5 Ways to Charge The Highest Fee Possible

Many Wealth Managers wish to charge a higher fee for their professional advice. In reality, no clients would want to pay a higher fee, especially when the plans may take years before they are able to see some benefits.

- 8 Reasons why building a portfolio is tough in Asia

- What Wealth Managers in Singapore struggle with

- 8 Reasons why customers don’t understand the value of Wealth Managers

- 7 Secrets how the old rich achieve success with Wealth Managers

The good news is, many professionals in different fields are able to consistently charge high fees, regardless of outcome such as:

- Lawyers

- Doctors / Specialists

- Management Consultants

- Hedge Fund Managers

The reason? Their clients either need their services or believe in their expertise or credibility. Wealth Managers can do that too.

Below, we list 5 ways how you can charge the highest fee possible:

No. 1 Be Transparent About the Fees

Bring up the most difficult part (the fees) of the conversation early. Share the range of fees to clients, making the sensitive discussion and potential deal-breaker later on much easier. Don’t forget to explain the basis of pricing.

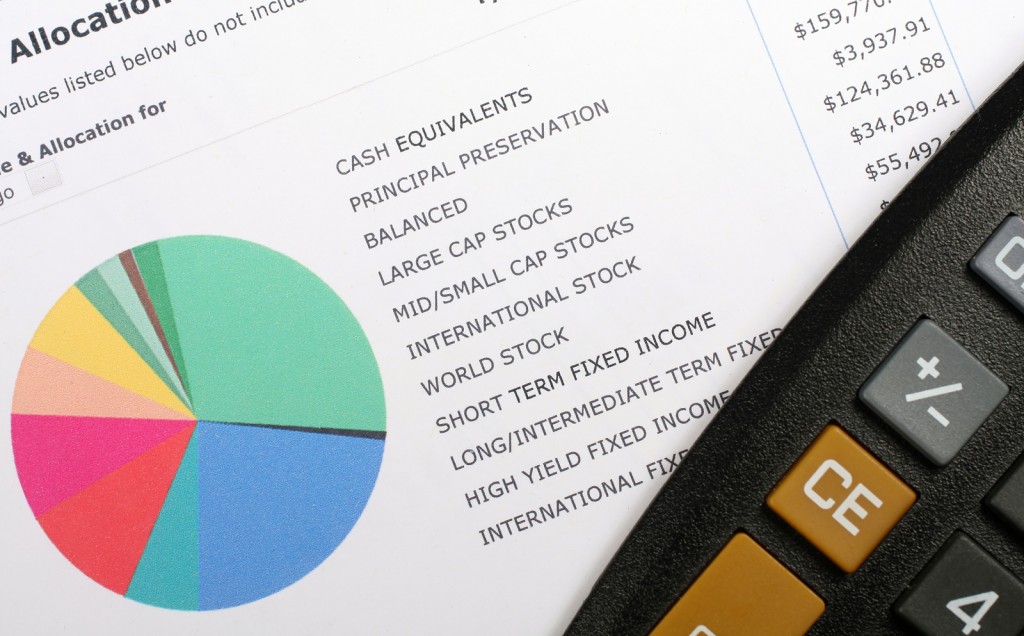

| Transaction Based | 0.25% – 2% |

| Mass Market | 1% – 5% |

| Affluent | 2% – 4% |

| High Net-worth | 2% – 3% |

| Ultra High Net-worth | 2.5% – 5% |

For example, online and minimum service providers can charge as low as 0.25% to 2% which are great for basic products such as buying and selling of stocks, term insurance, travel insurance or car insurance.

Ultra High Net-worth clients do pay more because they have complex financial matters, and many value the best people who have the expertise to manage large assets that can range from hundred of millions to billions.

No. 2 Don’t Just Talk About Value-Add. Show the Benefits.

The financial markets and wealth management platforms are extremely competitive. Showing how you as a Wealth Manager can advice them better than others, is often the deciding factor.

Examples of highlighting benefits to clients:

“You may not have the time, and the least you want to do when you are in an important meeting or going for a family vacation, is to check your phone on financial status, your stock or bond prices, the FX rate or insurance products. These are not the things you want to spend your time on.”

“It is always great to have a qualified wealth manager that is a call away and will be looking after your portfolio. That peace of mind is priceless. It frees up your time.”

“Sometimes when an emergency strikes and you need a large amount of cash, what amount of loan is available? What is the fastest way to get it? Which portfolio or assets do you sell? It is hard for yourself to make a good and rational decision. A Wealth Manager, like myself, who had been with you and who understand your circumstances, is valuable.”

No. 3 Upsell Premium Products

If a client places only 1% of their wealth or $5,000 into 1 or 2 products, there isn’t much wealth management advice you can give (for the investment sum and time spent). The client will then likely be comparing the fees and returns.

- 7 Factors to Consider Before Wealth Management Advisory Becomes Beneficial to Clients

- 8 Reasons Why Wealth Management is Not for Everyone

- 5 Reasons why Wealth Management is harder in low-tax countries

But if the client places $200,000 or maybe 30% of their assets, that is a good and sustainable amount for you to work with. You can then provide quality wealth management advice and bring in experts such as Investment Advisor, Treasury Specialist, Credit Specialist, Insurance Specialist, Estate Planner.

With the larger amount, you are able to work on complex financial questions such as:

- What if they need the funds next year for purposes like children’s education or buying a house?

- Do they take a loan or do they liquidate their financial portfolio?

- Will they have more cashflow coming in?

Going through the Wealth Management advisory process allows you to gather lots of useful information such as estimated net-worth and uncover financial needs of the clients.

Instead of marketing products, you can now deliver a holistic range of products and solutions. You can also sell premium products that benefit clients and generate quality revenue.

No. 4 High Fees Benefit Everyone

High fees benefit everyone. If clients are paying more fees, your team and yourself can spend more time working on their account, regardless of AUM (Assets Under Management) size.

Your job is also more sustainable, the business is more profitable and it allows everyone in the organisation and clients to focus less on pricing and more on what are the most important things in life. For your organization, you can work on improving and delivering better wealth management products, solutions and services to them.

If your clients disagree. You can perhaps try illustrating how the doctor in a government hospital charge very low fees but spend only a few minutes with each patient while a specialist in a private clinic spends quality time with the patient and charge a high price. When it comes to simple medical conditions, a government hospital doctor may suffice. But when it comes a complex matter, you definitely want to consider using a Specialist. There are also pharmacist stores that charge no fees and have off-the shelves medications. Read More: How do Wealth Managers Compete against Low Cost Providers?

Though not everyone can afford or want to pay high fees, you will be able to quickly profile your clients, and work with clients who can pay for the fees.

On the other hand, most people work so hard to earn an income and accumulate substantial savings. Don’t they want to hire the best wealth manager to manage their wealth?

No. 5 The Learning Journey

Wealth grow and income grow. It is always good to learn early about wealth management, budgeting, cashflow, investments, risk management, loans, economic boom and crisis.

Having a Wealth Manager provides clients with early money management tips that can help them make better financial decisions in the future.

For example many unwary clients get into Ponzi schemes, scams, overseas investments and get-rich schemes.

With a professional wealth manager, paying a higher fee could mean not making unnecessary investments, which could result in a loss of their life-savings. Plus, most financial instruments are regulated instruments, which protect consumers from shady practices.

Related Videos:

- Bernie Madoff: Scamming of America – The $50 Billion Ponzi Scheme

- Trillion Dollar Bet – The Demise of Long-Term Capital Management

These are 5 ways Wealth Managers can charge higher fees:

- Be transparent about the fees

- Don’t just talk about value-add. Show the benefits

- Upsell Premium Products

- High fees benefit everyone

- The Learning Journey

Related:

- How do you convince a hard-core deposit client to look at wealth management products?

- 8 Reasons why clients prefer to place money in deposits than investments

- 5 Ways to charge the highest fee possible

- 6 Ways to generate high revenue

- How do Wealth Managers compete against Low-Cost Providers?

Sign Up / Register

Caproasia Users

- Manage $20 million to $3 billion of assets

- Invest $3 million to $300 million

- Advise institutions, billionaires, UHNWs & HNWs

Caproasia Platforms | 11,000 Investors & Advisors

- Caproasia.com

- Caproasia Access

- Caproasia Events

- The Financial Centre | Find Services

- Membership

- Family Office Circle

- Professional Investor Circle

- Investor Relations Network

Monthly Roundtable & Networking

Family Office Programs

The 2025 Investment Day

- March - Hong Kong

- March - Singapore

- July - Hong Kong

- July - Singapore

- Sept- Hong Kong

- Sept - Singapore

- Oct- Hong Kong

- Nov - Singapore

- Visit: The Investment Day | Register: Click here

Caproasia Summits

- The Institutional Investor Summit

- The Investment / Alternatives Summit

- The Private Wealth Summit

- The Family Office Summit

- The CEO & Entrepreneur Summit

- The Capital Markets Summit

- The ESG / Sustainable Investment Summit