Forbes Goes Public on NYSE in $630 Million SPAC Merger with Magnum Opus

27th August 2021 | Hong Kong

Forbes, a global media brand covering influential leaders and the rich, is going public on NYSE (New York Stock Exchange) in a $630 million SPAC merger with Magnum Opus Acquisition Corp. In 2014, Hong Kong based investor Integrated Whale Media had bought a majority stake in Forbes for around $475 million. The new combined company with enterprise value at around $630 million, will raise $600 million with $200 million of cash from Magnum Opus’ trust account and $400 million of additional capital through private placement of ordinary shares of the combined company (PIPE ~ Private Investment in Public Equity). Forbes will receive $145 million in capital and Forbes’ shareholders will own approximately 22% of the combined company. The transaction is expected to close in late fourth quarter 2021 or early first quarter 2022, and Forbes will list on the NYSE under the ticker symbol “FRBS.”

“ Forbes Goes Public on NYSE in $630 Million SPAC Merger with Magnum Opus “

Magnum Opus Acquisition Limited (NYSE: OPA) is a publicly traded special purpose acquisition company focusing on global consumer, technology and media sectors. Magnum Opus Acquisition Limited is a special purpose acquisition company sponsored by L2 Capital, a private investment firm.

SPAC (Special Purpose Acquisition Company) is also popularly referred to as a blank cheque company, that allows the listed company without any existing businesses to raise capital through an IPO (initial public offering), and thereafter use the capital to invest into companies.

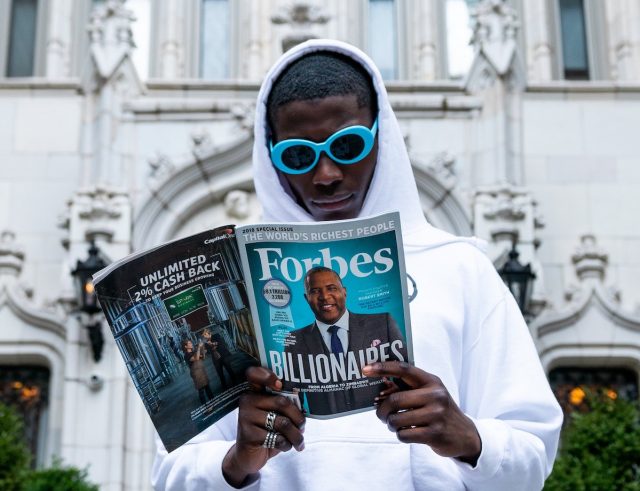

Forbes

The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE events, custom marketing programs and 45 licensed local editions covering 76 countries. Forbes’ brand extensions include real estate, education and financial services license agreements. Through its digital platforms, Forbes is among the top 50 most visited websites on the internet.

Related:

- Italian Luxury Brand Ermenegildo Zegna Goes Public on NYSE in $2.5 Billion SPAC Merger

- Grab $39.6 Billion SPAC IPO Delayed to Q4 2021, Pending Accounts Clearance

- Southeast Asia Grab Goes Public on Nasdaq at $39.6 Billion Valuation with SPAC Merger

- Singapore Exchange Seeks Feedback on SPACs Listing at SGD 300 Million Market Capitalization

- WeWork Goes Public at $9 Billion Valuation with SPAC Merger

- Facebook co-Founder Eduardo Saverin B Capital Creates SPAC to Raise $300 Million on NASDAQ

Mike Federle, CEO of Forbes:

“Leveraging our iconic global brand, Forbes has been executing a data-led platform strategy and is fast becoming the gateway for businesses, entrepreneurs and consumers to join the conversations and participate in the trends that are shaping the world today.

With this transition into a publicly traded company, Forbes will have the capital to accelerate growth by executing its differentiated content and platform strategy and fully realize the potential of our iconic brand.”

TC Yam, Executive Chairman of Integrated Whale Media:

“It has been exciting to watch the Forbes management team successfully complete a digital transformation since we have been involved, and then deliver record annual returns.

This is a testament to the outstanding, seasoned executive team, the consistently trusted quality of Forbes journalism and the dedication of the entire Forbes team. Now, it is time for the next exciting chapter in the Forbes narrative, one in which we are happy to remain involved as a significant investor and partner with the world class institutional and strategic investors at Magnum Opus.”

Jonathan Lin, Chairman and CEO of Magnum Opus:

“The Forbes platform is defined by high-quality, high-impact journalism, product offerings and a loyal user base. We are pleased to partner with the experienced management team to support initiatives to accelerate growth in high-quality and recurring revenue verticals. Forbes has expansive reach and is successfully broadening and deepening engagement through data-informed content curation that delivers what each Forbes user cares most about. The strategy fits perfectly with Magnum Opus’ strategy to support enterprises leveraging digitalization to craft more tailored user experiences, and big data analytics to create a positive feedback loop and multiple touchpoints with consumers.”

About Forbes

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 45 licensed local editions covering 76 countries. Forbes Media’s brand extensions include real estate, education and financial services license agreements. For more information, visit the Forbes News Hub or Forbes Connect.

About Magnum Opus

Magnum Opus Acquisition Limited is a special purpose acquisition company sponsored by L2 Capital, a private investment firm. Magnum Opus is a partnership of enterprise builders and public and private market investment specialists with extensive experience operating and investing throughout the business life cycle from founding, scaling operations through public listing. Magnum Opus aims to partner with public ready enterprises at the forefront of convergence of consumption and technology. Magnum Opus’ mission is to support companies to realize their vision as they embark on their journey into the public markets and face new opportunities, challenges and stakeholders.

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit