$60 Billion Top Hedge Fund Two Sigma Co-founders John Overdeck & David Siegel Moved to Arbitration Over Disagreement on Company Future, Both Announced to Step Down in 2024 August as Co-CEOs & Remain as Co-Chairs, Appointed Chief Business Officer Carter Lyons & ex-Lazard Asset Management General Counsel Scott Hoffman as Co-CEOs, Founders Disagreed on Company Leadership, Structure & Succession Plan, Cited in United States SEC Regulatory Filing on Material Risks Due to Disagreements

14th January 2025 | Hong Kong

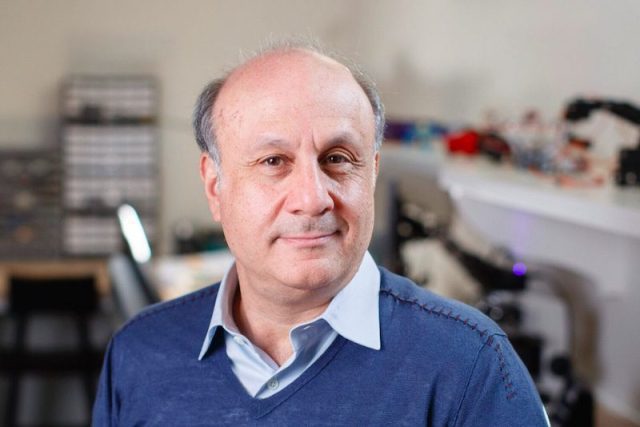

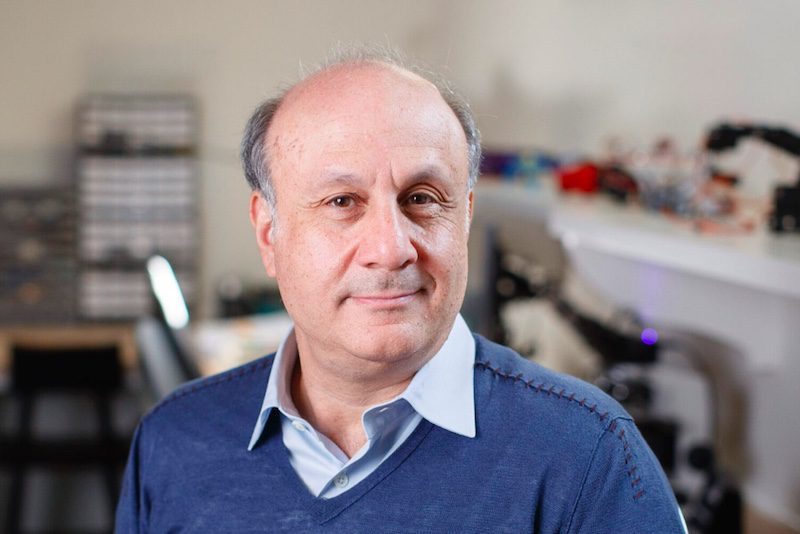

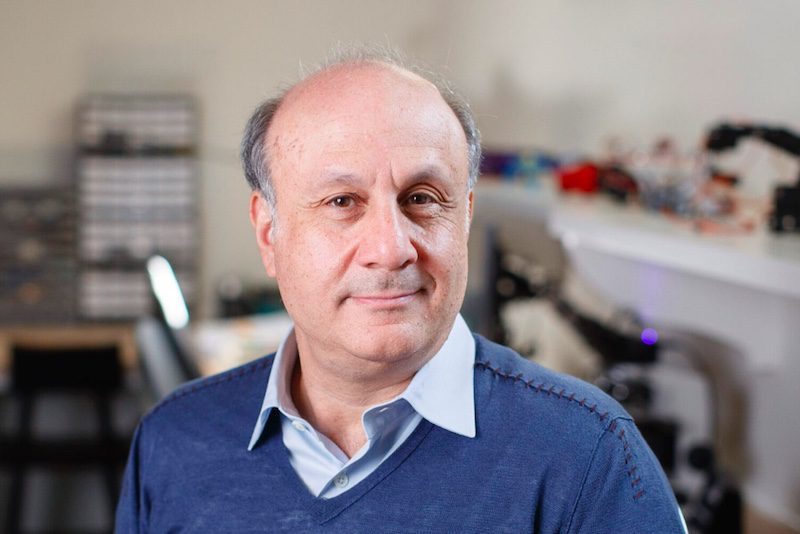

Top hedge fund Two Sigma Investments ($60 billion AUM) co-founders John Overdeck & David Siegel are moving to arbitration over their disagreement on the company future. In 2024 August, John Overdeck & David Siegel have announced to step down as Co-CEOs & remain as Co-Chairs, appointing Chief Business Officer Carter Lyons & ex-Lazard Asset Management General Counsel Scott Hoffman as Co-CEOs. In 2024 March, Two Sigma Investments ($60 billion AUM, Assets under Management) 12-year veteran & Global Head of Investor Relations David Cohen was reported to be leaving the hedge fund in May 2024. In 2023 June, Co-founders & Co-Chairmans John Overdeck & David Siegel disagreements on company leadership, structure & succession plan cited in the United States SEC (Securities and Exchange Commission) regulatory filing on material risks due to disagreements in the latest regulatory filing (29/3/24). Both co-founders John Overdeck & David Siegel are firms’ management committee. Two Sigma Investments was founded in 2001 by David Siegel, John Overdeck and Mark Pickard in 2001. View United States SEC first disagreement (2023) filing

“ $60 Billion Top Hedge Fund Two Sigma Co-founders John Overdeck & David Siegel Moved to Arbitration Over Disagreement on Company Future, Both Announced to Step Down in 2024 August as Co-CEOs & Remain as Co-Chairs, Appointed Chief Business Officer Carter Lyons & ex-Lazard Asset Management General Counsel Scott Hoffman as Co-CEOs, Founders Disagreed on Company Leadership, Structure & Succession Plan, Cited in United States SEC Regulatory Filing on Material Risks Due to Disagreements “

$60 Billion Top Hedge Fund Two Sigma Co-founders John Overdeck & David Siegel to Step Down as Co-CEOs & Remain as Co-Chairs, Appoints Chief Business Officer Carter Lyons & ex-Lazard Asset Management General Counsel Scott Hoffman as Co-CEOs, Founders Disagreed on Company Leadership, Structure & Succession Plan, Cited in United States SEC Regulatory Filing on Material Risks Due to Disagreements

30th August 2024 – Top hedge fund Two Sigma Investments ($60 billion AUM) John Overdeck & David Siegel have announced to step down as Co-CEOs & remain as Co-Chairs, appointing Chief Business Officer Carter Lyons & ex-Lazard Asset Management General Counsel Scott Hoffman as Co-CEOs. In 2024 March, Two Sigma Investments ($60 billion AUM, Assets under Management) 12-year veteran & Global Head of Investor Relations David Cohen was reported to be leaving the hedge fund in May 2024. In 2023 June, Co-founders & Co-Chairmans John Overdeck & David Siegel disagreements on company leadership, structure & succession plan cited in the United States SEC (Securities and Exchange Commission) regulatory filing on material risks due to disagreements in the latest regulatory filing (29/3/24). Both co-founders John Overdeck & David Siegel are firms’ management committee. Two Sigma Investments was founded in 2001 by David Siegel, John Overdeck and Mark Pickard in 2001. View United States SEC first disagreement (2023) filing

$60 Billion Top Hedge Fund Two Sigma 12-Year Veteran & Global Head of Investor Relations David Cohen to Leave in May 2024, Co-founders John Overdeck & David Siegel Disagreements on Company Leadership, Structure & Succession Plan, Cited in United States SEC Regulatory Filing on Material Risks Due to Disagreements

30th March 2024 – Top hedge fund Two Sigma Investments ($60 billion AUM, Assets under Management) 12-year veteran & Global Head of Investor Relations David Cohen is leaving the hedge fund in May 2024, with co-founders & co-Chairmans John Overdeck & David Siegel disagreements on company leadership, structure & succession plan cited in the United States SEC (Securities and Exchange Commission) regulatory filing on material risks due to disagreements in the latest regulatory filing (29/3/24). Both co-founders John Overdeck & David Siegel are firms’ management committee. Two Sigma Investments was founded in 2001 by David Siegel, John Overdeck and Mark Pickard in 2001. View United States SEC first disagreement (2023) filing

$60 Billion Top Hedge Fund Two Sigma Co-founders John Overdeck & David Siegel Disagreements on Company Leadership, Structure & Succession Plan, Cited in United States SEC Regulatory Filing on Material Risks Due to Disagreements

24th June 2023 – Top hedge fund Two Sigma Investments ($60 billion AUM, Assets under Management) co-founders & co-Chairmans John Overdeck & David Siegel disagreements on company leadership, structure & succession plan, were cited in the United States SEC (Securities and Exchange Commission) regulatory filing on material risks due to disagreements. Both co-founders John Overdeck & David Siegel are firms’ management committee. Two Sigma Investments was founded in 2001 by David Siegel, John Overdeck and Mark Pickard in 2001. View United States SEC filing

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit