United States Court Blocks Luxury Fashion Group Tapestry Offer to Buy Capri Holdings for $8.5 Billion, Capri Holdings Share Price Decreased -52% in 1 Day on 25th October 2024, Tapestry Owns Brands Including Coach & Kate Spade New York and Capri Holdings Owns Brands Including Versace, Jimmy Choo & Michael Kors

1st November 2024 | Hong Kong

A United States court has blocked luxury fashion group Tapestry ($11 billion market value) offer to buy Capri Holdings for $8.5 billion, with share price decreasing -52% in 1 day on 25th October 2024. In 2023 August, Tapestry announced to buy Capri Holdings for $8.5 billion. Tapestry owns brands including Coach & Kate Spade New York and Capri Holdings owns brands including Versace, Jimmy Choo & Michael Kors. Tapestry: “Tapestry Inc, a house of iconic accessories and lifestyle brands consisting of Coach, Kate Spade, and Stuart Weitzman, and Capri Holdings Limited (NYSE: CPRI), a global fashion luxury group consisting of Versace, Jimmy Choo, and Michael Kors, today announced that they have entered into a definitive agreement under which Tapestry will acquire Capri Holdings. Under the terms of the transaction Capri Holdings shareholders will receive $57.00 per share in cash for a total enterprise value of approximately $8.5 billion. This acquisition brings together six highly complementary brands with global reach, powered by Tapestry’s data-rich customer engagement platform and diversified, direct-to-consumer operating model. The combined company generated global annual sales in excess of $12 billion with a presence in over 75 countries and achieved nearly $2 billion in adjusted operating profit in the prior fiscal year.” See below for full statement:

“ United States Court Blocks Luxury Fashion Group Tapestry Offer to Buy Capri Holdings for $8.5 Billion, Capri Holdings Share Price Decreased -52% in 1 Day on 25th October 2024, Tapestry Owns Brands Including Coach & Kate Spade New York and Capri Holdings Owns Brands Including Versace, Jimmy Choo & Michael Kors “

$8.14 Billion Luxury Fashion Group Tapestry Buys Capri Holdings for $8.5 Billion, Tapestry Owns Brands Including Coach & Kate Spade New York and Capri Holdings Owns Brands Including Versace, Jimmy Choo & Michael Kors

11th August 2023 – Luxury fashion group Tapestry (11/8/23: $8.14 billion market value) has announced to buy Capri Holdings for $8.5 billion. Tapestry owns brands including Coach & Kate Spade New York and Capri Holdings owns brands including Versace, Jimmy Choo & Michael Kors. Tapestry: “Tapestry Inc, a house of iconic accessories and lifestyle brands consisting of Coach, Kate Spade, and Stuart Weitzman, and Capri Holdings Limited (NYSE: CPRI), a global fashion luxury group consisting of Versace, Jimmy Choo, and Michael Kors, today announced that they have entered into a definitive agreement under which Tapestry will acquire Capri Holdings. Under the terms of the transaction Capri Holdings shareholders will receive $57.00 per share in cash for a total enterprise value of approximately $8.5 billion. This acquisition brings together six highly complementary brands with global reach, powered by Tapestry’s data-rich customer engagement platform and diversified, direct-to-consumer operating model. The combined company generated global annual sales in excess of $12 billion with a presence in over 75 countries and achieved nearly $2 billion in adjusted operating profit in the prior fiscal year.” See below for full statement:

$8.14 Billion Luxury Fashion Group Tapestry Buys Capri Holdings for $8.5 Billion

10th August 2023 – Tapestry, Inc. (NYSE: TPR), a house of iconic accessories and lifestyle brands consisting of Coach, Kate Spade, and Stuart Weitzman, and Capri Holdings Limited (NYSE: CPRI), a global fashion luxury group consisting of Versace, Jimmy Choo, and Michael Kors, today announced that they have entered into a definitive agreement under which Tapestry will acquire Capri Holdings. Under the terms of the transaction Capri Holdings shareholders will receive $57.00 per share in cash for a total enterprise value of approximately $8.5 billion.

This acquisition brings together six highly complementary brands with global reach, powered by Tapestry’s data-rich customer engagement platform and diversified, direct-to-consumer operating model. The combined company generated global annual sales in excess of $12 billion with a presence in over 75 countries and achieved nearly $2 billion in adjusted operating profit in the prior fiscal year.

Joanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, “We are excited to announce the acquisition of Capri Holdings – uniting six iconic brands and exceptional global teams. Tapestry is an organization with a passion for building enduring brands through superior design and craftsmanship and an unwavering focus on our customers. Importantly, we’ve created a dynamic, data-driven consumer engagement platform that has fueled our success, fostering innovation, agility, and strong financial results. From this position of strength, we are ready to leverage our competitive advantages across a broader portfolio of brands. The combination of Coach, Kate Spade, and Stuart Weitzman together with Versace, Jimmy Choo, and Michael Kors creates a new powerful global luxury house, unlocking a unique opportunity to drive enhanced value for our consumers, employees, communities, and shareholders around the world.”

John D. Idol, Chairman and Chief Executive Officer of Capri Holdings Limited, said, “Today’s announcement marks a major milestone for Capri. It is a testament to all that our teams have achieved in building Versace, Jimmy Choo, and Michael Kors into the iconic and powerful luxury fashion houses they are today. We are confident this combination will deliver immediate value to our shareholders. It will also provide new opportunities for our dedicated employees around the world as Capri becomes part of a larger and more diversified company. By joining with Tapestry, we will have greater resources and capabilities to accelerate the expansion of our global reach while preserving the unique DNA of our brands.”

Tapestry, Inc.’s Chief Financial Officer and Chief Operating Officer, Scott Roe, said, “The acquisition of Capri Holdings accelerates our strategic agenda and represents a significant value creation opportunity. Importantly, this combination is immediately accretive on an adjusted basis and enhances Tapestry’s total shareholder return. This includes more than $200 million in expected run-rate cost synergies within three years of deal closing. Further, our diversified, strong, and consistent cash flows will allow us to continue to invest in our business and rapidly pay down debt – aligned with our commitment to maintaining an investment grade rating – while returning capital to shareholders, including today’s announced 17% increase in our dividend per share. Overall, we are disciplined financial operators and allocators of capital with a relentless drive to deliver meaningful shareholder value.”

Compelling Strategic Combination and Financial Rationale

The acquisition of Capri Holdings builds on Tapestry’s core tenets as consumer-centric brand-builders and disciplined operators, accelerating its strategic and financial growth agenda. The combination:

Expands Portfolio Reach and Diversification Across Consumer Segments, Geographies, and Product Categories

- Establishes a powerful house of iconic luxury and fashion brands across consumer segments globally

- Builds Tapestry’s portfolio in the attractive and resilient $200+ billion global luxury market for handbags, accessories, footwear, and apparel, where the company has deep experience and expertise, while providing deeper access to luxury consumers and market segments

- Extends global reach and geographic diversification given the Tapestry and Capri Holdings highly complementary respective positions in Asia and Europe

- Broadens Tapestry’s product offering through an increased penetration of lifestyle categories, notably footwear and ready-to-wear, where Capri Holdings brings extensive expertise with further opportunity for growth

Leverages Tapestry’s Consumer Engagement Platform to Drive Direct-to-Consumer Opportunity

- Leverages Tapestry’s customer engagement platform, data analytics capabilities, and modern technology infrastructure to drive deeper consumer connections

- Creates opportunity to further leverage Tapestry’s proven and profitable Direct-to-Consumer model with the goal of increasing Capri Holdings’ Direct-to-Consumer penetration over time

Unlocks Opportunity for Significant Cost Synergies

- Expect to realize over $200 million in run-rate cost synergies within three years post-closing, supported by operating cost savings and supply chain efficiencies

Generates Highly Diversified, Strong, and Consistent Cash Flow

- Builds portfolio in durable, high-margin categories where Tapestry has best-in-class operational execution, enhancing strong and consistent cash flow

- Generates significant cash flow that enables rapid deleverage, while continuing to reinvest in the business

Powers Continued Progress as a Purpose-Led, People-Centered Company

- Brings together more than 33,000 passionate employees around the world with shared values of innovation, inclusivity, and creativity, providing new opportunities for internal career mobility and growth

- The combined company will be well-positioned to advance a comprehensive and impactful ESG strategy focused on a shared mission to drive progress toward a more sustainable, equitable, and inclusive future. Importantly, as part of this commitment, Tapestry will continue to invite its employees to contribute their unique perspective to create a culture that is growing, dynamic, and diverse

Creates Path to Deliver Enhanced Total Shareholder Returns (TSR)

- Expected to deliver significant financial returns, including strong double-digit EPS accretion on an adjusted basis and compelling ROIC

- Accretive to Tapestry’s existing standalone TSR plan, underscoring the company’s financial discipline and commitment to value creation

- Continued commitment to capital return, with Tapestry’s Board of Directors approving a 17% increase to its quarterly dividend per share, resulting in an anticipated payout of $1.40 per share or approximately $325 million in Fiscal Year 2024

Transaction Details

The Boards of Directors of each of Tapestry, Inc. and Capri Holdings Limited have unanimously approved the transaction. The transaction is anticipated to close in calendar year 2024, subject to approval by the Capri Holdings shareholders, as well as the receipt of required regulatory approvals, and other customary closing conditions. The all-cash offer for Capri Holdings of $57.00 per share represents a premium of approximately 59% to the 30-day volume weighted average price ending August 9, 2023. The total enterprise value of the transaction of approximately $8.5 billion represents a 9x adjusted EBITDA multiple on a trailing-twelve-month basis, or 7x including expected synergies. The transaction is not subject to a financing condition. Tapestry has secured $8.0 billion in fully committed bridge financing from Bank of America N.A. and Morgan Stanley Senior Funding, Inc. The purchase price of approximately $8.5 billion is expected to be funded by a combination of senior notes, term loans, and excess Tapestry cash, a portion of which will be used to pay certain of Capri’s existing outstanding debt. Importantly, Tapestry has engaged with the rating agencies and is committed to a solid Investment Grade Rating. Tapestry will suspend its share repurchase activity to prioritize de-leveraging via debt reduction and anticipates reaching a leverage ratio of below 2.5x Debt/EBITDA within 24 months post-close. Furthermore, Tapestry is instituting a long-term leverage target of under 2.5x Debt/EBITDA.

Advisors

Morgan Stanley & Co LLC is serving as Tapestry, Inc.’s exclusive financial advisor and Latham & Watkins LLP is its legal advisor. Capri Holdings Limited’s financial advisor is Barclays and its legal advisor is Wachtell, Lipton, Rosen & Katz.

About Tapestry, Inc.

Our global house of brands unites the magic of Coach, Kate Spade New York and Stuart Weitzman. Each of our brands are unique and independent, while sharing a commitment to innovation and authenticity defined by distinctive products and differentiated customer experiences across channels and geographies. We use our collective strengths to move our customers and empower our communities, to make the fashion industry more sustainable, and to build a company that’s equitable, inclusive, and diverse. Individually, our brands are iconic. Together, we can stretch what’s possible.

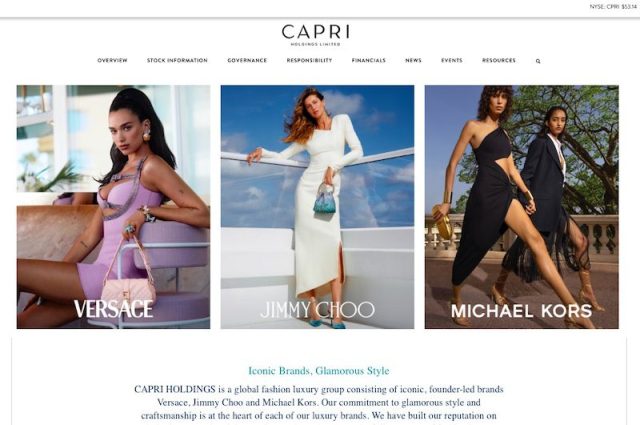

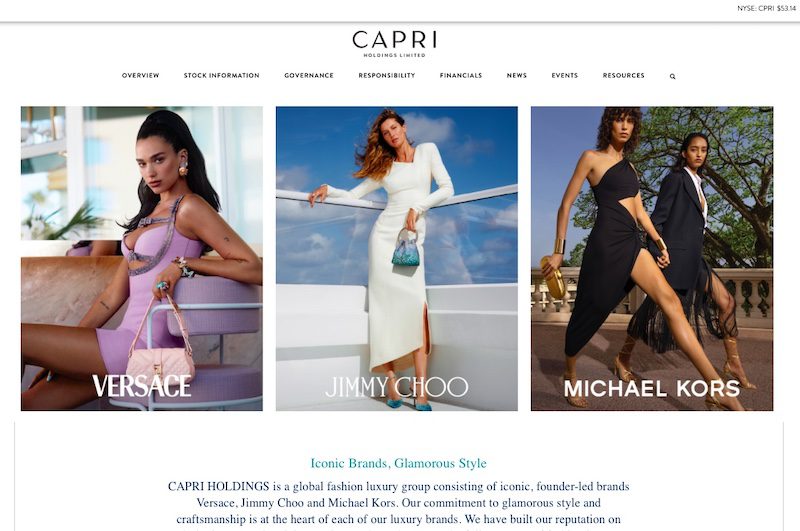

About Capri Holdings Limited

Capri Holdings is a global fashion luxury group consisting of iconic, founder-led brands Versace, Jimmy Choo and Michael Kors. Our commitment to glamorous style and craftsmanship is at the heart of each of our luxury brands. We have built our reputation on designing exceptional, innovative products that cover the full spectrum of fashion luxury categories. Our strength lies in the unique DNA and heritage of each of our brands, the diversity and passion of our people and our dedication to the clients and communities we serve. Capri Holdings Limited is publicly listed on the New York Stock Exchange under the ticker CPRI.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit