, body and baby powders, but it’s also used as an ingredient in color cosmetics, soap, toothpaste, antiperspirant, chewing gum and drug tablets.

- Following decades of studies conducted by medical experts across the globe, it has been demonstrated through science, research and clinical evidence that few ingredients have the same performance, mildness and safety profile as cosmetic talc.

- Talc, also known as talcum powder, is a naturally occurring mineral that is highly stable, chemically inert and odorless. The grade of talc used in cosmetics is of high purity—comparable to that used for pharmaceutical applications—and it’s only mined from select deposits in certified locations before being milled into relatively large, non-respirable-sized particles.

- Today, talc is accepted as safe for use in cosmetic and personal care products throughout the world.

At Johnson & Johnson, we believe good health is the foundation of vibrant lives, thriving communities and forward progress. That’s why for more than 135 years, we have aimed to keep people well at every age and every stage of life. Today, as the world’s largest and most broadly-based health care company, we are committed to using our reach and size for good. We strive to improve access and affordability, create healthier communities, and put a healthy mind, body and environment within reach of everyone, everywhere. We are blending our heart, science and ingenuity to profoundly change the trajectory of health for humanity.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit