The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Investment / Alternatives Summit - March / Oct / Nov

Investment Day - March / July / Sept / Oct / Nov

Private Wealth Summit - April / Oct / Nov

Family Office Summit - April / Oct / Nov

View Events | Register

This site is for accredited investors, professional investors, investment managers and financial professionals only. You should have assets around $3 million to $300 million or managing $20 million to $30 billion.

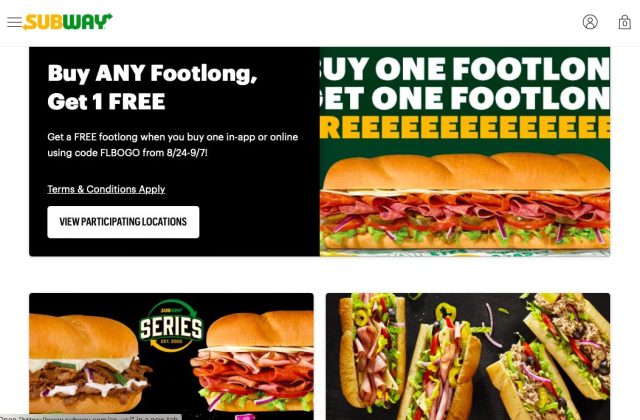

$37 Billion Private Equity Firm Roark Capital to Buy Subway for $9.55 Billion if All Milestones are Met or $8.95 Billion if Milestones are Not Met, Subway Founded in 1965 with $1,000 by 2 Families 17-Year Old Fred DeLuca and Nuclear Physicist Dr Peter Buck with First Restaurant Opened as Pete’s Super Submarines

25th August 2023 | Hong Kong

Private equity firm Roark Capital with $37 billion AUM (Assets under Management) has announced to buy Subway for $9.55 billion if all milestones are met or $8.95 billion if milestones are not met. Subway was founded in 1965 by 2 families 17-year old Fred Deluca and Dr Peter Buck (nuclear physicist) with the first restaurant opened as Pete’s Super Submarines (United States). Subway has more than 37,000 restaurants in over 100 countries. History – The Subway® story began in 1965 when 17-year-old Fred DeLuca asked his family friend, Dr. Peter Buck, a nuclear physicist, for advice on how to pay his college tuition. With an idea to open a submarine sandwich shop and an initial $1,000 investment from Dr. Buck, the two formed a business partnership that would ultimately change the landscape of the quick service restaurant industry. The partners opened their first restaurant in Bridgeport, Connecticut, in August of 1965, where they served freshly-made, customizable and affordable sandwiches to local guests. By 1974, Fred and Dr. Buck owned and operated 16 submarine sandwich shops throughout Connecticut. But, to take the brand even further and reach their 32-restaurant goal in time, the pair decided to begin franchising — a business model that launched the Subway® brand into a period of incredible growth and popularity. More info below:

“ $37 Billion Private Equity Firm Roark Capital to Buy Subway for $9.55 Billion if All Milestones are Met or $8.95 Billion if Milestones are Not Met, Subway Founded in 1965 with $1,000 by 2 Families 17-Year Old Fred DeLuca and Nuclear Physicist Dr Peter Buck with First Restaurant Opened as Pete’s Super Submarines “

Caproasia Access | Events | Summits | Register Events | The Financial Centre

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

Basic Member: $5 Monthly | $60 Yearly

Newsletter Daily 2 pm (Promo): $20 Monthly | $180 Yearly (FP: $680)

Hong Kong | Singapore

March / July / Sept / Oct / Nov

Private Equity, Hedge Funds, Boutique Funds, Private Markets & more. Join 20+ CIOs & Senior investment team, with > 60% single family offices with $300 million AUM. Taking place in Hong Kong and in Singapore. Every March, July, Sept, Oct & Nov.

Visit | Register here

10th April & 16th Oct Hong Kong Ritz Carlton | 24th April & 6th Nov Singapore Amara Sanctuary Resort

Join 80 single family offices & family office professionals in Hong Kong & Singapore

Links: 2025 Family Office Summit | Register here

March / Oct / Nov in Hong Kong & Singapore

Join leading asset managers, hedge funds, boutique funds, private equity, venture capital & real estate firms in Hong Kong, Singapore & Asia-Pacific at the Investment / Alternatives Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

April / Oct / Nov in Hong Kong & Singapore

Join CEOs, CIOs, Head of Private Banking, Head of Family Offices & Product Heads at The Private Wealth Summit. Join as delegate, speaker, presenter, partner & sponsor.

Visit | Register here

John Chidsey, CEO of Subway: “This transaction reflects Subway’s long-term growth potential, and the substantial value of our brand and our franchisees around the world. Subway has a bright future with Roark, and we are committed to continuing to focus on a win-win-win approach for our franchisees, our guests and our employees.”

$37 Billion Private Equity Firm Roark Capital to Buy Subway for $9.55 Billion if All Milestones are Met or $8.95 Billion if Milestones are Not Met

24th August 2023 – Subway today announced that it has entered into a definitive agreement to be acquired by affiliates of Roark Capital. The transaction is a major milestone in Subway’s multi-year transformation journey, combining Subway’s global presence and brand strength with Roark’s deep expertise in restaurant and franchise business models. Roark is a private equity firm with $37 billion in assets under management. Roark focuses on investments in consumer and business service companies, with a specialization in franchise and franchise-like businesses, and prides itself on being a trusted partner for management and business owners.

The transaction comes on the heels of Subway announcing its 10th consecutive quarter of positive same store sales. The company will continue to execute its strategy with a focus on sales growth, menu innovation, modernization of restaurants, overall guest experience improvements, and international expansion.

J.P. Morgan is serving as financial advisor and Sullivan & Cromwell LLP is serving as legal counsel to Subway. Timing is subject to regulatory approvals and customary closing conditions.

About Subway® Restaurants

As one of the world’s largest quick service restaurant brands, Subway serves freshly made-to-order sandwiches, wraps, salads and bowls to millions of guests, across more than 100 countries in nearly 37,000 restaurants every day. Subway restaurants are owned and operated by Subway franchisees – a network that includes thousands of dedicated entrepreneurs and small business owners – who are committed to delivering the best guest experience possible in their local communities.

About Roark Capital

Roark is an Atlanta-based private equity firm with $37 billion in assets under management. Roark focuses on investments in consumer and business service companies, with a specialization on franchise and multi-location businesses in the retail, restaurant, consumer and business services sectors.

For Investment Managers, Hedge Funds, Boutique Funds, Private Equity, Venture Capital, Professional Investors, Family Offices, Private Bankers & Advisors, sign up today. Subscribe to Caproasia and receive the latest news, data, insights & reports, events & programs daily at 2 pm.

Join Events & Find Services

Join Investments, Private Wealth, Family Office events in Hong Kong, Singapore, Asia-wide. Find hard-to-find $3 million to $300 million financial & investment services at The Financial Centre | TFC. Find financial, investment, private wealth, family office, real estate, luxury investments, citizenship, law firms & more. List hard-to-find financial & private wealth services.

Have a product launch? Promote a product or service? List your service at The Financial Centre | TFC. Join interviews & editorial and be featured on Caproasia.com or join Investments, Private Wealth, Family Office events. Contact us at angel@caproasia.com or mail@caproasia.com

Caproasia.com | The leading source of data, research, information & resource for financial professionals, investment managers, professional investors, family offices & advisors to institutions, billionaires, UHNWs & HNWs. Covering capital markets, investments and private wealth in Asia. How do you invest $3 million to $300 million? How do you manage $20 million to $3 billion of assets?

The 2025 Investment Day | 2025 Family Office Summits | Family Office Circle

2020 List of Private Banks in Hong Kong

2020 List of Private Banks in Singapore

2020 Top 10 Largest Family Office

2020 Top 10 Largest Multi-Family Offices

2020 Report: Hong Kong Private Banks & Asset Mgmt - $4.49 Trillion

2020 Report: Singapore Asset Mgmt - $3.48 Trillion AUM

For Investors | Professionals | Executives

Latest data, reports, insights, news, events & programs

Everyday at 2 pm

Direct to your inbox

Save 2 to 8 hours per week. Organised for success

Register Below

Get Ahead in 60 Seconds. Join 10,000 +

Save 2 to 8 hours weekly. Organised for Success.

Sign Up / Register

Please click on desktop.

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit

Contact Us

For Enquiries, Membershipmail@caproasia.com, angel@caproasia.com

For Listing, Subscription

mail@caproasia.com, claire@caproasia.com

For Press Release, send to:

press@caproasia.com

For Events & Webinars

events@caproasia.com

For Media Kit, Advertising, Sponsorships, Partnerships

angel@caproasia.com

For Research, Data, Surveys, Reports

research@caproasia.com

For General Enquiries

mail@caproasia.com

a financial information technology co.

since 2014