Citi Wealth Outlook 2025: GDP to Grow +2.9% in Both 2025 & 2026, Continued Growth, Strategic Asset Allocation Equities 60.9%, Fixed Income 37% & Cash 2%, 10-Year Return Annualized Forecast (2025 to 2035) Equities +5.6%, Fixed Income +4.8%, Cash +3.2%, Hedge Funds +8.1%, Private Assets +12.6%, Real Estate +11% & Commodities +2.5%, Citi 4 Unstoppable Trends are Artificial Intelligence, Climate, Healthcare & Portfolio Positioning for United States & China Polarisation, Citi 10 Opportunistic Portfolio – Semiconductor Equipment Makers, Medical Equipment, Defence Contractors, Biotechnology, United States Banks, Nuclear Energy, Midstream Energy Transportation, Renewed Volatility, Enablers of Cryptocurrencies, Brazil Equities

16th January 2025 | Hong Kong

Citi has released the Citi Wealth Outlook 2025, providing key insights into investment outlook for 2025. Global GDP Forecast: +2.9% for both 2025 & 2026. Key Countries / Region 2025 GDP Forecast – United States +2.4%, China +5.2%, European Union +1.2%, United Kingdom +1.1%. 2025 Trends Forecast – 1) Continued global growth & rising profits, 2) Geopolitics may trigger more volatility, 3) Broaden portfolio with potential in several asset classes, 4) Key risks include United States overheating, global trade war & high valuation, 5) United States (Output, Employment & Income) kept growing despite recession signals. 2025 & Beyond – Continuing growth, Potential for long-term returns, Discord & other risks. Strategic Asset Allocation – Equities 60.9%, Fixed Income 37%, Cash 2%, Commodities 0%. Asset Allocation Equities (60.9%) – Developed Equities 52.2%, Emerging Market Equity 8.7%. Asset Allocation Fixed Income (37%) – Developed Sovereign 18.8%, United States Securitized – 6.1%, Developed IG Corporates 6.9%, High Yield 2%, Emerging Market Sovereign 3.1%. 10-Year Return Annualized Forecast (2025 to 2035) – Equities +5.6%, Fixed Income +4.8%, Cash +3.2%, Hedge Funds +8.1%, Private Assets +12.6%, Real Estate +11%, Commodities +2.5%. Portfolio Insights – Portfolios heavily concentrated in United States have performed strongly in recent years but may not do as well over the next decade. Equities Insights – 1) Bull market in equities to continue in 2025, 2) Some U.S. sectors may do better as its economy faces inwards, 3) India, east Asian AI-exposed markets, Japan and Brazil may offer attractions, 4) Risks include inflation, rising trade tensions & valuations. Fixed Income Insights – 1) U.S. rates fall, we favor making investment grade (IG) credit a core portfolio holding, 2) Potential in certain lower rated IG bonds and sub-IG bonds, 3) Differentiated credit includes structured credit, bank loans and preferred securities, 4) Risks include those relating to repayment, liquidity, interest rates & borrowers repaying early. Top 3 Fixed Income & Equity Assets Yield (20/11/24) – US bank loan 8.2%, EM USD agg 6.6%, US IG preferreds 6%. Private Asset Insights – 1) Potential for seeking diversification and returns from private markets, 2) Evergreen funds are broadening access to private equity, private credit and real estate, 3) Favor the likes of secondary private equity strategies, private credit, and industrial and hospitality real estate, 4) Risks include leverage, less transparency and operational issues. Hedge Funds Insights – 1) Various kinds of hedge fund strategies have historically done better or worse under certain market conditions, 2) Suitable and qualified investors might consider combining varieties of these strategies in portfolios, 3) Potential in some diversifying and directional hedge fund strategies, 4) Risks include but are not limited to losses from the use of leverage, concentrated portfolios and limited transparency. Citi 10 Opportunistic Portfolio – Semiconductor Equipment Makers, Medical Equipment, Defence Contractors, Biotechnology, United States Banks, Nuclear Energy, Midstream Energy Transportation, Renewed Volatility, Enablers of Cryptocurrencies, Brazil Equities. Citi 4 Unstoppable Trends – Artificial Intelligence (Getting more real), Climate (Investing in innovative technologies), Healthcare (Prescription for longevity), Portfolio (Positioning for United States & China polarisation). Citi 6 Opportunities in Artificial Intelligence (AI) – Reinventing Software, Smarter Healthcare, Financial Services New Frontier, Rise of Robotics, Empowering Education, Enhanced Agriculture. See below for key findings & summary | View report here

“ Citi Wealth Outlook 2025: GDP to Grow +2.9% in Both 2025 & 2026, Continued Growth, Strategic Asset Allocation Equities 60.9%, Fixed Income 37% & Cash 2%, 10-Year Return Annualized Forecast (2025 to 2035) Equities +5.6%, Fixed Income +4.8%, Cash +3.2%, Hedge Funds +8.1%, Private Assets +12.6%, Real Estate +11% & Commodities +2.5%, Citi 4 Unstoppable Trends are Artificial Intelligence, Climate, Healthcare & Portfolio Positioning for United States & China Polarisation, Citi 10 Opportunistic Portfolio – Semiconductor Equipment Makers, Medical Equipment, Defence Contractors, Biotechnology, United States Banks, Nuclear Energy, Midstream Energy Transportation, Renewed Volatility, Enablers of Cryptocurrencies, Brazil Equities “

Citi Wealth Outlook 2025: GDP to Grow +2.9% in Both 2025 & 2026, Continued Growth, Strategic Asset Allocation Equities 60.9%, Fixed Income 37% & Cash 2%, 10-Year Return Annualized Forecast (2025 to 2035) Equities +5.6%, Fixed Income +4.8%, Cash +3.2%, Hedge Funds +8.1%, Private Assets +12.6%, Real Estate +11% & Commodities +2.5%, Citi 4 Unstoppable Trends are Artificial Intelligence, Climate, Healthcare & Portfolio Positioning for United States & China Polarisation, Citi 10 Opportunistic Portfolio – Semiconductor Equipment Makers, Medical Equipment, Defence Contractors, Biotechnology, United States Banks, Nuclear Energy, Midstream Energy Transportation, Renewed Volatility, Enablers of Cryptocurrencies, Brazil Equities

Citi has released the Citi Wealth Outlook 2025, providing key insights into investment outlook for 2025. See below for key findings & summary | View report here

Summary

- Global GDP Forecast: +2.9% for both 2025 & 2026

- Key Countries / Region 2025 GDP Forecast – United States +2.4%, China +5.2%, European Union +1.2%, United Kingdom +1.1%

- 2025 Outlook – 1) Continued global growth & rising profits, 2) Geopolitics may trigger more volatility, 3) Broaden portfolio with potential in several asset classes, 4) Key risks include United States overheating, global trade war & high valuation, 5) United States (Output, Employment & Income) kept growing despite recession signals

- 2025 & Beyond – Continuing growth, Potential for long-term returns, Discord & other risks

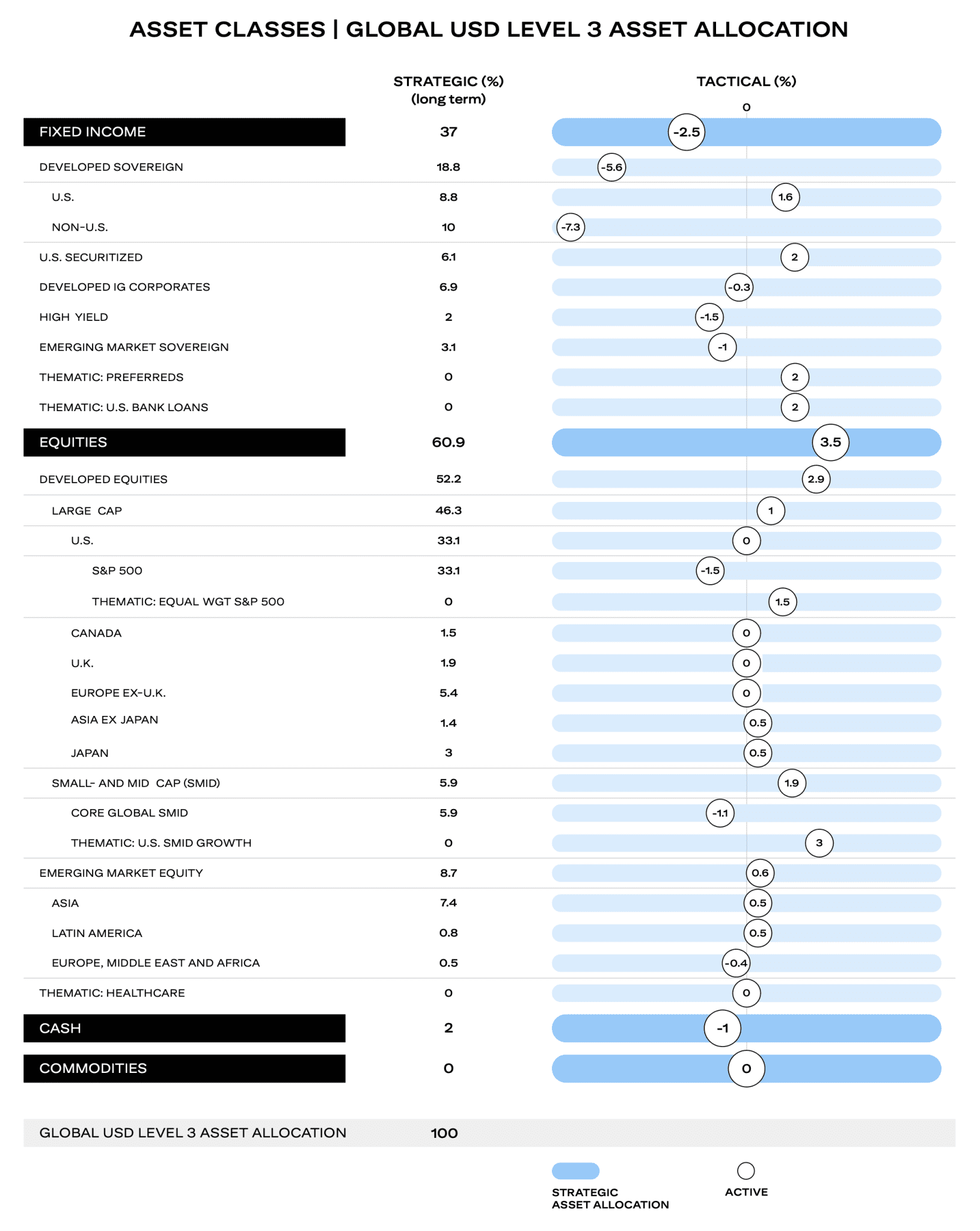

- Strategic Asset Allocation – Equities 60.9%, Fixed Income 37%, Cash 2%, Commodities 0%

- Asset Allocation Equities (60.9%) – Developed Equities 52.2%, Emerging Market Equity 8.7%

- Asset Allocation Fixed Income (37%) – Developed Sovereign 18.8%, United States Securitized – 6.1%, Developed IG Corporates 6.9%, High Yield 2%, Emerging Market Sovereign 3.1%

- 10-Year Return Annualized Forecast (2025 to 2035) – Equities +5.6%, Fixed Income +4.8%, Cash +3.2%, Hedge Funds +8.1%, Private Assets +12.6%, Real Estate +11%, Commodities +2.5%

- Portfolio Insights – Portfolios heavily concentrated in United States have performed strongly in recent years but may not do as well over the next decade

- Equities Insights – 1) Bull market in equities to continue in 2025, 2) Some U.S. sectors may do better as its economy faces inwards, 3) India, east Asian AI-exposed markets, Japan and Brazil may offer attractions, 4) Risks include inflation, rising trade tensions & valuations

- Fixed Income Insights – 1) U.S. rates fall, we favor making investment grade (IG) credit a core portfolio holding, 2) Potential in certain lower rated IG bonds and sub-IG bonds, 3) Differentiated credit includes structured credit, bank loans and preferred securities, 4) Risks include those relating to repayment, liquidity, interest rates & borrowers repaying early

- Top 3 Fixed Income & Equity Assets Yield (20/11/24) – US bank loan 8.2%, EM USD agg 6.6%, US IG preferreds 6%

- Private Asset Insights – 1) Potential for seeking diversification and returns from private markets, 2) Evergreen funds are broadening access to private equity, private credit and real estate, 3) Favor the likes of secondary private equity strategies, private credit, and industrial and hospitality real estate, 4) Risks include leverage, less transparency and operational issues

- Hedge Funds Insights – 1) Various kinds of hedge fund strategies have historically done better or worse under certain market conditions, 2) Suitable and qualified investors might consider combining varieties of these strategies in portfolios, 3) Potential in some diversifying and directional hedge fund strategies, 4) Risks include but are not limited to losses from the use of leverage, concentrated portfolios and limited transparency

Citi 10 Opportunistic Portfolio – Semiconductor Equipment Makers, Medical Equipment, Defence Contractors, Biotechnology, United States Banks, Nuclear Energy, Midstream Energy Transportation, Renewed Volatility, Enablers of Cryptocurrencies, Brazil Equities - Citi 4 Unstoppable Trends – Artificial Intelligence (Getting more real), Climate (Investing in innovative technologies), Healthcare (Prescription for longevity), Portfolio (Positioning for United States & China polarisation)

- Citi 6 Opportunities in Artificial Intelligence (AI) – Reinventing Software, Smarter Healthcare, Financial Services New Frontier, Rise of Robotics, Empowering Education, Enhanced Agriculture

Citi Wealth Outlook 2025

1) 2025 Investment Outlook

2025 Outlook:

- Continued global growth and rising profits in 2025

- Discordant geopolitics may trigger more volatility across markets

- Broadening portfolio horizons, with potential in several asset classes

- Risks include but are not limited to U.S. overheating, a global trade war and pockets of high valuation

- United States output, employment and Income kept growing despite recession signals

Outlook – The World in 2025 & Beyond:

- Continuing growth

- Potential for long-term returns

- Discord & other risks

2025 GDP Forecast

- United States: +2.4%

- China: +5.2%

- European Union: +1.2%

- United Kingdom: +1.1%

- Global: +2.9%

2024 GDP Forecast:

- United States: +2.7%

- China: +4.9%

- European Union: +0.7%

- United Kingdom: +1%

- Global: +2.6%

2026 GDP Forecast:

- United States: +2.1%

- China: +4.8%

- European Union: +1.6%

- United Kingdom: +1.5%

- Global: +2.9%

2) Asset Allocation

Citi Strategic Asset Allocation:

- Equities – 60.9%

- Fixed Income – 37%

- Cash – 2%

- Commodities – 0%

Asset Allocation Equities (60.9%):

- Developed Equities – 52.2%

- Emerging Market Equity – 8.7%

Asset Allocation Fixed Income (37%):

- Developed Sovereign – 18.8%

- United States Securitized – 6.1%

- Developed IG Corporates – 6.9%

- High Yield – 2%

- Emerging Market Sovereign – 3.1%

Asset Allocation Equities (60.9%) Breakdown:

I) Developed Equities – 52.2%:

A) Large Cap – 46.3%

- United States – 33.1%

- Canada – 1.5%

- United Kingdom – 1.9%

- Europe ex-UK – 5.4%

- Asia ex-Japan – 1.4%

- Japan – 3%

B) Small & Mid-Cap – 5.9%

- Core Global – 5.9%

- Thematic United States Growth – 0%

II) Emerging Market Equity – 8.7%

- Asia – 7.4%

- Latin America – 0.8%

- EMEA – 0.5%

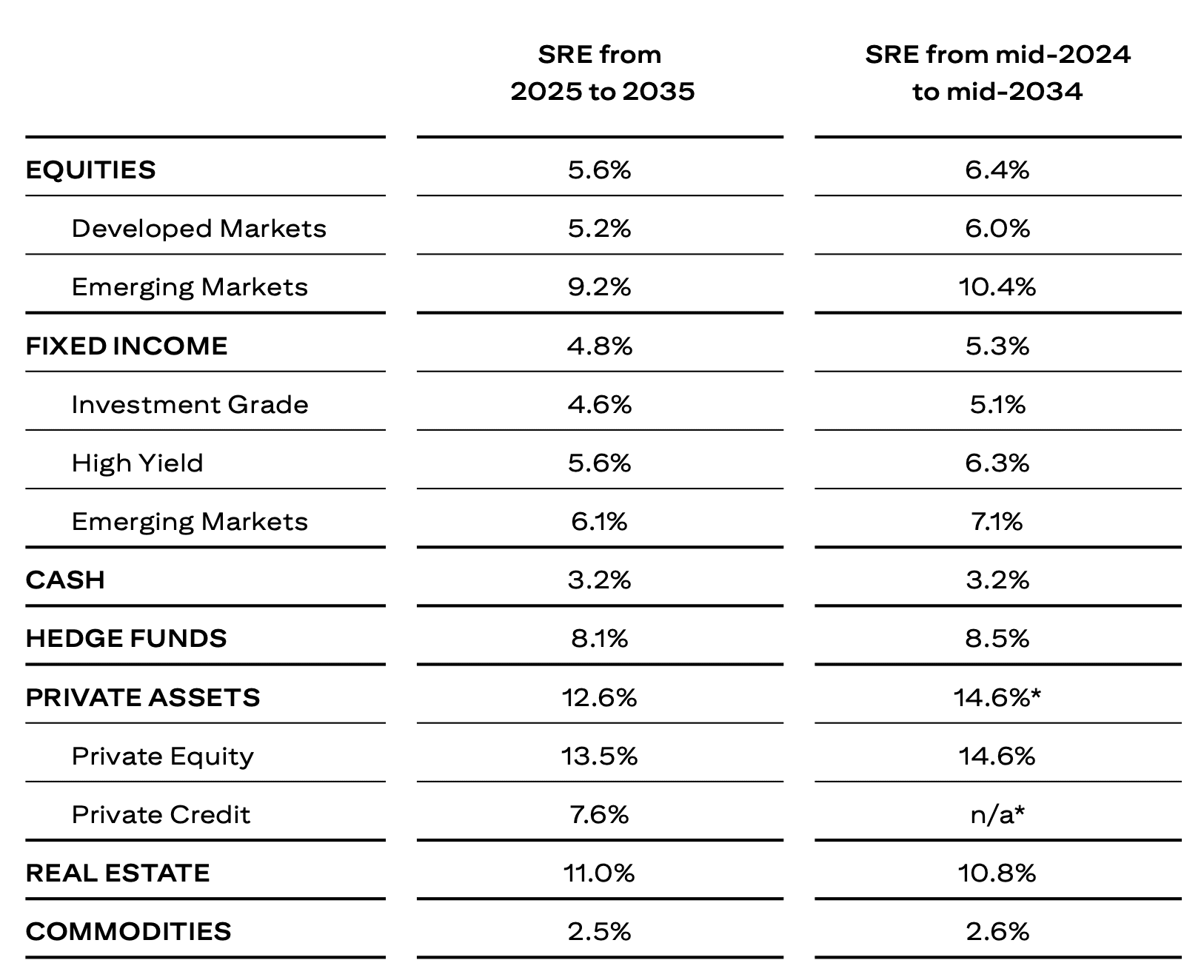

3) 10-Year Return (2025 to 2035)

10-Year Return Annualized Forecast (2025 to 2035):

- Equities: +5.6%

- Fixed Income: +4.8%

- Cash: +3.2%

- Hedge Funds: +8.1%

- Private Assets: +12.6%

- Real Estate: +11%

- Commodities: +2.5%

Equities Return Breakdown:

- Developed Markets: +5.2%

- Emerging Markets: +9.2%

Fixed Income Return Breakdown:

- Investment Grade: +4.6%

- High Yield: +5.6%

- Emerging Markets: +6.1%

Private Assets Breakdown

- Private Equity: +13.5%

- Private Credit: +7.6%

4) Investment Insights

Portfolio Insights:

- Portfolios heavily concentrated in the U.S. have performed strongly in recent years but may not do as well over the next decade

- Broaden portfolios in line with investors’ long-term investment plans and investment objectives

- Alternative asset classes may offer return and diversification potential for suitable and qualified investors’ portfolios

Equities Insights:

- We look for the bull market in equities to continue in 2025

- Some U.S. sectors may do better as its economy faces inwards, such as small- and mid-cap and various large-cap segments

- India, east Asian AI-exposed markets, Japan and Brazil may offer attractions

- Risks include inflation, rising trade tensions & valuations

Fixed Income Insights:

- As U.S. rates fall, we favor making investment grade (IG) credit a core portfolio holding

- We see potential in certain lower rated IG bonds and sub-IG bonds

- Differentiated credit includes structured credit, bank loans and preferred securities (a hybrid of debt and equity)

- Risks include those relating to repayment, liquidity, interest rates & borrowers repaying early

Fixed Income & Equity Assets Yield (20/11/24):

- US bank loan – 8.2%

- EM USD agg – 6.6%

- US IG preferreds – 6%

- US IG corp – 5.2%

- US IG CMBS – 5.2%

- US agg – 4.8%

- US Agency MBS – 4.6%

- US Treasuries – 4.4%

- US munis – 3.6%

- MSCI World ex-US Div. Yield – 3.1%

- Global agg ex-US – 2.7%

- S&P 500 Div. Yield – 1.3%

Private Asset Insights:

- We see potential for seeking diversification and returns from private markets

- Evergreen funds are broadening access to private equity, private credit and real estate

- We favor the likes of secondary private equity strategies, private credit, and industrial and hospitality real estate

- Risks include leverage, less transparency and operational issues

Hedge Funds Insights:

- Various kinds of hedge fund strategies have historically done better or worse under certain market conditions

- Suitable and qualified investors might consider combining varieties of these strategies in portfolios

- We see potential in some diversifying and directional hedge fund strategies

- Risks include but are not limited to losses from the use of leverage, concentrated portfolios and limited transparency

2024 Hedge Funds Strategies Performance:

- MSCI ACWI TR Index (USD): +20%

- HFRI Equity Hedge (Total) Index: +11.6%

- HFRI Relative Value (Total) Index: +9.8%

- HFRI Event-Driven (Total) Index: +8.6%

- Global Agg Index (USD Hedged): +3.6%

- HFRI Macro (Total) Index: +3.2%

2022 Hedge Funds Strategies Performance:

- HFRI Macro (Total) Index: +9%

- HFRI Relative Value (Total) Index: -0.7%

- HFRI Event-Driven (Total) Index: -4.8%

- HFRI Equity Hedge (Total) Index: -10.1%

- Global Agg Index (USD Hedged): -11.2%

- MSCI ACWI TR Index (USD): -18%

2022 Hedge Funds Strategies Performance:

- MSCI ACWI TR Index (USD): +22.8%

- HFRI Equity Hedge (Total) Index: +11.4%

- HFRI Event-Driven (Total) Index: +10.4%

- Global Agg Index (USD Hedged): +7.1%

- HFRI Relative Value (Total) Index: +7%

- HFRI Macro (Total) Index: -0.3%

Hedge Fund – The index returns shown do not represent the results of actual trading of investor assets. The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance

5) Opportunistic Portfolio, 4 Unstoppable Trends & AI

Citi 10 Opportunistic Portfolio:

- Semiconductor Equipment Makers

- Medical Equipment

- Defence Contractors

- Biotechnology

- United States Banks

- Nuclear Energy

- Midstream Energy Transportation

- Renewed Volatility

- Enablers of Cryptocurrencies

- Brazil Equities

Potential Opportunistic Positions:

- Philadelphia Stock Exchange Semiconductor Index

- Dow Jones U.S. Medical Equipment Index

- S&P Aerospace & Defense Index

- S&P Biotechnology Select Industry Index

- S&P 500 Banks Index

- Alerian Midstream Energy Index

- MVIS Global Uranium and Nuclear Energy Index

- CBOE VIX (1-month implied volatility) Index

- Bitwise Crypto Innovators 30 Index

- MSCI Brazil USD Index

Citi 4 Unstoppable Trends:

- Artificial Intelligence (AI) – Getting more real

- Climate – Investing in innovative technologies

- Healthcare – Prescription for longevity

- Portfolio – Positioning for United States & China polarisation

6 Opportunities in Artificial Intelligence (AI):

- Reinventing Software

- Smarter Healthcare

- Financial Services New Frontier

- Rise of Robotics

- Empowering Education

- Enhanced Agriculture

6) Citi Asset Allocation 2025

7) Citi Return Estimates 2025

The Citi Wealth Outlook 2025 was prepared by The Office of the Chief Investment Strategist in collaboration with colleagues from Citi Investment Management and our Alternative Investments team.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit