United States Business Procurement Platform Startup ZipHQ Raised $190 Million at $2.2 Billion Valuation, New & Existing Investors Include BOND, DST Global, Adams Street, Alkeon, Tiger Global, Y Combinator & CRV, ZipHQ Founded in 2020 by Rujul Zaparde & Lu Cheng

24th October 2024 | Hong Kong

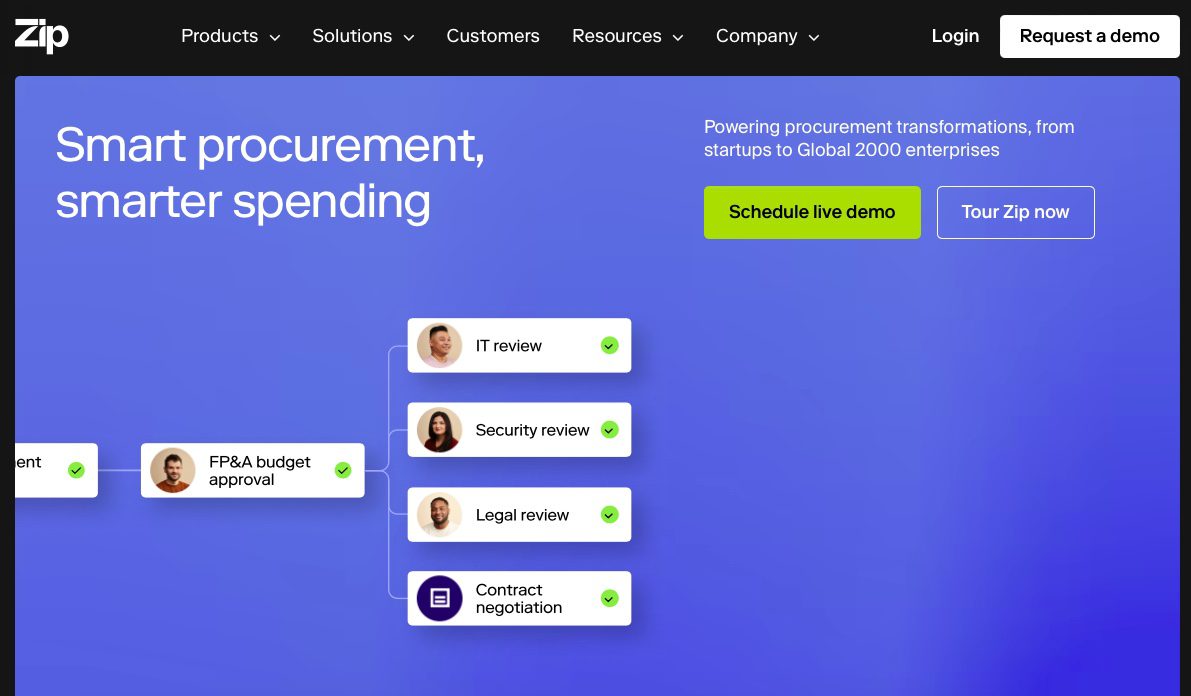

United States business procurement platform startup ZipHQ has raised $190 million at $2.2 billion valuation, with new & existing investors Include BOND, DST Global, Adams Street, Alkeon, Tiger Global, Y Combinator & CRV. ZipHQ was founded in 2020 by Rujul Zaparde & Lu Cheng. Zip (21/10/24): – Zip is a procurement orchestration platform that allows employees, stakeholders, and procurement teams to better connect with the world’s suppliers so business can flow. In 2020, Rujul Zaparde and Lu Cheng co-founded Zip. Their goal was to transform the slow, messy process of procurement into an effortless experience that could deliver unmatched value to businesses worldwide. With the launch of Zip’s leading Intake-to-Procure solution, they set a new standard for the industry by bringing a consumer-grade user experience to B2B purchasing. Today, Zip has grown into a powerful procurement orchestration platform that helps companies of all sizes procure with the fastest process, least risk, and best value so they can drive greater impact on the world. By streamlining intake, sourcing, vendor management, purchase orders, and global payments in one flexible platform, Zip provides unmatched transparency and control over how and when purchases are made. Our passionate team of 300+ serves a diverse range of customers including Prudential, Snowflake, Instacart, and Northwestern Mutual, who have transformed their financial and procurement operations with Zip. Zip’s investors include Adams Street, Alkeon, BOND, CRV, DST, Tiger Global, and Y Combinator. In October 2024, Zip announced a $190 million Series D funding round at a $2.2 billion valuation.”

“ United States Business Procurement Platform Startup ZipHQ Raised $190 Million at $2.2 Billion Valuation, New & Existing Investors Include BOND, DST Global, Adams Street, Alkeon, Tiger Global, Y Combinator & CRV, ZipHQ Founded in 2020 by Rujul Zaparde & Lu Cheng “

United States Business Procurement Platform Startup ZipHQ Raised $190 Million at $2.2 Billion Valuation, New & Existing Investors Include BOND, DST Global, Adams Street, Alkeon, Tiger Global, Y Combinator & CRV, ZipHQ Founded in 2020 by Rujul Zaparde & Lu Cheng

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit