The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Investment / Alternatives Summit - March / Oct / Nov

Investment Day - March / July / Sept / Oct / Nov

Private Wealth Summit - April / Oct / Nov

Family Office Summit - April / Oct / Nov

View Events | Register

This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $30 billion.

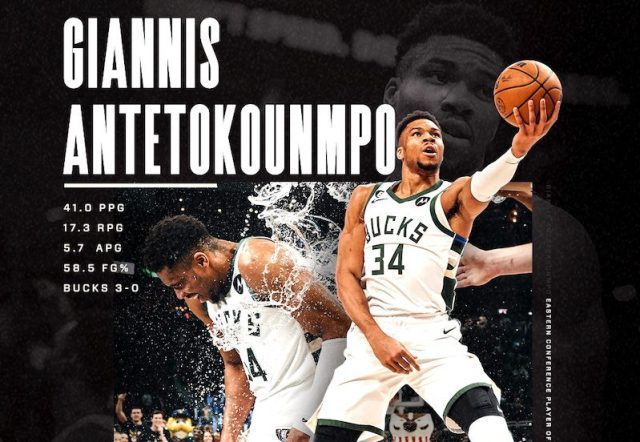

$12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation, New Owners Own NFL Cleveland Browns & Major League Soccer Club Columbus Crew

4th March 2023 | Hong Kong

Untied States private equity group Avenue Capital ($12.5 billion AUM) founder Marc Lasry is selling NBA basketball team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 billion valuation, with the new owners also owning 2 major sports team in United States (NFL Cleveland Browns & Major League Soccer (MLS) club Columbus Crew). NBA basketball team Milwaukee Bucks is currently one of the leading basketball team in NBA, and recently won the NBA championships in 2021. In 2022 December, billionaires Mat Ishbia & his brother Justin Ishbia has bought a majority stake in NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value. AUM ~ Assets under management. More info below.

“ $12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation, New Owners Own NFL Cleveland Browns & Major League Soccer Club Columbus Crew “

Caproasia Access | Events | Summits | Register Events | The Financial Centre

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Basic Member: $5 Monthly | $60 Yearly

Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680)

Hong Kong | Singapore

March / July / Sept / Oct / Nov

Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Join 20+ CIOs & Senior investment team, with > 60% single family offices with $300 million AUM. Taking place in Hong Kong and in Singapore. Every March, July, Sept, Oct & Nov.

Visit | Register here

10th April & 16th Oct Hong Kong Ritz Carlton | 24th April & 6th Nov Singapore Amara Sanctuary Resort

Join 80 single family offices & family office professionals in Hong Kong & Singapore

Links: 2025 Family Office Summit | Register here

March / Oct / Nov in Hong Kong & Singapore

Join leading asset managers, hedge funds, boutique funds, private equity, venture capital & real estate firms in Hong Kong, Singapore & Asia-Pacific at the Investment / Alternatives Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

April / Oct / Nov in Hong Kong & Singapore

Join CEOs, CIOs, Head of Private Banking, Head of Family Offices & Product Heads at The Private Wealth Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

Avenue Capital Group is a global investment firm that was founded in 1995 by its Senior Principals, Marc Lasry and Sonia Gardner. The firm is primarily focused on specialty lending, distressed debt and other special situations investments in the United States, Europe and Asia. The Senior Principals and the Senior Portfolio Managers have spent virtually their entire careers in this investment strategy. Headquartered in New York, with three offices across Europe, four offices throughout Asia, an office in Silicon Valley and an office in Abu Dhabi, the firm manages assets estimated to be approximately $12.5 billion as of January 31, 2023. Avenue draws on the skills and experience of over 180 employees worldwide and maintains a well-developed infrastructure with dedicated Accounting, Operations, Legal, Risk Management, Compliance, Business Development and Information Technology Departments.

Marc Lasry Chairman, CEO & Co-Founder – Mr. Lasry co-founded Avenue Capital Group in 1995, and distressed investing has been the focus of his professional career for over 39 years. Prior to forming Amroc Investments, LLC (“Amroc”) as an independent entity, Mr. Lasry managed capital for Amroc Investments, L.P., an investment fund affiliated with the Robert M. Bass Group. Prior to that, Mr. Lasry was Co–Director of the Bankruptcy and Corporate Reorganization Department at Cowen & Company. Prior to Cowen, he was the Director of the Private Debt Department at Smith Vasiliou Management Company, the firm where he first became involved in the distressed debt markets. He spent the prior year practicing law at Angel & Frankel where he focused on bankruptcies. Mr. Lasry also clerked for the Honorable Edward Ryan, former Chief Bankruptcy Judge for the Southern District of New York. Mr. Lasry is currently a member of the Council on Foreign Relations and he has served and will continue to serve on various other boards of advisors/directors of both for-profit and not-for-profit private and public companies. Mr. Lasry graduated with a B.A. in History from Clark University (1981) and a J.D. from New York Law School (1984).

$12.5 Billion Private Equity Avenue Capital Founder Marc Lasry to Sell NBA Basketball Team Milwaukee Bucks to Jimmy & Dee Haslam at $3.5 Billion Valuation

Billionaires Mat Ishbia & Brother Justin Ishbia Buy Majority Stake in NBA Teams Phoenix Suns & WNBA Phoenix Mercury at $4 Billion Market Value, Owns United States Largest Mortgage Lender United Wholesale Mortgage Which IPO via SPAC in 2021 at $16 Billion Valuation

22nd December 2022 – Billionaires Mat Ishbia & his brother Justin Ishbia has bought a majority stake in NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value. Billionaires Mat Ishbia & his brother Justin Ishbia family (founded by father Jeff Ishbia in 1986) owns United States largest wholesale mortgage lender United Wholesale Mortgage, which IPO via SPAC listing in 2021 at $16 billion valuation. United Wholesale Mortgage was launched as a side job by Jeff Ishbia while working as an attorney. See transaction announcement below.

Founded in 1968, the Phoenix Suns are one of the NBA’s premier franchises. Under Sarver’s stewardship, the team made seven playoff appearances, four trips to the western conference finals and one NBA finals appearance. The Phoenix Mercury, founded in 1997, were one of eight founding members of the WNBA and the only remaining team to still be in business and operated by its original NBA team owner. The Mercury under Sarver’s ownership made 14 playoff appearances, including a current record 10 consecutive, appeared in four WNBA finals, and won three WNBA championships.

Announcement – NBA teams Phoenix Suns & WNBA Phoenix Mercury at $4 billion market value

Group Led by Mat Ishbia Agrees to Acquire Majority Stake in Phoenix Suns and Mercury Basketball Teams

Robert Sarver, managing partner of Suns Legacy Holdings (owner of the Phoenix Suns and Mercury), and Mat Ishbia, Chairman and CEO of United Wholesale Mortgage, today announced that Mat and his brother Justin have reached an agreement to purchase a majority stake in the franchises, pending approval from the NBA. Mat will serve as Governor and Justin will serve as alternate Governor.

The agreement values the Suns and Mercury at $4 billion. The deal involves the sale of more than 50% ownership of the team including all of Robert Sarver’s interest, and a portion of the interest of minority partners, who were also granted additional sale rights.

“Mat is the right leader to build on franchise legacies of winning and community support and shepherd the Suns and Mercury into the next era,” said Sarver, who acquired control of both teams in 2004 and oversaw the two winningest records of major professional sports franchises in Arizona. “As a former collegiate basketball player and national champion, Mat has exactly the right spirit, commitment and resources to pursue championships. Equally important, though, is his philanthropic outlook and commitment to using sports as a way to elevate and connect people. I know he shares my unwavering support for women’s basketball and I look forward to watching him become a unifying force across the Valley of the Sun.”

While the deal is pending league approval, Ishbia said: “I am extremely excited to be the next Governor of the Phoenix Suns and Mercury. Both teams have an incredibly dynamic fan base and I have loved experiencing the energy of the Valley over the last few months. Basketball is at the core of my life, from my high school days as a player to the honor of playing for Coach Izzo and winning a national title at Michigan State University. I’ve spent the last two decades building my mortgage business, United Wholesale Mortgage, into the number one mortgage lender in America and I’m confident that we can bring that same level of success to these great organizations on and off the floor. This is a dream come true for my entire family including my parents, my three children, and my brother Justin, who will be making a significant investment with me and bring his incredible business acumen and shared passion for basketball. I appreciate Robert Sarver’s time and support throughout the process. We are so honored to be, with approval by the NBA, the next stewards of the Phoenix Suns and Phoenix Mercury.”

Phoenix Suns

Founded in 1968, the Phoenix Suns are one of the NBA’s premier franchises. Under Sarver’s stewardship, the team made seven playoff appearances, four trips to the western conference finals and one NBA finals appearance. The Phoenix Mercury, founded in 1997, were one of eight founding members of the WNBA and the only remaining team to still be in business and operated by its original NBA team owner. The Mercury under Sarver’s ownership made 14 playoff appearances, including a current record 10 consecutive, appeared in four WNBA finals, and won three WNBA championships.

For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm.

Join Events & Find Services

Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services.

Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at angel@caproasia.com or mail@caproasia.com

Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets?

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

2020 List of Private Banks in Hong Kong

2020 List of Private Banks in Singapore

2020 Top 10 Largest Family Office

2020 Top 10 Largest Multi-Family Offices

2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion

2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM

For Investors | Professionals | Executives

Latest data, reports, insights, news, events & programs

Everyday at 2 pm

Direct to your inbox

Save 2 to 8 hours per week. Organised for success

Register Below

Get Ahead in 60 Seconds. Join 10,000 +

Save 2 to 8 hours weekly. Organised for Success.

Sign Up / Register

Please click on desktop.

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Contact Us

For Enquiries, Membershipmail@caproasia.com, angel@caproasia.com

For Listing, Subscription

mail@caproasia.com, claire@caproasia.com

For Press Release, send to:

press@caproasia.com

For Events & Webinars

events@caproasia.com

For Media Kit, Advertising, Sponsorships, Partnerships

angel@caproasia.com

For Research, Data, Surveys, Reports

research@caproasia.com

For General Enquiries

mail@caproasia.com

a financial information technology co.

since 2014