IMF World Economic Outlook 2024: Global GDP to Grow +3.2% with +5.8% Inflation in 2024, United States +2.8% & China +4.8% in 2024, 2 Growth Upside – Stronger Recovery in Investment in Advanced Economies & Stronger Momentum of Structural Reforms, 7 Downside Risks – Monetary Tightening, Financial Markets Reprice Due to Monetary Policy, Sovereign Debt Stress in Emerging & Developing Economies, China Property Sector Contracts More Deeply, Renewed Spikes in Commodity Prices Due to Climate Shocks, Regional Conflicts or Geopolitical Tensions, Protectionist Policies & Social Unrest

1st November 2024 | Hong Kong

The International Monetary Fund (IMF) has released the IMF World Economic Outlook 2024 (October Update), providing key insights into global economy & GDP growth in 2024 & 2025. Global GDP is expected to grow +3.2% in 2024 and +3.2% in 2025, with global inflation forecast at +5.8% in 2024 and +4.3% in 2025 (2023: +6.7%). United States GDP growth forecast in 2024 / 2025 +2.8% / +2.2% and China +4.8% / +4.5%. 2 Growth Upside – Stronger recovery in investment in advanced economies, Stronger momentum of structural reforms. 7 Downside Risks – Monetary policy tightening, Financial markets reprice as a result of monetary policy reassessments, Sovereign debt stress intensifies in emerging market and developing economies, China’s property sector contracts more deeply than expected, Renewed spikes in commodity prices arise as a result of climate shocks, regional conflicts, or broader geopolitical tensions, Countries ratchet up protectionist policies, Social unrest resumes. Central Bank policies recommendations / priorities – Managing the final descent of inflation, Rebuilding buffers to prepare for future shocks and achieving debt sustainability, Enabling durable medium-term growth, Strengthening resilience through multilateral cooperation. 2024 Global Outlook – Global battle against inflation has largely been won. Inflation peaked at 9.4% YOY in Q3 2022, projected to reach 3.5% by the end of 2025, below average level of 3.6% between 2000 and 2019. Global economy unusually resilient throughout the disinflationary process, avoiding a global recession. Downside risks are rising and now dominate the outlook: an escalation in regional conflicts, monetary policy remaining tight for too long, a possible resurgence of financial market volatility with adverse effects on sovereign debt markets, a deeper growth slowdown in China, and the continued ratcheting up of protectionist policies. World dominated by supply disruptions – from climate, health, and geopolitics. Harder for monetary policy to maintain price stability when faced with such shocks, which simultaneously increase prices and reduce output. Level of uncertainty surrounding the outlook is high – Newly elected governments (about half of the world population has gone or will go to the polls in 2024) could introduce significant shifts in trade and fiscal policy. Little change in the global growth outlook since the April 2024 World Economic Outlook. Following the post-pandemic rebound, the global projection for GDP growth has been hovering at about 3%, both in the short and the medium term. See below for key findings & summary | View report here

“ IMF World Economic Outlook 2024: Global GDP to Grow +3.2% with +5.8% Inflation in 2024, United States +2.8% & China +4.8% in 2024, 2 Growth Upside – Stronger Recovery in Investment in Advanced Economies & Stronger Momentum of Structural Reforms, 7 Downside Risks – Monetary Tightening, Financial Markets Reprice Due to Monetary Policy, Sovereign Debt Stress in Emerging & Developing Economies, China Property Sector Contracts More Deeply, Renewed Spikes in Commodity Prices Due to Climate Shocks, Regional Conflicts or Geopolitical Tensions, Protectionist Policies & Social Unrest “

IMF World Economic Outlook 2024: Global GDP to Grow +3.2% with +5.8% Inflation in 2024, United States +2.8% & China +4.8% in 2024, 2 Growth Upside – Stronger Recovery in Investment in Advanced Economies & Stronger Momentum of Structural Reforms, 7 Downside Risks – Monetary Tightening, Financial Markets Reprice Due to Monetary Policy, Sovereign Debt Stress in Emerging & Developing Economies, China Property Sector Contracts More Deeply, Renewed Spikes in Commodity Prices Due to Climate Shocks, Regional Conflicts or Geopolitical Tensions, Protectionist Policies & Social Unrest

The International Monetary Fund (IMF) has released the IMF World Economic Outlook 2024 (October Update), providing key insights into global economy & GDP growth in 2024 & 2025. See below for key findings & summary | View report here

IMF World Economic Outlook 2024

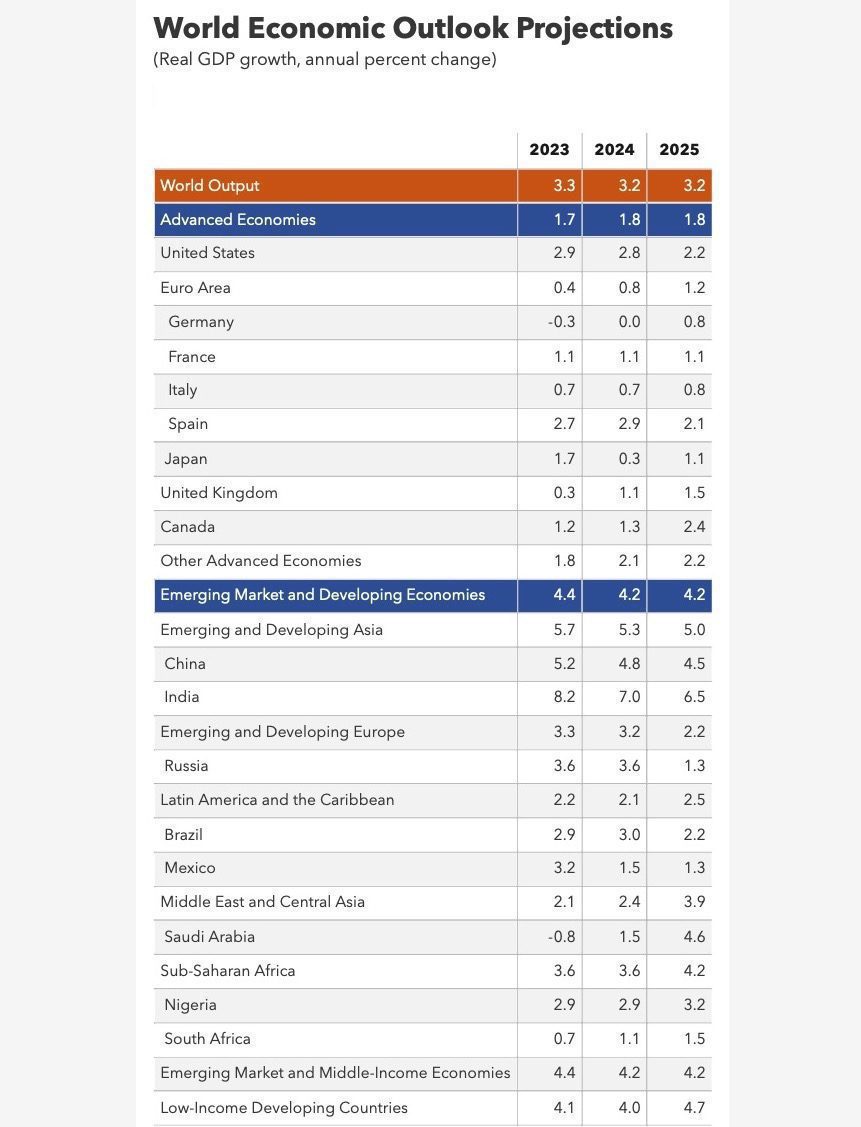

GDP Growth Forecast (2024 / 2025):

- Global: +3.2% / +3.2%

- Advanced Economies: +1.8% / +1.8%

- Emerging Market and Developing Economies: +4.2% / +4.2%

Global Inflation Forecast (2024 / 2025): +5.8% / +4.3% (2023: 6.7%)

2024 / 2025 GDP Growth forecast in Americas:

- United States: +2.8% / +2.2%

- Canada: +1.4 / +2.3%

- Brazil: +1.3% / +2.4%

- Mexico: +1.5% / +1.3%

2024 / 2025 GDP Growth forecast in Europe:

- United Kingdom: +1.1% / +1.5%

- Germany: 0% / 0.8%

- France: +1.1% / +1.1%

- Italy: +0.7% / +0.8%

- Spain: +2.9% / +2.1%

- Netherlands: +0.6% / +1.6%

- Switzerland: +1.3% / +1.3%

- Russia: +3.6% / +1.3%

2024 / 2025 GDP Growth Forecast in APAC:

- China: +4.8% / +4.5%

- India: +7% / +6.5%

- Japan: +0.3% / +1.1%

- South Korea: +2.5% / +2.2%

- Taiwan: +3.7% / +2.7%

- Hong Kong: +3.2% / +3%

- Singapore: +2.6% / +2.5%

- Indonesia: +5% / +5.1%

- Malaysia: +4.8% / +4.4%

- Thailand: +2.8% / +3%

- Philippines: +5.8% / +6.1%

- Vietnam: +6.1% / +6.1%

- Australia: +1.2% / +2.1%

- New Zealand: 0% / +1.9%

2024 / 2025 GDP Growth Forecast in Middle East:

- UAE: +4% / +5.1%

- Saudi Arabia: +1.5% / +4.6%

Top 10 Economies in the World (GDP):

- United States – $27.3 trillion

- China – $17.7 trillion

- Germany – $4.4 trillion

- Japan – $4.2 trillion

- India – $3.5 trillion

- United Kingdom – $3.3 trillion

- France – $3 trillion

- Brazil – $2.2 trilion

- Italy – $2.2 trillion

- Canada – $2.1 trillion

Top 15 Economies in Asia-Pacific (GDP):

- China – $17.7 trillion

- Japan – $4.2 trillion

- India – $3.5 trillion

- South Korea – $1.7 trillion

- Australia – $1.7 trillion

- Indonesia – $1.3 trillion

- Taiwan – $755 billion

- Thailand – $514 billion

- Singapore – $501 billion

- Bangladesh – $437 billion

- Philippines – $437 billion

- Vietnam – $433 billion

- Malaysia – $399 billion

- Hong Kong – $381 billion

- Pakistan – $374 billion

1) 2024 Global Economy

- Global GDP – To increase to +3.2% in 2024, and +3.2% in 2025

- Global inflation – To decrease to +5.8% in 2024, and +4.3% in 2025

2) 2024 Global Outlook

- Global battle against inflation has largely been won

- Inflation peaked at 9.4% YOY in Q3 2022, projected to reach 3.5% by the end of 2025, below average level of 3.6% between 2000 and 2019.

- Global economy unusually resilient throughout the disinflationary process, avoiding a global recession.

- Downside risks are rising and now dominate the outlook: an escalation in regional conflicts, monetary policy remaining tight for too long, a possible resurgence of financial market volatility with adverse effects on sovereign debt markets, a deeper growth slowdown in China, and the continued ratcheting up of protectionist policies.

- World dominated by supply disruptions – from climate, health, and geopolitics.

- Harder for monetary policy to maintain price stability when faced with such shocks, which simultaneously increase prices and reduce output.

- Level of uncertainty surrounding the outlook is high – Newly elected governments (about half of the world population has gone or will go to the polls in 2024) could introduce significant shifts in trade and fiscal policy

- Little change in the global growth outlook since the April 2024 World Economic Outlook. Following the post-pandemic rebound, the global projection for GDP growth has been hovering at about 3%, both in the short and the medium term.

Assumptions:

- Commodity price assumptions – Oil prices are expected to rise by 0.9% in 2024 to about $81 a barrel

- Monetary policy assumptions – Compared with that in 2 April 2024, the anticipated trajectory of policy rates for major central banks in advanced economies has shifted. In the euro area, 100 basis points of cuts are expected in 2024 and 50 basis points in 2025, bringing the policy rate to 2.5 percent by June 2025. In the United States, the Federal Reserve pivoted to cutting rates in September, starting with a 50 basis point drop. The federal funds rate is projected to reach its long-term equilibrium of 2.9% in the third quarter of 2026, almost a year earlier than what was expected in April.

- Fiscal policy assumptions: Governments in advanced economies are on average expected to tighten their fiscal policy stances in both 2024 and 2025, halving primary deficits by 2029.

3) 2 Growth Upside

- Stronger recovery in investment in advanced economies

- Stronger momentum of structural reforms

4) 7 Downside Risks

- Monetary policy tightening

- Financial markets reprice as a result of monetary policy reassessments.

- Sovereign debt stress intensifies in emerging market and developing economies.

- China’s property sector contracts more deeply than expected.

- Renewed spikes in commodity prices arise as a result of climate shocks, regional conflicts, or broader geopolitical tensions

- Countries ratchet up protectionist policies

- Social unrest resumes

5) Central Bank policies recommendations / priorities:

- Carefully calibrate monetary policy.

- Mitigate disruptive foreign exchange volatility

- Restore macro-prudential buffers and ensure financial stability

- Urgently devise credible fiscal plans to avoid disruptive adjustments

- Safeguard growth-enhancing measures while reducing inequality

- Ensure debt sustainability.

- Advance macrostructural reforms

- Accelerate the green transition and address climate change

- Strengthen multilateral cooperation

6) IMF World Economic Outlook 2024 Forecast – October Update

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit