South Korea $20 Billion Defence Company Hanwha Aerospace Share Price Increased +2,808% in Last 5 Years, +171.3% in Last 12 Months & +73.3% YTD, Hanwha Aerospace (Samsung Techwin) Acquired by Hanwha Corporation in 2014, Founded in 1977 as Samsung Precision, Renamed as Samsung Aerospace in 1987 & IPO on Korea Stock Exchange in 1988, Renamed to Samsun Techwin in 2000

29th March 2025 | Hong Kong

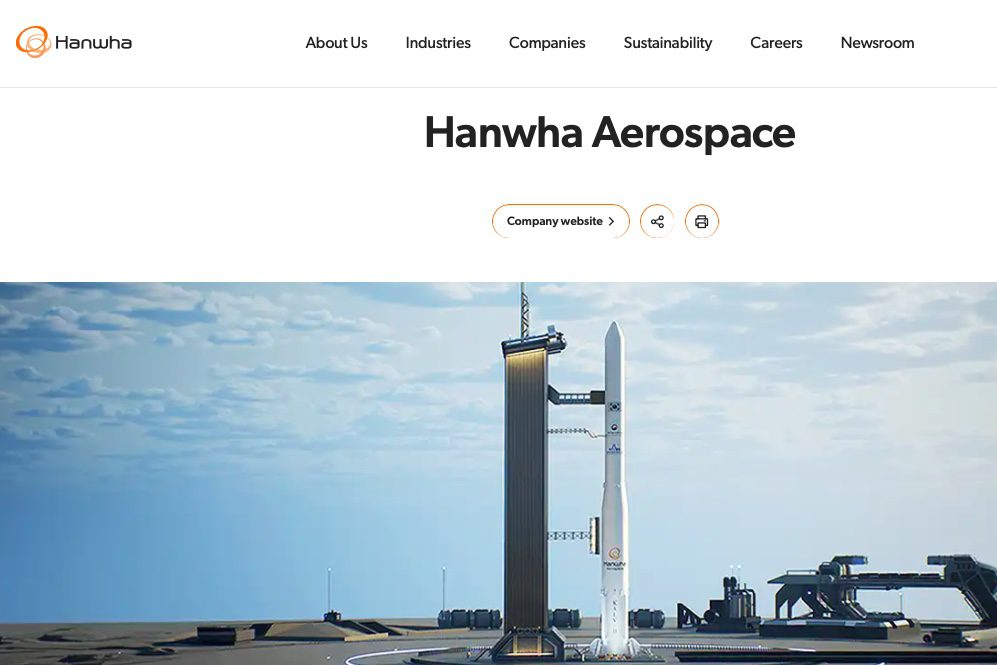

South Korea defence company Hanwha Aerospace ($20 billion market value) share price has increased +2,808% in the last 5 years, +171.3% in last 12 months & +73.3% YTD. Hanwha Aerospace (Samsung Techwin) was acquired by Hanwha Corporation in 2014. The company was founded in 1977 as Samsung Precision, renamed as Samsung Aerospace in 1987 & IPO on Korea Stock Exchange in 1988. In 2000, Samsung Aerospace was renamed to Samsun Techwin. Hanwha Aerospace – Since founded in 1977, Hanwha Aerospace has become a leading company in South Korea by expanding its business into spaceㆍaviation and defense. With an unwavering focus on customer-centric quality management, technological innovation, and product competitiveness reinforced by advanced technologies, the company is surging forward as a global leader by providing total solutions that speak to needs in both the commercial field (space and aviation) as well as those in defense (land, naval, and air). For 25 years, Hanwha Aerospace’s business has advanced in line with Korea’s journey in space development. Starting with the development of the Korean Sounding Rocket-III (KSR-III) in 1999, our journey bore fruit in June 2022 with the successful launch of Nuri (KSLV-II), an indigenous space vehicle. This remarkable milestone turned South Korea into the seventh country in the world to put a 1.5-ton satellite into orbit with indigenous technologies. With unrivalled space engine manufacturing capability, the company has played a critical role in producing key components, including the 75-ton liquid rocket engine, fuel feed valves, and attitude control systems, improving the country’s space technological prowess, and enhancing the space sovereignty of South Korea. In December 2022, Hanwha Aerospace was appointed the system integrator for KSLV upgrades in recognition of our business acumen and technological expertise. In 2023, it successfully participated in the third launch of the KSLV-II rocket after upgrading the indigenous space vehicle. The company aims to launch four additional vehicles by 2027, an achievement that will upgrade existing technologies and solidify our presence in the space industry ecosystem.

“ South Korea $20 Billion Defence Company Hanwha Aerospace Share Price Increased +2,808% in Last 5 Years, +171.3% in Last 12 Months & +73.3% YTD, Hanwha Aerospace (Samsung Techwin) Acquired by Hanwha Corporation in 2014, Founded in 1977 as Samsung Precision, Renamed as Samsung Aerospace in 1987 & IPO on Korea Stock Exchange in 1988, Renamed to Samsun Techwin in 2000 “

South Korea $20 Billion Defence Company Hanwha Aerospace Share Price Increased +2,808% in Last 5 Years, +171.3% in Last 12 Months & +73.3% YTD, Hanwha Aerospace (Samsung Techwin) Acquired by Hanwha Corporation in 2014, Founded in 1977 as Samsung Precision, Renamed as Samsung Aerospace in 1987 & IPO on Korea Stock Exchange in 1988, Renamed to Samsun Techwin in 2000

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit