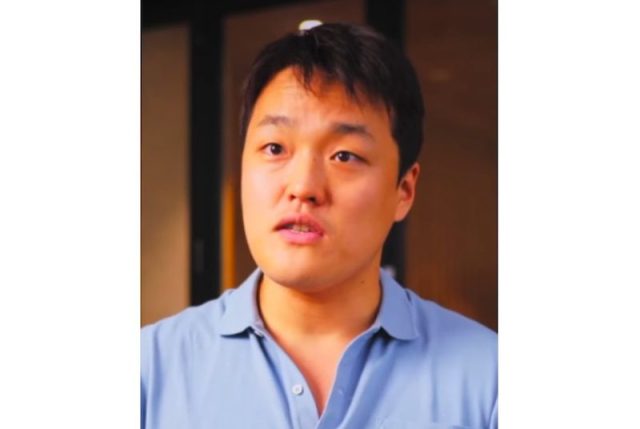

United States SEC Fines Terraform Labs & South Korean Co-founder Do Kwon $4.5 Billion & to Wind Down with Do Kwon to Pay $204 Million in Settlement Agreement for Misleading Investors in Collapse of Terra Platform with $40 Billion Losses Between TerraUSD & Cryptocurrency LUNA, TerraUSD was Supposedly Pegged to USD But Do Kwon & Terraform Had Secretly Used 3rd Party to Buy TerraUSD to Support the Price, New York Court Convicted Do Kwon Guilty of Civil Fraud in 2024 April

18th June 2024 | Hong Kong

The United States SEC (Securities & Exchange Commission) has fined Terraform Labs & South Korean Co-founder Do Kwon $4.5 billion and Terraform to wind down with Do Kwon to pay $204 million in settlement agreement for misleading investors in the collapse of Terra platform with $40 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). TerraUSD was supposedly pegged to USD but Do Kwon & Terraform had secretly used a 3rd-party to buy TerraUSD to support the price. In 2024 April, a United States New York court jury has convicted Terraform co-founder & South Korean Do Kwon guilty of civil fraud. United States SEC (13/6/24): “The Securities and Exchange Commission today announced that Terraform Labs PTE, Ltd. and Do Kwon agreed to pay more than $4.5 billion following a unanimous jury verdict holding them liable for orchestrating a years-long fraud involving crypto asset securities that led to massive investor losses when the scheme unraveled. A nine-day jury trial in April exposed the extent of the defendants’ lies to victims about the false use of the Terraform blockchain to settle transactions and about the stability of their crypto asset security, UST. The SEC also offered evidence at trial showing that, in May 2022, after UST de-pegged from the U.S. dollar, the price of UST and Terraform’s other tokens plummeted to close to zero. This wiped out $40 billion in market value nearly overnight and caused devastating losses to countless investors, including numerous retail investors who believed defendants’ lies and poured their life savings into Terraform’s ecosystem. The SEC charged Terraform and Kwon in U.S. District Court for the Southern District of New York on February 16, 2023, with securities fraud and for offering and selling securities in unregistered transactions. On December 28, 2023, the District Court found Terraform and Kwon liable for offering and selling crypto asset securities in unregistered transactions. On January 21, 2024, Terraform filed a voluntary Chapter 11 petition in the U.S. Bankruptcy Court for the District of Delaware. On April 5, 2024, a jury unanimously found Terraform and Kwon liable for securities fraud after less than two hours of deliberation. As part of the settlement, Terraform agreed to pay $3,586,875,883 in disgorgement, $466,952,423 in prejudgment interest, and a $420,000,000 civil penalty. Terraform also agreed to stop selling its crypto asset securities, wind down its operations, replace two of its directors, and distribute its remaining assets to investor victims and creditors through a liquidation plan, subject to approval by the court in Terraform’s pending bankruptcy case. Kwon agreed to pay $110,000,000 in disgorgement and $14,320,196 in prejudgment interest on a joint and several basis with Terraform, as well as an $80,000,000 civil penalty. In addition, the defendants consented to the entry of a final judgment permanently enjoining them from violating the registration and fraud provisions they violated. Earlier in March 2024, Terraform co-founder & South Korean Do Kwon was jailed 4 months in Montenegro, and will be extradited to South Korea instead of United States in a Montenegro court ruling. In 2023 June, Do Kwon (Age 31) was sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. In January 2024, Singapore-based Terraform Labs had filed for Chapter 11 Bankruptcy Protection in United States Delaware with assets & liabilities of $100 million to $500 million (21/1/24). More info below.

” United States SEC Fines Terraform Labs & South Korean Co-founder Do Kwon $4.5 Billion & to Wind Down with Do Kwon to Pay $204 Million in Settlement Agreement for Misleading Investors in Collapse of Terra Platform with $40 Billion Losses Between TerraUSD & Cryptocurrency LUNA, TerraUSD was Supposedly Pegged to USD But Do Kwon & Terraform Had Secretly Used 3rd Party to Buy TerraUSD to Support the Price, New York Court Convicted Do Kwon Guilty of Civil Fraud in 2024 April “

SEC Chair Gary Gensler: “This case affirms what court after court has said: The economic realities of a product—not the labels, the spin, or the hype—determine whether it is a security under the securities laws. Terraform and Do Kwon’s fraudulent activities caused devastating losses for investors, in some cases wiping out entire life savings. Their fraud serves as a reminder that, when firms fail to comply with the law, investors get hurt. Terraform and Kwon fought our efforts to investigate – taking a fight over investigative subpoenas all the way to the Supreme Court. Thankfully, with this settlement, the victims of their massive fraud will now get some justice.”

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement: “Do Kwon and Terra orchestrated one of the largest securities frauds in U.S. history by, among other things, falsely claiming that they had achieved the Holy Grail of crypto: a non-illicit use case. As the jury found, that was a lie, as was their claim of creating an ‘algorithmic stablecoin.’ In the end, all they succeeded in doing was lying to investors, wiping out tens of billions of dollars in market value, and creating a trail of victims. Today’s multi-billion dollar settlement not only holds them accountable and prioritizes the return of hundreds of millions of dollars to harmed investors, but also makes clear that, despite the vast resources that crypto asset defendants deploy against us, the dedicated staff of the Division of Enforcement will not stop until they achieve justice for the victims of these breathtaking frauds.”

The litigation is being handled by Devon Staren, Laura Meehan, Christopher Carney, and Carina Cuellar from the Trial Unit, as well as Roger Landsman, and supervised by James Connor and Jorge Tenreiro. The SEC is represented in Terraform’s bankruptcy case by Therese Scheuer, Michael Kelly, and William Uptegrove, with supervision by Alistaire Bambach. The investigation was conducted by Mr. Landsman, Elisabeth Goot, Kathleen Hitchins, James Murtha, Daniel Koster, Donald Battle, and David Crosbie and was supervised by Reid Muoio, Osman Nawaz, Mr. Tenreiro, and David Hirsch from the Complex Financial Instruments and Crypto Assets and Cyber Units.

Terraform Labs & South Korean Co-founder Do Kwon Reached Settlement Agreement with United States SEC for Misleading Investors in Collapse of Terra Platform with $40 Billion Losses Between TerraUSD & Cryptocurrency LUNA, TerraUSD was Supposedly Pegged to USD But Do Kwon & Terraform Had Secretly Used 3rd Party to Buy TerraUSD to Support the Price, New York Court Convicted Do Kwon Guilty of Civil Fraud in 2024 April

5th June 2024 – Terraform Labs & South Korean Co-founder Do Kwon have reached a settlement agreement with United States SEC (Securities & Exchange Commission) for misleading investors in the collapse of Terra platform with $40 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). TerraUSD was supposedly pegged to USD but Do Kwon & Terraform had secretly used a 3rd-party to buy TerraUSD to support the price. In 2024 April, a United States New York court jury has convicted Terraform co-founder & South Korean Do Kwon guilty of civil fraud. Earlier in March 2024, Terraform co-founder & South Korean Do Kwon was jailed 4 months in Montenegro, and will be extradited to South Korea instead of United States in a Montenegro court ruling. In 2023 June, Do Kwon (Age 31) was sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. In January 2024, Singapore-based Terraform Labs had filed for Chapter 11 Bankruptcy Protection in United States Delaware with assets & liabilities of $100 million to $500 million (21/1/24). More info below.

United States New York Court Convicts Terraform Co-founder & South Korean Do Kwon Guilty of Civil Fraud in Collapse of Terra Platform with $40 Billion Losses Between TerraUSD & Cryptocurrency LUNA, TerraUSD was Supposedly Pegged to USD But Do Kwon & Terraform Had Secretly Used 3rd Party to Buy TerraUSD to Support the Price

8th April 2024 – A United States New York court jury has convicted Terraform co-founder & South Korean Do Kwon guilty of civil fraud in the collapse of Terra platform with $40 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). TerraUSD was supposedly pegged to USD but Do Kwon & Terraform had secretly used a 3rd-party to buy TerraUSD to support the price. Earlier in March 2024, Terraform co-founder & South Korean Do Kwon was jailed 4 months in Montenegro, and will be extradited to South Korea instead of United States in a Montenegro court ruling. In 2023 June, Do Kwon (Age 31) was sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. In January 2024, Singapore-based Terraform Labs had filed for Chapter 11 Bankruptcy Protection in United States Delaware with assets & liabilities of $100 million to $500 million (21/1/24). More info below.

Terraform Co-founder & South Korean Do Kwon Jailed 4 Months in Montenegro to be Extradited to South Korea Instead of United States in Montenegro Court Ruling, Charged in United States for Fraud in Collapse of Terra Platform with $60 Billion Losses Between TerraUSD & Cryptocurrency LUNA

9th March 2024 – Terraform co-founder & South Korean Do Kwon jailed 4 months in Montenegro will be extradited to South Korea instead of United States in a Montenegro court ruling. In 2023 June, Do Kwon (Age 31) was sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. In January 2024, Singapore-based Terraform Labs had filed for Chapter 11 Bankruptcy Protection in United States Delaware with assets & liabilities of $100 million to $500 million (21/1/24). More info below.

Singapore-Based Terraform Labs Files for Chapter 11 Bankruptcy Protection in United States Delaware with Assets & Liabilities of $100 Million to $500 Million, Co-founder & South Korean Do Kwon Jailed 4 Months in Montenegro for Using Forged Passports after Arrest in Montenegrin Airport & Found with Forged Costa Rica & Belgium Passports, Charged in United States for Fraud in Collapse of Terra Platform with $60 Billion Losses Between TerraUSD & Cryptocurrency LUNA

24th January 2024 – Singapore-based Terraform Labs has filed for Chapter 11 Bankruptcy Protection in United States Delaware with assets & liabilities of $100 million to $500 million (21/1/24). In June 2023, Terraform co-founder & South Korean Do Kwon (Age 31) had been sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. More info below.

Terraform Co-founder & South Korean Do Kwon Jailed 4 Months in Montenegro for Using Forged Passports after Arrest in Montenegrin Airport & Found with Forged Costa Rica & Belgium Passports, Charged in United States for Fraud in Collapse of Terra Platform with $60 Billion Losses Between TerraUSD & Cryptocurrency LUNA

21st June 2023 – Terraform co-founder & South Korean Do Kwon (Age 31) had been sentenced to 4 months jail in Montenegro for using forged passports after being arrested in Montenegrin Airport (March 2023), and found with forged Costa Rica & Belgium passports. Montenegro is a country in Southeastern Europe, and is bordered by Croatia, Albania, Kosovo, Bosnia & Herzegovina. Montenegro has a GDP of $5.8 billion and population of around 619,000. In 2023 March, United States prosecutors charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA (2022 May). In 2022 September, a South Korea court issued an arrest warrant for Terraform Labs Co-founder Do Kwon. More info below.

United States Charged Terraform Co-founder Do Kwon with Fraud in Collapse of Terra Platform with $60 Billion Losses Between TerraUSD & Cryptocurrency LUNA, Arrested in Montenegrin Airport & Found with Forged Costa Rica & Belgium Passports

25th March 2023 – United States prosecutors have charged Terraform co-founder Do Kwon with fraud in the collapse of Terra platform with $60 billion losses between TerraUSD & cryptocurrency LUNA, and was arrested in Montenegrin airport (Podgorica airport) on 23rd March 2023 and founded with forged Costa Rica & Belgian passports. In 2022 September, a South Korea court has issued an arrest warrant for Terraform Labs Co-founder Do Kwon. More info below.

South Korea Court Issues Arrest Warrant for Terraform Co-founder Do Kwon, Collapse of Terra Platform with $60 Billion Losses Between TerraUSD & Cryptocurrency LUNA

15th September – A South Korea court has issued an arrest warrant for Terraform Labs Co-founder Do Kwon, 4 months after the collapse of Terra platform resulting in around $60 billion losses between TerraUSD (UST) & cryptocurrency LUNA. TerraUSD (UST) (stable coin) was pegged at 1:1 to USD, but the divergence of the pricing peg led to a collapse, resulting in numerous bankruptcy of crypto exchanges and more than $2 trillion of cryptocurrencies value wiped out. In July 2022, Crypto exchange Voyager Digital filed for chapter 11 bankruptcy protection, with $1.3 billion assets, $350 million cash & $650 million claim against crypto fund Three Arrows Capital. Three Arrows Capital had been ordered into liquidation by a BVI Court (British Virgin Islands), after failing to meet creditors demand for payment including $665 million from Voyager Digital. One of the largest crypto lender Celsius Network had also filed for chapter 11 bankruptcy, with senior executives reported to have sold their crypto holdings but had encouraged investors to buy on swings & low volume.

Billionaire Mark Cuban Named in Class Action Lawsuit for Promoting Crypto Currency Platform Voyager Digital

Billionaire & NBA team Dallas Mavericks owner Mark Cuban had been named in a class action lawsuit for promoting cryptocurrency platform Voyager Digital, which had announced a 5-year sponsorship of Dallas Mavericks in 2021 and filed for bankruptcy on 6th July 2022. Mark Cuban was a client of Voyager Digital, trading on the platform itself. His comments include: “As close to risk-free as you’re gonna get in the crypto.” In the class action lawsuit, the investors alleged the Voyager Digital was a “Ponzi scheme”.

Terra

Terra is an open-source, community-owned blockchain which hosts a vibrant ecosystem of applications. On Terra, you can build applications and organizations using the available suite of cutting-edge developer tools, or simply try out existing ones by connecting a wallet. The Terra ecosystem runs on its native cryptocurrency, LUNA. You can use LUNA to pay for transaction fees on the Terra blockchain as you interact with various applications. Additionally, you can also use LUNA to earn staking rewards, purchase your favorite digital art, have a say on community-led governance proposals, and much more. Terra is permissionless and borderless, which means that its next-generation financial products are accessible to anyone in the world with an Internet connection.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- July 2024 - Hong Kong

- July 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Oct 2024 - Hong Kong

- Nov 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit