14 Trends of the Next Decade for High Net-worth Wealth Managers

50 years ago. A phone call to 5,000 miles away and a businessman could have $5 million of family assets parked 5,000 miles away in cities such as Switzerland and London, well-protected from political and business risks. Global political risks then were enormous, creating uncertainties for wealthy individuals and businessmen. Highly skilled bankers and wealth managers were extremely important as they navigate complex financial manoeuvres to protect their clients’ wealth.

In the last decade, as Asia’s wealth had grown at an extraordinary pace, millions and billions of wealth are accumulated annually. Business opportunities were rampant in Asia, and high net worth clients were aggressive on their businesses, neglecting oversight of their personal wealth. This meant wealth & investment professionals were always secondary to their wealth growth.

The reasons for having wealth & investment professional in the last decade were:

- access to basic financial services

- access basic investment services

- corporate banking relationships

- tax reasons

- family reasons

- peace of mind

- privacy

- networking

- prestige

With the lucrative phase of Asia’s wealth growth comes to an end, a major cleanup of the financial and economic system is ongoing. What are the future trends in the next decade for high net worth Wealth Managers?

We identified 14 trends for wealth managers for the next decade for high net worth & ultra high net worth clients.

No. 1 Unlocking Corruption

Wealth Managers are constantly reminded to scrutinise client’s source of funds to combat tax evasion, bribery, money-laundering, terrorism financing, illicit source of funds.

Managing assets for the rich is a sensitive affair. Many of them prefer not to disclose much about how they accumulate their wealth and their complex business structures. With an increasing scrutiny on corruption, wealth managers are now playing dual roles of being the ears of clients and the eyes of law.

Example of sensitive high profile situation:

- Hong Kong’s Billionaire Thomas Kwok sentenced to jail

- Ex-Taiwanese President Chen Shui-bian accused of hiding money overseas

No. 2 Connections & Disconnections

Connections are important in businesses. Warren Buffett being extremely influential often get the best investment deals, but also get into trouble. In Asia, it is no different.

Just like dominos, when one falls, the rest crumbles.

- The $6 Billion Penny stocks collapse in Singapore

- China crackdown on corruption

- 27,000 risk managers in Lehman Brothers before bankruptcy

- Warren Buffett in anti-trust probe for using Moody’s Investors Service

No. 3 Power Shift

Europe and United States went through centuries of power struggles. World War I and II, American Civil War are the recent bits of history in modern world. Then, the struggle for ownership, land, resources and control caused huge uncertainty to the healthy being of the domestic and global economy.

This can cause capital flight in a country arising from economic uncertainties. For wealth managers domiciled in the country, it would be an absolute disaster. This reinforce the importance of a wealth manager to have a global perspective in managing assets.

Read More:

- Tan Sri Khoo Teck Puat was pushed out from Maybank in 1964, the bank he founded in 1960

- OCBC Bank was nationalised by new Myanmar Government in 1962

No. 4 Policies & Economic Shift

If the government influences the future of the country, the foremost impact is through the governing policies.

Asia for the last 2 decades of growth had been led by Government policies, Western economic policies and Multi-National Corporations (MNCs) based in Asia. This had created new class of wealthy clients in Asia, where their needs are clearly different from the traditional client base.

Client Base Segementation:

| Traditional Client Base | New Client Base |

| Business Owners | Asset Rich Clients |

| Entrepreneurs | MNCs Executives |

| C-Level Executives | Startups Employees |

| Top Professionals | Investors |

| Inheritance |

All these are about to change as governments and new emerging politicians in Asia introduce their new policies for the next decade. Which are the new mega-trends? How would they impact your clients’ investment & business decisions?

No. 5 Law & Regulations

With a drive for capital, financial stability and prudence, governments around the world are changing laws and regulations to encourage companies & citizens to take responsible financial actions to benefit local economy.

- Indonesia introduce tax amnesty for Indonesians with offshore assets

- BHP Billiton in tax dispute with Australia Government

No. 6 Tax

As globalisation and a free market increases economic interaction, tax becomes a complex and sensitive issue.

Which is the right country to pay tax in? If there is a choice to pay no tax: 17% tax or 51% tax – which would you advise your client to pay?

- A businessman would say: pay the least

- A government would say: pay according to our tax policies

- A lawyer would say: pay where you are legally obliged to do so

- A tax consultant would say: we help you to save on tax

- What would a wealth manager say?

Illustrating the future cost of tax:

| Tax Rate | Yearly Income | Year 10 |

| 0% | $1,000,000 | $10,000,000 |

| 10% | $900,000 | $9,000,000 |

| 17% | $830,000 | $8,300,000 |

| 27% | $730,000 | $7,300,000 |

| 47% | $530,000 | $5,300,000 |

In Year 10, the client that went for the lowest cost jurisdiction would have $10 Million intact, compared to only $5.3 Million remaining if the client resides in a high tax jurisdiction.

Illustrating the opportunity cost of investment:

| Tax Rate | 5% p.a. | 10% p.a. | 20% p.a. |

| 0% | $12.57 Million | $15.93 Million | $25.95 Million |

| 10% | $11.32 Million | $14.34 Million | $23,36 Million |

| 17% | $10.43 Million | $13.22 Million | $21.54 Million |

| 27% | $9.18 Million | $11.64 Million | $18.94 Million |

| 47% | $6.66 Million | $8.46 Million | $13.75 Million |

In Year 10, the difference between a client paying 0% tax and earning 5% p.a. would be $6 Million difference in total wealth. That would rise to a net $12 Million difference if returns are generated at 20% p.a.

For a client with an income of $10 Million annually, the wealth accumulated and protected would be $259 million at 20% p.a. with offshore structures with 0% tax compared to a client who pays 47% tax, accumulating a total wealth of $137.5 Million. This also highlights the predicament of entrepreneur tax savings and the need for government to gather tax revenues. If a client spend half the time in a country that tax at 40% and in another at 20%, where should he pay the tax?

Client refers to individuals, entities and companies. Above is an illustration highlighting the complexities and tradeoffs of tax planning.

IN THIS WORLD NOTHING CAN BE SAID TO BE CERTAIN, EXCEPT DEATH AND TAXES

~ BENJAMIN FRANKLIN

No. 7 Combat Money-Laundering

One of the biggest curse word for Wealth Managers. Being the one in contact with clients means the main responsibility on surveillance is automatically delegated to wealth managers.

Thinking like a detective and probing for potential infringements is the surest way for wealthy clients to sack their wealth managers.

- HSBC fined $1.9 billion for failure in money-laundering controls

- Barclays fined £72m over $1.9 billion wealth management deal

- ABN AMRO fined for failure to control money-laundering risks

No. 8 Fraud

For so many years, the frauds were occurring in the most trusted financial institutions, and by the people who possibly were advising you and your clients. All these were kept internally or often turned a blind eye to. How do you manage these risks going forward?

- Barclays, HSBC & RBS fined $924 million for forex rigging

- Deutsche Bank expect to pay more than $1.5 billion for LIBOR fixing

- 6 banks fined $5.6 billion for foreign exchange rigging

One Barclays trader wrote in a November 5, 2010 chat:

“IF YOU AINT CHEATING, YOU AINT TRYING”

No. 9 Increasing Transparency

Most wealthy clients prefer to be private for obvious business and personal reasons. Unfortunately, the call for efficient & effective governance alongside the digital economy has transformed privacy into transparency.

Where previously they could use proxies and nominees, have now come under scrutiny with prejudice tags such as tax evasion and money-laundering.

No. 10 Tracking

For many decades, individuals and corporate datas are basic profiles and biography at best. With the advancement of technology, advanced tracking on past activities and behaviours are now possible. This increasingly expose the risks of confidential disclosure such as in investment trades, business deals and sensitive family affairs. Read More: Barclays fined $150 Million

The British bank was caught cancelling clients’ trades when the market moved in the customer’s favour

No. 11 Hacking

As personal datas are now stored in many places other than banks and government. New personal datas are encrypted in all regular bills such as utilities, mobile, healthcare and insurance.

Increasingly, personal datas are also stored on E-commerce, travel sites and cloud solutions. This means any data hack could severely affect clients’ privacy and well being.

No. 12 Anti-trust

As economy moves into advanced phase, anti-trust are often introduced to promote fair competition and prevent monopolies of industries.

High Net-worth Wealth Managers will faced increased pressures from clients, both emotionally and advisory to ensure their assets and estates are well-taken care of.

No. 13 Kidnapping & Blackmails

Part of being wealthy, is to live wealthily. This includes living, travelling and arriving in style. Reports of wealth are often published and in cities such as Hong Kong and Singapore where crime rates are lower relative to neighbouring countries, it is often taken for granted that wealth could be flaunt.

This increases themselves and family members being exposed to kidnaps & blackmails.

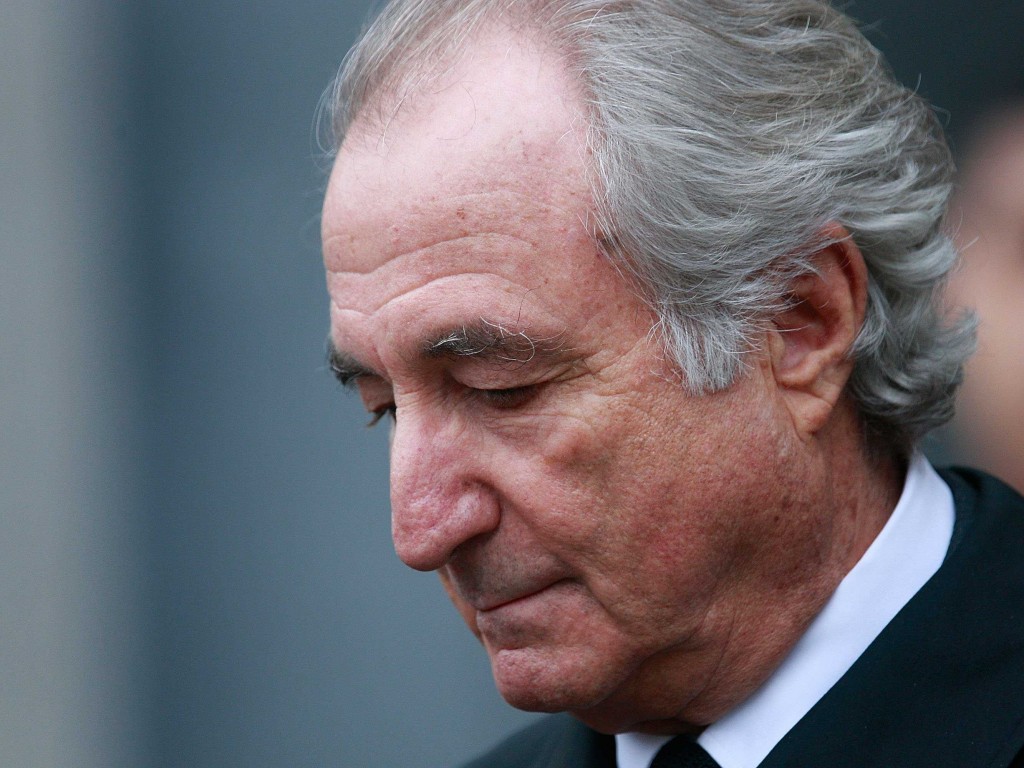

No. 14 Scams Again

Smart and wealthy people are always susceptible to scams. Worst, it is usually not scams on a small scale.

Bernie Madoff for example, came with impressive background. At one point, he served as Chairman of the Board of Directors and on the Board of Governors of the National Association of Securities Dealers.

Through his investment firm Bernard L. Madoff Investment Securities LLC founded in 1960, he managed almost $50 billion of assets until his arrest on 11th December 2008. The setup to trap ultra wealthy clients is usually extravagant and by people with impressive background.

- The Demise of Long-Term Capital Management

- Bernie Madoff: Scamming of America – The $50 Billion Ponzi Scheme

- Rogue Trader: Nick Lesson and the Collapse of Barings Bank

- 20 Traders who lost more than a billion

These are 14 trends for high net worth Wealth Managers in Asia.

In Review:

- Unlocking Corruption

- Connections & Disconnections

- Power Shift

- Policies & Economic Shift

- Law & Regulations

- Tax

- Combat Money-Laundering

- Fraud

- Increasing Transparency

- Tracking

- Hacking

- Anti-trust

- Kidnapping & Blackmails

- Scams Again

What if all these risks could be managed and monitored?

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit