Brazil & Swiss Banking Empire Safra Group with $350 Billion Assets Heiress Esther Safra Dayan Age 47 Sells Shares to Brothers Jacob Safra Age 49 & David Safra Age 40, Alberto Safra Filed Lawsuit in New York in 2023 Against Mother & 2 Brothers for Diluting His Shares, 4 Siblings Inherited Less than Half of $14 Billion Fortune Left by Late Brazilian Tycoon Joseph Safra in 2020

5th February 2025 | Hong Kong

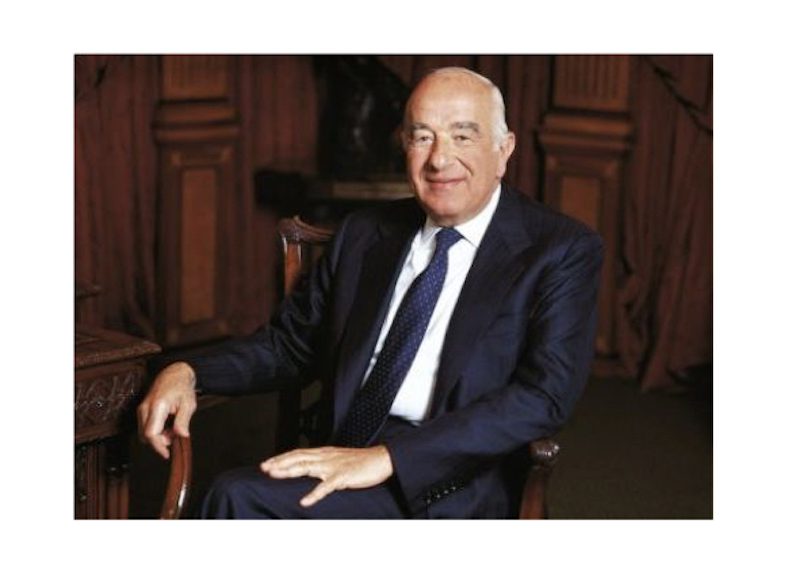

Brazil & Switzerland banking empire Safra Group ($350 billion assets) heiress Esther Safra Dayan (Age 47) has sold her shares in Safra Group to her brothers Jacob Safra (Age 49) & David Safra (Age 40). In 2023, Brazil & Switzerland banking empire Safra Group banking heir Alberto Safra has filed a lawsuit in New York against his mother (Vicky Safra) & his 2 brothers (Jacob Safra & David Safra) for engaging in corporate misconducts including resulting in the diluting of his shares, with 4 siblings (Alberto, Jacob, David, Esther Safra Dayan) inheriting less than half of the $14 billion fortune left by the late Brazilian tycoon Joseph Safra in 2020. The lawsuit was filed in New York state court by Alberto Safra on Monday (6/2/23). Profile (2022) – The J. Safra Group, with total assets under management of $208 billion and aggregate stockholder equity of $17.4 billion, is controlled by the late Joseph Safra family. The group consists of privately owned banks under the Safra name and investment holdings in asset-based business sectors such as real estate and agribusiness.

“ Brazil & Swiss Banking Empire Safra Group with $350 Billion Assets Heiress Esther Safra Dayan Age 47 Sells Shares to Brothers Jacob Safra Age 49 & David Safra Age 40, Alberto Safra Filed Lawsuit in New York in 2023 Against Mother & 2 Brothers for Diluting His Shares, 4 Siblings Inherited Less than Half of $14 Billion Fortune Left by Late Brazilian Tycoon Joseph Safra in 2020 “

Brazil & Swiss Banking Empire Safra Banking Heir Alberto Safra Files Lawsuit in New York Against Mother & 2 Brothers for Diluting His Shares, 4 Siblings Inherited Less than Half of $14 Billion Fortune Left by Late Brazilian Tycoon Joseph Safra in 2020

11th February 2023 – Brazil & Switzerland banking empire Safra Group banking heir Alberto Safra has filed a lawsuit in New York against his mother (Vicky Safra) & his 2 brothers (Jacob Safra & David Safra) for engaging in corporate misconducts including resulting in the diluting of his shares, with 4 siblings (Alberto, Jacob, David, Esther Safra Dayan) inheriting less than half of the $14 billion fortune left by the late Brazilian tycoon Joseph Safra in 2020. The lawsuit was filed in New York state court by Alberto Safra on Monday (6/2/23). The J. Safra Group, with total assets under management of $208 billion and aggregate stockholder equity of $17.4 billion, is controlled by the late Joseph Safra family. The group consists of privately owned banks under the Safra name and investment holdings in asset-based business sectors such as real estate and agribusiness.

J. Safra Group

The J. Safra Group, with total assets under management of $208 billion and aggregate stockholder equity of $17.4 billion, is controlled by the late Joseph Safra family. The group consists of privately owned banks under the Safra name and investment holdings in asset-based business sectors such as real estate and agribusiness. The group’s real estate holdings consist of more than 200 premier commercial, residential, retail and farmland properties worldwide. Its investments in other sectors include agribusiness holdings in Brazil and Chiquita Brands International. More than 29,000 employees are associated with the J. Safra Group.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit