Most Popular Investment Theories Clients Ask Wealth Managers

What is Value Investing or Fundamental Analysis? What is Modern Portfolio Theory and Dollar Cost Averaging?

Wealth Managers, Personal Bankers, Private Bankers & Investment Advisors deal with hundreds if not thousands of client’s enquiries a year, managing millions and billions of annual investment transactions.

Working with clients from diverse background, varying understanding of financial markets, they get the same questions all the time. We look at the most popular investment theories clients ask, or perhaps test wealth managers:

No. 1 What is Value-Investing?

An investment principle originating from Benjamin Graham and David Dodd, made famous by legendary investor Warren Buffet. Value-Investing involves analysing financial statements and ratios to measure the value of the companies. If the assessed value is higher than the current market value, the company would be considered undervalued. The investor would buy the stock in view that the stock price will rise and trade around the assessed value.

- P/E Ratio

- Cashflow

- Book Value

- Dividends

What Client is Really Asking: If you don’t know about Value-Investing, you don’t know about investing. Maybe you should learn a thing or two from Warren Buffett about Value-Investing. If you do know, could we get into some investments that are under-valued, and get similar results (positive) that will outperform the market in the “long run.” – Long run could mean 2 – 3 years or 4 – 5 years.

Related Articles:

- Warren Buffett Documentary by Bloomberg Television

- Warren Buffett Documentary by Bio

- 12 Top Quotes from Warren Buffett

- Legendary Advisor: Benjamin Graham

- 35 Quotes from Benjamin Graham

- 3 Supreme Quotes from Benjamin Graham

No. 2 What is Fundamental Analysis?

Fundamental Analysis is an accounting & finance methodology to analyse the overall business and financial matters of the company. This involves reviewing, analysing and projecting balance sheet, assets & liabilities, financial cashflow and profit / loss statements.

What Client is Really Asking: Have you done your homework before you recommend the investment?. Have you looked through the important financial numbers? If you have done these well, you should be picking good stocks and bonds for our portfolio, which means the portfolio should be doing better than expected – earning lots of money.

No. 3 What is Technical Analysis?

Technical Analysis is a study on charting and patterns using historical market data such as price and volume. Technical Analysis and Popular Theories Examples::

Technical Analysis:

- Moving Average

- Relative Strength Index

- MACD

- Fibonacci

Popular Theories:

- Candlestick Charting

- Dow theory

- Elliott Wave Theory

What Client is Really Asking: Are you choosing the right timing to go in? Do you have the 1-year low, 2-years low, 5-years low, 10-years low info? How about the highs? Is the price level good now? – that means low enough such that it should be going up / profiting when we are getting in.

No. 4 What is Efficient Market Hypothesis?

A financial economics theory that all relevant information is currently reflected in the price – making it not possible to do better than the market, over time.

What Client is Really Asking: All the information is already reflected in the market. Your brilliant analysis is perhaps, not that brilliant, as someone else would have spotted and analysed that too. Thus, the price is already reflecting that today. By the way, I know about this theory too, so try not to confuse me. I’m testing you, as I have a genuine interest in financial markets, investments, economic trends.

No. 5 What is Modern Portfolio Theory?

Harry Markowitz created the Modern Portfolio Theory (MPT) in 1952. The theory involves a mathematical process to construct a portfolio that is optimised for the expected returns, for its associated risks. If the portfolio is constructed with an expected return of 5%, the associated risks should be the most efficient, thus the lowest risks possible to achieve the 5% returns.

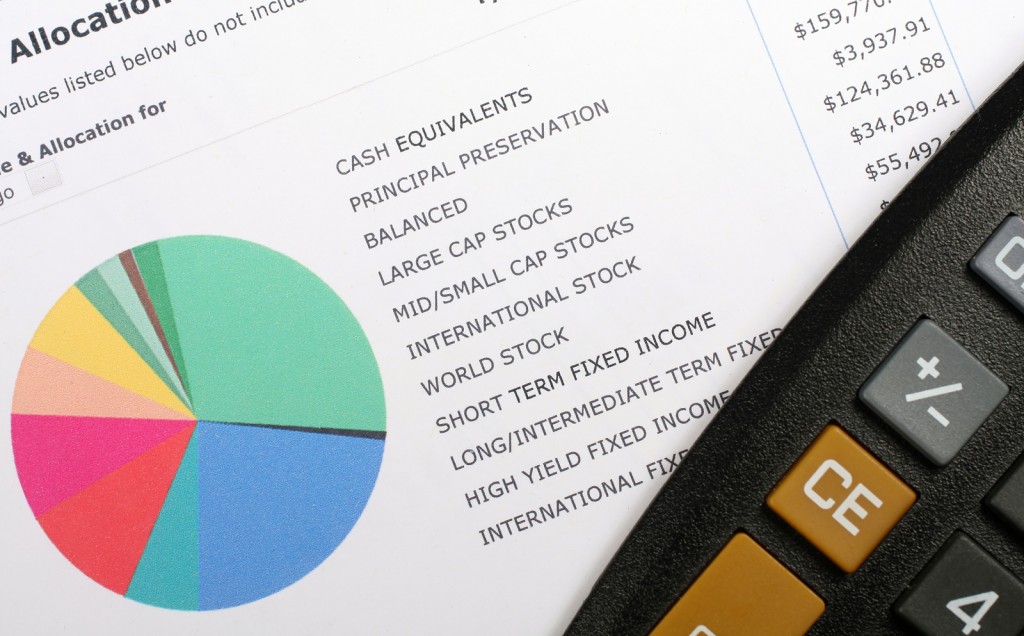

The portfolio construction process includes security valuation, asset valuation, asset allocation and performance measurement.

What Client is Really Asking: Are you well-versed in managing money, wealth, investments and portfolio? Are you qualified? Are you certain you know what you are talking about?

No. 6 What is Dollar Cost Averaging?

Dollar Cost Averaging is an investment methodology to invest regularly to average the prices over time. This reduces price fluctuations on investments and the investor will be able to buy more units when the prices are low.

Example of Dollar Cost Averaging:

| Month 1 | Month 2 | |

| Capital | $100 | $100 |

| Price | $1.00 | $0.50 |

What is the average price?

- $0.25

- $0.33

- $0.50

- $0.66

- $0.75

- $1.00

Read More: The paradox of dollar cost averaging

What Client is Really Asking: It is a simple concept. Buy when it is lower, and more frequently. When it goes up, we will earn more money, isn’t it? Are you also following this approach for your clients? Is everyone doing it? Do you believe in it? Does it really work? When should we buy more? Perhaps in the future when I have more money to try? Since it might come down, how about buying at $0.50 instead?

No. 7 What is Trending Following?

Trending Following is an investment or trading approach simply by following a clear trend, especially in price movement. For example, when the price of a stock or bond or currency starts to go up or down, many other investors and traders would have spotted the trend too. This means the price movements will be steeper and more predictable, if they caught the correct trend. If the trader or investor got into the wrong-side of the trend, they simply make a wrong trend following move.

What Client is Really Asking: We don’t really know what trend following is, but it sounds technically sophisticated than simply following the crowd. This sounds great because we like an intellectual discussion and decision making process. Should we follow the trend since the trend is clear and it sounds trendy too to employ this approach. It is also simple to understand:

- The price is on the way up, it should go higher – so we should get in.

- The price is on the way down, it should go lower – we should either short / sell.

- The price is not moving, so it should stay the same.

No. 8 What is Herd Mentality?

Herd mentality is where many others are investing, more investors are joining in and will join in because many others are doing so.

What Client is Really Asking: Are we investing or should we invest just because everyone is going in? What if they are all wrong? But if we don’t get in, would we be missing out on an obvious investments? Since everyone is getting in, it should be a profitable investment. Should we not just follow the crowd? Can you help to make the decision? You are the expert.

No. 9 What is Contrarian Investing?

What Client is Really Asking: Investment is simple – we simply do the opposite. Do you agree? Or should we not? Since everyone who is so convinced is right, are most often wrong, we should just do the opposite. But I’m not so comfortable today to get into the investments. Let’s leave it for another day, when the price is much lower. Really, I am just ultra-conservative and would like to have a good bargain involving little risks and huge returns.

Related Articles:

- Why Access to Global Economic and Investment Opportunities is Never Equal for Everyone

- 8 Reasons why Clients prefer to place Money in Deposits than Investments

- 3 Reasons Why Good Investment Idea may be a Bad Idea

- What are the challenges of an Investment Advisor?

- 7 Key Investment Products in Personal Banking

- List of Important Asset Classes

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit