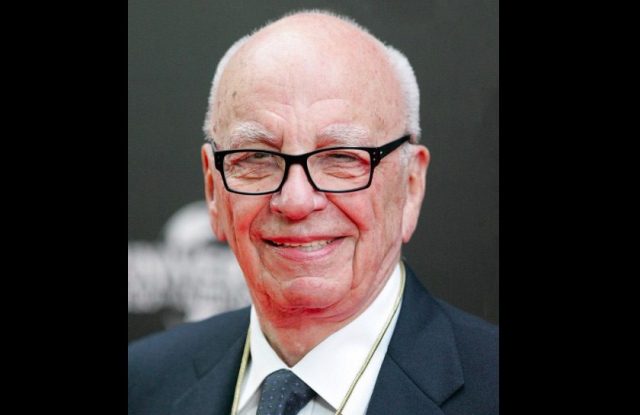

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group Increased Buyout Offer of $8.1 Billion Rejected by UK Largest Real Estate Platform Rightmove

26th September 2024 | Hong Kong

Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group increased buyout offer to $8.1 billion has been rejected by UK largest real estate platform Rightmove. In September 2024, REA Group had increased the buyout offer to $8.1 billion (GBP 6.1 billion) from $7.3 billion (GBP 5.6 billion) for Rightmove. REA Group $7.3 billion buyout offer (GBP 5.6 billion) had earlier been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

“ Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group Increased Buyout Offer of $8.1 Billion Rejected by UK Largest Real Estate Platform Rightmove “

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group Increased Buyout Offer to $8.1 Billion from $7.3 Billion for UK Largest Real Estate Platform Rightmove

24th September 2024 – Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group has increased the buyout offer to $8.1 billion (GBP 6.1 billion) from $7.3 billion (GBP 5.6 billion) for UK largest real estate platform Rightmove. REA Group $7.3 billion buyout offer (GBP 5.6 billion) had earlier been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

Rupert Murdoch $15 Billion News Corp 62%-Owned Property Listing Firm REA Group $7.3 Billion Buyout Offer Rejected by UK Largest Real Estate Platform Rightmove

19th September 2024 – Rupert Murdoch News Corp ($15 billion market value) 62%-owned property listing firm REA Group $7.3 billion buyout offer (GBP 5.6 billion) has been rejected by UK largest real estate platform Rightmove. Earlier in September 2024, Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

$15 Billion Rupert Murdoch News Corp Large Shareholder & Hedge Fund Starboard Value LP Proposes to Remove Dual-Class Share Structure Which Provides Super-Voting Rights & De Facto Control to Inheritors of Founder, News Corp Suffers from Corporate Governance Resulting in Valuation Discount, Rupert Murdoch Personal Fortune at $20 Billion

13th September 2024 – Australia media tycoon Rupert Murdoch News Corp ($15 billion market value) large shareholder Starboard Value LP (Hedge Fund) has proposed to remove dual-class share structure which provides super-voting rights & de facto control to inheritors of founder, with News Corp suffering from corporate governance resulting in valuation discount. Rupert Murdoch has a personal fortune of around $20 billion. In 2023 September, Australia media tycoon (Age 92) Rupert Murdoch with $17 billion fortune has stepped down from $14.7 billion Fox Corp & $11.3 billion News Corp, with Rupert Murdoch eldest son Lachlan Murdoch (Age 52) taking over as Chairman of News Corp and continue as Chairman & CEO of Fox Corp. News Corp CEO is Robert Thomson. In 2023 January, Rupert Murdoch (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. In April 2023, Fox Corporation & Fox News announced to pay $787.5 million settlement for a defamation lawsuit (2021) by United States voting-machine maker Dominion (Dominion Voting Systems).

Australia Media Tycoon Rupert Murdoch with $17 Billion Fortune Terminate Plans to Merge $9 Billion News Corp & $16 Billion Fox News 10 Years after Split, Brands Include Wall Street Journal, Dow Jones, The Sun, The Australian & Realtor.com

26th January 2023 – Australia media tycoon Rupert Murdoch (Age 91) with $17 billion fortune (Murdoch & the Murdoch Family Trust) News Corp and Fox News have announced the termination of the merger plan (24/1/23), first announced in October 2022. Rupert Murdoch had requested the News Corp & Fox News Board to review plan to merge $9 billion News Corp & $16 billion Fox News (market capitalisation), around 10 years after their split. News Corp owns leading brands including Wall Street Journal, Dow Jones, The Sun, The Australian, New York Post, Realtor.com & REA Group. Should the merger go through, the combined group will create a diversified global news, sport and digital giant. News Corp: “News Corp … . following the receipt of letters from K. Rupert Murdoch and the Murdoch Family Trust, has formed a Special Committee composed of independent and disinterested members of the Board to begin exploring a potential combination with Fox Corporation.”

News Corp ($9 billion) valuation comes from its $5.7 billion shareholding in REA Group, and The Dow Jones group & remain businesses are valued at $3.4 billion. Fox Corporation produces and distributes compelling news, sports and entertainment content through its primary iconic domestic brands, including FOX News Media, FOX Sports, FOX Entertainment and FOX Television Stations, and leading AVOD service Tubi.

Official Press Release – News Corp – News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) announced today that the Company’s Board of Directors, following the receipt of letters from K. Rupert Murdoch and the Murdoch Family Trust, has formed a Special Committee composed of independent and disinterested members of the Board (the “Special Committee”) to begin exploring a potential combination with Fox Corporation (“Fox”) (Nasdaq: FOXA, FOX).

The Special Committee, consistent with its fiduciary duties and in consultation with its independent financial and legal advisors, will thoroughly evaluate a potential combination with Fox. The Special Committee has not made any determination with respect to any such potential combination at this time, and there can be no certainty that the Company will engage in such a transaction.

Neither the Company nor the Special Committee intends to comment on or disclose further developments regarding the Special Committee’s work unless and until it deems further disclosure is appropriate or required.

News Corp

The company comprises businesses across a range of media, including: digital real estate services, subscription video services in Australia, news and information services and book publishing. Headquartered in New York, News Corp operates primarily in the United States, Australia, and the United Kingdom, and its content and other products and services are distributed and consumed worldwide.

Fox Corporation

Fox Corporation produces and distributes compelling news, sports and entertainment content through its primary iconic domestic brands, including FOX News Media, FOX Sports, FOX Entertainment and FOX Television Stations, and leading AVOD service Tubi.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2024 Investment Day

- March 2024 - Hong Kong

- March 2024 - Singapore

- July 2024 - Hong Kong

- July 2024 - Singapore

- Sept 2024 - Hong Kong

- Sept 2024 - Singapore

- Oct 2024 - Hong Kong

- Nov 2024 - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit