How do you become a Personal Banker?

To become a Personal Banker, you can apply to the banks directly. Alternatively, you can get a friend in the bank to help you send in the application. Most of the banks have a formal training program and to graduate, you will have to pass industry exams in Singapore known as CMFAS (Capital Markets Financial Advisory Services).

How do you actually get into one?

You must qualify for the role. We list some of the common criterias the banks look for:

- Age 21 (Minimum age to be licensed as a financial advisor)

- At least a tertiary education, “A” Levels or Diploma

- Banking & Finance background

- Good communication & Interpersonal Skills

- Preferred with CMFAS certifications

A lot of people would qualify. Surely there are other screening criterias?

Because a Personal Banker has to quickly learn the job, understand the financial market and importantly, sell financial products and meet his sales target, the following factors become paramount to selecting you:

- Able to absorb & understand financial information

- Able to sell financial products

- Able to meet sales target

- Able to address problems and concerns

- Fit the image of the banks and people in the bank as a frontline staff

- Able to connect with people, and from different background

- Have the drive to learn and succeed

If you think you can do it, how do you get started?

You need to start applying to them. In Singapore, banks such as DBS Bank, OCBC Bank and UOB Bank recruit about 15 to 30 Personal Bankers every 2 months. There are 14 retail banks including Citibank, HSBC, CIMB Bank, Standard Chartered Bank to apply for.

What if I can’t do it, but I would like to try?

You probably don’t want to say this during the interview. Most banks offer a training program for 1 or 2 months. You will learn about banking, wealth management, industry standards and obligations. All these will give you the basic foundation to get started.

What if I come from another industry or I am an experienced insurance agent or financial advisor?

Yes, banks are always looking for people and talents – and many have done well because they came from diverse background such as Engineering and Social Sciences. This helps because a Personal Banker must be able to connect with people quickly. Sometimes, it isn’t always talking about financial products. This is why a Personal Banker or as you advance in your career – the role is widely known as a Relationship Manager.

What Personal Bankers Say?

“I didn’t know what I was saying at the interview. But I got the job. That is the most important. After 5 years, I am very happy with the career choice. I have learnt a lot.” Personal Financial Consultant from OCBC Bank

” I thought the role was exciting. In the end, the constant sales pressure was too much. I switched role to become a Service Relationship Manager in Priority Banking.” Service Relationship Manager from UOB Privilege Banking

Visit Career page

- Personal Banker Guide

- Priority Banker Guide

- Private Banker Guide

- Investment Advisor Page

- Treasury Specialist Page

Related Articles

- What is a Personal Banker?

- How do you become a Personal Banker?

- 50% of Personal Banker quit in 9 months?

- How do you survive as a Personal Banker?

- How do you succeed as a Personal Banker? Part 1

- How do you succeed as a Personal Banker? Part 2

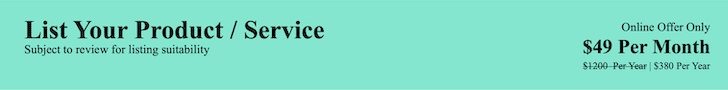

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit