18th Asian Financial Forum 2025 Hong Kong on 13th & 14th January Attended by More than 3,600 Delegates Globally, 100+ Key Speakers & Held 700+ 1-on-1 Deal-Making Meetings, On-Site Poll: 41.6% View Generative AI-Led Innovation is Most Critical Engine of Growth in APAC, 2 Keynote Luncheons Held with Prof Justin Lin Yifu (Chief Economist & Senior Vice President of the World Bank) & Prof Stuart Russell (Co-Chair of the World Economic Forum’s Council on AI), Alibaba Group Chairman Joe Tsai in Fireside Chat on Role of Large Companies in Supporting Start-ups & Social Enterprises

17th January 2025 | Hong Kong

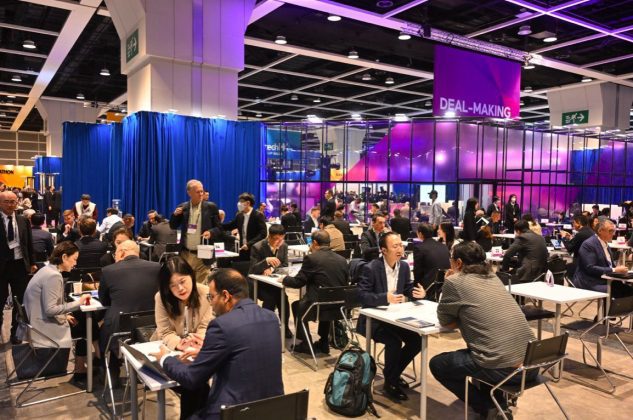

The 18th Asian Financial Forum 2025 Hong Kong on 13th & 14th January was attended by more than 3,600 delegates globally, 100+ key speakers, and held 700+ 1-on-1 Deal-making meetings. On-site Poll: 41.6% view Generative AI-led innovation is most critical engine of growth in APAC (Asia-Pacific). 2 keynote luncheons were held, with Prof Justin Lin Yifu (Chief Economist & Senior Vice President of the World Bank) & Prof Stuart Russell (Co-Chair of the World Economic Forum’s Council on AI). Alibaba Group Chairman Joe Tsai was in a fireside chat on the “Role of Large Companies in Supporting Start-ups & Social Enterprises.” Announcement (14/1/25): “The 18th Asian Financial Forum (AFF), co-organised by the Hong Kong Special Administrative Region (HKSAR) Government and the Hong Kong Trade Development Council (HKTDC), successfully wrapped up today under the theme “Powering the Next Growth Engine”. This year’s forum attracted over 3,600 global financial and business elites from more than 50 countries and regions. The event leveraged Hong Kong’s role as an international financial centre to strengthen the international communication platform, foster multilateral cooperation and promote mutually beneficial outcomes. Three high-level Mainland China officials attended the Opening Session of the AFF yesterday, including Zhou Ji, Executive Vice Director of the Hong Kong and Macao Affairs Office of the State Council of the People’s Republic of China and Hong Kong and Macao Affairs Office of the State Council; Dr Pan Gongsheng, Governor of the People’s Bank of China; and Liu Zhenmin, Special Envoy for Climate Change of China. As the year’s first large-scale international financial and business event in the region, the atmosphere at the AFF was vibrant and charged with a positive energy. The forum showcased emerging perspectives across the diverse sessions, all of which were well-attended and well-received by speakers and audiences alike. Leaders from around the world actively engaged in discussion throughout the two-day event, with more than 130 policymakers, international financial and multilateral organisation representatives, financial institutions, and global corporate leaders joining as speakers. The speaker at the Keynote Luncheon on the first day of this year’s AFF was Prof Justin Lin Yifu, Chief Economist and Senior Vice President of the World Bank (2008-2012), who delivered an in-depth analysis of the shifting global economic landscape. Prof Lin pointed out: “In terms of purchasing power, China has the largest domestic market in the world. I think China can reach a 4.5 % growth rate on the average annually between 2019 and 2049. Thus China will continue to contribute around 30% of growth to the world every year. It’s good not only for China, but also will be the most important asset of Hong Kong in the coming years.” Keynote Luncheon today focused on AI: Future Industries and Implications, with Prof Stuart Russell, Co-chair of the World Economic Forum’s Council on AI, sharing his insights into the development, application and governance of generative AI. Prof Russell said: “We could build AI systems that are guaranteed to further human interests but we aren’t. Some may worry that the machines that we are building will become conscious and lose control, but competence should actually be the topic that we worry about. As history shows, we cause species to become extinct due to our competence, not our consciousness. We are training them to have human-like objectives, and that is a fundamental mistake. I am hoping that if we design the AI system well enough, they themselves will refuse to contribute to the enfeeblement of the human race.” Another AI expert, Dr Kai-Fu Lee, Chairman of Sinovation Ventures, also addressed the transformative power of AI and its impact on technological advancements in the global business ecosystem during a dialogue session. In alignment with the HKSAR Government’s initiatives to promote sustainable development in Hong Kong, sustainability emerged as a key focus at the forum. A session yesterday featured experts including Sue Lloyd, Vice Chair of the International Sustainability Standards Board (ISSB), who delved into the adoption of financial disclosure standards to enhance confidence in Hong Kong’s capital markets. Today saw more discussions related to sustainable development, including a Breakfast Panel dedicating to transition finance and two more sessions – on sustainable investment and Post-COP29 Implementation: Enhance Climate Ambition and Enable Financing Action – at which Liu Zhenmin, Special Envoy for Climate Change of China, gave remarks. This afternoon saw the debut of the Gulf Cooperation Council Chapter, jointly organised by the AFF and the Gulf Cooperation Council (GCC). Christopher Hui, Secretary for Financial Services and the Treasury of the HKSAR Government, and HE Jasem Mohamed AlBudaiwi, Secretary General of the Cooperation Council for the Arab States of the Gulf, delivered keynote remarks. Financial officials and representatives from Oman, Qatar, Saudi Arabia and the United Arab Emirates joined industry leaders from Hong Kong to share updates on economic developments in the Gulf region, highlight future investment opportunities, and examine ways to strengthen financial cooperation and investment between the member states of the GCC and Hong Kong. In addition, pioneers from a range of industries actively participated in sessions such as CIO Insights, Dialogues for Tomorrow and Global Spectrum, focusing on hot topics ranging from fintech and capital markets to female entrepreneurship and philanthropy. One of the heavyweight speakers at this year’s AFF was Joe Tsai, Chairman of the Alibaba Group, who shared his views at a fireside chat moderated by Ronnie Chan, Honorary Chair, Hang Lung Properties Limited on how large companies spur economic development in a session titled Global Spectrum – The Role of Large Companies in Supporting Start-ups and Social Enterprises. Views on mainland and overseas industries and environmental economies tracked on-site – Real-time polling was conducted during the forum to gauge participants’ views on various topics, such as the global economic outlook and China opportunities. It indicated that generative AI-led innovation (41.6%) and non-AI innovation, including digital infrastructure & healthcare (23%), were seen by participants as the most critical growth engines in the Asia Pacific region. Meanwhile, generative AI (31.4%) and advanced manufacturing (20%) were seen as the most promising growth sectors in Mainland China. More than 700 one-on-one matching meetings facilitated on-site over two days – This year’s AFF Deal-making, co-organised by the HKTDC and the Hong Kong Venture Capital and Private Equity Association (HKVCA), brought together more than 270 investors and over 560 investment projects with more than 700 one-on-one meetings held, covering a wide spectrum of sectors such as fintech, healthtech, deep tech, consumer goods, infrastructure and real estate, environment, energy and environmental technology. The meetings helped to connect funds and investment projects from across the globe … … As always, the AFF featured several exhibition zones, set up with the aim of creating business connections and promoting networking, including the Fintech Showcase, Fintech HK Startup Salon, the InnoVenture Salon, and the Global Investment Zone. These zones featured more than 140 exhibitors including international financial institutions, technology companies, start-ups, investment promotion agencies and sponsors such as AFF Knowledge Partner EY, along with HSBC, Bank of China (Hong Kong), Standard Chartered Bank, UBS, Prudential, China International Capital Corporation (CICC) and Huatai International and more. Three other events ran concurrently with the AFF across the two days. The Hong Kong International Fundraising Roundtable 2025 yesterday convened C-suite leaders from overseas and mainland enterprises with Hong Kong’s financial and professional service providers to address pressing financing and fundraising needs. The Malaysia–Hong Kong Islamic Finance Roundtable, co-organised with Malaysia International Islamic Financial Centre (MIFC) Leadership Council, facilitated the development of cross-border financial activities between Hong Kong and Islamic economies represented by Malaysia. Additionally, the Family Office Symposium, co-organised with the Private Wealth Management Association (PWMA), spotlighted Hong Kong’s advantages as a premier family office destination and explored current investment trends. The Asian Financial Forum was a signature event of 2025 International Financial Week (IFW), which runs from 13 to 17 January and brings together more than 20 partner events to create synergies in the industry. These events cover many topics of global interest to the financial and business community, including private equity, family offices, net zero investing and generative AI, among others. This week of events helps underscore the importance of Hong Kong as an international financial hub.”

“ 18th Asian Financial Forum 2025 Hong Kong on 13th & 14th January Attended by More than 3,600 Delegates Globally, 100+ Key Speakers & Held 700+ 1-on-1 Deal-Making Meetings, On-Site Poll: 41.6% View Generative AI-Led Innovation is Most Critical Engine of Growth in APAC, 2 Keynote Luncheons Held with Prof Justin Lin Yifu (Chief Economist & Senior Vice President of the World Bank) & Prof Stuart Russell (Co-Chair of the World Economic Forum’s Council on AI), Alibaba Group Chairman Joe Tsai in Fireside Chat on Role of Large Companies in Supporting Start-ups & Social Enterprises “

18th Asian Financial Forum 2025 Hong Kong

18th Asian Financial Forum 2025 Hong Kong Taking Place on 13th & 14th January with 3,600 Attendees & 100+ Key Speakers Including Global Policymakers, Business Leaders, Financial Experts And Investors, Entrepreneurs, Tech Giants & Economists, 2-Day Program Include Keynote Luncheons, Exhibitions, Deal-Making, Global Economic Outlook, CIO Insights, China Opportunities, Silver Economy, Emerging Technologies, Sustainability, Capital Markets Collaboration, Family Business Succession, Female Entrepreneurship, CSR & Philanthropy, Fintech, Blue Finance & More

11th January 2025 – The 18th Asian Financial Forum 2025 Hong Kong is taking place on the 13th & 14th January 2025 with more than 3,600 attendees & 100+ key speakers including global policymakers, business leaders, financial experts and investors, entrepreneurs, tech giants & economists. The 2-day program include keynote luncheons, exhibitions, deal-making, Global Economic Outlook, CIO Insights, China Opportunities, Silver Economy, Emerging Technologies, Sustainability, Capital Markets Collaboration, Family Business Succession, Female Entrepreneurship, CSR & Philanthropy, Fintech, Blue Finance & more. The 18th Asian Financial Forum 2025 Hong Kong will be held at the Hong Kong Convention & Exhibition Centre (HKCEC). Hong Kong Trade Development Council (7/1/25): “The 18th Asian Financial Forum 2025 (AFF), co-organised by the Government of the Hong Kong Special Administrative Region (HKSAR) and the Hong Kong Trade Development Council (HKTDC), will be held at the Hong Kong Convention and Exhibition Centre (HKCEC) on 13 and 14 January (Monday and Tuesday). As the region’s first major international financial conference in 2025, the forum will examine the landscape for new business opportunities in various industries and regions in the coming year and promote global cooperation, and is expected to attract more than 3,600 finance and business heavyweights. Themed “Powering the Next Growth Engine”, the AFF will bring together more than 100 global policymakers, business leaders, financial experts and investors, entrepreneurs, tech companies and economists to share their views on the shifting global economic landscape and financial ecosystem. These industry experts will dissect the risk management strategy, discover new business opportunities, and explore how Hong Kong can seek breakthroughs in a period of change. First flagship financial event to showcase Hong Kong’s financial strengths – Launched in 2007, the AFF has become a flagship financial event for Hong Kong and the broader region, highlighting the city’s pivotal role as a globally renowned financial hub with a highly competitive economic and business environment. Amid a rapidly changing global macroeconomic landscape, and shifts in geopolitical dynamics and monetary policies, Hong Kong’s financial services sector continues to leverage its strengths across various domains, drawing on its world-class business infrastructure and robust regulatory regime to help drive cooperation and mutual success across Asia and around the world. … … As a key element of this year’s forum, AFF Deal-making offers one-on-one matching services for project owners and investors. More than 270 investors and 560 projects are expected to participate, with investment opportunities across industries such as environmental, energy, clean technology, food and agriculture tech, healthcare tech, fintech and deep technology. The exhibition sections of the AFF – Fintech Showcase, InnoVenture Salon, FintechHK Startup Salon and Global Investment Zone – will attract more than 130 local and global exhibitors, international financial institutions, technology companies, start-ups, investment promotion agencies and sponsors, including Knowledge Partner EY, HSBC, Bank of China (Hong Kong), Standard Chartered Bank, UBS, Prudential, China International Capital Corporation (CICC), Huatai International and more. Notably, the InnoVenture Salon will provide a platform for more than 100 start-ups to showcase innovative technologies in a variety of fields such as finance, regulation, sustainability, health and agriculture, supported by more than 110 Investment Mentors and Community Partners. International Financial Week (IFW) 2025 runs from 13 to 17 January with the AFF as its highlight event. This year’s IFW will feature more than 20 partner events, covering a wide range of global financial and business topics, including private equity, family offices, net-zero investing and generative AI. As the region’s first major financial event of the year, the AFF attracts top global enterprises and leaders to Hong Kong, creating connections between capital and opportunities. The forum assists industry professionals in seizing opportunities in the new year and helps promote the mega event economy in Hong Kong. This year, the AFF has collaborated with various organisations to provide special travel, dining and shopping discounts and privileges for overseas participants joining the event. Activities include Peak Tram and Sky Terrace trips, the iconic Aqua Luna red-sail junk boat, and guided tours of Man Mo Temple and Tai Kwun arranged by the Hong Kong Tourism Board. Participants can also enjoy dining discounts and guided tours from the Lan Kwai Fong Group, as well as the Winter Wonderland at the Hong Kong Jockey Club’s Happy Wednesday at Happy Valley Racecourse, all designed to immerse overseas visitors in the vibrancy and diversity of Hong Kong.” More info below:

Christopher Hui, Secretary for Financial Services and the Treasury of the HKSAR Government: “Hong Kong’s financial market went through a lot of reforms and innovation last year. We have also launched a roadmap on sustainability disclosure in Hong Kong and issued a policy statement on responsible application of artificial intelligence in the financial market with a view to boosting green finance and sustainable financing. The upcoming Asian Financial Forum will gather the top-tier of the financial and various sectors from all around the world, the Mainland and in Hong Kong and hence is the perfect occasion for us to showcase to the world the new momentum and latest advantages of Hong Kong in the financial realm. Participants will also have a chance to learn more about how Hong Kong can partner with them to explore new collaborations and development areas while expanding their network here.”

Luanne Lim, Chairperson of the AFF Steering Committee and Chief Executive Officer, Hong Kong, of HSBC: “The global economy faces greater uncertainties in 2025 compared to 2024. However, robust growth in India and ASEAN nations, combined with increased policy support from Mainland China, is expected to keep Asia’s (ex-Japan) GDP growth at a strong 4.4%, well above the global average of 2.7%.” (Against this backdrop, this year’s Asia Financial Forum is aptly themed “Powering the Next Growth Engine” and will focus on high-potential markets such as ASEAN, the Middle East (particularly the Gulf Cooperation Council countries), and the role that Hong Kong can play. Ms Lim said Hong Kong’s unique role as a bridge between the mainland and international markets allows it to support mainland enterprises expanding globally. She added that Hong Kong is committed to attracting global talent and investors, driving growth for both mainland and international businesses.)

Patrick Lau, HKTDC Deputy Executive Director: “As we move into the new year, different economies around the world are facing challenges in maintaining economic growth. As an international financial centre, Hong Kong is playing an important role both as a ‘super-connector’ and a ‘super value-adder’ to link the world, enabling investors and fundraisers to leverage the city’s professional services and investment platforms to facilitate collaboration and create business opportunities. This year’s forum not only brings together heavyweight speakers and thought leaders but also builds on the success of previous years to provide a business platform for international participants, promoting financial and business cooperation and working together to launch new engines for growth.”

Register

- Asian Financial Forum 2025: View Event

- Speaker List: View Speakers

- Register Now | View Programme

Pricing

- Full Pass – $1,400 / HKD 11,000

- Standard Pass – $1,030 / HKD 8,030

- Networking Pass – $200 / HKD 1,600

- Register here

Register with Caproasia discount code (30%):

- F-AM06-ML (Full pass)

- S-AM06-ML (Standard pass)

Complimentary Passes – Limited complimentary passes available for Caproasia Executive Members & Subscribers. Contact your Relationship Manager or send to [email protected]

18th Asian Financial Forum 2025 Hong Kong Taking Place on 13th & 14th January with 100+ Key Speakers Including Global Policymakers, Business Leaders, Financial Experts And Investors, Entrepreneurs, Tech Giants & Economists, 2-Day Program Include Keynote Luncheons, Exhibitions, Deal-Making, Global Economic Outlook, CIO Insights, China Opportunities, Silver Economy, Emerging Technologies, Sustainability, Capital Markets Collaboration, Family Business Succession, Female Entrepreneurship, CSR & Philanthropy, Fintech, Blue Finance & More

24th December 2024 – The 18th Asian Financial Forum 2025 Hong Kong is taking place on the 13th & 14th January 2025 with 100+ key speakers including global policymakers, business leaders, financial experts and investors, entrepreneurs, tech giants & economists. The 2-day program include keynote luncheons, exhibitions, deal-making, Global Economic Outlook, CIO Insights, China Opportunities, Silver Economy, Emerging Technologies, Sustainability, Capital Markets Collaboration, Family Business Succession, Female Entrepreneurship, CSR & Philanthropy, Fintech, Blue Finance & more. The 18th Asian Financial Forum 2025 Hong Kong will be held at the Hong Kong Convention & Exhibition Centre (HKCEC). More info below:

Luanne Lim, Chairperson of the AFF Steering Committee and Chief Executive Officer, Hong Kong, of HSBC: “The geopolitical and economic landscape of 2025 is set to be fraught with challenges, underscoring the importance of international collaboration. The Forum adopts the theme ‘Powering the Next Growth Engine’, bringing together influential speakers and thought leaders to share insights, dissect the evolving global landscape and spotlight emerging investment opportunities. Key areas of focus include the growth potential of emerging markets such as Mainland China, ASEAN and the Middle East, as well as advancements in sectors like artificial intelligence, fintech, sustainability, philanthropy and family offices. The Forum continues to provide a premier platform for renowned global investors and fundraisers to collaborate and ignite new engines for growth with its strong international influence and diverse perspectives.”

18th Asian Financial Forum 2025 Hong Kong Taking Place on 13th & 14th January with 100+ Key Speakers Including Global Policymakers, Business Leaders, Financial Experts And Investors, Entrepreneurs, Tech Giants & Economists, 2-Day Program Include Keynote Luncheons, Exhibitions, Deal-Making, Global Economic Outlook, CIO Insights, China Opportunities, Silver Economy, Emerging Technologies, Sustainability, Capital Markets Collaboration, Family Business Succession, Female Entrepreneurship, CSR & Philanthropy, Fintech, Blue Finance & More

18th Asian Financial Forum 2025

13th – 14th January 2025 | Hong Kong Venue: Hong Kong Convention & Exhibition Centre – View Event | Register

Themed “Powering the Next Growth Engine”, the 18th Asian Financial Forum 2025 (AFF) will be the first major financial and business event in the region in the new year, bringing together more than 100 global policymakers, business leaders, financial experts and investors, entrepreneurs, tech giants and economists to share their views on the latest developments in financial markets and investment opportunities and explore how Hong Kong can leverage its strengths as an international financial centre to seek breakthroughs in a period of change.

This year’s Forum will feature a distinguished line-up of speakers, with a two-day programme featuring various panels and workshops. Speakers from the mainland, ASEAN, the Middle East, Europe and the United States will shed light on a range of key topics, including macroeconomics, China opportunities, investment prospects, artificial intelligence (AI) and fintech as well as sustainability. Notable speakers include (in alphabetical order):

- J Christopher Donahue, President & Chief Executive Officer of Federated Hermes, Inc

- Antoine Gosset-Grainville, Chairman of the Board of Directors of AXA

- Dr Fred Hu, Founder and Chairman of Primavera Capital Group

- Dr Kai-Fu Lee, Chairman of Sinovation Ventures

- Li Yimei, Chief Executive Officer of China Asset Management

- Prof Justin Lin Yifu, Chief Economist and Senior Vice President of the World Bank (2008-2012)

- Sue Lloyd, Vice Chair of the International Sustainability Standards Board (ISSB)

- Vincent Mortier, Group Chief Investment Officer of Amundi

- Prof Stuart Russell, OBE, Distinguished Professor of Computer Science at the University of California, Berkeley and Co-chair of the World Economic Forum’s Council on AI and the OECD’s Expert Group on AI Futures

- Joe Tsai, Chairman of the Alibaba Group

In addition, the Fintech Showcase, InnoVenture Salon, FintechHK Start-up Salon and Global Investment Zone will be assembled at the AFF to help fintech companies, start-ups and international investment agencies from around the world to connect businesses, showcase the latest technological innovations and promote collaboration. In addition to offering pitching and startup advisory sessions, the InnoVenture Salon features an exhibition of innovative technologies across various fields such as regtech, deep tech, green tech, health tech and food tech and agri-tech. Additionally, AFF Deal-making, a unique deal-sourcing and matching session, will build on the success of previous years to connect sources of funds and deals from around the world through one-on-one meetings.

Announcement

The 18th Asian Financial Forum 2025 (AFF), co-organised by the Government of the Hong Kong Special Administrative Region (HKSAR) and the Hong Kong Trade Development Council (HKTDC), will be held at the Hong Kong Convention and Exhibition Centre (HKCEC) on 13 and 14 January (Monday and Tuesday). Themed “Powering the Next Growth Engine”, AFF will be the first major financial and business event in the region in the new year, bringing together more than 100 global policymakers, business leaders, financial experts and investors, entrepreneurs, tech giants and economists to share their views on issues related to political leadership, geopolitical tensions, monetary policy shifts, macroeconomic challenges and more. These industry heavyweights will discuss the latest developments in financial markets and investment opportunities and explore how Hong Kong can leverage its strengths as an international financial centre to seek breakthroughs in a period of change.

Harnessing Hong Kong’s unique advantages to demonstrate financial excellence – Launched in 2007, the AFF has become a flagship financial event for Hong Kong and the broader region, showcasing the city’s status as an international financial centre and its role as a connector in spearheading regional financial activities. Against the backdrop of a constantly shifting global economic landscape, Hong Kong has been leveraging its unique geographical position, professional services and global perspective to continue fostering collaboration and ensuring mutual success between Asia and the world.

Impactful sessions spotlight global issues – The Forum will feature a distinguished line-up of speakers, with a two-day programme featuring various panels and workshops, including plenary sessions, policy dialogues, keynote luncheons, breakfast panels and fireside chats, as well as thematic workshops focusing on development and innovation across different industries. It will continue to stage well-received sessions such as Global Economic Outlook, China Opportunities and CIO Insights. Global Economic Outlook will analyse international economic trends and provide insights into business opportunities and wealth accumulation in emerging industries and regions in 2025. China Opportunities will focus on examining the investment outlook in Mainland China under the acceleration of technological innovation and its impact on global businesses. CIO Insights will explore new opportunities for cross-regional cooperation from macroeconomic and asset allocation perspectives, offering participants insights and strategies that can help realise long-term growth.

Financial pioneers share insights on future economy

- One of the keynote speakers at AFF will be Prof Justin Lin Yifu, a globally renowned economist and Chief Economist and Senior Vice President of the World Bank (2008-2012). Prof Lin will deliver an in-depth analysis of the shifting global economic landscape and the impact on Mainland China and international markets, exploring strategies for achieving stable growth and driving rapid economic development amid a complex international environment.

- The Forum will also bring together scholars, financial officials and business leaders from the mainland, ASEAN, the Middle East, Europe and the United States to shed light on a range of key topics, including macroeconomics, China opportunities, investment prospects, artificial intelligence (AI) and fintech as well as sustainability.

- As the world’s second largest economy, the mainland’s economic and industrial development plays a significant role in driving global economic growth. Heavyweight speakers include Dr Fred Hu, Founder and Chairman of Primavera Capital Group; Jin Liqun, President and Chair of Asian Infrastructure Investment Bank; Li Yimei, Chief Executive Officer of China Asset Management, and Joe Tsai, Chairman of Alibaba Group, will take the stage at AFF to share their views.

- Emerging markets such as the Association of Southeast Asian Nations (ASEAN) and the Middle East will also be spotlighted. Speakers from ASEAN will include Satvinder Singh, Deputy Secretary-General for ASEAN Economic Community of ASEAN while a new session will highlight the opportunities in financial cooperation and investment between the Middle East and Hong Kong, featuring speakers from the two places.

- A stellar line-up of speakers and company representatives from Europe and the US will offer new impetus at various panel discussions. Featured speakers include Edward Dolman, Executive Chairman and Chief Executive Officer of Phillips Auctioneers; J Christopher Donahue, President & Chief Executive Officer of Federated Hermes, Inc; Antoine Gosset-Grainville, Chairman of the Board of Directors of AXA; Dr Hou Yang, Chairman and Chief Executive Officer, Greater China Region and Global Senior Vice President of Microsoft; Philip Lane, Chief Economist and Member of the Executive Board of the European Central Bank; Vincent Mortier, Group Chief Investment Officer of Amundi; and Dr Olli Rehn, Governor and Chairman of the Board of the Bank of Finland.

- AI and fintech are having a profound impact as they become more broadly adopted in the financial services sector. Prof Stuart Russell, Co-chair of the World Economic Forum Council on AI; Dr Kai-Fu Lee, Chairman of Sinovation Ventures and Ken Wong, Executive Vice President of Lenovo and President of Lenovo Solutions & Services Group, will address the latest industry developments and prospects at the AFF. Prof Russell, Distinguished Professor of Computer Science at the University of California, Berkeley and Co-chair of the World Economic Forum’s Council on AI and the OECD’s Expert Group on AI Futures, will explore the prospects of AI becoming a new engine for global economic growth.

- Sustainable development is another key topic at the AFF. In different sessions of the Forum, Sue Lloyd, Vice Chair of the International Sustainability Standards Board (ISSB); Martin Neubert, Partner and Group Chief Investment Officer of Copenhagen Infrastructure Partners, and Jiadi Yu, Chief Investment Officer of International Finance Corporation (IFC), will share views on how the adoption of the ISSB will contribute to market confidence in Hong Kong’s capital markets.

Diverse exhibition zones create opportunities, innovative technologies drive growth

- The Fintech Showcase, InnoVenture Salon, FintechHK Start-up Salon and Global Investment Zone will be assembled at the AFF to help fintech companies, start-ups and international investment agencies from around the world to connect businesses, showcase the latest technological innovations and promote collaboration.

- In addition to offering pitching and startup advisory sessions, the InnoVenture Salon features an exhibition of innovative technologies across various fields such as regtech, deep tech, green tech, health tech and food tech and agri-tech. This capacity-building support will connect entrepreneurs with potential clients, users and investors from different regions and industries, helping businesses refine their strategies, expand operations and thrive in the global market. Additionally, AFF Deal-making, a unique deal-sourcing and matching session, will build on the success of previous years to connect sources of funds and deals from around the world through one-on-one meetings.

AFF – Hong Kong’s major annual financial event – International large-scale events play a strategically important role for Hong Kong. As the first major financial event of the year, the AFF is designed to provide industry professionals with the latest insights and help them explore new opportunities. Early bird registration is now open for participants. The AFF is collaborating with various organisations to provide special travel, dining and shopping discounts and privileges for overseas participants, encouraging them to make the most of their stay and experience the vitality of Hong Kong. More details regarding the content, speaker lineup and media registration arrangements for the AFF will be announced at a press conference on 7 January 2025.

Websites

- Asian Financial Forum: https://www.asianfinancialforum.com/conference/aff/en/about-aff

- Programme: https://www.asianfinancialforum.com/conference/aff/en/info-programme

- Speaker list: https://www.asianfinancialforum.com/conference/aff/en/speakers

The Program – Day 1

- Opening Session

- Plenary Session I

- Presentation on Joint Survey by HKTDC & EY

- Policy Dialogue

- Keynote Luncheon- Envisioning the Next Global Dynamics under the Ever-changing Global Landscape

- Global Economic Outlook

- Navigating the Silver Economy: Insurance Sector Opportunities in an Aging Society

- Global Economic Outlook

- Funding the Future of Emerging Technologies

- China Opportunities

- Engaging the Next Wave of Investors

- Setting Global Milestone in Sustainability

- Payment Tech in Action

- Collaboration: The Road to Growth and Prosperity

- Cocktail Reception (By Invitation Only)

- AFF Deal-making

The Program – Day 2

- Accelerating Flows of Transition Finance: Shaping a Sustainable Future for GBA and Beyond

- Forging Regional Capital Markets Collaboration

- Dialogue with Kai-Fu Lee

- Passing the Baton: A Visionary Roadmap for Family Business Succession

- CIO Insights

- Thematic Workshop

- Asia Dialogue on Post COP29 Implementation: Enhance Climate Ambition and Enable Financing Action

- Keynote Luncheon – AI: Future Industries and Implications

- Roadmap to be AI Unicorns in Eurasia

- Female Entreprenueurship

- The Role of CSR and Philanthropy in Supporting Start-ups and Social Enterprises

- What’s Next for Fintech in Southeast Asia

- Blue Finance

- AFF Deal-making

Register

- Asian Financial Forum 2025: View Event

- Speaker List: View Speakers

- Register Now | View Programme

Pricing

- Full Pass – $1,400 / HKD 11,000

- Standard Pass – $1,030 / HKD 8,030

- Networking Pass – $200 / HKD 1,600

- Register here

Register with Caproasia discount code (30%):

- F-AM06-ML (Full pass)

- S-AM06-ML (Standard pass)

Complimentary Passes – Limited complimentary passes available for Caproasia Executive Members & Subscribers. Contact your Relationship Manager or send to [email protected]

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit