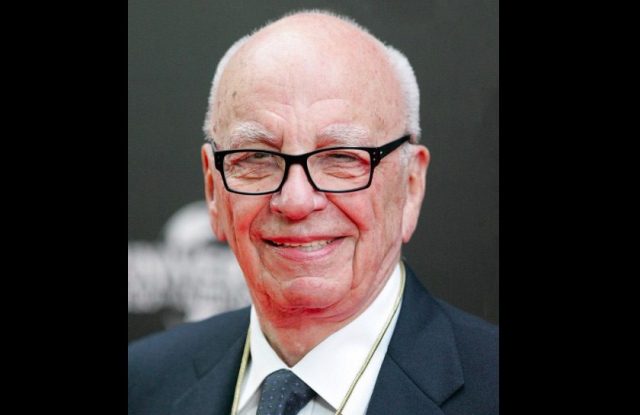

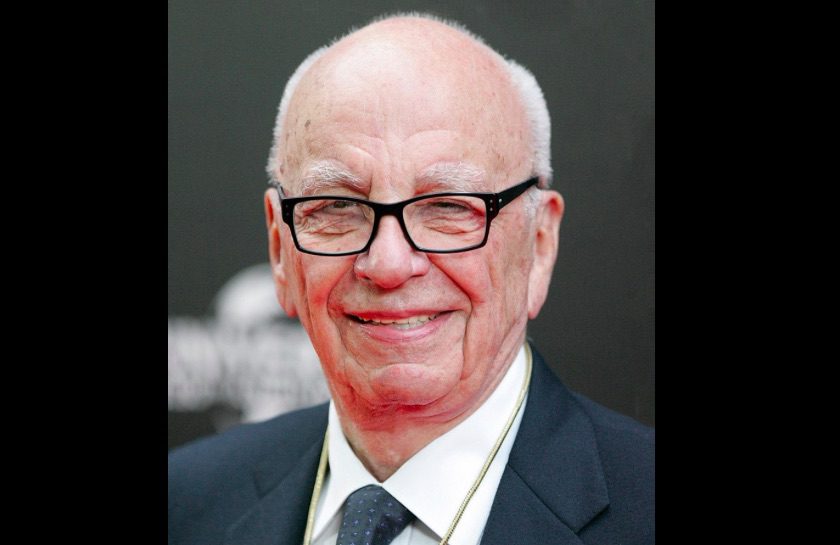

Rupert Murdoch $16 Billion News Corp Sells Australia Sports & Entertainment Media Group Foxtel to Sports Entertainment Group DAZN for $2.1 Billion, News Corp to Focus on Growth Businesses in Dow Jones, Digital Real Estate Services & Book Publishing

27th December 2024 | Hong Kong

Rupert Murdoch News Corp ($16 billion market value) has announced to sell Australia sports & entertainment media group Foxtel to sports entertainment group DAZN for $2.1 billion (AUD 3.4 billion) with News Corp to focus on growth businesses in Dow Jones, Digital Real Estate Services & Book Publishing. Announcement (23/12/24): “News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS, NWSA: ASX: NWS, NWSLV) announced today that it has entered into a definitive agreement for the sale of Foxtel Group (“Foxtel”) to DAZN Group Limited (“DAZN”), a premier global sports streaming platform. Under the terms of the agreement, shareholder loans in the amount of A$578 million outstanding and owing to News Corp will be repaid in full in cash at closing. Foxtel’s current debt will be refinanced at closing and transfer with Foxtel, and News Corp will hold a minority equity interest in DAZN of approximately 6% as well as one seat on its Board of Directors. Telstra Group Ltd (“Telstra”) will also sell its minority interest in Foxtel, have its shareholder loans of A$128 million repaid, and take a minority stake in DAZN of approximately 3%. The proposed transaction values Foxtel at an enterprise value of A$3.4 billion, representing more than 7x fiscal 2024 Foxtel EBITDA. The agreement follows a strategic and financial review of Foxtel as part of News Corp’s ongoing efforts to optimize its portfolio and simplify the structure of the Company. Under News Corp’s management, Foxtel has become a digital and streaming leader in sports and entertainment. With DAZN’s global reach, industry leading technology and broad content portfolio, the proposed transaction enhances Foxtel’s position as a digital-first, streaming-focused business, led by the current CEO, Patrick Delany, and his world-class management team. The proposed transaction likewise empowers News Corp to further focus on its key growth segments: Dow Jones, Digital Real Estate Services and Book Publishing, while also providing the Company with a shareholding in a larger, global sports streaming and entertainment company with over 300 million viewers across 200 markets. DAZN continues to experience significant growth as it pursues expansion into new markets and across more sports. The transaction, which is expected to close in the second half of fiscal 2025, is subject to regulatory approvals and other customary closing conditions. For News Corp financial reporting purposes, Foxtel will be classified as discontinued operations as of the second quarter of fiscal 2025.” In 2024 December, Australia News Corp & Fox News media tycoon & billionaire Rupert Murdoch (Age 93) with $12 billion fortune has lost in a United States Nevada Court Commissioner ruling to change his family trust from his 4 children to give control to his eldest Lachlan Murdoch without interference from 3 other children Prudence, Elisabeth & James with voting rights. In 2024 September, News Corp ($15 billion market value) 62%-owned property listing firm REA Group increased buyout offer to $8.1 billion has been rejected by UK largest real estate platform Rightmove. In September 2024, REA Group had increased the buyout offer to $8.1 billion (GBP 6.1 billion) from $7.3 billion (GBP 5.6 billion) for Rightmove. REA Group $7.3 billion buyout offer (GBP 5.6 billion) had earlier been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

“ Rupert Murdoch $16 Billion News Corp Sells Australia Sports & Entertainment Media Group Foxtel to Sports Entertainment Group DAZN for $2.1 Billion, News Corp to Focus on Growth Businesses in Dow Jones, Digital Real Estate Services & Book Publishing “

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The Company comprises businesses across a range of media, including: information services and news, digital real estate services, book publishing and subscription video services in Australia. Headquartered in New York, News Corp operates primarily in the United States, Australia and the United Kingdom, and its content and other products and services are distributed and consumed worldwide.

Foxtel – The Foxtel Group is one of Australia’s leading media companies with 4.7 million subscribers. Its businesses include subscription television, streaming, sports production and advertising. The Foxtel Group is owned 65% by News Corp and 35% by Telstra. The Foxtel Group’s diversified business includes Fox Sports, Australia’s leading sports production company, famous for live sports and shows with the best commentators and personalities. It is also the home of local and global entertainment content and continues to be the partner of choice for the widest range of sports and international content providers based on established, long-term relationships, growing streaming audiences, and position as the largest Australian-based subscription television company.

DAZN – As a world-leading sports entertainment platform, DAZN streams over 90,000 live events annually and is available in more than 200 markets worldwide. DAZN is the home of European football, women’s football, boxing and MMA, and the NFL internationally. The platform features the biggest sports and leagues from around the world – Bundesliga, Serie A, LALIGA, Ligue 1, Formula 1, NBA, Moto GP, and many more including the 2025 FIFA Club World Cup. DAZN is transforming the way people enjoy sport. With a single, frictionless platform, sports fans can watch, play, buy, and connect. Live and on-demand sports content, anywhere, in any language, on any device – only on DAZN. DAZN partners with leading pay-TV operators, ISPs and Telcos worldwide to maximise sports exposure to a broad audience. Its partners include Deutsche Telekom, Orange, Sky, Movistar, Telenet, Vodafone, and many more. DAZN is a global, privately-owned company, founded in 2016, with more than 3,000 employees. The Group generated $3.2bn in revenue in 2023, having grown its annual revenues by over 50% on average from 2020 to 2023, through diverse revenue streams comprising subscriptions, advertising, sponsorship, and transactional.

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group Increased Buyout Offer of $8.1 Billion Rejected by UK Largest Real Estate Platform Rightmove

26th September 2024 – Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group increased buyout offer to $8.1 billion has been rejected by UK largest real estate platform Rightmove. In September 2024, REA Group had increased the buyout offer to $8.1 billion (GBP 6.1 billion) from $7.3 billion (GBP 5.6 billion) for Rightmove. REA Group $7.3 billion buyout offer (GBP 5.6 billion) had earlier been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group Increased Buyout Offer to $8.1 Billion from $7.3 Billion for UK Largest Real Estate Platform Rightmove

24th September 2024 – Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group has increased the buyout offer to $8.1 billion (GBP 6.1 billion) from $7.3 billion (GBP 5.6 billion) for UK largest real estate platform Rightmove. REA Group $7.3 billion buyout offer (GBP 5.6 billion) had earlier been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group $7.3 Billion Buyout Offer Rejected by UK Largest Real Estate Platform Rightmove

19th September 2024 – Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group $7.3 billion buyout offer (GBP 5.6 billion) has been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

$15 Billion Rupert Murdoch News Corp Large Shareholder & Hedge Fund Starboard Value LP Proposes to Remove Dual-Class Share Structure Which Provides Super-Voting Rights & De Facto Control to Inheritors of Founder, News Corp Suffers from Corporate Governance Resulting in Valuation Discount, Rupert Murdoch Personal Fortune at $20 Billion

13th September 2024 – Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

Australia Media Tycoon Rupert Murdoch with $17 Billion Fortune Terminate Plans to Merge $9 Billion News Corp & $16 Billion Fox News 10 Years after Split, Brands Include Wall Street Journal, Dow Jones, The Sun, The Australian & Realtor.com

26th January 2023 – Australia media tycoon Rupert Murdoch (Age 91) with $17 billion fortune (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. Should the merger go through, the combined group will create a diversified global news, sport and digital giant. News Corp: “News Corp … . following the receipt of letters from K. Rupert Murdoch and the Murdoch Family Trust, has formed a Special Committee composed of independent and disinterested members of the Board to begin exploring a potential combination with Fox Corporation.”

News Corp ($9 billion) valuation comes from its $5.7 billion shareholding in REA Group, and The Dow Jones group & remain businesses are valued at $3.4 billion. Fox Corporation produces and distributes compelling news, sports and entertainment content through its primary iconic domestic brands, including FOX News Media, FOX Sports, FOX Entertainment and FOX Television Stations, and leading AVOD service Tubi.

Official Press Release – News Corp – News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) announced today that the Company’s Board of Directors, following the receipt of letters from K. Rupert Murdoch and the Murdoch Family Trust, has formed a Special Committee composed of independent and disinterested members of the Board (the “Special Committee”) to begin exploring a potential combination with Fox Corporation (“Fox”) (Nasdaq: FOXA, FOX).

The Special Committee, consistent with its fiduciary duties and in consultation with its independent financial and legal advisors, will thoroughly evaluate a potential combination with Fox. The Special Committee has not made any determination with respect to any such potential combination at this time, and there can be no certainty that the Company will engage in such a transaction.

Neither the Company nor the Special Committee intends to comment on or disclose further developments regarding the Special Committee’s work unless and until it deems further disclosure is appropriate or required.

News Corp

The company comprises businesses across a range of media, including: digital real estate services, subscription video services in Australia, news and information services and book publishing. Headquartered in New York, News Corp operates primarily in the United States, Australia, and the United Kingdom, and its content and other products and services are distributed and consumed worldwide.

Fox Corporation

Fox Corporation produces and distributes compelling news, sports and entertainment content through its primary iconic domestic brands, including FOX News Media, FOX Sports, FOX Entertainment and FOX Television Stations, and leading AVOD service Tubi.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit